Need a simple and professional receipt template for free? Download a ready-to-use format that meets UK standards. Whether you’re a freelancer, small business owner, or landlord, a clear and structured receipt helps maintain accurate records and ensures compliance with tax regulations.

A standard receipt should include date, receipt number, payer and payee details, itemized list of goods or services, total amount, and payment method. Adding a signature or company stamp enhances credibility. If VAT applies, include the VAT number and a breakdown of tax.

For flexibility, choose a template in Word, Excel, or PDF. Word and Google Docs allow easy text editing, while Excel automatically calculates totals. PDFs maintain a consistent format when sharing with clients.

Download a free template, customize it with your branding, and issue receipts effortlessly. Keeping digital copies ensures easy access during audits or financial reviews.

Here’s the revised version without unnecessary repetition:

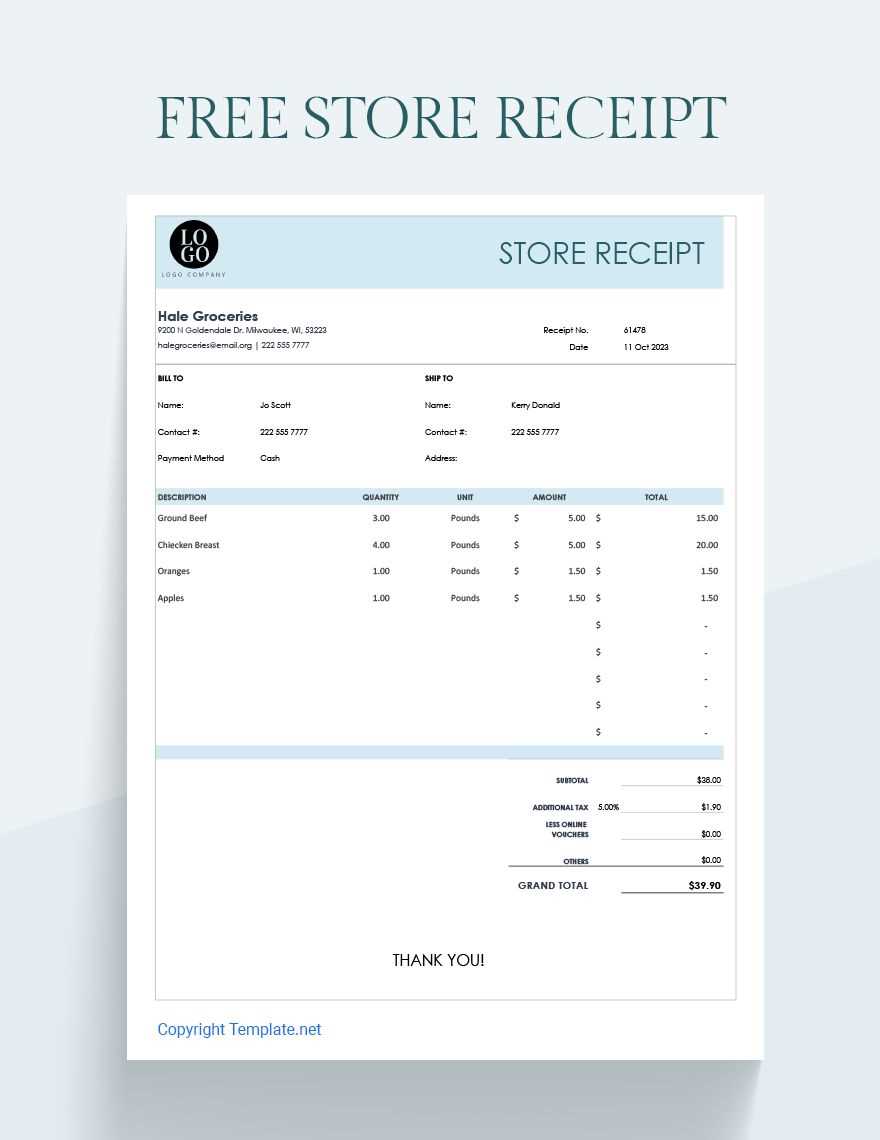

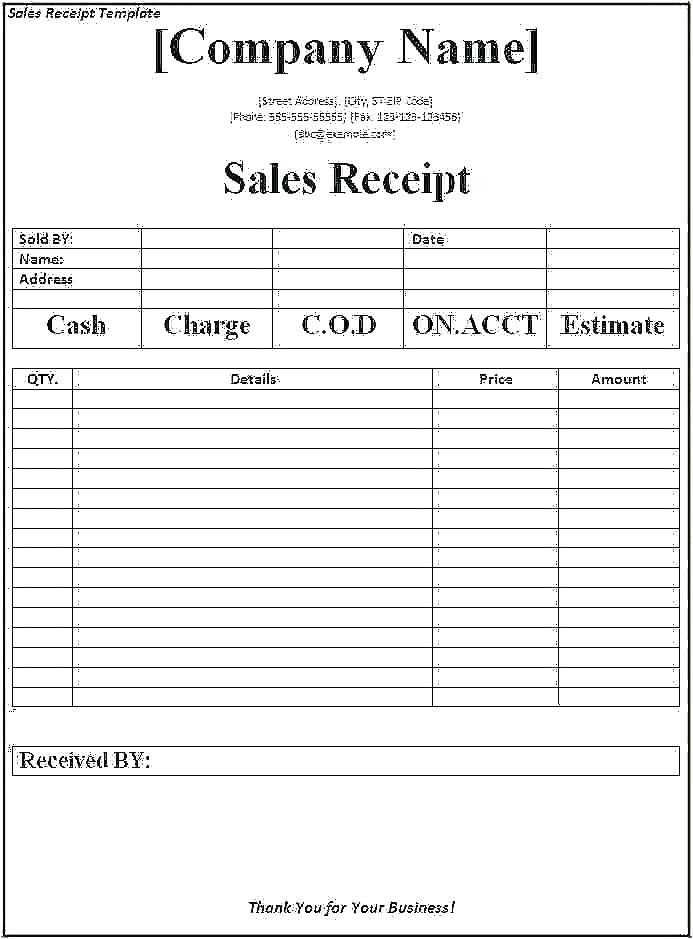

To create a clean and simple receipt template, focus on the key elements. Start with the business name and contact details at the top. Ensure the date and receipt number are clearly visible for record-keeping. Include a detailed list of purchased items, along with the price for each, and clearly mark the total amount due. Add any tax or discount information where applicable. Conclude with payment details, such as method (cash, card, etc.), and thank the customer for their purchase.

Keep the format straightforward. Avoid clutter by only including necessary fields. This helps customers understand their receipt quickly, making it both practical and professional.

- Free Basic Receipt Template UK

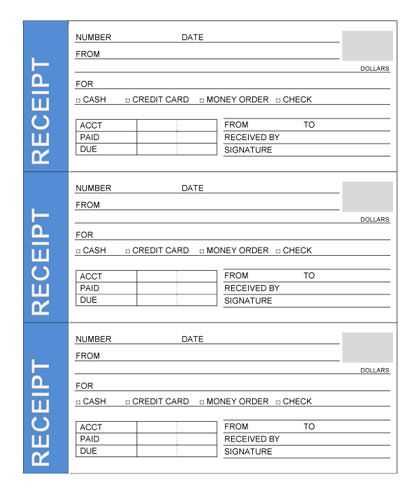

If you need a simple receipt template, a basic one is quick to fill out and easy to understand. Start with the date, the seller’s details, and the buyer’s information. Include the amount paid and a description of the item or service purchased. This is enough to meet the minimum requirements for most transactions in the UK.

