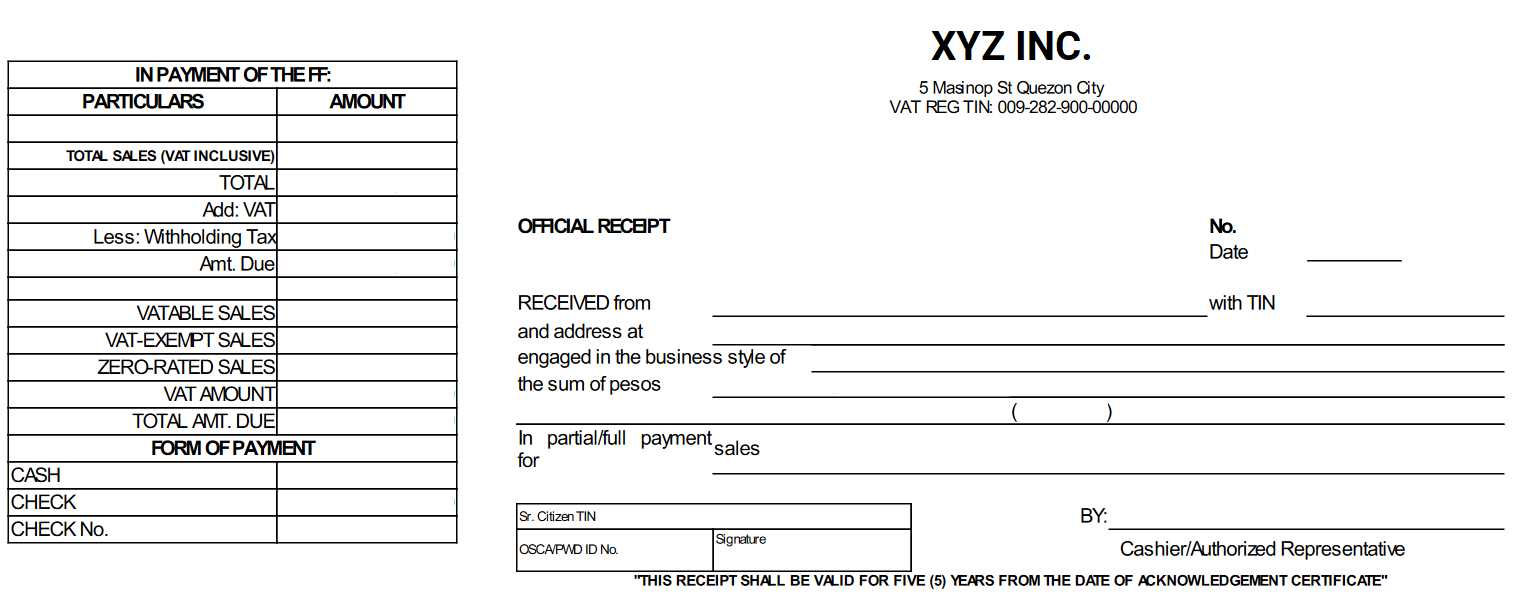

If you’re looking for an official receipt template, start by including key details like the name of the seller, the buyer’s information, and a clear description of the transaction. This will ensure both parties have a record of the exchange that’s easy to reference.

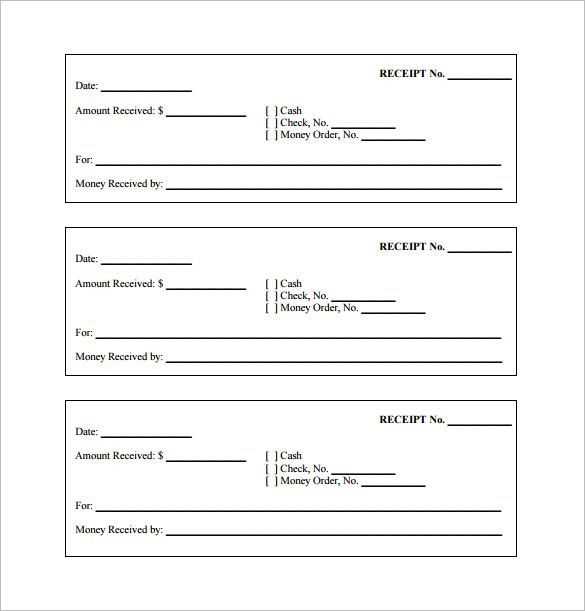

Include the date of purchase or service rendered. This helps to verify the transaction timeline. Along with that, make sure to specify the payment method, whether it’s cash, card, or bank transfer, to prevent any confusion about how the payment was made.

