Essential Details to Include

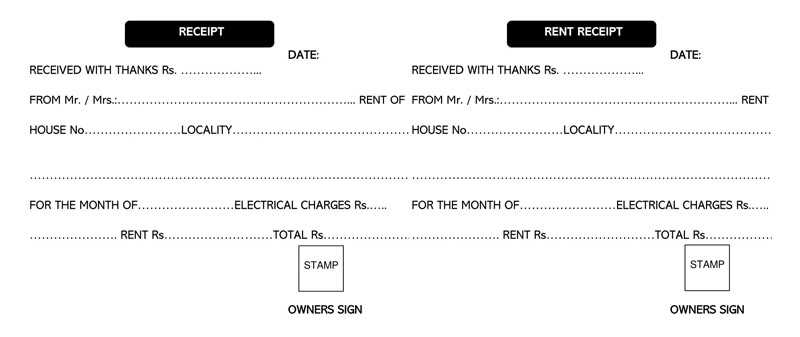

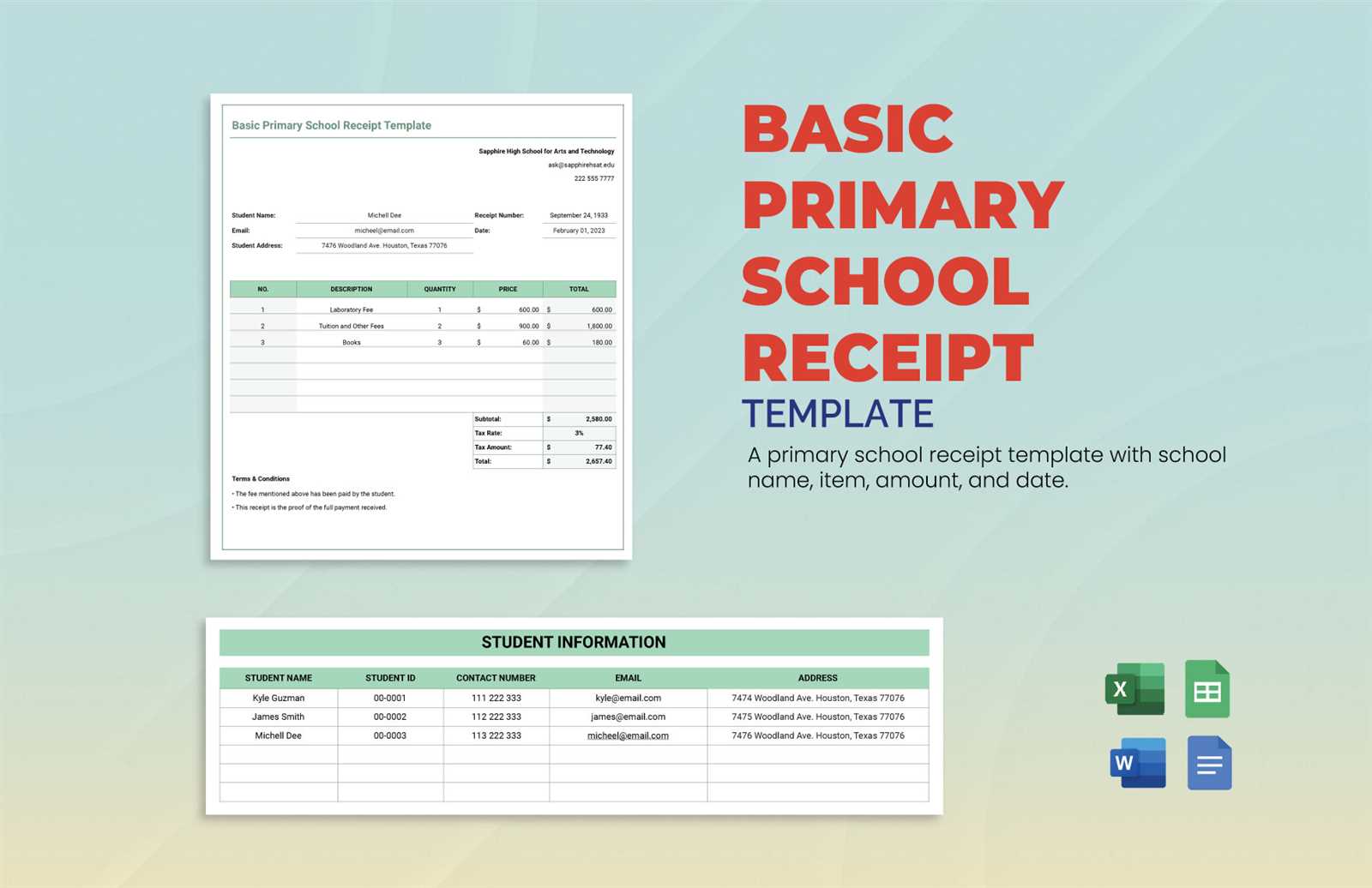

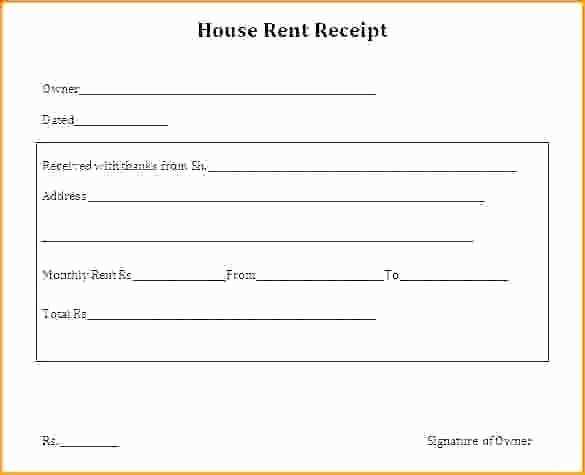

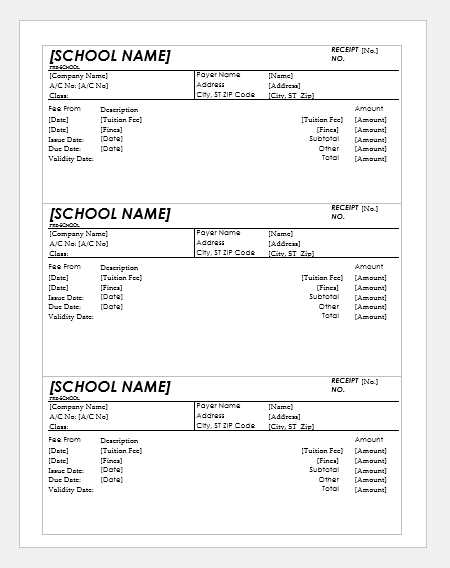

A well-structured receipt should contain clear and precise information. Missing details can lead to confusion or disputes. Here are the core elements every college receipt must have:

- Institution Name and Contact Information: Clearly display the college’s name, address, phone number, and email.

- Receipt Number: A unique identifier ensures proper tracking and record-keeping.

