Key Elements of a Taxi Receipt

A well-structured taxi receipt should include essential details for clarity and accuracy. Missing information can cause disputes or rejections for reimbursement. Ensure your receipt contains the following:

- Date and Time: Clearly indicate when the trip occurred.

- Taxi Company Name and Contact: Include the business name, phone number, and address.

- Driver Information: Full name or identification number for verification.

- Pick-up and Drop-off Locations: List the exact addresses for proper documentation.

- Fare Breakdown: Separate base fare, distance charge, additional fees, and taxes.

- Payment Method: Specify whether cash, credit card, or app payment was used.

- Receipt Number: A unique identifier for tracking and record-keeping.

How to Create a Printable Taxi Receipt

For a professional and reusable template, follow these steps:

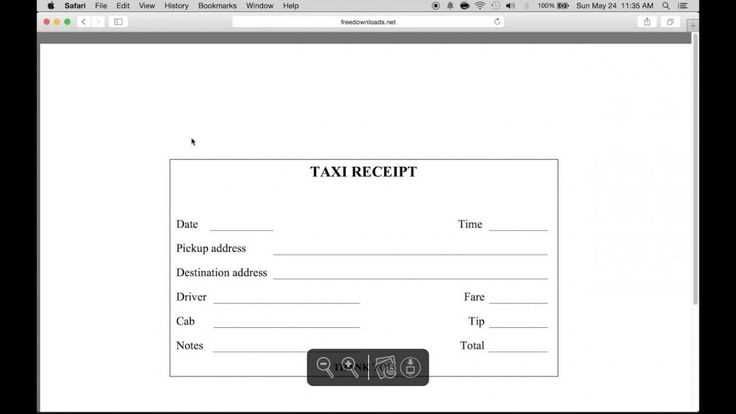

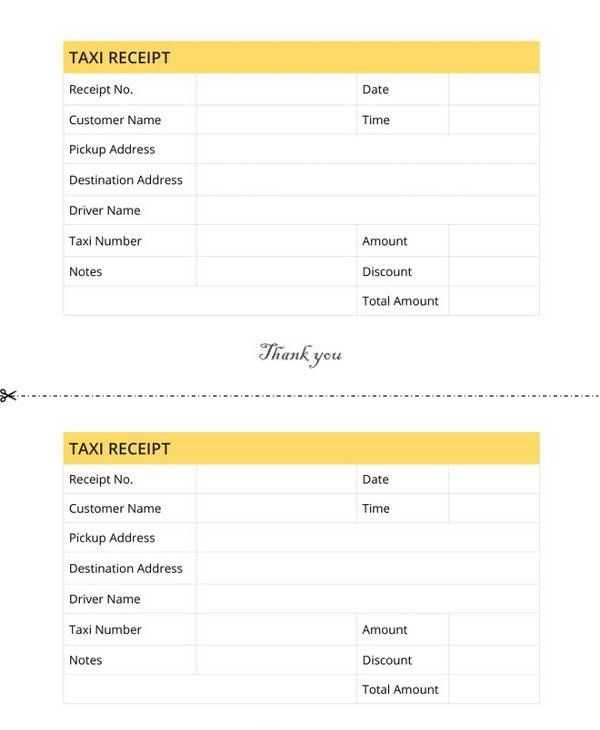

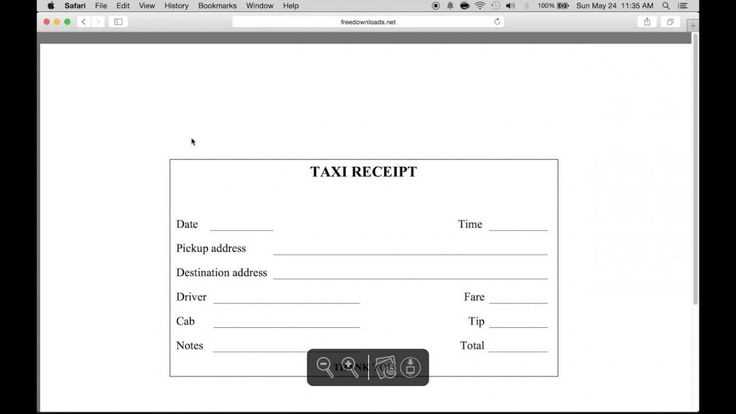

- Use a Simple Layout: A clear format ensures readability. Use tables or structured spacing.