Payment amount is another key aspect. Be specific about the currency and ensure the total is accurate. You might also want to break down the amount if applicable–such as taxes or discounts–so that the details are transparent.

Additional details like the seller’s business address or a contact number can be helpful. Providing a unique receipt number will also make it easier to track each transaction, especially if you are dealing with multiple receipts in a day or across different platforms.

By using a clear and concise format for your official receipt, you’ll avoid misunderstandings and maintain a professional approach to transactions. Make sure the template is easily adaptable for different types of purchases or services.

Here are the corrected lines:

Review the following points for accurate and clear receipt structure:

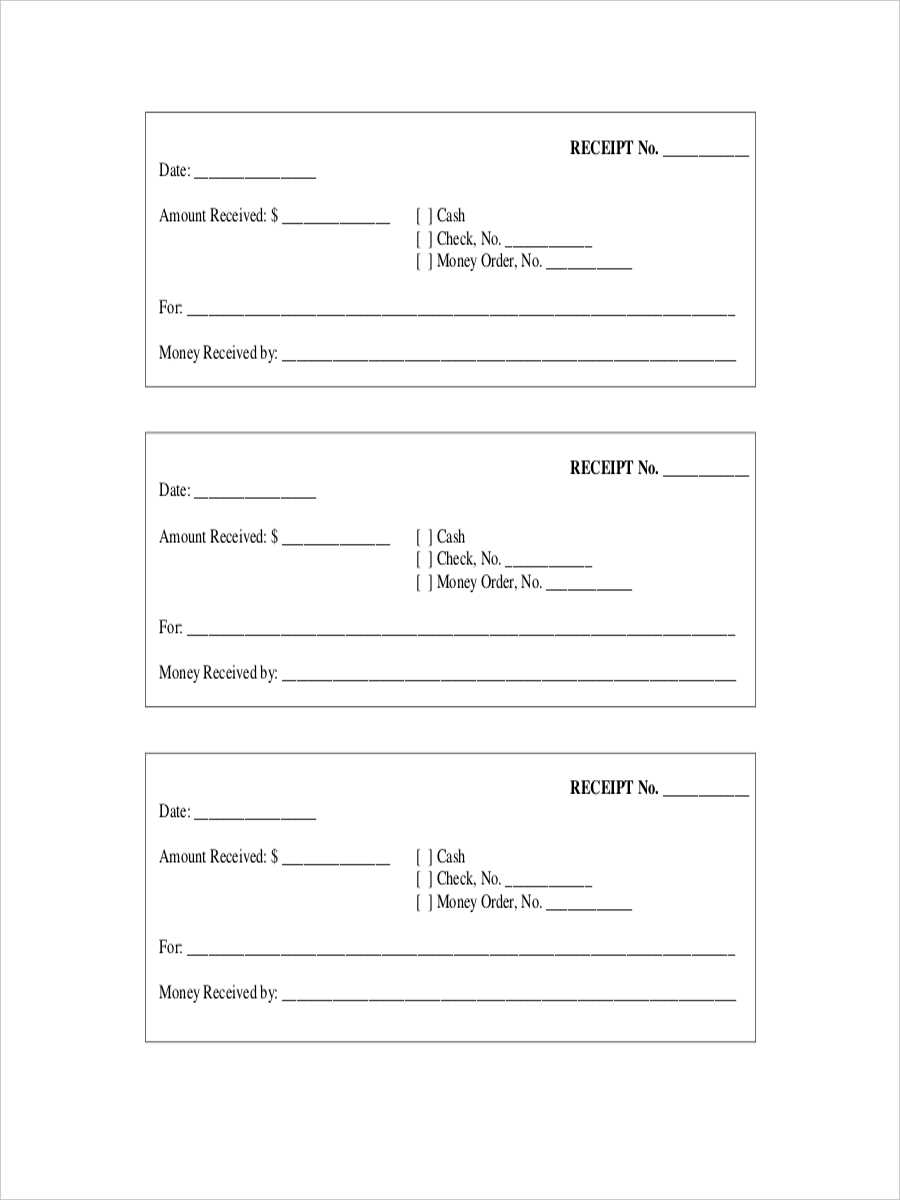

- Receipt Title: Ensure the title “Receipt” is placed clearly at the top of the document.