- Date of Transaction: The exact date of payment helps in verifying financial records.

- Student’s Name and ID: Include the full name and student identification number for reference.

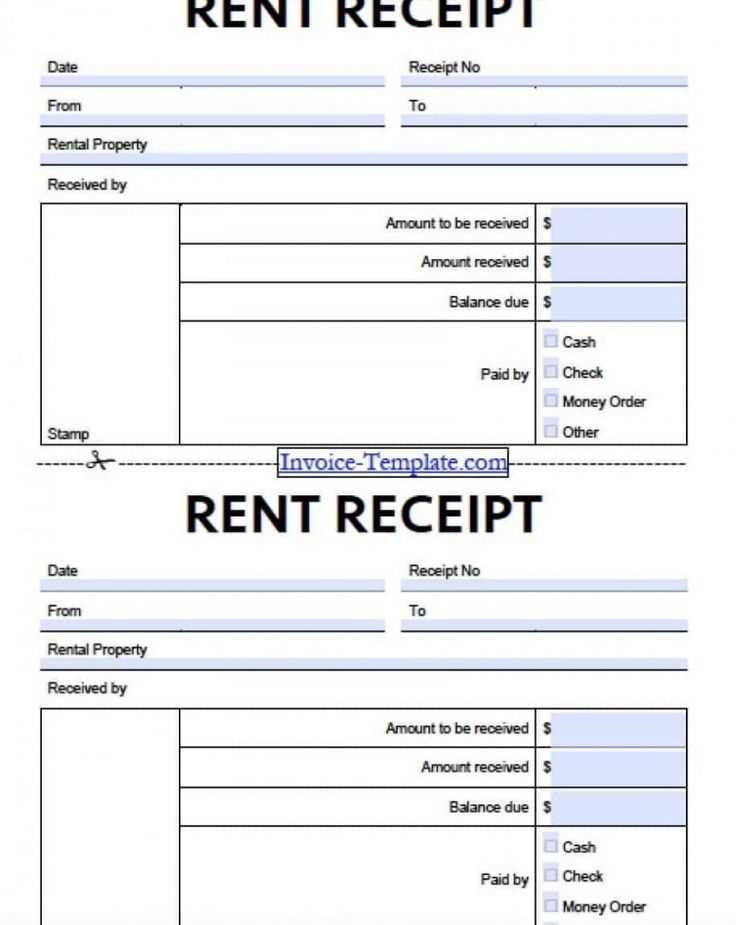

- Payment Details: Specify the amount paid, the payment method (cash, credit, online transfer), and any transaction reference number.

- Breakdown of Fees: List tuition, lab fees, library fees, and other applicable charges separately.

- Signature or Stamp: An authorized signature or official college stamp adds authenticity.

