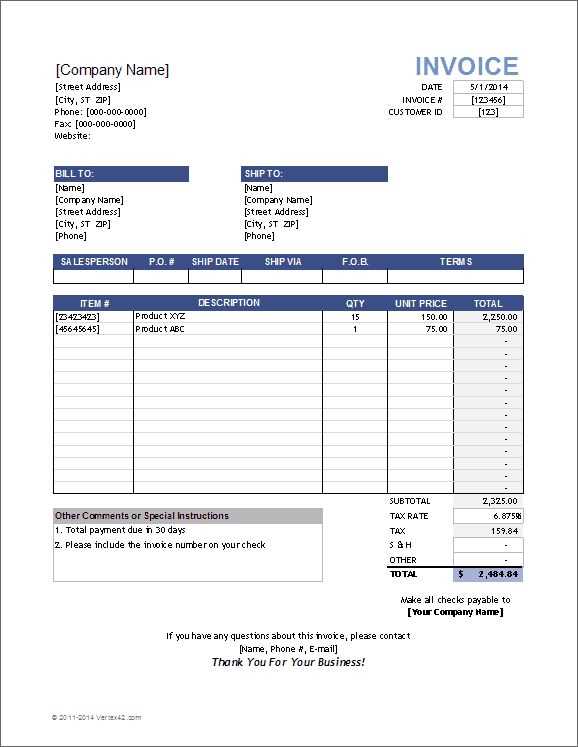

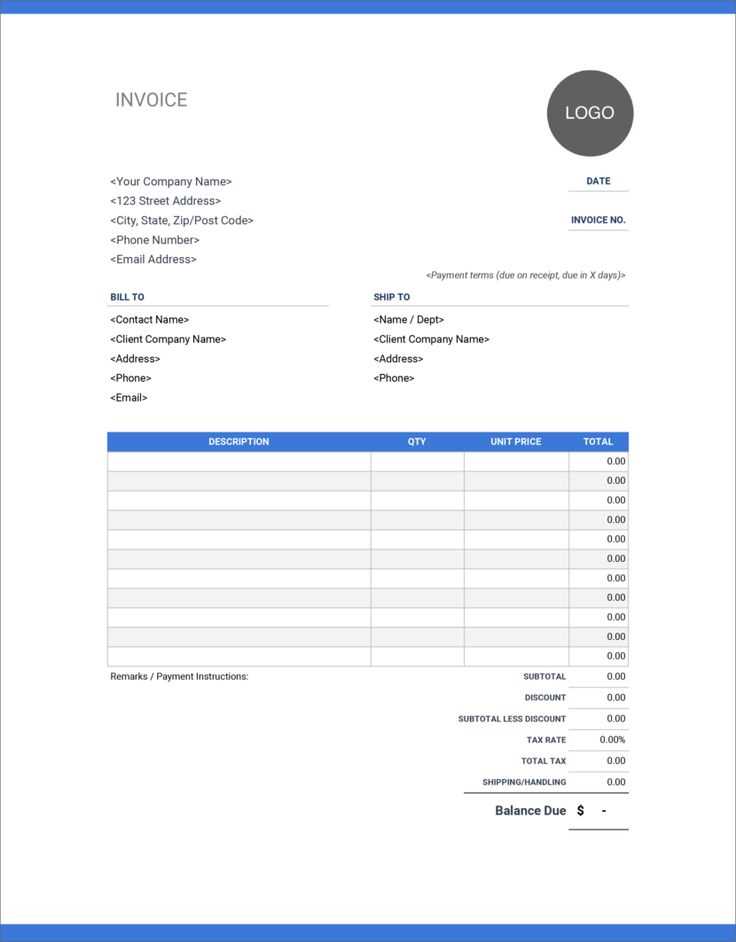

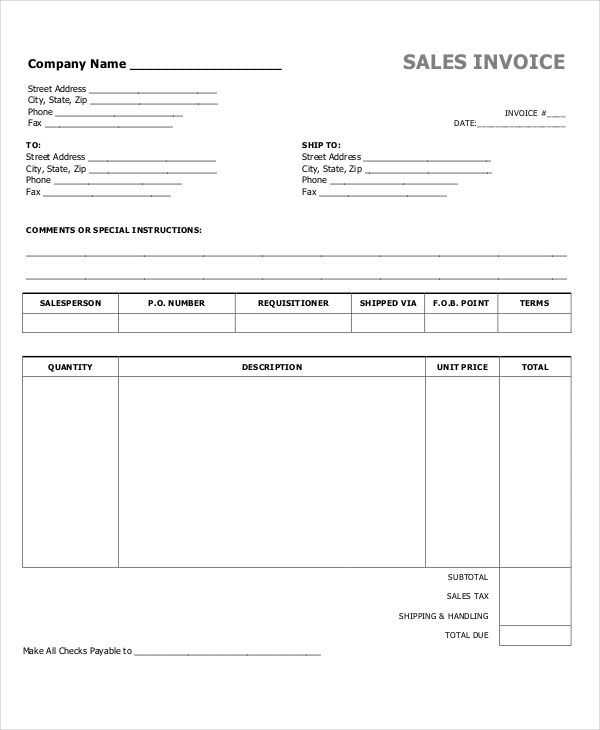

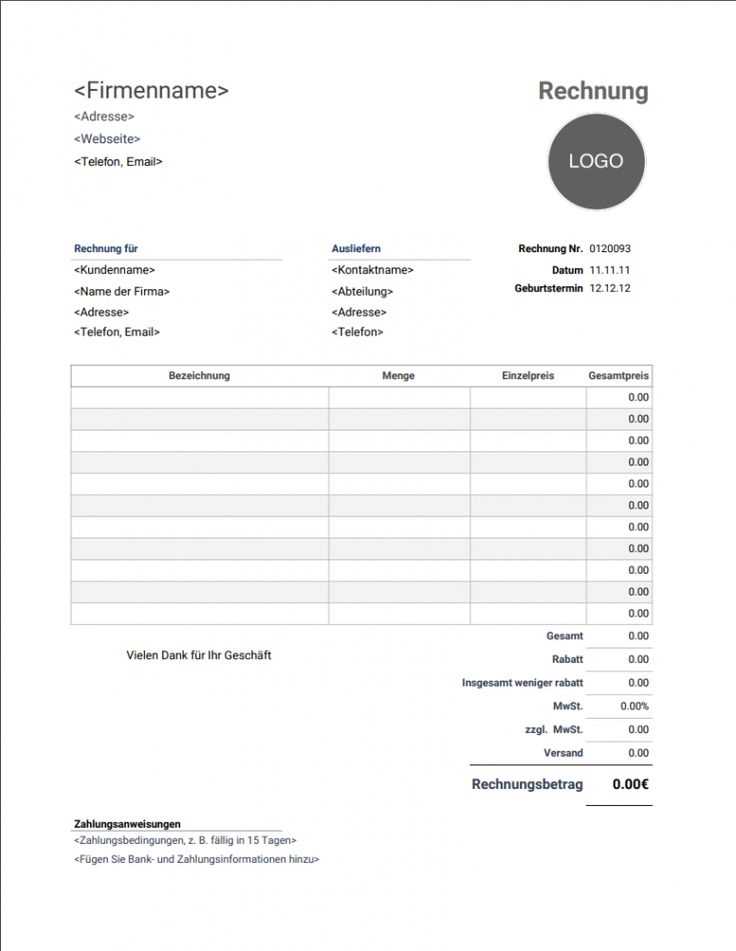

Download a free invoice and receipt template to simplify your billing process. Choose a format that fits your needs, whether it’s a PDF, Word, or Excel file. Customizable templates help you add your logo, business details, and payment terms in minutes.

