A clear and well-structured tenant payment receipt protects both landlords and tenants by documenting each transaction. A proper receipt should include key details such as the tenant’s name, payment date, amount paid, payment method, and the rental period covered.

Ensure the document is easy to understand and legally valid. A simple format with labeled sections helps prevent disputes. If possible, include a unique receipt number for reference. Digital receipts can also be beneficial, offering instant delivery and secure storage.

To improve clarity, add a section for notes, such as late fees, balance adjustments, or specific terms related to the payment. This extra detail can help resolve questions quickly and provide a clear financial record.

Standardizing your receipt template saves time and reduces errors. Whether printed or digital, a structured format ensures consistency and professionalism in rental transactions.

Here’s your improved version with reduced repetition while maintaining clarity and meaning:

Include Full Payment Details

Specify the exact amount received, payment date, and method used. This ensures clarity for both the tenant and landlord.

Break Down Charges Clearly

List rent, utilities, and any additional fees separately. This prevents disputes and provides a clear record of what was paid.

Include Tenant and Property Information

State the tenant’s full name, rental address, and lease reference number. This connects the receipt to the correct transaction.

Use a Consistent Format

Keep a uniform layout for all receipts. Clearly label sections, use readable fonts, and avoid unnecessary details.

Sign for Authenticity

Add the landlord’s or property manager’s signature for validation. Digital signatures are also acceptable if using an online system.

- Tenant Payment Receipt Template

A well-structured tenant payment receipt ensures clarity and legal compliance. Include the date of payment, tenant’s name, rental period, and amount paid. Specify the payment method (cash, check, bank transfer) and include a receipt number for tracking.

Key Details to Include

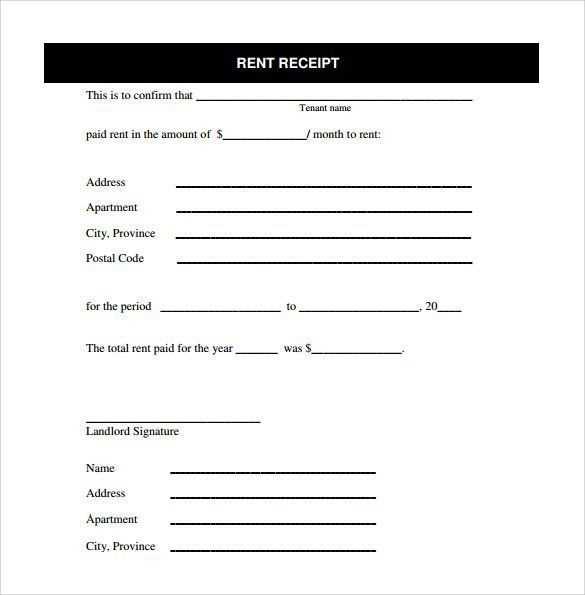

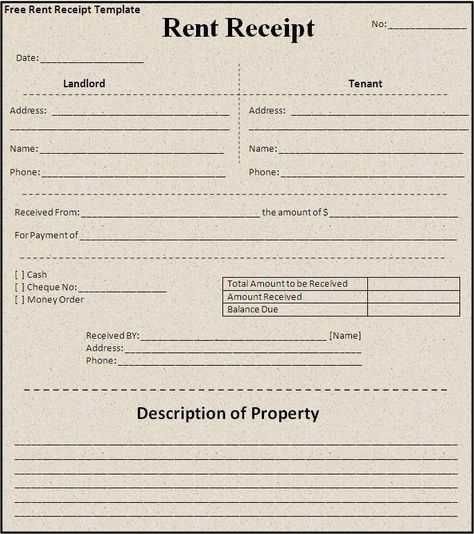

- Landlord’s Information: Name, address, and contact details.

- Property Address: Location of the rented unit.

- Breakdown of Charges: Rent, utilities, or other fees.

- Signature: Landlord or property manager’s confirmation.

Best Practices

Use a consistent format to maintain records. Provide copies to both parties. If digital receipts are issued, ensure they include an electronic signature or official stamp for verification.

Include the full name of the tenant and landlord to ensure clarity in case of disputes. Record the property address exactly as stated in the lease to avoid confusion.

