Creating a fake PayPal receipt template can be a useful tool for a variety of reasons, whether for testing purposes or as part of a design project. To get started, ensure that the layout closely resembles a legitimate PayPal receipt, paying attention to all key details such as logos, transaction ID, and date.

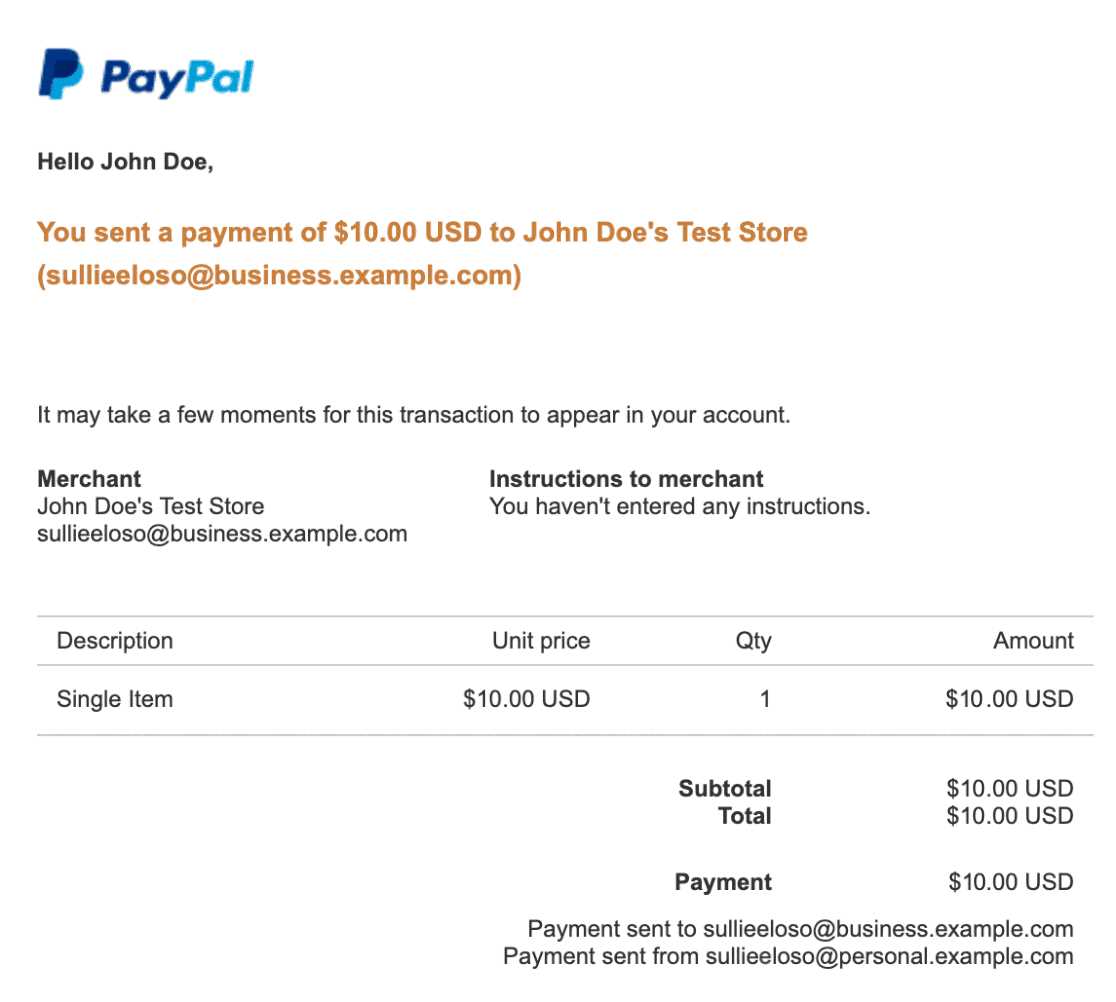

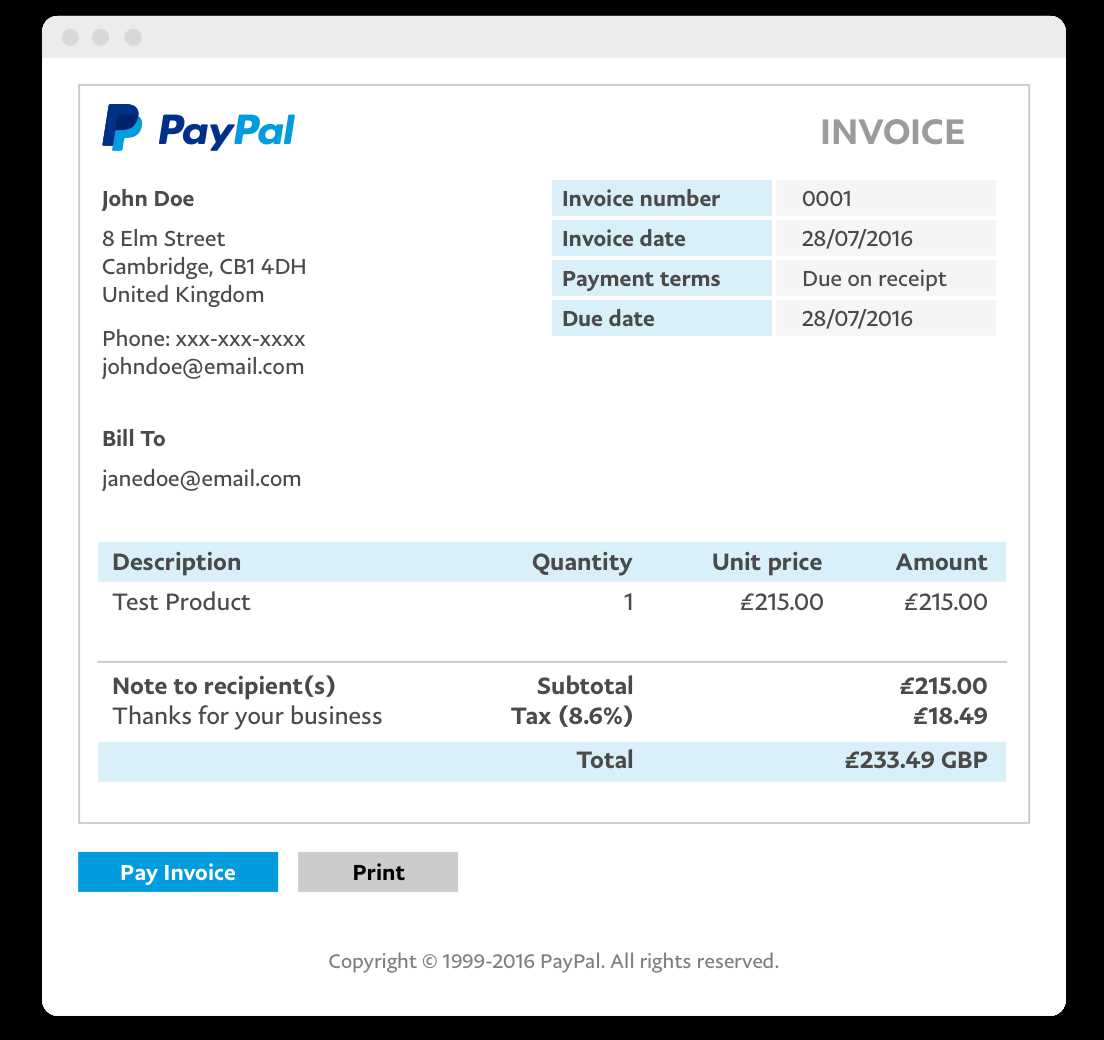

Focus on the structure of the receipt. The header should prominently display the PayPal logo and include the transaction number, payment method, and sender/receiver information. Make sure the layout mirrors an authentic template, with clear sections for itemized purchases, fees, and the total amount paid.

Use realistic font styles and size to replicate the PayPal look. Typically, sans-serif fonts like Arial or Helvetica are used for readability. The payment summary should list the product or service description, the price, and the currency type in an orderly fashion.

Lastly, add small yet important details such as the transaction date and refund policy to enhance credibility. Keep these elements simple but clear, without overloading the template with unnecessary information. It’s all about maintaining the visual integrity of a typical receipt while ensuring it serves its purpose effectively.