A free template for receipts can help avoid confusion, especially for small businesses or freelance work. These templates are widely available online and can be customized with your business name, logo, and contact information. A professional, clean layout makes the receipt easy to read and keeps everything clear for both parties.

Look for templates that include fields for VAT numbers if needed, as this is important for certain types of sales in the UK. It’s also helpful to have a unique receipt number for easy reference in case of disputes or for accounting purposes.

Most free receipt templates allow you to download them in formats like Word, Excel, or PDF, so you can fill them out digitally or print them. Simply search for “free basic receipt template UK” to find an option that suits your needs.

Make sure your receipt includes these basic elements to stay clear and compliant with UK standards:

Business Information: Include the full name of your business, address, and contact details. If you’re VAT registered, add your VAT number. This helps recipients easily verify your business and ensures transparency.

Receipt Number: Every receipt should have a unique number for tracking and record-keeping purposes. This helps both the business and the customer maintain organized records.

Date of Transaction: Clearly state the date when the transaction took place. This is essential for both accounting and consumer rights, as it marks when the payment was made.

Itemized List: List each item or service sold, including the quantity and price. This ensures clarity and avoids any confusion about what was purchased.

Total Amount: Clearly show the total amount paid, including taxes if applicable. If VAT is involved, the breakdown between the net and VAT amount should be displayed.

Payment Method: Indicate how the payment was made, whether it’s cash, card, or another method. This helps both parties track financial transactions accurately.

Return/Refund Policy: If relevant, briefly include any return or refund policy, ensuring customers know their rights in case of issues with the purchase.

Receipts in the UK must comply with certain legal requirements to ensure transparency and protect consumer rights. For businesses, issuing receipts is a key part of maintaining proper records. These records can be used for tax purposes or resolving disputes with customers.

