If you need a legal receipt template, you’re in the right place. A simple, well-organized receipt is a reliable way to document financial transactions and can help avoid future misunderstandings. By using a free template, you save both time and money, while ensuring your records remain clear and professional.

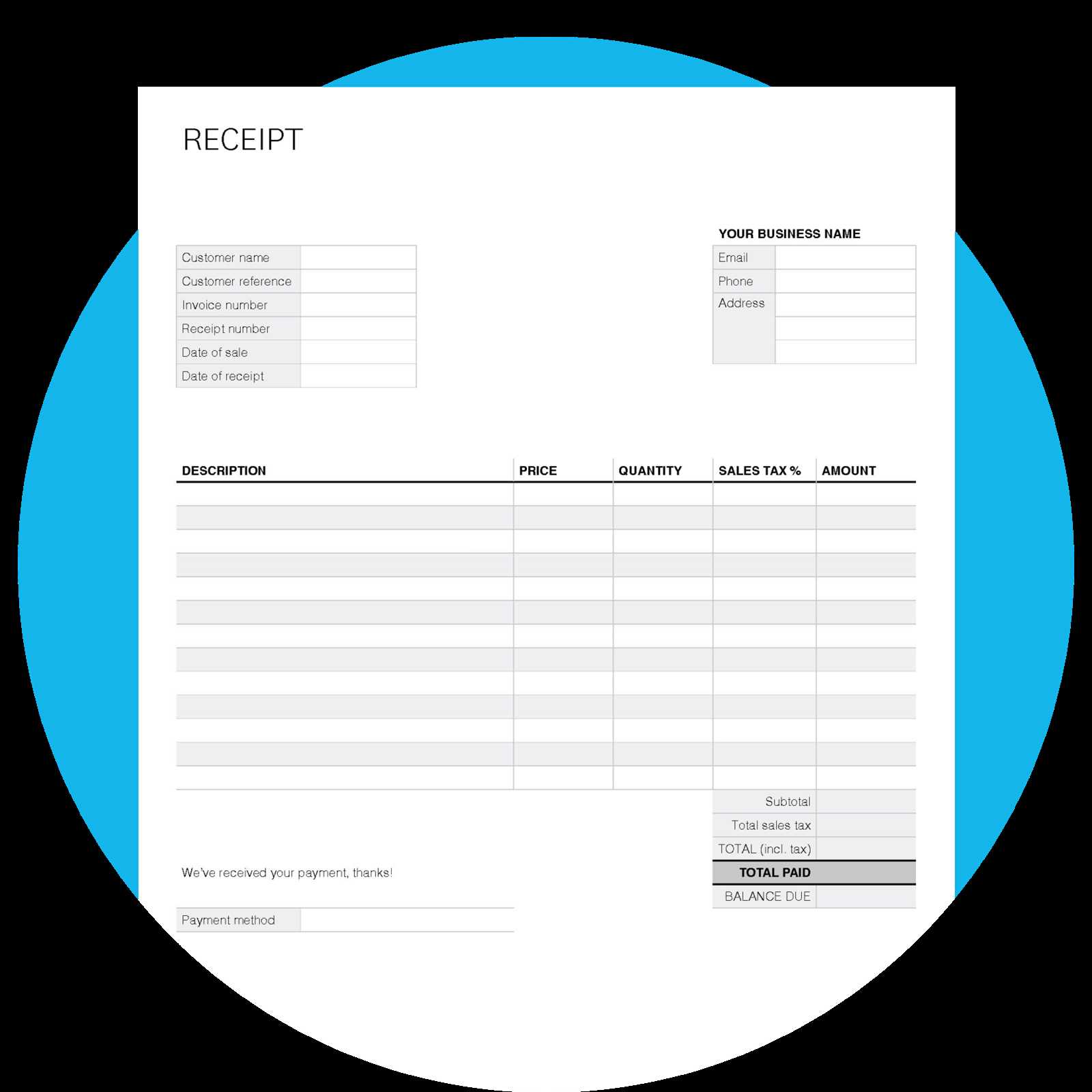

First, make sure your template includes all necessary details such as the date, transaction amount, payer and payee names, and a description of the service or product provided. This ensures your receipt is legally valid and can be used for tax or legal purposes. It’s also recommended to add a receipt number for better tracking.