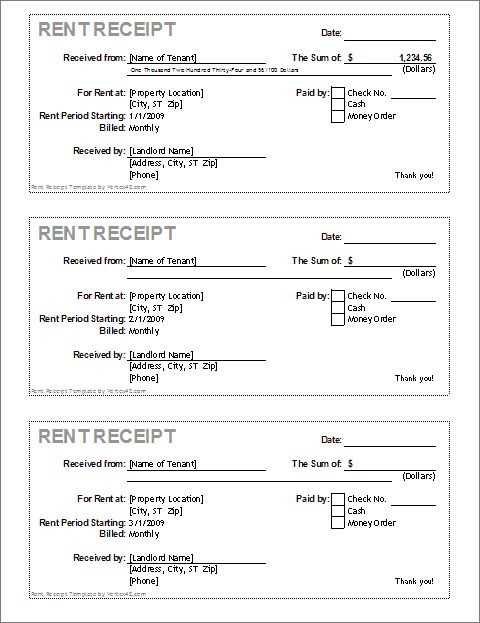

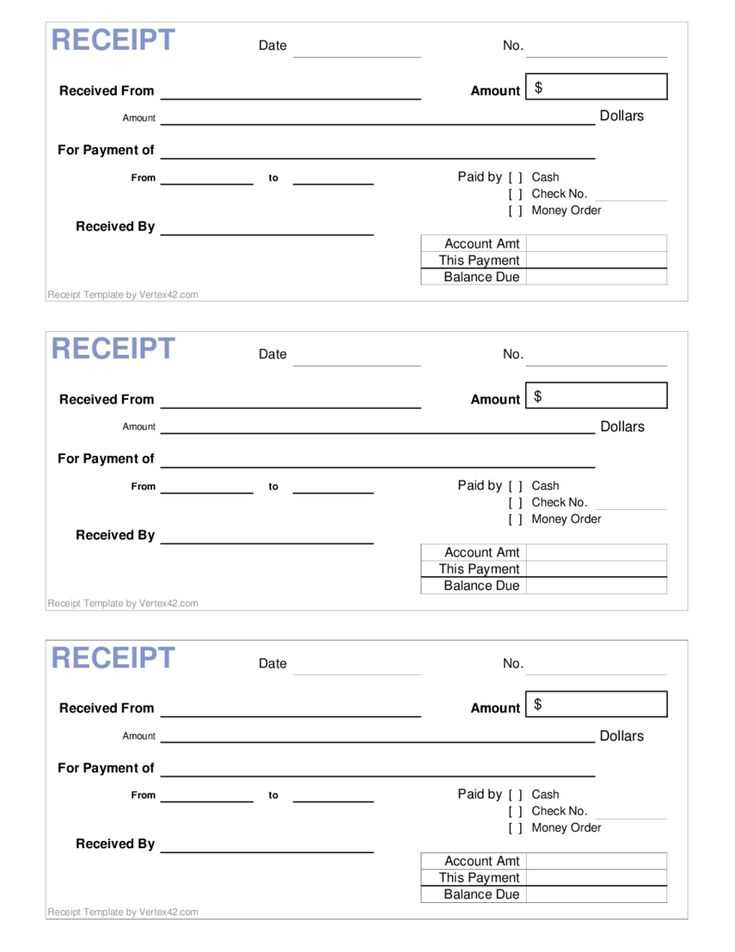

Specify the payment amount in both numerical and written formats to prevent misinterpretation. Note the date of payment and the period it covers, such as “March 2025 rent paid on February 28, 2025.”

Indicate the payment method, whether cash, check, bank transfer, or another form. If applicable, include a check number or transaction ID for reference.

List any additional charges, such as late fees or utilities, separately from the base rent. Provide a breakdown to make it clear how the total was calculated.

Include a receipt number or unique identifier for tracking purposes. If signatures are required, leave space for both tenant and landlord to sign, confirming receipt.

Use a structured layout with clear sections. Place the landlord’s and tenant’s full names at the top, followed by the date of payment. Align text neatly and keep spacing consistent for easy reading.

Key Details to Include

Specify the amount paid in both numerical and written formats to prevent misunderstandings. State the payment method (cash, check, bank transfer) and the period it covers. If there are outstanding balances, list them separately.