UK law does not mandate receipts for all transactions, but businesses must provide them when requested by customers. If a receipt is issued, it must include specific details. The following table outlines the key information that should appear on a receipt:

| Information | Description |

|---|---|

| Date of Transaction | The exact date the transaction occurred. |

| Business Name | The name of the company or individual issuing the receipt. |

| Business Address | The address where the business is located. |

| Description of Goods or Services | A clear description of what was purchased or the service rendered. |

| Total Amount Paid | The full price of the transaction, including taxes if applicable. |

| VAT Details (if applicable) | If VAT is charged, the receipt must show the VAT rate and amount. |

For businesses registered for VAT, they must issue VAT invoices that include additional details such as VAT registration number. This is not required for non-VAT registered businesses.

It’s advisable for businesses to issue a receipt for every transaction, as it provides clear proof of payment for both parties and can serve as evidence in the event of a dispute.

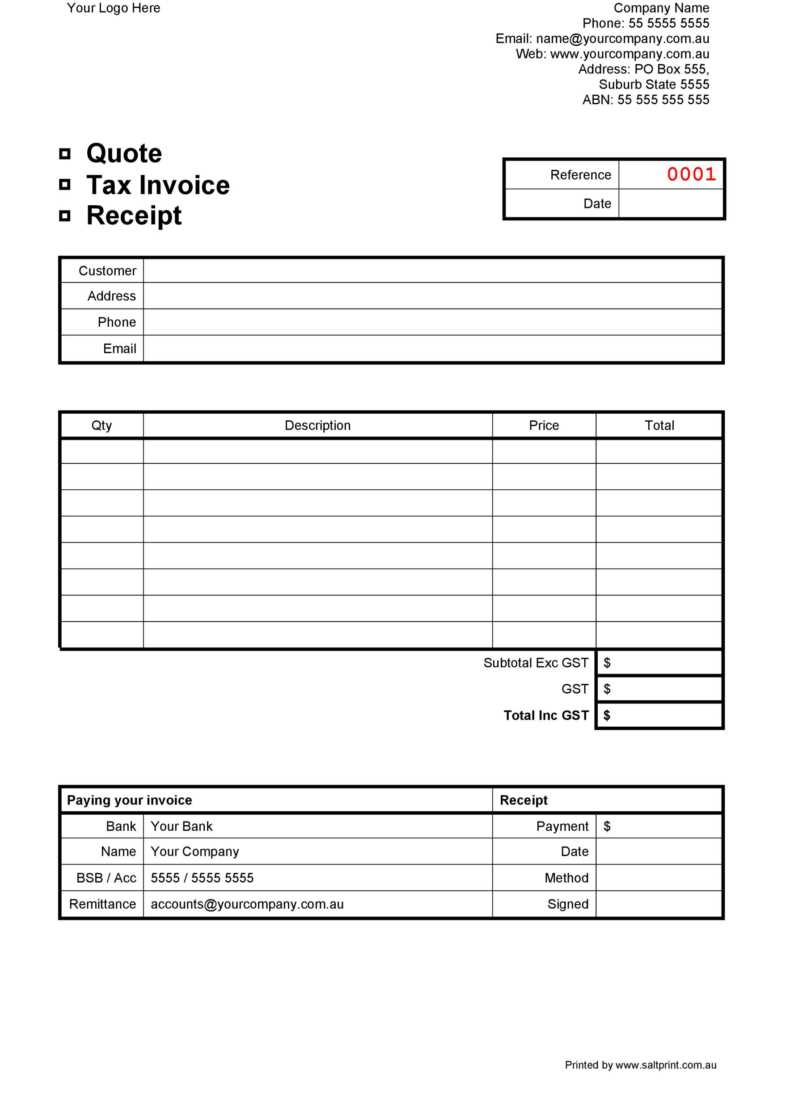

For creating a basic receipt, selecting the right format can simplify your work and enhance its usability. Word, Excel, and PDF each offer specific advantages depending on your needs. Here’s a breakdown to guide your choice:

Word Format

If you prefer to easily edit and personalize your receipt, Word is an excellent option. It allows for quick adjustments, such as adding logos or changing fonts, without requiring technical skills. Word documents are user-friendly, widely compatible, and can be shared easily. However, it’s not ideal if you want to ensure the layout stays fixed across different devices or systems.

Excel Format

Excel is best for receipts that involve calculations or itemized lists. You can easily input quantities, prices, and taxes, and Excel will do the math for you. This format is especially useful for businesses that need to track inventory or sales data. It allows for simple data manipulation and also offers formulas for advanced users.

