Keep track of all rental transactions with a simple and straightforward rent receipt ledger template. This tool helps you document rental payments, providing clear records for both tenants and landlords. Each entry should include the date, tenant name, amount paid, payment method, and the rental period covered.

A well-organized ledger reduces the chances of miscommunication or confusion. It also acts as a reference for both parties, ensuring that there is a clear record of payments made. Use this template to stay organized and to keep a detailed log of all financial exchanges throughout the rental period.

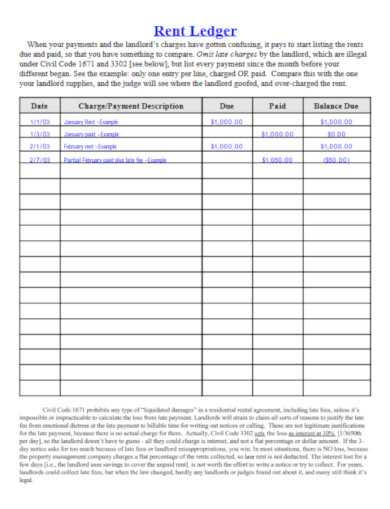

Customize the template to fit the specific needs of your rental agreement. Whether you manage a single property or multiple, this tool ensures that you capture all necessary payment details. Regular updates to the ledger will provide an accurate financial history, making it easier to track overdue payments and monitor trends in rental income.

Here are the revised lines with minimized repetition of words:

Consider creating a simple ledger to track rent payments. A detailed rent receipt ledger helps in organizing records and ensures accuracy. Ensure each entry contains key information such as the tenant’s name, amount paid, and the payment date.

Design the Layout

Design a straightforward layout with columns for tenant names, dates, amounts, and payment methods. This layout should be clear and allow for easy entry and reference.

Keep Records Updated

Update the ledger regularly. Accurate and timely entries reduce the chances of errors and disputes. Always double-check the details before finalizing each entry.

- Rent Receipt Ledger Template

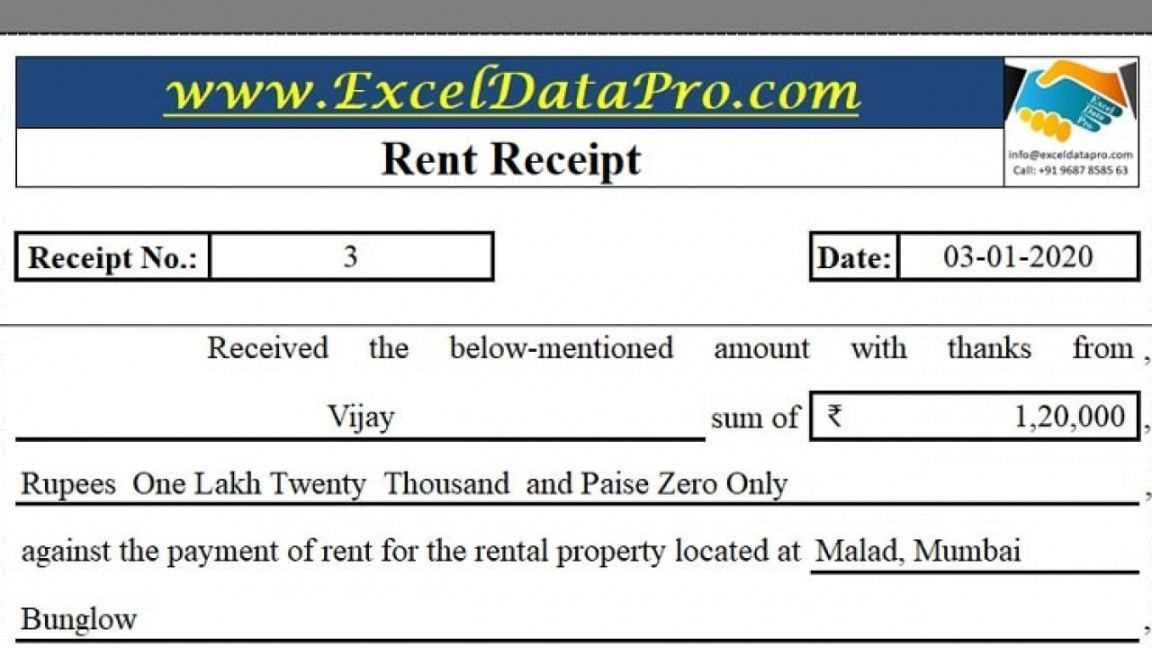

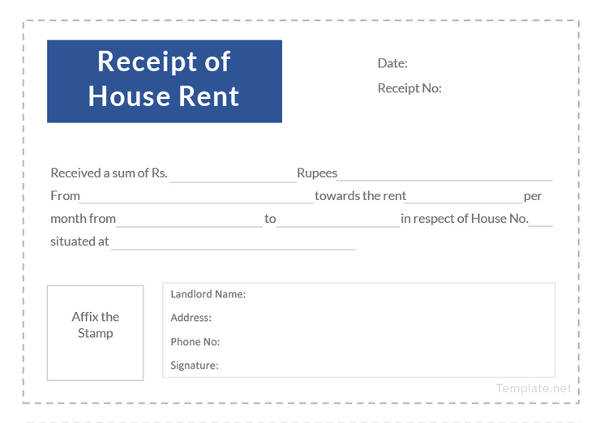

To create a rent receipt ledger template, first establish a clear and simple structure that includes the following key elements:

- Date: Record the date of each rent payment.