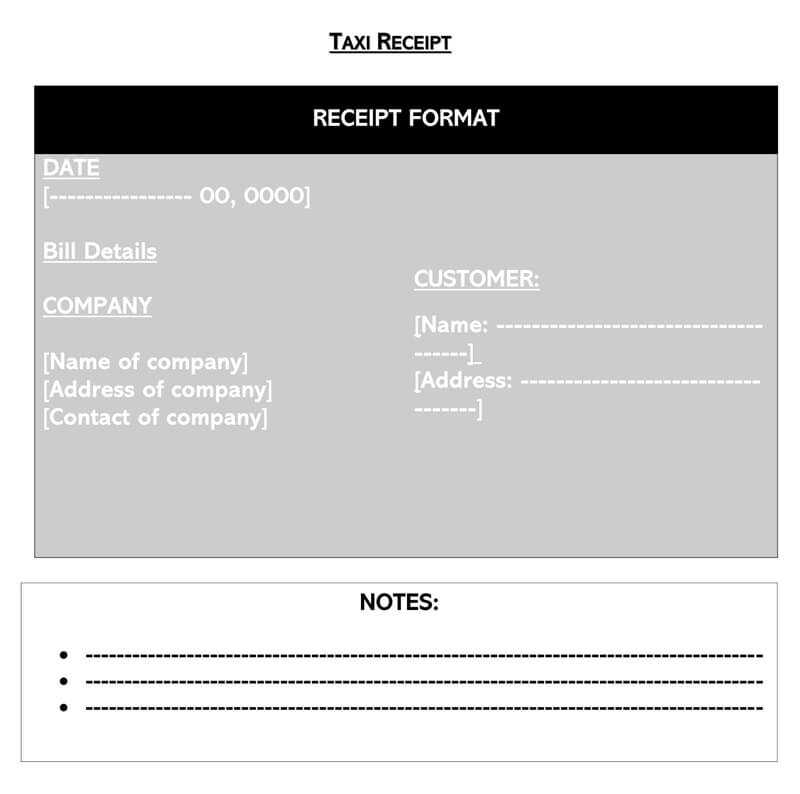

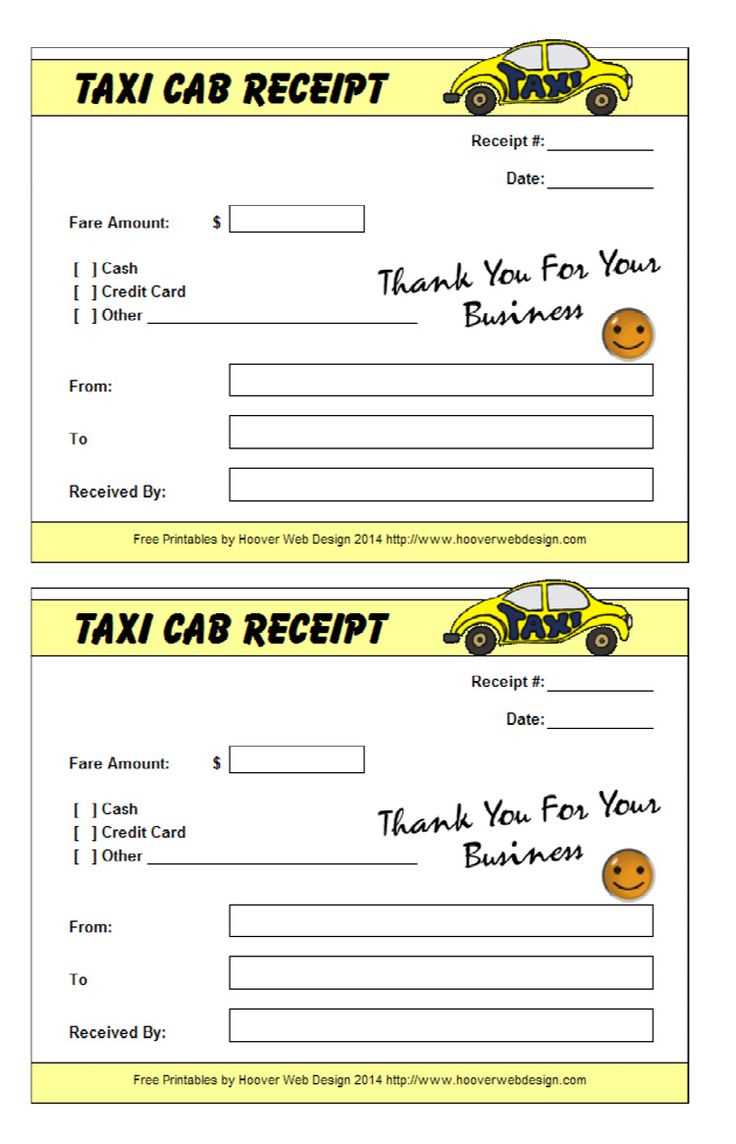

- Include Business Branding: If applicable, add a logo and official header.

- Ensure Legal Compliance: Check local requirements for tax and licensing information.

- Provide a Digital Option: Many companies now offer email receipts for convenience.

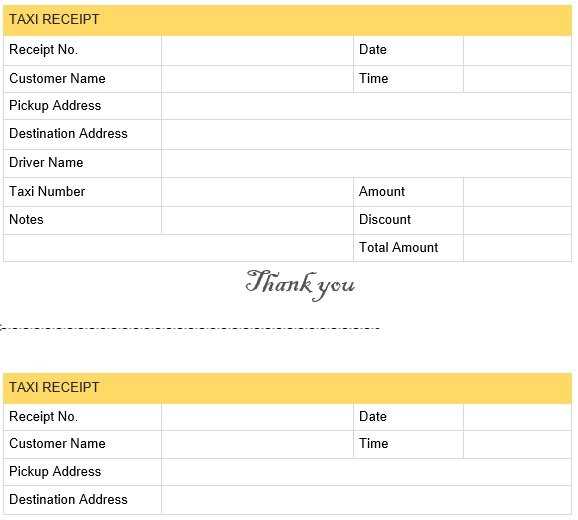

Example Template

A basic taxi receipt template can look like this:

Taxi Company Name Phone: (XXX) XXX-XXXX Address: [Street, City, State, ZIP] Date: [MM/DD/YYYY] Time: [HH:MM AM/PM] Receipt #: [XXXXXX] Pick-up: [Address] Drop-off: [Address] Base Fare: $X.XX Distance Fare: $X.XX Additional Fees: $X.XX Tax: $X.XX Total: $X.XX Paid via: [Cash/Card/App] Driver ID: [XXXXXX] Thank you for riding with us!

Keep templates customizable to fit different regulations and business needs. A professional receipt ensures transparency and builds customer trust.

American Taxi Receipt Template

Key Elements of a Cab Receipt

Legal and Tax Rules for Receipts

Design and Formatting Tips

Customizing for Various Services

Common Errors in Creating Receipts

Digital vs. Paper: Pros and Cons

Key Elements of a Cab Receipt

A proper taxi receipt must include the date and time of the ride, the pick-up and drop-off locations, and the fare breakdown. Always list any additional charges, such as tolls or surcharges, separately. Ensure the receipt has the company name, license number, and driver’s identification for verification. A unique transaction number prevents duplication and enhances accountability.

Legal and Tax Rules for Receipts

Receipts must meet IRS requirements for business expense claims. Include the total fare, payment method, and a clear description of the service. For digital receipts, ensure they are timestamped and securely stored. Many jurisdictions mandate that receipts remain available for audits for at least three years. Providing inaccurate or incomplete receipts can lead to fines or disputes with tax authorities.