Essential Information to Include

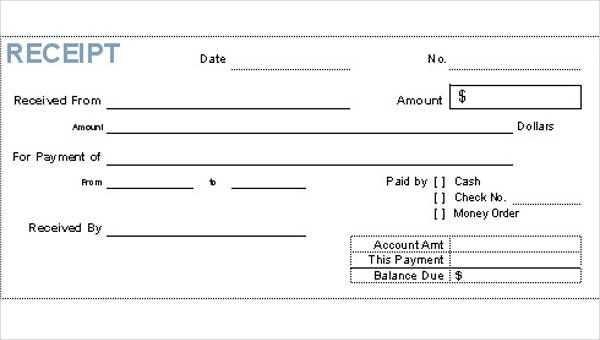

A well-structured sublet receipt protects both the tenant and subtenant by documenting payment details clearly. Ensure the receipt includes:

- Date of Payment: Clearly specify when the rent was paid.

- Tenant and Subtenant Information: Include full names and contact details.

- Rental Address: Provide the full address of the sublet property.

- Payment Amount: State the exact amount received.

- Payment Method: Mention if it was cash, check, bank transfer, or another method.

- Rental Period: Define the time frame covered by the payment.

- Signature: Have the tenant or sublessor sign for verification.

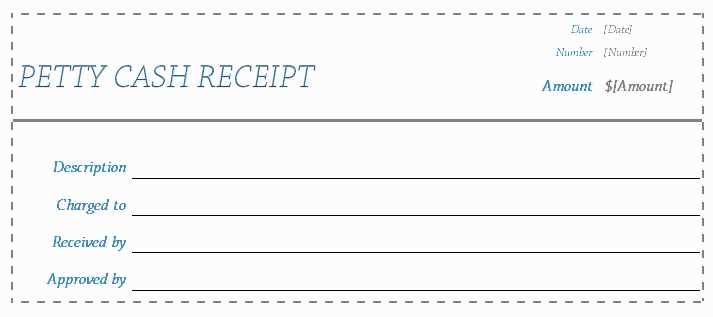

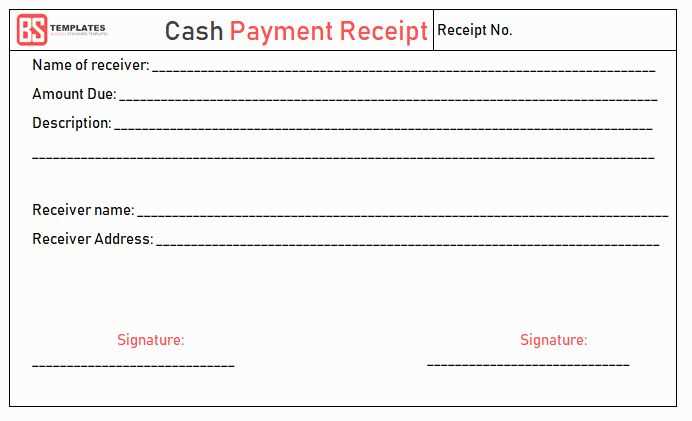

Free Sublet Receipt Template

Use the template below to create a legally sound receipt for your sublease agreement:

Sublet Rent Receipt Date: [MM/DD/YYYY] Received from: [Subtenant's Name] Received by: [Tenant’s Name] Rental Property Address: [Full Address] Payment Amount: $[Amount] Payment Method: [Cash/Check/Bank Transfer] Rental Period: [Start Date] - [End Date] Signature: ___________________ (Tenant)

Best Practices for Issuing Sublet Receipts

- Issue receipts immediately after receiving payment.

- Keep a copy for record-keeping purposes.

- Use digital receipts if both parties prefer electronic documentation.

A properly documented sublet receipt helps prevent disputes and ensures transparency in rental transactions.

