Creating a wholesale receipt template is a straightforward yet impactful step for any business. It helps you maintain organized records of transactions, ensuring clarity for both you and your customers. Whether you’re selling in bulk or offering products at discounted prices, a well-designed receipt acts as proof of purchase and reflects professionalism.

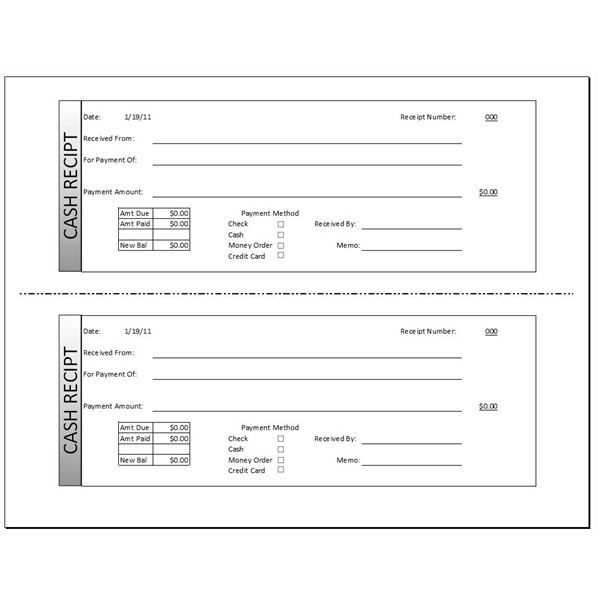

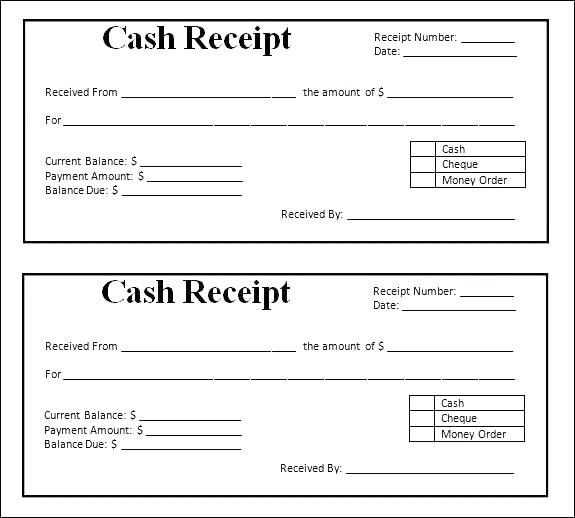

Use a simple layout that includes key details: buyer’s name, address, contact information, itemized list of products, and total amount paid. This ensures the document serves as a clear record for both parties. Including your business name, logo, and contact details at the top reinforces your brand identity and makes it easy for customers to reach out with any follow-up questions.

Make sure to clearly separate the unit price and total price of each item, and include relevant tax information where applicable. A subtotal section should come before the final total, giving the buyer a transparent breakdown of costs. This format is crucial when handling bulk orders, as it reduces errors and builds trust with customers.

Finally, make sure your wholesale receipt template is editable, allowing you to customize it as needed. This flexibility will help you keep up with any changes in pricing, promotions, or tax rates without having to redesign the document from scratch. An editable template streamlines your process, saving time and ensuring accuracy.

Here are the corrected lines:

For a wholesale receipt, make sure the following details are clear and consistent:

| Field | Correction |

|---|---|

| Invoice Number | Ensure a unique and sequential format. Example: INV-0001 |

| Buyer Name | Double-check for accurate spelling and complete business name. |

| Item Description | Be precise and include relevant details like model number, color, or size. |

| Quantity | List the exact number of items purchased, without rounding off. |

| Unit Price | Ensure the price reflects any discounts or bulk pricing if applicable. |

| Total Amount | Check for correct multiplication of quantity and unit price. |

| Payment Terms | Clarify if payment is due immediately, on a certain date, or if installments apply. |

| Delivery Date | Confirm the expected delivery date is accurate and updated if necessary. |