- Seller’s Information: Include the seller’s name, business name, address, and contact details.

- Buyer’s Information: Include the buyer’s name and contact details where applicable.

- Date of Transaction: Mention the date of the purchase or service provided clearly.

- Items or Services Sold: List each item or service purchased, with a description and the respective price.

- Total Amount: Clearly show the total amount paid, including taxes, discounts, or additional charges.

- Payment Method: Specify whether the payment was made via cash, card, or any other method.

- Signature: A space for the signature of the person issuing the receipt (optional).

Additional Details

Ensure that the receipt is legible and formatted neatly, with a simple layout for easy understanding. Double-check for spelling mistakes or incorrect prices, as these can lead to confusion.

Example Structure

- Receipt

- Seller Name: XYZ Ltd.

- Buyer Name: John Doe

- Date: February 4, 2025

- Items: 2 x Widget A – $15, 1 x Widget B – $25

- Total: $55

- Payment Method: Credit Card

- Signature: _______________

- Official Receipt Sample Template

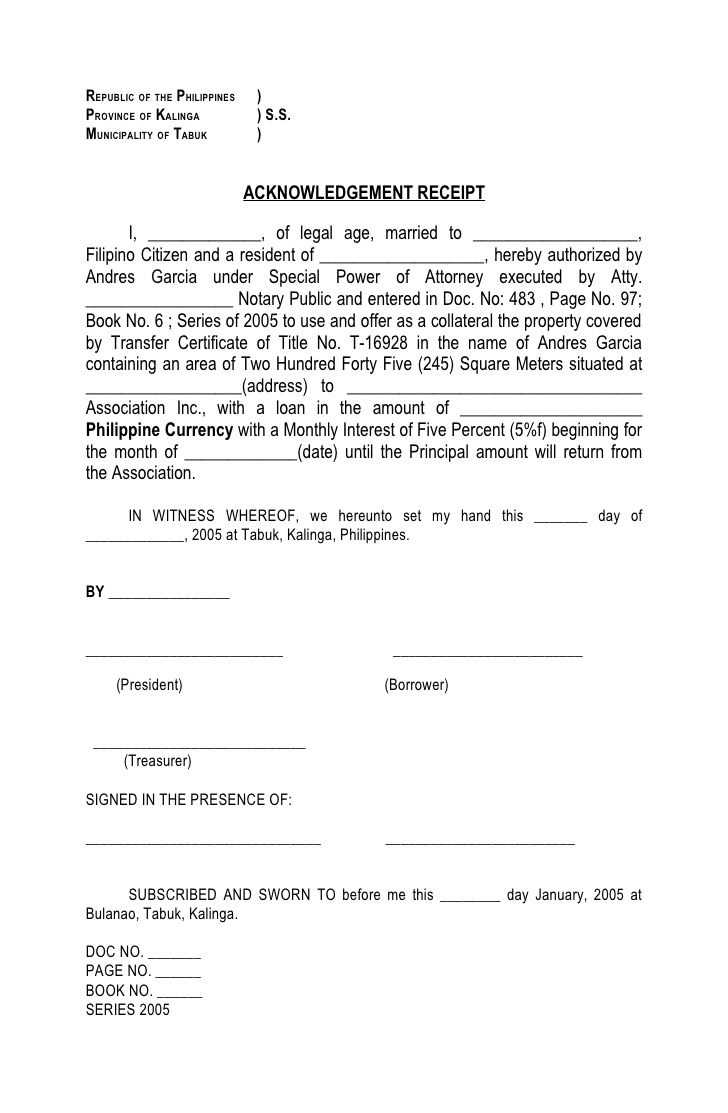

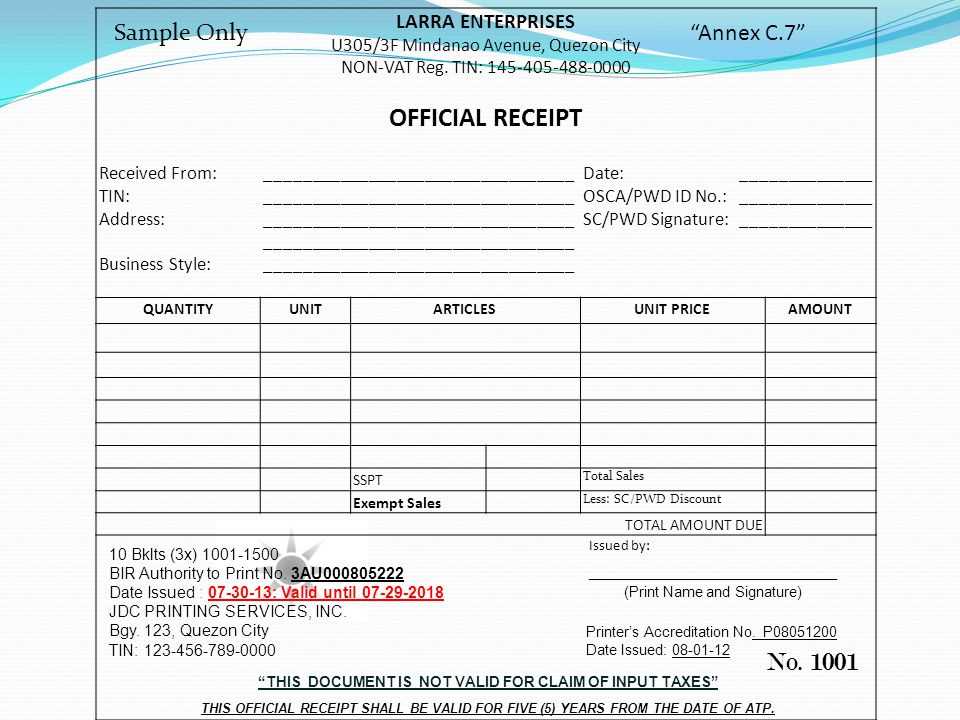

An official receipt is a document confirming a transaction between a buyer and a seller. To create a professional receipt, include specific details for clarity and legal purposes.