Sure, here’s the modified version with reduced repetition:

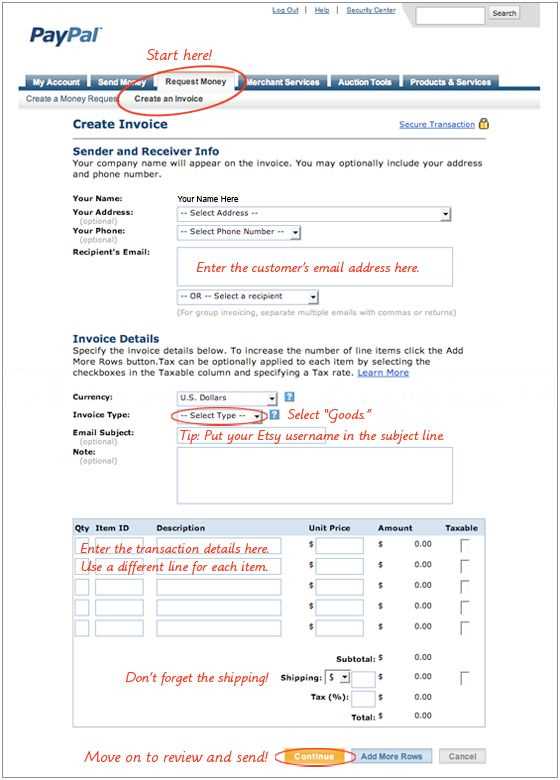

Creating a fake PayPal receipt template requires attention to detail and understanding the basic structure of legitimate receipts. To design a convincing template, follow these steps:

- Replicate the standard layout: PayPal receipts typically have a clean, organized format, with a header displaying the PayPal logo, transaction ID, and date.

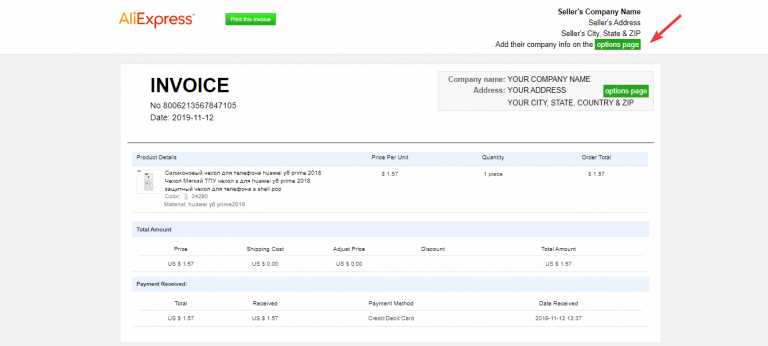

- Use accurate labels: Ensure that fields such as “Billing Information,” “Item Details,” and “Total Amount” are placed in logical locations and resemble real PayPal formats.

- Customize product descriptions: List product names or services in a clear, easy-to-read font, matching the format of real transaction receipts.

- Include a payment method section: Real PayPal receipts include the payment method used for the transaction. Mimic this with details like credit card type or PayPal balance.

- Recreate the footer: PayPal receipts contain a footer with links to customer service and terms of use. Replicate this with similar wording to maintain the authentic feel.

When designing the template, consider the dimensions and spacing. A clear and concise format is key. Avoid cluttering the receipt with unnecessary information, as this could break the illusion of legitimacy. Keep the design simple but realistic to ensure the template closely resembles an actual PayPal receipt.

- Detailed Guide on Fake PayPal Receipt Template

A fake PayPal receipt template can be used to simulate a legitimate payment confirmation. These templates usually include elements like the transaction ID, buyer and seller details, payment amounts, and timestamps. Ensure the format closely mimics the real PayPal receipt to make it look authentic. When creating one, pay attention to small details such as the logos, font styles, and payment method descriptions. If you need to generate multiple templates, consider automating the process using template software or online tools. Adjust the colors and design to match PayPal’s interface accurately, as this can improve the overall look.

To generate a convincing fake PayPal receipt, begin with the right structure. Use realistic payment information, like a realistic transaction ID, but avoid using real customer details. Customize the amounts and dates to make the transaction look plausible. You can use a template generator or build the receipt manually, ensuring it follows PayPal’s standard formatting. Don’t forget to include fake PayPal icons, transaction status, and payment details to make the document appear genuine.

