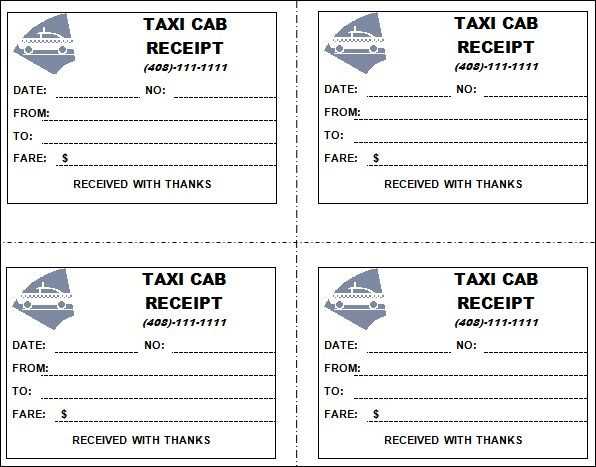

Ready-to-Use Taxi Receipt Templates

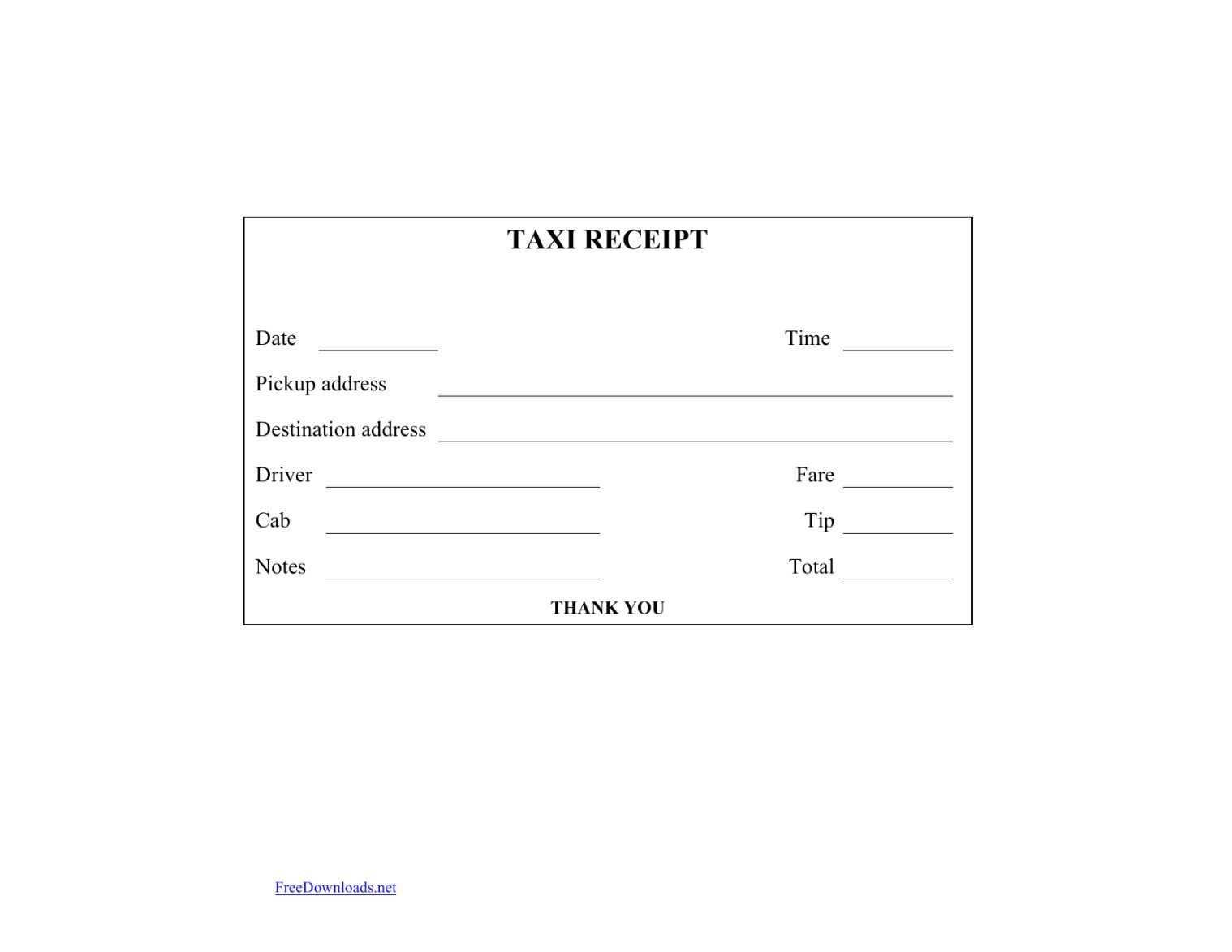

Download a taxi receipt template in PDF, Word, or Excel format to create professional receipts for customers. Choose a template with pre-filled fields for date, time, fare, and payment method, or select an editable version to customize details as needed.