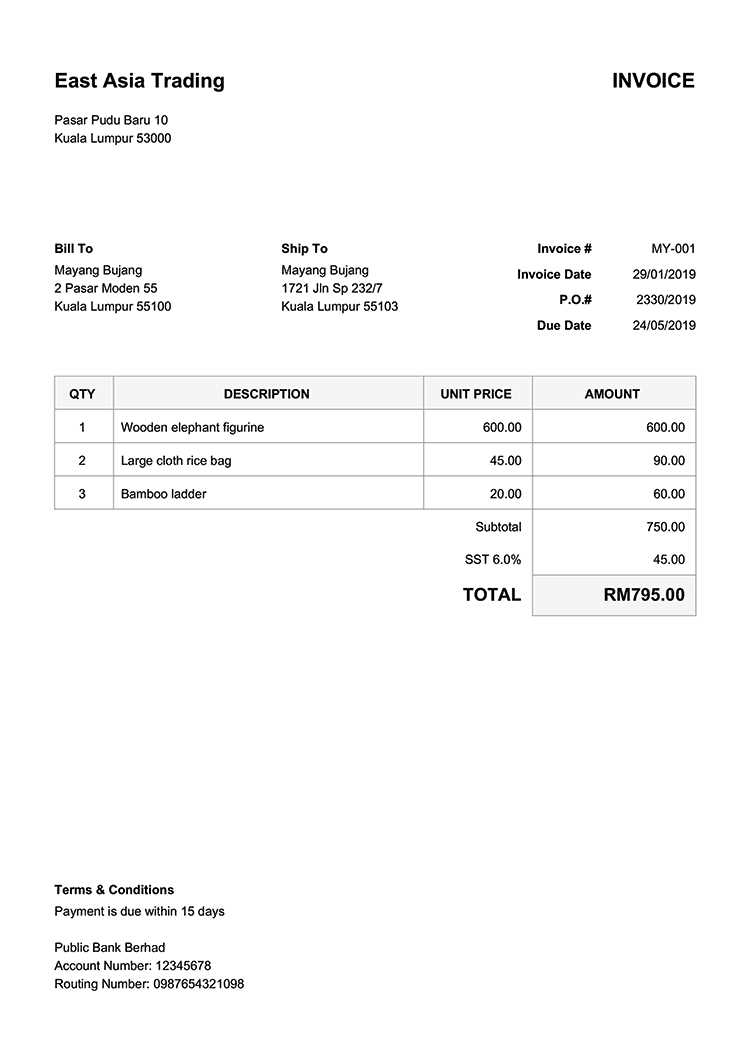

A well-structured invoice ensures faster payments and clear communication with clients. Include key details such as itemized services, tax calculations, and due dates. A receipt template, on the other hand, provides proof of payment, reinforcing trust and professionalism.

For freelancers, small businesses, and service providers, a standardized template saves time and minimizes errors. Automated formulas in Excel templates can calculate totals instantly, while Word and PDF versions maintain a polished look for easy sharing.

Optimize your invoicing process by selecting a template that meets your business requirements. Download, customize, and send professional documents with ease.

Here’s the revised version with fewer word repetitions while preserving meaning:

Choose a template that includes clear sections for invoice numbers, dates, itemized charges, and payment terms. Consistency in format improves readability and ensures accuracy.

Customize the layout by adjusting fonts, colors, and logos to align with your brand. Many free templates offer easy modifications without requiring advanced design skills.

Ensure that tax calculations, discounts, and totals are correctly formatted. Automated formulas in spreadsheet-based templates minimize errors and streamline calculations.

| Feature | Benefits |

|---|---|

| Pre-formatted fields | Reduces manual entry time |

| Editable branding | Maintains a professional appearance |

| Built-in calculations | Eliminates miscalculations |

Save templates in multiple formats such as PDF, Word, or Excel for easy sharing. Keeping a digital record helps with financial tracking and simplifies tax reporting.

- Free Invoice and Receipt Template

Choose a template that matches your needs. Whether you’re a freelancer, small business owner, or contractor, a well-structured invoice ensures clear communication with clients. Look for a template that includes essential details like invoice number, date, payment terms, and a breakdown of services.

Customize the template for a professional touch. Add your business name, logo, and contact details. Ensure all necessary fields are included, such as tax information and payment methods. A clear, organized layout helps prevent disputes and speeds up payment processing.

Use digital formats for convenience. PDF and Excel templates work well for most cases, while Google Docs and Sheets allow easy sharing and collaboration. Consider cloud storage for quick access and automatic backups.

Automate calculations to reduce errors. Many templates come with built-in formulas that calculate totals, taxes, and discounts. This saves time and ensures accuracy, making financial management easier.