- Tenant’s Name: Include the full name of the tenant making the payment.

- Amount Paid: Specify the exact amount of rent paid by the tenant.

- Payment Method: Note the method of payment (e.g., cash, check, bank transfer).

- Receipt Number: Assign a unique number to each receipt for tracking purposes.

- Outstanding Balance: Track any remaining balance if the rent is paid in installments.

Each entry should be clearly dated and organized to allow easy tracking of rent payments. You can either design the ledger using a simple spreadsheet or create a printable template for manual entries.

A good template should also leave space for additional notes if there are any special agreements or late payment penalties. Consider adding a section for the landlord’s signature to confirm receipt of the payment. Keep the ledger updated regularly to avoid discrepancies.

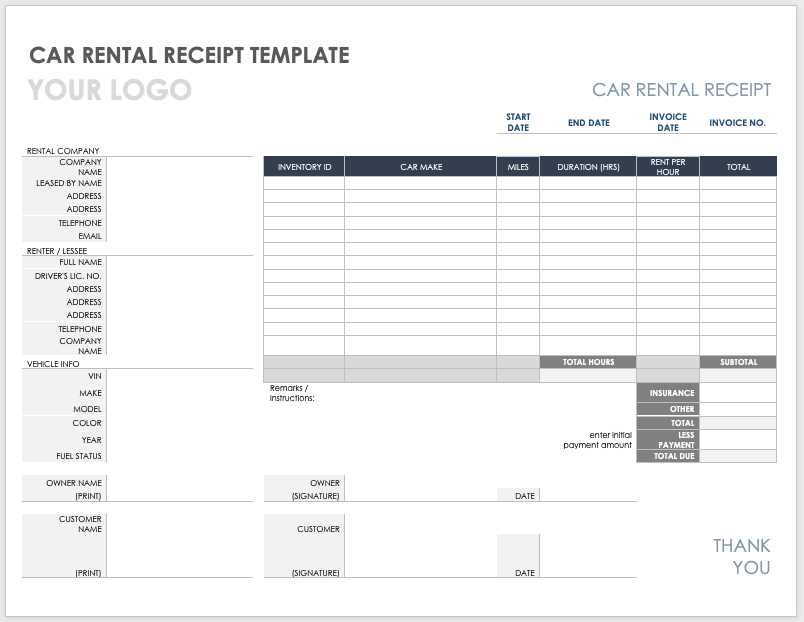

Begin by determining the layout of your rent ledger. Use a table format to organize all relevant information in a clear, structured manner. Create columns for the following details: tenant name, lease start and end dates, rent amount, payment due date, payment date, and any late fees.

Next, set up rows for each payment period, ensuring each entry corresponds to a specific month or week, depending on your payment schedule. Include space for additional notes, such as payment method or tenant communication, to keep track of any important details.

After the basic structure is in place, decide how you will track overdue payments. Add a column that shows whether a payment is overdue or has been made on time. This can help you quickly identify any issues and take appropriate action.

For clarity, use simple labels and keep the ledger neat. Consistency is key–make sure every tenant’s information is recorded in the same format. Regularly update the ledger as payments are made to avoid confusion.

Finally, ensure your ledger is stored securely and is easily accessible when needed. If you plan to share it, consider using a cloud storage service or spreadsheet software with password protection to maintain privacy and accuracy.

To keep track of rental transactions efficiently, your receipt ledger should contain the following key elements:

- Receipt Number: Assign a unique identifier to each transaction for easy reference and tracking.

- Date of Payment: Record the exact date the payment was received. This helps maintain a clear financial timeline.

- Tenant Information: Include the name and contact details of the tenant for clarity and future communication.

- Payment Amount: Document the exact amount paid by the tenant. This ensures accurate accounting and prevents discrepancies.

- Payment Method: Note whether the payment was made in cash, by check, or electronically. This helps with tracking the payment history.

- Property Address: Specify the rental property that the payment is for, especially if you manage multiple properties.

- Period Covered: Indicate the rental period for which the payment applies, such as a monthly or quarterly span.

- Balance Due: If applicable, include any outstanding balance after the payment. This helps maintain accurate records of what is still owed.

Including these elements in your receipt ledger ensures that each transaction is properly documented, simplifying accounting and communication with tenants.

Adjust the template’s layout to reflect the specific requirements of your property management tasks. Modify fields such as tenant name, property address, rental period, and payment details to match the rental contracts you handle. Add sections for deposit tracking, late fees, or additional charges to ensure the document covers all financial aspects of the lease agreement.

