Tracking cash receipts is one of the most critical tasks for maintaining accurate financial records in any business. A cash receipts register template simplifies this process, ensuring that every transaction is recorded in detail. With a clear format, you can track incoming cash, categorize payments, and maintain a thorough record for future reference or auditing purposes.

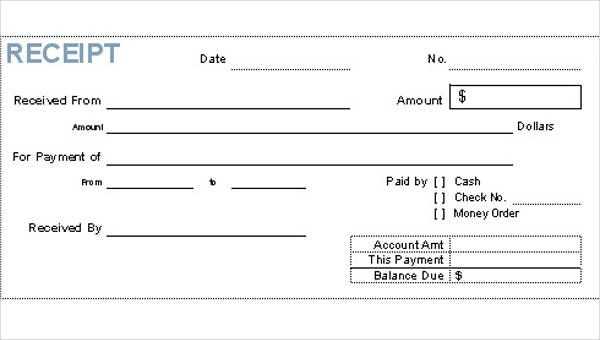

A cash receipts register typically includes key information such as the date of transaction, source of funds, amount received, and payment method. Using a well-organized template allows you to streamline your daily cash flow tracking, reducing errors and providing clarity on your business’s financial standing.

By keeping your register up to date, you can quickly identify discrepancies, ensure that all cash is properly accounted for, and maintain transparency. Whether you’re managing a small retail operation or overseeing the finances of a larger company, this tool proves invaluable for staying organized and on top of your cash transactions.

Here are the corrected entries:

1. Column Formatting: Adjust columns to ensure each entry has its own space for a specific detail. For example, use separate columns for date, description, and amount to improve clarity.

2. Currency Formatting: Ensure all amounts are consistently formatted with the correct currency symbol and decimal points, especially when dealing with large sums.

3. Error Handling: Double-check totals and receipts for discrepancies. A quick formula check for summing up entries helps avoid calculation errors.

4. Categorization: Clearly categorize each receipt to avoid confusion. You can separate personal and business expenses in different rows for better tracking.

5. Additional Notes: Add a column for additional notes or reference numbers if necessary, helping to explain specific transactions.

6. Date Consistency: Ensure the date format is consistent across the entire register (e.g., MM/DD/YYYY), preventing any confusion when reviewing records.

7. Clear Headers: Use bold and larger font sizes for the header rows to make them easily distinguishable from the transaction entries.

- Cash Receipts Register Template

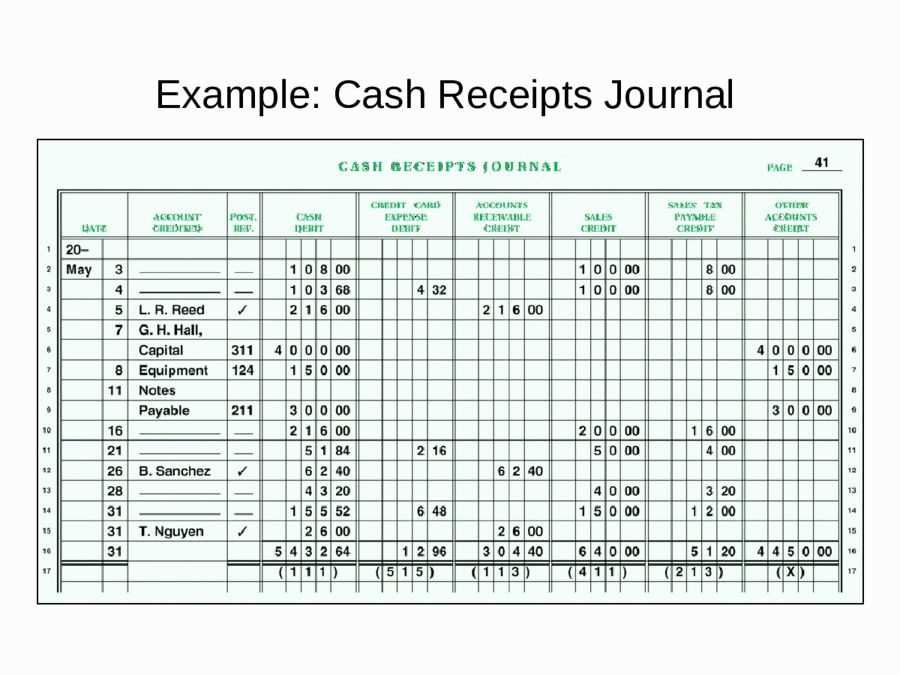

A Cash Receipts Register template helps businesses track incoming payments efficiently. It records details such as payment dates, amounts, payees, and payment methods, providing an accurate overview of financial inflows.