| Shipping Address | Verify the address to avoid delays or errors in shipping. |

- Wholesale Receipt Template

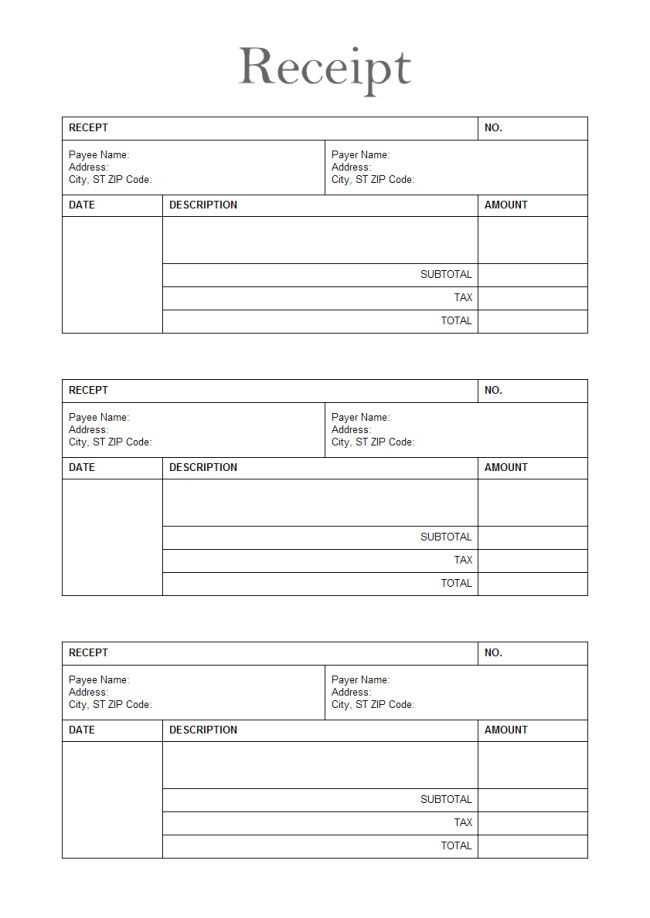

A well-structured wholesale receipt template helps streamline your transactions and ensures both parties have clear records. Include the following key elements for accuracy:

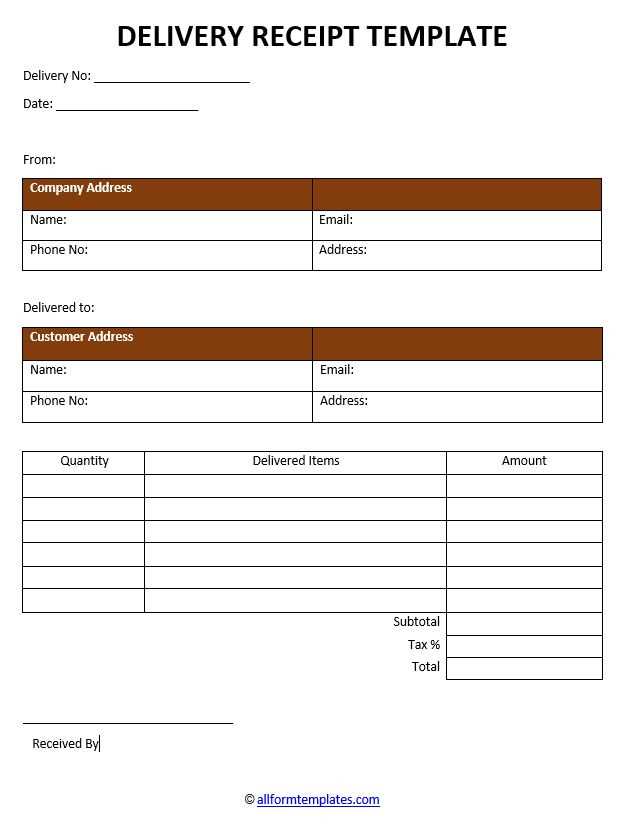

1. Company Information: Clearly list the seller’s business name, address, phone number, and email. This gives the buyer easy access to contact details if needed.

2. Buyer Information: Include the buyer’s name, company (if applicable), and contact details. This ensures both parties can be identified in case of any issues or returns.