Focus on Key Data Points

Include customizable fields for tracking rent payments, balances, and outstanding amounts. Ensure that each transaction is easy to update, allowing property managers to monitor financial activity in real-time. A well-organized payment section will streamline your record-keeping and help prevent miscommunication with tenants.

Tailor for Multiple Properties

If managing multiple properties, consider adding tabs or separate sections within the template for each property. This feature helps maintain clear and distinct records, reducing the chance of errors and making it easier to locate information specific to each rental unit.

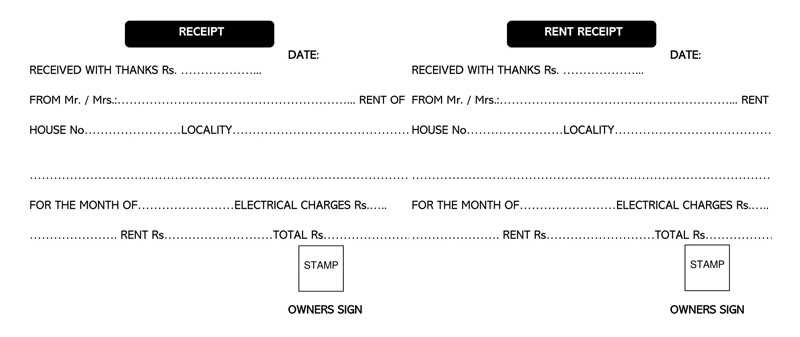

To keep your rent ledger accurate, record each payment as soon as it is received. This ensures you don’t overlook any transactions. For each payment, include the tenant’s name, the payment date, amount, and method of payment. This way, you can easily track who has paid and when.

If a payment is late, add a note about the late fee. This note should specify the amount charged, the date the fee was applied, and any relevant details like grace periods or specific payment terms. Keep this separate from regular payments to avoid confusion.

| Tenant Name | Payment Date | Payment Amount | Late Fee Applied | Balance Due |

|---|---|---|---|---|

| John Doe | 2025-01-01 | $1000 | $50 | $0 |

| Jane Smith | 2025-01-05 | $1000 | $0 | $0 |

| Michael Lee | 2025-01-10 | $1000 | $100 | $0 |

For tenants who consistently pay late, note the late fees each time. This will give you a clear picture of payment trends. Regularly update the balance due to reflect these late charges and keep your records transparent for both you and the tenants.

Sort receipts by category to simplify tax filing. Create separate folders or digital files for each category, such as business expenses, medical costs, and charitable donations. This ensures you can find specific receipts quickly when you need them.

Use a System to Track Receipts

Utilize a receipt tracker or an app to record important details like date, amount, and purpose. This prevents receipts from piling up and keeps everything organized. Scan physical receipts and store them in digital form to avoid losing them.

Store Receipts by Year

Keep receipts from each tax year in separate folders. Use labeled folders or files to track receipts by the year they were issued. This will help you stay organized and prevent confusion when reviewing receipts during tax season.

Make sure you keep receipts for at least three years, as the IRS may request them for audit purposes. Organizing receipts now can save time and stress during tax filing.

Stay consistent with updating your rent ledger. Record payments as soon as they are made, and ensure all transactions are listed accurately. A delay in entering payments can lead to confusion and missed details, which could impact both you and your tenants.

Organize by Date and Tenant

Sort entries chronologically and by tenant name for easy access. This way, you can quickly find any information related to a specific payment or tenant, which is especially helpful during audits or disputes. Ensure you also track payment amounts and due dates in separate fields.

Use Automated Reminders

Set up automatic reminders for tenants’ upcoming rent payments. This reduces the chances of late payments and helps maintain a smooth cash flow. Alerts can also notify you of overdue payments, keeping you on top of any delays.

Utilize clear categories for different types of payments such as base rent, utilities, and fines. This prevents confusion and helps both you and your tenants understand how payments are being applied.

Ensure the digital ledger is backed up regularly. This will safeguard your data in case of a technical issue, ensuring that you don’t lose important financial records.

How to Create a Rent Receipt Ledger Template

To design a rent receipt ledger template, focus on clarity and organization. Begin by including basic information such as the tenant’s name, the rental property address, and the payment due date. Add a column for the payment amount received, the payment method, and the receipt number to maintain accurate records.

Key Sections of a Rent Receipt Ledger

The ledger should have distinct sections for each rental period, whether it’s weekly, monthly, or yearly. Each entry should include the following details:

- Tenant’s name and contact details

- Payment date and the amount paid

- Payment method (e.g., check, bank transfer, cash)

- Balance remaining, if applicable

- Signature of the landlord or property manager (if desired)

Additional Features for Better Tracking

If you’re creating a digital ledger, consider incorporating formulas to automatically calculate totals and outstanding balances. For paper templates, leave enough space for manual calculations. Track overdue payments with an “Outstanding Amount” column, and mark each receipt with a unique number to help with future references.