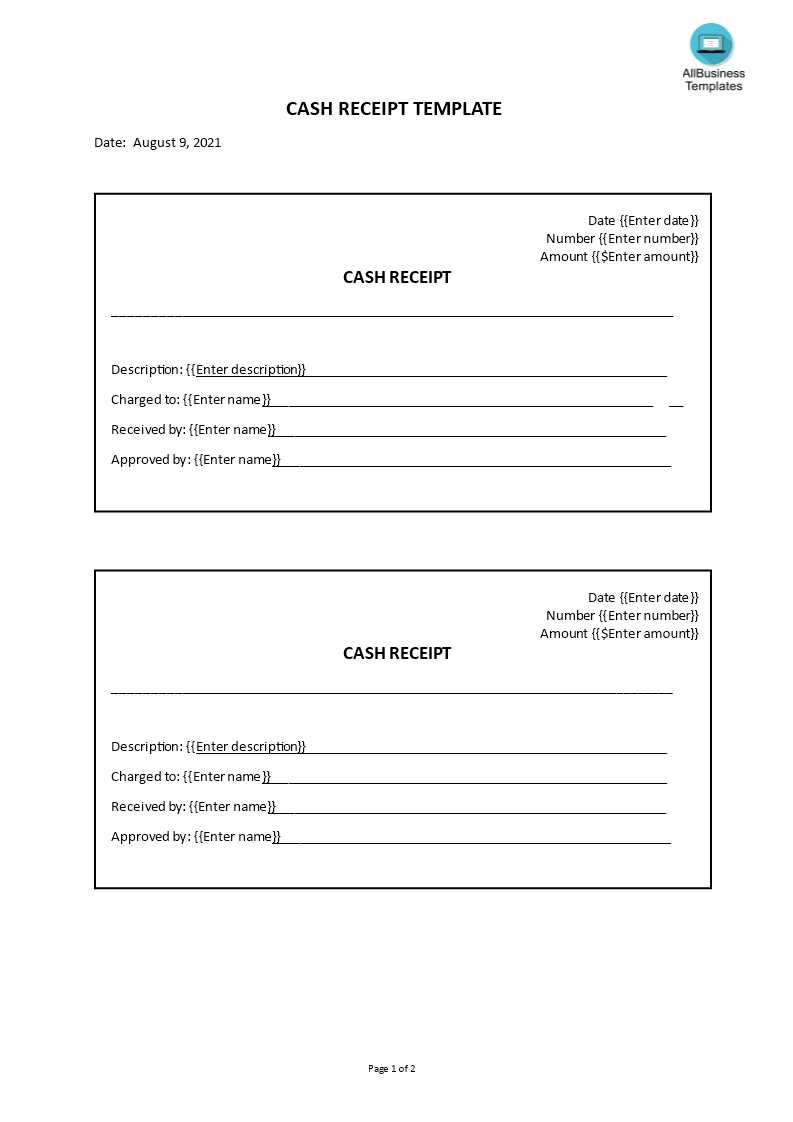

Formatting for Clarity

A structured layout improves readability. Keep these points in mind:

- Use Clear Sections: Separate details with lines or spacing to avoid clutter.

- Consistent Font Size: Ensure important details like total amount and due date stand out.

- Highlight Key Information: Use bold text for critical fields such as amount paid and receipt number.

Common Mistakes to Avoid

- Missing Payment Details: Always include the mode of payment and any reference number.

- Incorrect Amounts: Double-check figures to prevent errors.

- Omitting Student Information: Every receipt should clearly identify the student to whom it belongs.

Digital vs. Paper Receipts

Both formats have advantages. Digital receipts offer convenience and easy retrieval, while printed receipts provide a physical record. Colleges often issue both to ensure accessibility.

Customizing Templates

Many institutions use software-generated templates. If creating one manually, ensure it meets the institution’s financial standards and legal requirements. A well-designed template enhances transparency and simplifies record-keeping.

College Receipt Template

Key Elements to Include in an Academic Receipt

Formatting Standards for Official Documents

Common Mistakes When Creating a Payment Record

Digital vs. Paper-Based Records for Educational Institutions

Legal and Tax Considerations for Student Payment Proofs

Best Tools for Designing an Educational Receipt Template

Include the institution’s name, logo, and official contact details at the top. This ensures authenticity and simplifies verification. Below, list the student’s full name, ID number, and course details to associate the payment with the correct records.

Use a structured format with clear section headers. A standard layout includes payment date, amount, payment method, and an itemized breakdown of fees. Indicate any applicable taxes or discounts separately to maintain transparency.

Avoid vague descriptions. Instead of “tuition fees,” specify “Spring Semester Tuition – Undergraduate Program.” This prevents confusion when reconciling payments.

Choose a consistent font and spacing to improve readability. Bold key details, such as total amount and due date, for quick reference. If using a digital format, ensure compatibility with common file types like PDF for easy sharing.

Errors such as missing authorization signatures, incorrect calculations, or inconsistent formatting reduce credibility. Always review the receipt before issuing it.

Digital receipts streamline record-keeping and minimize paper waste. Secure storage options, such as cloud-based systems, help institutions track payments and provide instant retrieval. However, paper receipts may still be necessary for official documentation in certain cases.

Ensure compliance with financial regulations. Receipts should include tax details if applicable, and institutions must retain copies for audit purposes.

For easy template creation, use spreadsheet software, specialized accounting tools, or document processors with pre-designed layouts. These options save time and reduce formatting errors.