| Field | Description |

|---|---|

| Receipt Number | A unique identifier for the receipt. It helps to track and reference transactions easily. |

| Date of Transaction | The exact date the transaction occurred. This is crucial for accounting and audit purposes. |

| Seller’s Information | The name, address, and contact details of the seller. This establishes the identity of the business. |

| Buyer’s Information | The buyer’s name and address, if applicable. This provides a record of who made the payment. |

| Items or Services Purchased | A detailed description of the goods or services sold, including quantities and individual prices. |

| Total Amount | The total cost of the transaction, including any applicable taxes or discounts. |

| Payment Method | Indicates how the payment was made (e.g., cash, credit card, bank transfer). |

| Signature | The signature of the seller or authorized representative. It validates the transaction. |

By including these fields, the receipt provides both parties with clear documentation of the transaction. It can be used for record-keeping, refunds, or warranty claims.

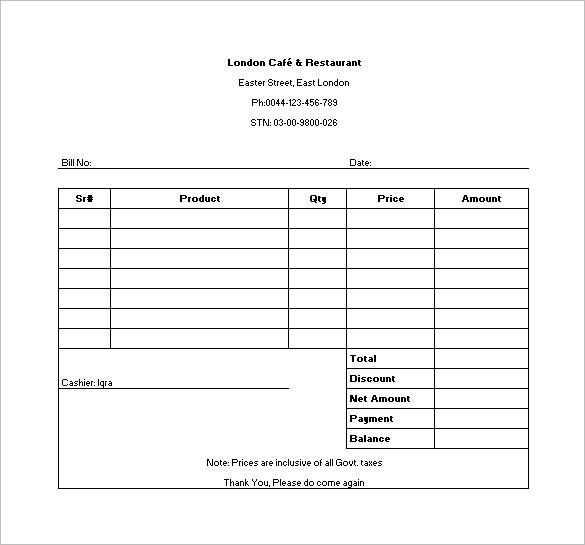

Begin by including your company name, logo, and contact information at the top of the receipt. This ensures customers can easily identify your business. Make sure to use a professional, readable font to maintain clarity.