- PDF Format: Best for printing and handwritten receipts.

- Word Format: Easily editable for digital use.

- Excel Format: Includes automatic fare calculation.

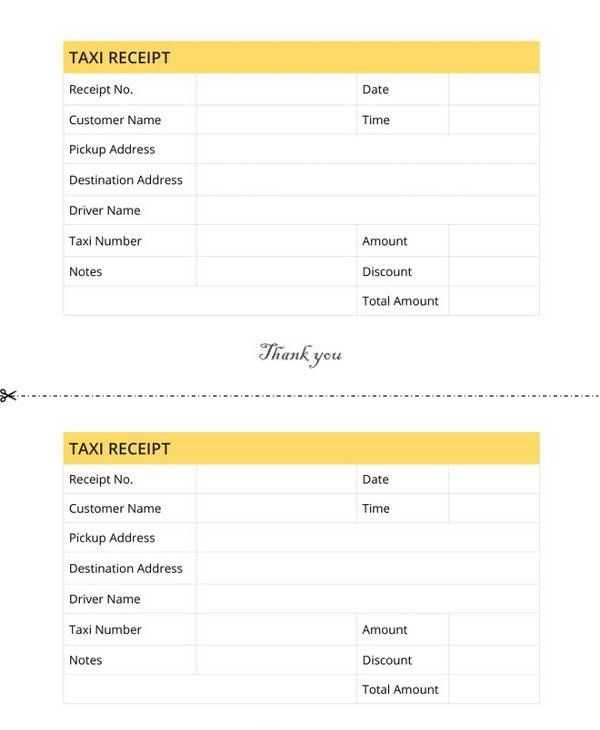

Key Features of a Taxi Receipt

A well-structured taxi receipt should include:

- Company Name and Logo: Add branding for a professional look.

- Receipt Number: Helps track transactions.

- Date and Time: Confirms trip details.

- Pickup and Drop-off Locations: Records journey specifics.

- Fare Breakdown: Includes base fare, distance charge, and any additional fees.

- Payment Method: Cash, card, or online payment.

- Driver’s Details: Name and license number for reference.

How to Download and Use

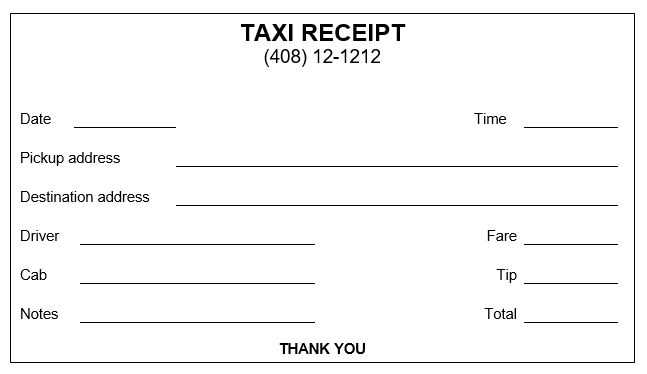

- Choose a template format that suits your needs.

- Download and open the file in your preferred application.

- Fill in the necessary details manually or use an automated system.

- Print or save the completed receipt as needed.

Where to Get Free Taxi Receipt Templates

Several websites offer free downloads of taxi receipt templates. Look for options that match your business requirements and ensure they include all essential fields for accurate documentation.

Taxi Receipt Template Download

Where to Get Free Cab Receipt Samples

Key Information for a Taxi Fare Receipt

Editable Versions: PDF, Word, and Excel Forms

Customizing a Fare Receipt for Your Business

Legal and Tax Aspects of Ride Receipts

Frequent Problems with Taxi Receipt Templates and Solutions

Free taxi receipt templates are available on business document websites, template platforms, and online invoicing tools. Websites like Template.net, Invoice Home, and Microsoft Office Templates offer downloadable formats in PDF, Word, and Excel. These versions allow quick customization to fit your needs.

A proper taxi fare receipt should include the date, fare breakdown, distance traveled, company details, and driver information. If required for business purposes, adding a unique receipt number and tax identification details improves record-keeping.

For customization, Word and Excel formats allow easy modifications, such as adding a logo, adjusting fields, or including payment details. PDF versions provide a fixed layout, making them ideal for print-ready receipts.

Legal and tax compliance depends on local regulations. Some regions require official tax invoices with VAT details, while others accept simple fare receipts. Using a standardized format helps avoid issues with audits and reimbursements.

Common problems include missing details, incorrect fare calculations, and formatting issues. To prevent errors, use automated receipt generators or pre-formatted templates with editable fields. If receipts are frequently lost, digital versions or emailed copies can provide better record management.