Send invoices promptly and keep records. A well-maintained archive helps track payments and simplifies tax reporting. Consistency in format and structure builds trust with clients, making transactions smoother and more reliable.

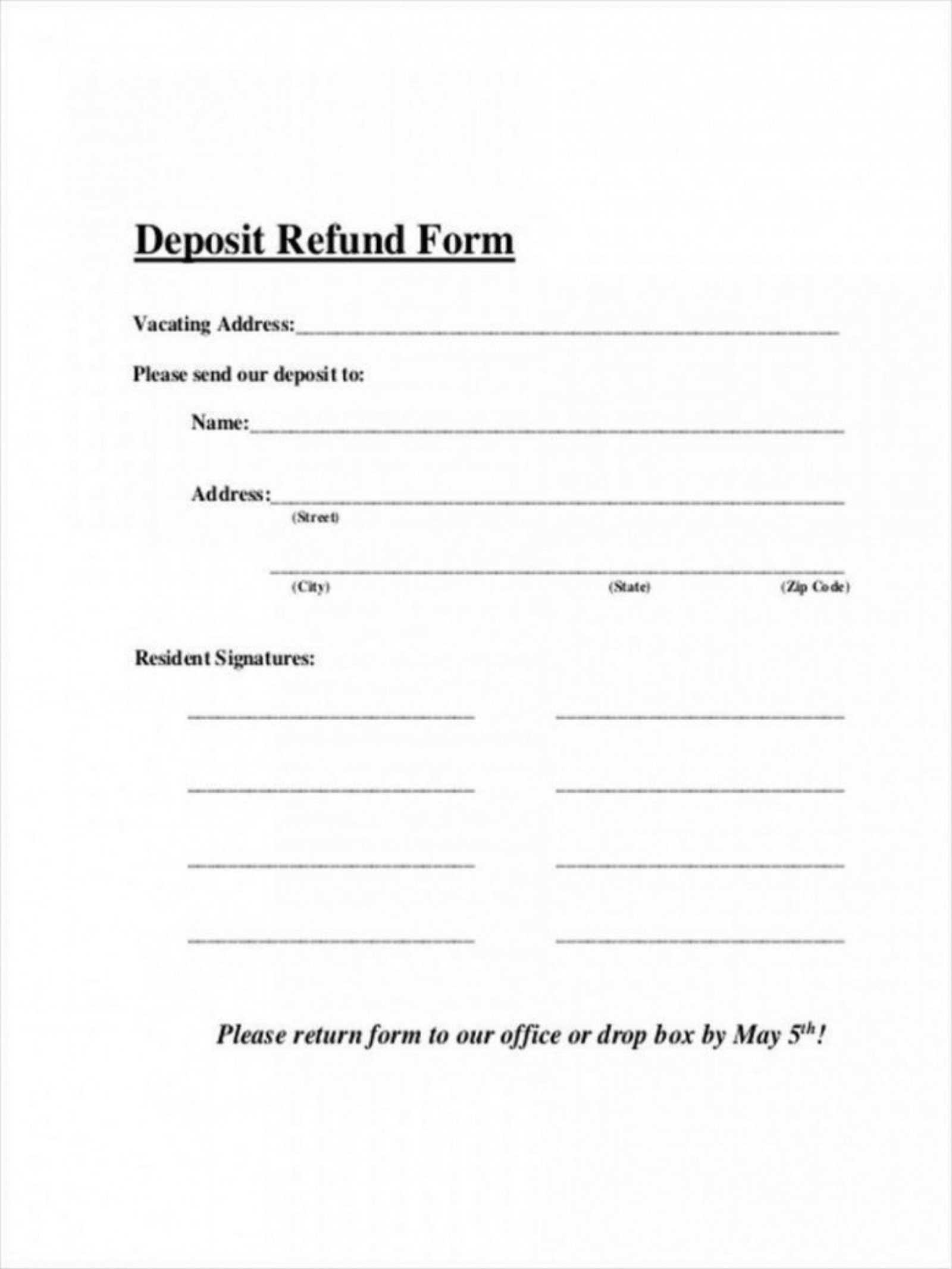

An invoice requests payment, while a receipt confirms it. The first document outlines what is owed, listing services or products with corresponding prices and due dates. The second serves as proof of completed transactions, acknowledging that funds have been received.