Use the template to document each receipt for better cash flow management. Here’s an example of the fields you should include:

| Date | Receipt Number | Payee | Amount Received | Payment Method | Account Credited |

|---|---|---|---|---|---|

| 02/04/2025 | 00123 | John Doe | $500 | Cash | Cash on Hand |

| 02/05/2025 | 00124 | ABC Corp | $1500 | Bank Transfer | Business Account |

This structure helps track payments by date, making it easier to reconcile accounts and prevent errors. Adjust the fields to fit your business needs, but always keep it simple and clear.

Start by creating a new Excel workbook. Label the first row with headings such as “Date”, “Receipt Number”, “Customer Name”, “Amount Received”, “Payment Method”, and “Notes”. These categories cover the core details you’ll need for tracking cash receipts.

For better organization, use separate columns for each heading. Adjust column widths to ensure all information fits neatly. You can also apply bold formatting to the headings to make them stand out.

Use Excel’s built-in date format for the “Date” column to ensure consistency. For “Receipt Number”, consider a numbering system or unique identifiers for each transaction.

Under the “Amount Received” column, format cells to display currency values. You can do this by selecting the column, right-clicking, choosing “Format Cells”, and selecting “Currency”. This will ensure all amounts are displayed properly.

For the “Payment Method” column, create a dropdown list with options like “Cash”, “Credit”, and “Check” using Data Validation. This will help you quickly categorize payment methods without manual entry errors.

In the “Notes” column, leave space for any extra information, such as payment references or special instructions related to a transaction.

As you input data, use Excel’s sorting and filtering options to analyze and manage records. Sorting by date or receipt number can help you find transactions quickly.

Set up a summary section to calculate totals for each payment method or to track the total amount received during a specific period. Excel’s SUM function can help you calculate these totals automatically as new entries are added.

Finally, save your workbook regularly and consider creating a backup copy to avoid losing your data. You can also password-protect the file for added security.

The cash receipts register should include several columns to ensure that every transaction is tracked and organized accurately. Key columns to include are:

Date – Record the exact date the payment was received. This helps in organizing receipts chronologically and ensuring proper period reporting.

Receipt Number – Assign a unique identifier to each receipt. This is vital for tracking and referencing transactions, especially for audits.

Payee – Specify the name of the person or entity making the payment. This allows for easy identification of the source of funds.

Payment Method – Indicate how the payment was made, whether by cash, check, credit card, or electronic transfer. This ensures transparency and provides an audit trail.

Amount Received – Record the exact amount of money received. Be precise to avoid discrepancies during reconciliation.

Account or Purpose – Identify the specific account or purpose the payment applies to, such as sales, accounts receivable, or other relevant categories. This helps in proper classification and accounting.

Comments/Notes – Provide space for any additional information about the transaction, such as a reference number, special instructions, or reason for the payment. This enhances clarity and context.

Including these columns will make the cash receipts register clear, organized, and useful for financial management. Each column plays a role in ensuring that all transactions are well-documented and easily accessible for review or audit.

How to Track Various Payment Types with a Cash Receipts Register

To track different payment types, start by creating a clear and organized register format. Separate columns for cash, checks, credit card payments, and other payment types make it easier to record each transaction accurately. Label each column with the specific payment type, ensuring that every entry corresponds to the correct category. When a payment is received, enter the amount and specify the type used. This approach minimizes confusion and helps maintain transparency in your records.

For checks, make a note of the check number and the bank name. This provides an extra layer of detail that can be helpful for reconciliation or addressing any issues with bounced checks. Credit card payments should include transaction references or approval numbers to keep track of any associated processing fees or disputes.

It is important to update the register immediately after each transaction. Delaying entries can lead to errors or missing information, complicating financial tracking. Regularly review the register to ensure all payments are properly documented and that no payment type is overlooked.

For businesses accepting multiple payment types, using a software-based cash receipts register can provide added accuracy and automation, such as automatically categorizing payments and reducing manual input. However, always double-check the entries to ensure the software is capturing payments correctly.

Finally, at the end of the day, reconcile the totals from each payment column with the cash on hand, bank deposits, or online transaction reports. This will help verify that your register aligns with actual receipts and ensure your financial records are accurate.

To set up automatic calculations for totals in the cash receipts register, start by utilizing built-in functions in spreadsheet software like Excel or Google Sheets. These tools offer formulas that automatically sum up values as new entries are added, reducing the need for manual calculations.