3. Transaction Date: The date of the transaction should be prominently displayed. This is important for accounting and for keeping track of orders.

4. Invoice Number: Assign a unique invoice number to each receipt. This helps both parties keep track of purchases and payments efficiently.

5. Itemized List of Products: Break down the purchased items, including product descriptions, quantities, unit prices, and total amounts. This level of detail prevents confusion and disputes over the transaction.

6. Taxes and Discounts: If applicable, include any tax rates and discount amounts. This ensures full transparency in the pricing structure.

7. Total Amount Due: Clearly state the total amount due, including any taxes or discounts. This helps avoid misunderstandings about the final payment.

8. Payment Terms: Indicate the payment method (e.g., credit, cash, or bank transfer) and the due date for payment. It’s helpful to include any late payment penalties, if relevant.

9. Signature Line: Include a space for both the buyer and seller to sign. This confirms that both parties have agreed to the terms of the transaction.

10. Return Policy: If relevant, add details about the return or exchange policy to ensure clarity on how returns will be handled.

Design a wholesale receipt that reflects your brand and provides clear details to your customers. Follow these steps for an organized and professional appearance:

- Include Key Business Information: Place your business name, address, contact details, and website at the top. This helps customers easily reach you for future orders or inquiries.

- Provide Transaction Details: Include the invoice number, date of purchase, and payment terms. This information is vital for tracking and future reference.

- List Products with Descriptions: Clearly state each product’s name, quantity, price per unit, and total price. Organize the products in a table format for easy reading.

- Show Discounts and Taxes: If applicable, indicate any discounts offered and tax rates applied. Break down these charges for transparency.

- Include Total Amount: Clearly highlight the final amount due, ensuring all previous charges are accounted for. Make it easy for customers to see the final figure.

- Payment Methods: Specify the payment methods accepted and any relevant payment instructions to avoid confusion.

- Add a Return Policy: If applicable, briefly include your return policy or provide a reference to where customers can find it. This establishes trust and avoids misunderstandings.

- Brand Elements: Incorporate your logo and use your brand colors to keep the receipt in line with your business identity.

By following these steps, you ensure your wholesale receipts are clear, professional, and aligned with your business’s standards.

Every wholesale receipt should clearly state the business details, including the seller’s name, address, and contact information. This ensures both parties can easily follow up on any inquiries or issues that may arise.

Next, include the date of the transaction and a unique receipt number for reference. This helps in tracking sales and serves as a point of reference for both parties in case of returns or disputes.

The items purchased need to be listed in detail, including descriptions, quantities, and unit prices. This transparency minimizes confusion and keeps both parties aligned on what was exchanged.

Indicate any discounts applied to the purchase, as well as the total price after those discounts. This provides a clear breakdown of the amount paid, avoiding future disputes over pricing.

Don’t forget to add the payment method, whether it was credit, cash, or another form of payment. This record assists in tracking cash flow and payment verification.

If applicable, the receipt should also state any taxes charged, breaking them down clearly to show the tax rate and amount. This is particularly important for compliance with local tax regulations.

Finally, include return and warranty information, so both parties are clear on the terms in case the buyer needs to return items or claims warranty coverage.

Select a format that best suits your business needs and the way you process transactions. A simple, clear structure is key. For most, a straightforward text-based receipt in a .txt or .pdf format offers flexibility and ease of printing or sharing. If you use point-of-sale (POS) systems, your receipt template should be compatible with these platforms, usually in .csv or .xml formats for easy integration and data management.

If you need customization, consider using a .docx or .xlsx format, as these allow for easy editing and adjusting of details like company logos, terms of service, or product categories. However, if your business frequently sends receipts online, a .pdf or .html format may be the most reliable choice for keeping the layout consistent across devices.

For a modern and scalable solution, using a cloud-based format, such as a receipt template generated from a web-based app or API, can save time. These often integrate with accounting software and can automate details like tax calculations and discounts. They offer high accuracy and reduce human error.

Adjust the layout of your wholesale template to highlight the unique features of each product. For example, if you’re selling electronics, focus on technical specifications, warranty details, and model numbers. Use sections or tables to clearly display this information, ensuring easy readability for buyers.