Next, add a unique receipt number. This helps with tracking and avoids confusion with other transactions. A numbering system that’s sequential and easy to follow works best. You can also include a date and time stamp for added accuracy.

Customize the itemized list of products or services. Clearly state the description, quantity, and price of each item. If applicable, include tax rates and discounts. This transparency enhances trust with your customers.

Ensure that the total amount is prominently displayed at the bottom, followed by the payment method (e.g., cash, credit card). This will make it easier for customers to reference later. If you accept multiple payment methods, provide space for this detail.

Finally, don’t forget a thank-you message or a reminder about return or exchange policies. Personal touches like these can improve customer experience and loyalty. Keep the layout simple and uncluttered to avoid confusion.

Include the following key details in your official receipt to ensure clarity and legal validity:

1. Receipt Number and Date

Each receipt should have a unique number for tracking and reference. Additionally, include the date of the transaction to establish the time of the purchase or payment.

2. Seller’s Information

Clearly display the business name, address, and contact information of the seller. This helps verify the receipt’s authenticity and provides contact details for any follow-up or queries.

3. Buyer’s Information

Include the name and contact details of the buyer, if necessary, for documentation purposes. This may be required for high-value transactions or for invoicing purposes.

4. Description of Goods or Services

List the items or services purchased with clear descriptions. Include quantities, unit prices, and any additional details that clarify the nature of the transaction.

5. Payment Method

Specify how the payment was made–whether in cash, by credit card, bank transfer, or another method. This provides clarity on the transaction type.

6. Total Amount Paid

Clearly state the total amount paid, including applicable taxes or discounts. This ensures transparency and avoids confusion regarding the final payment amount.

7. Tax Information

If relevant, provide details of tax charges applied, such as VAT or sales tax. Include the tax rate used and the total tax amount for complete documentation.

8. Signature or Stamp

For added authenticity, include a signature or company stamp, especially in formal transactions or when dealing with legal requirements.

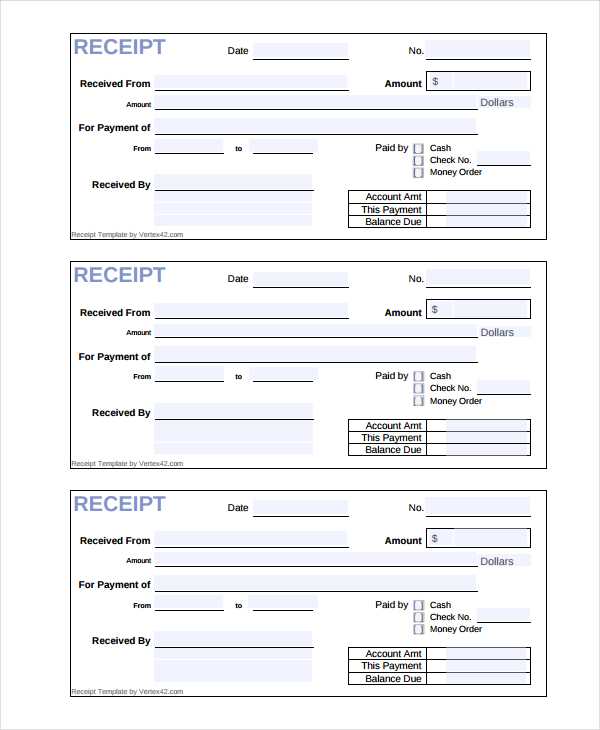

Design a receipt with easy-to-read fonts and organized sections. This ensures users quickly identify the most relevant information. Choose a font size of at least 10pt for readability, using bold for headings like “Receipt Number” or “Total Amount” to stand out.

Separate different types of information into distinct sections. Keep payment details, date, and transaction information clearly segmented. This method reduces confusion and allows each detail to be found effortlessly.

- Include key details: Always list the business name, address, contact info, receipt number, payment method, and date of transaction.

- Highlight total amount: The total should be the most prominent number on the receipt, usually in bold or larger text.

- Organize line items: Use a table format for each product or service with columns for description, quantity, price, and subtotal.