Avoid cluttering your receipt with unnecessary information. Keep the layout clean and focused on the details that matter most for both parties involved. You’ll want to include clear payment terms, especially when dealing with services or products that involve future obligations.

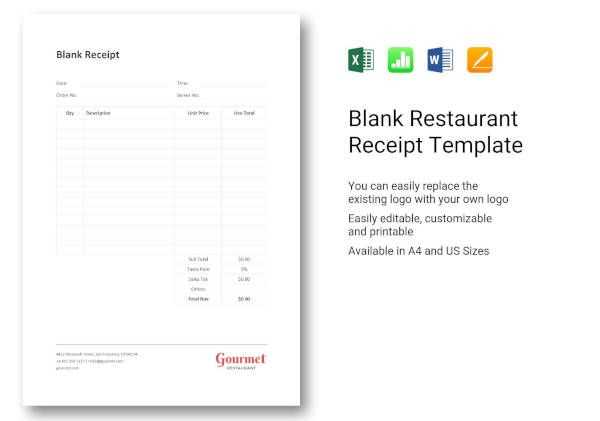

Using a free template doesn’t mean sacrificing quality. Many templates are designed to be user-friendly and fully customizable, so you can add your company logo or adjust the format to meet specific legal or personal preferences. Always double-check the template’s content to ensure it complies with local laws and regulations.

Here’s the revised version with minimal repetition:

Begin by clearly stating the purpose of the receipt. Indicate the goods or services provided, including quantities, prices, and any relevant taxes. Specify the transaction date to provide a clear record. Ensure the buyer’s and seller’s details are accurate, including names, addresses, and contact information. This will facilitate future references and communication.

Use a straightforward format that highlights key details like the payment method and total amount due. Avoid clutter, and focus on what’s necessary to ensure clarity. For instance, list payment terms, if applicable, to prevent any misunderstandings. Be concise in describing the transaction and avoid redundant phrases. Include space for signatures or electronic acknowledgment to confirm receipt completion.

Lastly, review the template regularly. Minor updates will keep it aligned with any changes in tax laws or business practices. Consistent checks ensure the document remains accurate and relevant to both parties.

Free Legal Receipt Template

How to Create a Receipt Template from Scratch

What Information Should Be Included in a Legal Receipt?

How to Customize a Free Template for Your Business

Legal Considerations for Using a Receipt Template

Common Mistakes to Avoid When Using a Legal Template

Where to Find Reliable Free Templates Online

Creating a receipt template involves setting up a clear, professional layout with spaces for the required information. Use tools like Microsoft Word or Google Docs for simplicity or opt for Excel or Google Sheets for better organization. Begin by designing sections for the business name, contact details, itemized list of purchased goods or services, payment method, and date of transaction.

Legal receipts must include the seller’s name, business address, and tax identification number. The buyer’s name, description of goods or services, price, applicable taxes, total amount, and payment method should also be listed. If the transaction is subject to tax, include the tax rate and amount separately.

Free templates can be customized by inserting your business details and modifying the layout to match your brand’s style. Adjust fonts, colors, and add your logo to make it unique. Ensure the template meets local legal requirements by adding necessary fields like tax identification numbers or any other region-specific data.

Legally, receipts must accurately reflect the transaction and provide proof of payment. Use templates that comply with local tax laws. Ensure all required details are included, as incomplete receipts may not hold up in legal situations. Additionally, verify that the receipt complies with local business regulations and tax reporting requirements.

Common mistakes include omitting important transaction details like tax rates or not properly recording the payment method. Avoid using templates that don’t provide enough space to list all necessary information. Also, do not use overly complex formats that could confuse customers or leave out essential data.

Reliable sources for free templates include websites offering legal forms and small business resources, such as legal document platforms or trusted templates from accounting firms. Always ensure the site is reputable and check the template for compliance with your specific region’s legal requirements.