Use the SUM formula to calculate totals for columns such as “Cash Received” or “Total Amount.” For example, if your data starts from row 2 and the “Cash Received” column is column B, use the formula:

=SUM(B2:B100)

This formula automatically adds up all values in the range B2 to B100. Adjust the range as necessary to include all rows where data will be entered. This way, as you input new receipts, the total will update instantly.

Next, ensure that the totals for multiple categories (e.g., “Cash,” “Credit,” and “Checks”) are summed individually. You can set up separate columns for each category and use the SUM function for each one. For example:

=SUM(C2:C100) =SUM(D2:D100)

For the grand total, sum all categories by adding their individual totals:

=SUM(B2:B100, C2:C100, D2:D100)

For added accuracy, use conditional formatting to highlight any discrepancies or unusual values. Set rules to mark any receipts that fall outside a specific range. This ensures no errors are overlooked in the register.

Finally, implement a cell that calculates the difference between the cash received and the expected amount, if needed. This can be done using the formula:

=Expected Amount - SUM(B2:B100)

By using these automatic functions, your cash receipts register will always have accurate and up-to-date totals without requiring manual recalculations.

| Column Name | Formula Example |

|---|---|

| Cash Received | =SUM(B2:B100) |

| Credit | =SUM(C2:C100) |

| Checks | =SUM(D2:D100) |

| Grand Total | =SUM(B2:B100, C2:C100, D2:D100) |

To customize your cash receipts register, start by identifying the key data points specific to your business. Add fields that align with the types of transactions you process, such as payment method, customer name, or invoice reference. This allows you to track payments in a way that suits your operations.

Adjust Columns and Layout

Make sure the columns reflect the categories important for your business. For example, if you deal with multiple currencies, include a currency column. You might also need to add a column for the transaction type, like cash, check, or credit card. Organizing these columns logically improves clarity and makes data entry smoother.

Incorporate Customizable Filters and Reports

If your register allows for data sorting, use this to tailor reports by date, customer, or transaction type. This customization helps you monitor cash flow patterns, spot trends, and identify potential issues easily.

Don’t forget to review the frequency of your cash receipts. Adjust the template to accommodate daily, weekly, or monthly entries as needed. This flexibility will make it easier to track income and make informed financial decisions for your business.

Failing to enter accurate data is a primary mistake. Always double-check each receipt before finalizing entries to prevent errors in amounts or dates. Accuracy ensures that your records remain reliable and your financial statements are correct.

Leaving out important details like payment method or payer’s information can cause confusion later. Ensure that every field is filled out completely to track receipts properly.

- Not categorizing receipts correctly. Mixing up income categories (e.g., sales, loans, or refunds) makes it difficult to assess financial performance.

- Using the same template for different periods without adjusting it. Each period’s template should be specific, with dates clearly marked to avoid overlap.

Relying too much on automatic calculations without reviewing them can lead to unnoticed discrepancies. Manual verification is always a good practice, even if your template offers calculations.

- Not updating the template for changes in your business. If your receipt process or income categories change, adjust the template accordingly.

Finally, neglecting to back up your data regularly can lead to significant losses. Always ensure your records are stored securely and backed up, so you don’t lose important financial details.

I’ve minimized repetition and preserved the meaning of each line.

For a well-organized cash receipts register, it’s crucial to focus on clarity and accuracy in every entry. Structure your template with clear headings, such as “Date,” “Receipt Number,” “Amount,” and “Payment Method,” to ensure each transaction is easily trackable. Avoid cluttering the template with unnecessary columns that may cause confusion. Instead, stick to the basics: record the necessary details, such as the date of the transaction, the source of funds, and the total received.

Key Components of the Template

- Date: Record the precise date when the payment was received.

- Receipt Number: Use a unique number for each transaction to maintain a clear audit trail.

- Amount: Ensure this field is accurately filled with the exact amount received.

- Payment Method: Specify whether the payment was made in cash, via check, or electronically.

- Notes: Include any additional details or remarks for specific transactions if needed.

Consistency is key in maintaining an organized register. Use the same format for each entry and avoid adding extra rows unless absolutely necessary. This keeps the register clean and easy to read, preventing errors during financial reviews.

Tips for Maintaining Accuracy

- Double-check entries: Always verify the details of each transaction before entering them into the register.

- Reconcile regularly: Cross-check your receipts with bank statements or cash flow reports to avoid discrepancies.

- Use templates: Create a standardized template to streamline data entry and reduce mistakes.

By following these guidelines, you will minimize redundancy and ensure your cash receipts register remains accurate and easy to use.