Product Variations

For items that come in different sizes, colors, or configurations, customize your template to showcase these variations. Include drop-down menus or checkboxes that allow buyers to select the specific option they want. If you sell clothing, a size chart is a must-have. For bulk items, provide quantity selection options to streamline the buying process.

Pricing and Discounts

Make your pricing structure clear and adaptable. For bulk items, include volume discounts or tiered pricing options. If offering seasonal or promotional discounts, ensure these are prominently displayed in a section that stands out but doesn’t overwhelm the rest of the information.

Incorporate a simple but effective layout that aligns with the nature of your products, ensuring that all key details are easy to find and visually appealing. Customize your template to speak to the specific needs of your target audience.

In different regions, the legal requirements for receipts vary significantly, and understanding these regulations ensures compliance with local laws. Here’s what you need to know for some key areas:

- United States: Receipts must include the seller’s name, the date of the transaction, an itemized list of goods or services, and the total amount paid. For businesses required to collect sales tax, the receipt must also display the tax rate and the total tax amount collected. Additionally, certain states, such as California, mandate that receipts for transactions over a certain amount include specific information like a return policy.

- European Union: The EU requires receipts to display the seller’s VAT number if the seller is VAT-registered. Receipts must list the price of goods or services, the VAT rate, and the total tax amount. Countries like France and Germany also require businesses to provide a unique identification number for each transaction on receipts, while others may have more relaxed requirements depending on the value of the transaction.

- Canada: Similar to the U.S., Canadian receipts must show the name of the business, the date, a description of the goods or services, and the total amount. For VAT (referred to as GST or HST in Canada), the rate and total tax must also be included. Specific provinces like Quebec require bilingual receipts in both English and French.

- Australia: Receipts in Australia need to clearly display the business name, ABN (Australian Business Number), date of the transaction, itemized list of goods or services, and the total amount. In some cases, businesses may need to provide proof of GST registration if the sale includes GST.

- Japan: Japanese receipts must list the name of the business, transaction details, and the total amount, including tax. For larger transactions, a receipt may also include the purchaser’s information if required by the business for warranty purposes. Japan’s tax system mandates clear documentation of the consumption tax collected.

Always ensure that receipts comply with the tax laws and business regulations in the region where your business operates. Staying informed helps avoid legal complications and builds trust with customers.

Use software with built-in receipt templates to automate the process. Many accounting tools offer customizable receipt formats, saving time on manual entry. Set up these templates to automatically pull transaction data from your point of sale (POS) system, reducing human error.

Integrate with Payment Systems

Link your receipt generation software with your payment processor. This integration allows receipts to be generated immediately after a transaction. This also helps track payments and issues receipts in real time, without delays or errors.

Set Up Auto-Email Features

Configure your system to automatically email receipts to customers after a purchase. Customize the email message and make sure the receipt is attached in the format you prefer, such as PDF. This process reduces paper waste and makes receipt storage easy for your clients.

Test Automation before rolling it out. Run tests to ensure all data is correctly captured and displayed in receipts. Test edge cases like refunds or discounts to confirm that your automation handles these situations appropriately.

By setting up an automated system with integrations and custom features, you’ll streamline your workflow and improve accuracy in receipt generation. Regularly update your software to ensure compatibility with the latest POS or payment systems.

Begin by clearly labeling the document as a “Wholesale Receipt” for easy identification. This sets the tone for the transaction and ensures that both parties know the document’s purpose.

Make the company details prominent at the top. Include the business name, physical address, phone number, and email for direct communication. This allows customers to reach out quickly if any issues arise.

Next, list the purchased items in an organized format. Include product names, descriptions, quantities, unit prices, and line totals. This section needs to be straightforward and easily readable.

After the items, provide a breakdown of the subtotal, applicable taxes, and any discounts applied. Clearly show the total amount due, leaving no room for confusion.

Indicate payment terms, including due dates and accepted payment methods. If you offer a grace period or other conditions, make sure those are clearly stated.

Lastly, add space for customer and seller signatures, ensuring both parties have acknowledged the transaction. A signature section adds a layer of professionalism to the receipt.