Enhancing Readability

Use bold or underlined text for critical details like total amount and due dates. Keep sentences concise and avoid unnecessary jargon. A simple acknowledgment line, such as “This receipt confirms full/partial payment for the stated period.”, ensures clarity.

End with the landlord’s signature or an official stamp for verification.

Specify the payment details clearly, including the date, amount, payment method, and rental period covered. Any ambiguity can lead to disputes.

- Ensure Compliance with Local Laws: Some jurisdictions require specific details on receipts, such as tax information or landlord registration numbers. Check relevant regulations before issuing a document.

- Maintain Accurate Records: Keep copies of all receipts for tax reporting and legal protection. Digital and printed versions should match exactly.

- Use Authorized Signatures: A handwritten or digital signature from the landlord or property manager adds credibility and legal validity.

- Avoid Misleading Language: Clearly state that the receipt confirms payment received, not future obligations or lease modifications.

- Include Tenant Identification: List the tenant’s full name and rental unit details to prevent confusion, especially in multi-unit properties.

Review receipts for errors before providing them. Incorrect details can cause legal complications, especially in eviction or tax-related matters.

Adjust payment details: Include specific rent amounts, due dates, and accepted payment methods for each lease type. A commercial lease might list bank transfers as the primary option, while a residential lease could include cash or check payments.

Specify tenant and landlord details: Add full names, addresses, and contact information to personalize receipts for different agreements. A sublease may require an additional field for the original tenant’s details.

Incorporate lease-specific terms: Some agreements include late fees, security deposit deductions, or maintenance costs. Modify the template to reflect these terms clearly, ensuring accuracy in financial records.

Format for compliance: Certain jurisdictions require specific language or disclosures on receipts. Verify local regulations and adjust templates to meet legal standards.

Automate for consistency: If handling multiple leases, use formulas or scripts in digital templates to auto-fill recurring details. This minimizes errors and saves time on manual adjustments.

Choose digital records for quick access, automated calculations, and secure cloud backups. Digital receipts reduce physical clutter and minimize risks like loss or damage. Most accounting software integrates digital payment logs, making tax reporting easier.

Paper records provide a tangible backup, independent of power or internet access. Some landlords prefer handwritten receipts for immediate proof without relying on devices. However, paper can fade, be misplaced, or require manual organization.

For reliability, use a hybrid system. Scan paper receipts for digital storage and print essential digital records when needed. This approach ensures accessibility while maintaining redundancy.

Failing to Include Complete Payment Details

A receipt must clearly state the amount paid, date of payment, and payment method. Omitting these details can create confusion and disputes. Specify whether the payment covers rent, utilities, or security deposit to avoid ambiguity.

Not Including Both Parties’ Information

A receipt should list the full name and contact details of both the tenant and landlord. Missing this information can make it difficult to verify payments later. Always ensure that the landlord’s signature or official stamp is present to confirm authenticity.

| Common Mistake | Impact | Solution |

|---|---|---|

| Missing payment breakdown | Unclear record of what was paid | Itemize rent, fees, and deposits separately |

| Omitting payment date | Disputes over late fees | Always include the exact payment date |

| Lack of landlord’s signature | No proof of acknowledgment | Ensure the receipt is signed or stamped |

Clear and accurate documentation prevents misunderstandings and legal complications. Reviewing receipts for missing details before issuing them helps maintain reliable records.

Use clear itemization to make the receipt details easy to read and verify. Each section should provide structured information, ensuring transparency for both parties.

- Date: Always include the exact date the payment was received to maintain accurate records.

- Tenant Name: Specify the full name of the tenant to avoid confusion, especially in multi-unit properties.

- Rental Period: Indicate the time frame the payment covers to prevent disputes.

- Amount Paid: State the exact sum received, including currency symbols for clarity.

- Payment Method: Clarify whether the payment was made via cash, check, or electronic transfer.

- Property Address: Mention the full address to link the payment to the correct rental unit.

- Landlord Contact: Include a phone number or email for any follow-up questions.

Ensure that each receipt is signed or electronically verified to confirm authenticity. Storing copies in both physical and digital formats helps maintain organized financial records.