Ensure that your receipt has a professional tone without overcrowding the design. Keep unnecessary graphics or flourishes minimal to allow the key details to remain the focus.

- Maintain consistency: Use consistent alignment and spacing throughout. Avoid cluttering sections, and leave enough white space to give the document a clean appearance.

- Use clear headings: Each section should be clearly labeled, such as “Payment Details” or “Items Purchased,” so the reader knows exactly where to look.

Test the receipt on different devices or printers to ensure all information is legible and the layout works well in different formats.

Avoid leaving out crucial details. Missing information like the business name, address, or contact number can create confusion and make the receipt less professional. Always include these basic elements in your template.

Don’t neglect the layout. An overly cluttered or unorganized design can make it hard for the recipient to read the information. Keep the structure clear, with well-defined sections for the itemized list, totals, and payment method.

Misrepresenting the pricing or taxes is another common mistake. Ensure that all amounts, including taxes and discounts, are clearly listed and correctly calculated. Double-check the math before finalizing the template.

Forget to leave room for adjustments or custom notes. Providing space for refunds, exchanges, or special instructions can improve customer experience and provide flexibility.

Avoid using non-standard fonts or hard-to-read text. Stick to clean, readable fonts like Arial or Times New Roman. Using overly stylized fonts can make the receipt difficult to interpret.

Finally, do not overlook the legal requirements. Depending on the region, receipts may need specific legal information, such as VAT numbers or license identifiers. Make sure you are aware of these regulations before finalizing your template.

In many countries, receipts serve as proof of purchase and can be used for tax, warranty, or returns purposes. Regulations surrounding receipts vary widely depending on local laws. For instance, in the European Union, businesses must provide receipts for transactions over a certain amount, and they must include specific details such as the seller’s VAT number. Failure to comply with these regulations can result in fines or other penalties.

In the United States, there is no federal law mandating businesses to provide receipts for all transactions, though some states may have specific rules for certain types of purchases, such as for fuel or large transactions. Businesses are encouraged to issue receipts for purchases above a certain threshold for record-keeping purposes. Many states also require that receipts display the correct sales tax rate.

In countries like Japan and South Korea, receipt regulations are more stringent. Receipts must include detailed breakdowns of items, taxes, and even the business’s registration information. The government often uses receipts as a means to combat tax evasion, so businesses are required to retain records for extended periods, often up to seven years. In these countries, issuing incomplete or inaccurate receipts can lead to serious consequences.

For businesses operating in multiple countries, it’s crucial to ensure receipts meet local legal standards. Even though requirements may seem complex, many countries have guidelines available for businesses to help them comply. It is advisable to consult a legal professional or local tax authority to avoid inadvertently violating local laws. Keeping track of changes to these regulations is key to staying compliant and avoiding penalties.

Use templates from Microsoft Word or Google Docs for simple receipt creation. These tools offer customizable templates that suit various business needs. Just add your business information, transaction details, and you’re done.

Invoice Generator Tools

For more specialized receipts, platforms like Invoice Generator and Zoho Invoice provide easy-to-use tools. These allow you to generate professional receipts in seconds by entering transaction details like date, amount, and services rendered. You can download them in different formats such as PDF or email them directly to clients.

Graphic Design Software

If you need more design flexibility, consider using Canva or Adobe Spark. Both allow you to create receipts with custom logos, fonts, and layout styles. These tools give you more creative control, making your receipts reflect your brand identity.

For an official receipt template, make sure it includes the following core elements: a unique receipt number, date of transaction, the name of the business, and the name of the customer. It should also specify the product or service purchased, the quantity, price per unit, and total amount. Clear labeling of tax information, if applicable, helps maintain transparency.

Ensure the receipt is well-organized by breaking down the information into easy-to-read sections. Consider using a table format to separate the line items, as shown below:

| Item Description | Quantity | Price | Total |

|---|---|---|---|

| Item 1 | 2 | $10.00 | $20.00 |

| Item 2 | 1 | $15.00 | $15.00 |

Adding payment methods and terms of return or warranty can be beneficial for both the business and the customer. Keep the language simple and precise, ensuring it is easy to reference for both parties. The receipt should be a clear record for accounting or reimbursement purposes.