PDF Format

PDFs are perfect for creating receipts that need to maintain consistent formatting across devices. Once created, a PDF is uneditable, ensuring the receipt remains as intended. It’s a reliable format for official documents or any receipt you want to distribute without the risk of accidental edits. PDFs are also the most professional-looking option for businesses that require formal receipts.

Each of these formats has its strengths. Depending on whether you prioritize ease of editing, data management, or a fixed design, one of these will suit your needs. Use them based on the specific features you require for your receipts.

How to Customize for Small Businesses

Start by adding your business logo and contact information at the top of the receipt. This ensures that customers can easily reach out if needed. Include the business name, phone number, email, and physical address.

Next, modify the item details section. If your small business offers unique products or services, make sure each item has a clear and concise description, along with prices that align with your pricing structure. This clarity helps avoid confusion for both the customer and your accounting system.

Incorporate any tax rates specific to your area, including VAT if applicable. You can either calculate this in real-time or include a breakdown of the tax as a separate line item for transparency.

Customize the payment methods section to reflect your options. For small businesses, this might include cash, card, or online payments. Make sure it’s easy for customers to see what they paid with, including any discounts or promotional offers that apply to the transaction.

Consider adding a note or thank-you message at the bottom of the receipt to show appreciation for the customer’s business. This can leave a positive impression and encourage repeat visits.

Lastly, choose a format that aligns with your business needs–whether it’s paper receipts, digital receipts via email, or both. Small businesses benefit from streamlining the process to ensure a smooth experience for both staff and customers.

If you need a simple and reliable receipt template for UK use, several platforms offer free downloadable options that are suitable for personal and business purposes. Below are a few trusted websites where you can easily find what you’re looking for:

1. Microsoft Office Templates

Microsoft offers a wide range of free receipt templates through its Office website. Whether you use Word or Excel, you can download customizable receipt templates specifically designed for UK formats. Visit the Microsoft Templates page to explore their options.

2. Google Docs Templates

Google Docs provides free, editable receipt templates. You can access these through Google Drive, allowing for easy customization and sharing. The templates are fully adaptable to UK requirements. Go to Google Docs, click “Template Gallery,” and look for the “Receipts” section to find suitable options.

3. Template.net

Template.net hosts a variety of free and premium templates. For UK-specific receipts, use their search filter to find templates that match your needs. Visit Template.net for quick access.

4. Vertex42

Known for its Excel-based templates, Vertex42 provides several free receipt templates tailored for UK users. These templates are easy to use and customizable to suit your requirements. Check out Vertex42 for more information.

5. UK Business Forums and Websites

For a more community-driven approach, UK business forums and websites often share free templates. Sites like UK Business Forums or AccountingWeb may offer user-shared templates that are designed specifically for UK businesses. These are often downloadable directly from forum threads.

By visiting these resources, you’ll have a variety of free templates at your fingertips, ensuring that you can easily create professional receipts with a UK-compliant format.

Ensure you always include the correct details. Mistakes like leaving out the date or the seller’s information can cause confusion later. Double-check the names, addresses, and any other identifying information for accuracy.

Incorrect Pricing is a frequent error. Always confirm that the prices listed match the final total. Inconsistencies in tax rates or discounts can lead to misunderstandings or disputes.

Misunderstanding the format can cause problems. Keep the receipt simple and easy to read. Ensure the item descriptions, quantities, and prices are clearly separated and easy to follow.

Not Providing Contact Information is another issue to avoid. It’s essential to include contact details in case the customer needs to get in touch for returns, refunds, or questions about the purchase.

Failing to include a unique reference number can lead to issues when verifying the transaction. This number helps track the receipt and ensures it’s easily identifiable for both the customer and the business.

Finally, not reviewing before printing can result in overlooked errors. Always take a moment to review the receipt before finalizing the transaction to prevent mistakes that could be avoided with a quick check.

Meaning is preserved, structure is natural, and there are no unnecessary repetitions.

To create a clear and efficient receipt template, avoid clutter and focus on key details. Start by including basic elements such as the business name, contact details, date, and the list of items or services provided. Ensure each item is accompanied by its price, and clearly indicate the total amount at the end.

Organizing the Receipt

- Include a header with your business name, logo, and contact details at the top.

- List each item with a brief description and its corresponding price.

- Make the total clearly visible at the bottom, along with any applicable taxes or discounts.

Formatting Tips

- Use a legible font and consistent spacing between elements.

- Ensure the text aligns correctly to avoid confusion, particularly with item descriptions and prices.

- Consider adding a thank-you note or a reminder about your return policy for a personal touch.

With these simple adjustments, you can ensure your receipt template remains clear, functional, and professional without unnecessary repetition or complexity.