Structure and Purpose

An invoice includes details like item descriptions, quantity, rates, total cost, and payment terms. It often assigns a unique number for tracking. A receipt, however, verifies payment and usually contains the date, amount paid, payment method, and business details.

Legal and Accounting Impact

Invoices help businesses track outstanding payments and manage cash flow. They are also crucial for tax reporting. Receipts, on the other hand, serve as evidence of expenses, aiding in bookkeeping and warranty claims.

Choose a template that matches your business needs. Look for a layout that includes all necessary fields, such as invoice number, date, client details, and itemized charges.

- Add Your Branding: Insert your company logo, use brand colors, and select a readable font that aligns with your business style.

- Modify Payment Terms: Adjust due dates, late fees, and accepted payment methods to reflect your policies.

- Customize Item Descriptions: Tailor product or service names and descriptions to be clear and specific for your customers.

- Include Legal Information: Add tax details, refund policies, or any legal disclaimers required for your industry.

- Save and Test: Export the template in multiple formats (PDF, Excel) and send a test invoice to ensure everything appears correctly.

Using a structured, branded template improves clarity and professionalism while making it easier for clients to process payments.

PDF ensures that invoices and receipts retain their original layout across all devices. It prevents accidental edits and supports digital signatures for quick approvals.

Why DOCX and XLSX Are Practical Choices

DOCX allows customization without special software, making it useful for businesses that adjust templates frequently. XLSX is ideal for tracking calculations and automating totals, ensuring accuracy in financial records.

When to Use CSV

CSV works best for bulk data imports into accounting systems. It removes unnecessary formatting, making it easy to transfer financial details between applications.

Ensure compliance with mandatory invoice details. Most countries require invoices to include the seller’s and buyer’s names, tax identification numbers, issue date, and a unique invoice number. Failing to meet these requirements can lead to fines or tax rejections.

Tax Regulations and Electronic Invoicing

VAT and sales tax compliance varies by region. The European Union mandates VAT invoices for cross-border transactions, while the U.S. applies different sales tax rules per state. Some countries, like Brazil and Italy, enforce electronic invoicing systems with government validation.

Receipt Requirements and Record Retention

Maintain receipts for tax and audit purposes. Businesses in Canada and the UK must keep records for at least six years, while Australia requires five. Digital receipts are widely accepted, but some jurisdictions still mandate physical copies for certain transactions.

Ignoring Formatting Issues

Many free templates come with preset formatting that may not align with your needs. Always check for inconsistent spacing, misaligned text, or missing sections. Adjust margins, fonts, and layout to ensure clarity and professionalism.

Failing to Customize Key Details

Leaving generic placeholders like “[Your Company Name]” or “[Date]” can make documents look unprofessional. Double-check every field, including payment terms and contact details, to avoid confusion and delays.

Templates often use default currency and tax settings. Verify that amounts, tax calculations, and legal disclaimers comply with local regulations before sending invoices or receipts.

Official government websites provide accurate and legally compliant templates. Many tax authorities offer free invoice and receipt forms that meet local regulations.

Accounting software providers often share free templates as part of their resources. Check their websites for customizable PDFs and spreadsheets designed for different business needs.

Freelancer and small business platforms like marketplaces and financial service websites frequently provide templates tailored for self-employed professionals.

Open-source template libraries offer downloadable invoice and receipt forms in multiple formats, allowing adjustments to fit various industries.

Business forums and communities sometimes feature shared templates from experienced users. Reviewing feedback ensures selecting a reliable option.

Use structured lists to keep your invoice and receipt templates clear and easy to read. Bullet points help break down details, making information digestible for clients and accountants alike. Here’s how to use them effectively:

- Itemized Lists: Separate products or services with clear descriptions and pricing.

- Payment Terms: Highlight due dates, accepted payment methods, and late fee policies.

- Tax Breakdown: Display tax rates and total amounts separately for transparency.

- Notes and Instructions: Include additional details like return policies or special agreements.

Keep lists concise, avoid unnecessary details, and ensure each entry adds value to the document. A well-organized format speeds up processing and improves accuracy.