Sublet Receipt Template: A Practical Guide

Key Elements to Include in a Sublease Receipt

How to Format a Rental Receipt for Clarity and Legality

Printable vs. Digital Lease Receipt: Pros and Cons

Common Mistakes to Avoid When Creating a Sublet Document

Legal Considerations for Rental Receipts in Different Jurisdictions

Where to Find Free Templates and How to Customize Them

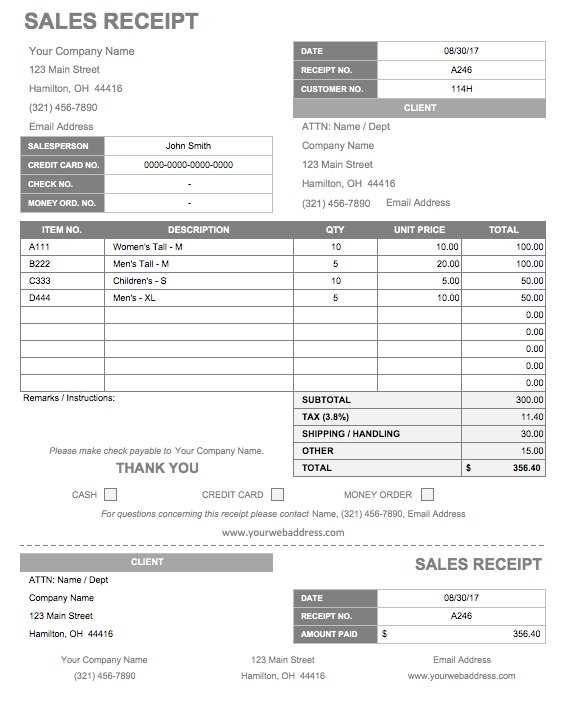

A sublet receipt must clearly state essential transaction details to protect both parties. Include the date of payment, amount, method used (cash, check, bank transfer), rental period covered, and signatures from both the sublessor and subtenant. If applicable, mention late fees or additional charges.

Use a structured format with labeled sections for easy reference. Bold headings help distinguish key information. Avoid vague descriptions; instead of “rent for the month,” specify “February 2025 rent payment for Unit 3B, 123 Main Street.”

Digital receipts offer convenience and backup options, while printed versions provide a tangible record. Ensure any digital format includes an electronic signature or acknowledgment from both parties to maintain legal validity.

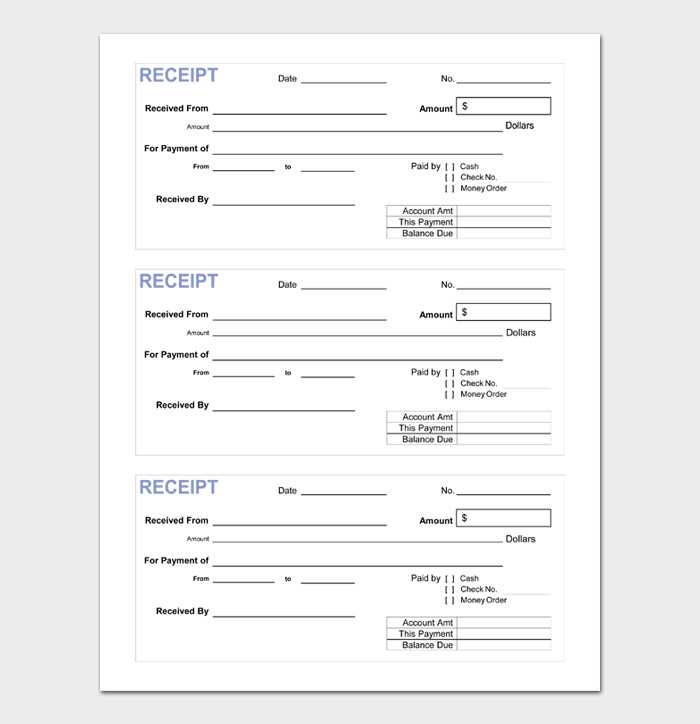

Common mistakes include omitting a receipt number, failing to specify the lease period, or leaving out contact details. Inconsistent formatting can also cause disputes, so keep details uniform in every receipt.

Legal requirements differ by region. Some jurisdictions require specific language or tax details. Research local rental laws or use templates that align with official guidelines.

Free templates are available on legal websites and rental platforms. Customize fields to match the lease terms, ensuring clarity and compliance with applicable laws.