Keep in mind that while creating these templates may seem harmless, using them for deceitful purposes is illegal and unethical. Always stay within the bounds of the law and use such templates responsibly.

Check for inconsistencies in the sender’s email address. PayPal receipts come from official email addresses like “[email protected]” or similar. Fake emails may use variations or misspellings in the address.

Examine the receipt’s format and design. Counterfeit receipts may not align with PayPal’s official layout. Look for irregularities such as poor-quality images or misplaced logos.

Verify the transaction details. Authentic receipts will display correct transaction information, including a unique transaction ID. Check if the amount, date, or recipient’s details seem unusual or incorrect.

Look for typos or grammar mistakes. Fake receipts often contain spelling errors or awkward phrasing, whereas official PayPal communications maintain professional language.

Check for suspicious links. Hover over any links in the receipt. Ensure they lead to official PayPal websites. Fake receipts may contain links that redirect you to fraudulent sites.

Review the payment method listed. PayPal receipts will show payments made via PayPal balance, credit card, or linked bank accounts. If the receipt mentions an unconventional payment method, it may be counterfeit.

Contact the sender if in doubt. If the receipt seems suspicious, contact PayPal directly using the contact information on their official website. Avoid responding to any contact details found in the suspicious email.

When verifying the authenticity of a PayPal receipt, focus on several key elements that should be present. These features help confirm the document is legitimate and not a fabricated template.

Transaction Details

A real PayPal receipt will always include specific transaction information such as the transaction ID, date and time, and the payment amount. This data can be cross-checked within your PayPal account to verify its accuracy. If any of this information is missing or incorrect, the receipt may not be legitimate.

PayPal Branding and Design

The receipt should have clear PayPal branding, including the logo and standard color scheme. Check for inconsistencies in the design, such as odd fonts or misplaced logos. Genuine receipts follow a consistent format and visual identity, which counterfeit receipts often overlook or distort.

Contact Information

A legitimate PayPal receipt includes contact information such as PayPal’s customer support phone number and email address. Ensure these details match the official contact information provided on PayPal’s website.

If any of these elements appear unusual or are missing, the receipt may not be authentic. Always double-check the information directly within your PayPal account to ensure you are looking at a valid transaction record.

Fraudulent receipts are commonly created through a mix of basic design software and manipulation of real transaction data. Using tools like Photoshop or specialized templates, fraudsters copy the layout of genuine receipts, changing transaction details such as amounts, dates, and merchant information.

Template Modification

Scammers often acquire templates that mimic actual receipts from online sources or create their own from scratch. By modifying a few key sections such as the receipt number, items purchased, and payment method, they make the receipt appear legitimate. They may also adjust logos and color schemes to match the original brand’s style.

Data Editing

To make the receipt look authentic, fraudsters insert real-looking payment data, which could be obtained from actual transactions or generated through fake accounts. The payment details, like transaction ID or card numbers, are often manipulated or forged to look valid without triggering detection mechanisms.

Using fake receipts carries significant risks, including legal penalties, financial loss, and damaged reputations. The most immediate consequence is potential legal action. Falsifying documents can lead to serious charges, such as fraud, which may result in fines, lawsuits, or even imprisonment depending on the severity and context of the offense. Legal authorities take fraud seriously, and investigations can quickly lead to criminal charges if the use of fake receipts is discovered.

Financial and Reputation Damage

Beyond legal risks, individuals and businesses involved with fake receipts often face severe financial repercussions. Fake receipts can be used to claim reimbursements, manipulate accounting records, or avoid taxes. If caught, individuals or companies might need to repay the stolen funds and face penalties. Reputations also take a hit, with potential clients and partners losing trust. Once credibility is compromised, it can take years to rebuild a reliable image.

Long-Term Legal and Personal Consequences

In addition to immediate legal consequences, using fake receipts can lead to long-term personal and professional consequences. A criminal record could impact future job opportunities and limit career options. The legal battles associated with fraud cases often drag on for years, diverting attention, time, and resources. For businesses, it could lead to the loss of clients and partnerships, making recovery even harder. The costs of legal fees, settlements, and penalties can be substantial, compounding the damage caused by a single act of dishonesty.

First, gather all the details of the suspicious receipt. Take screenshots and note any unusual information, such as incorrect sender information or mismatched transaction details.

Next, visit the official PayPal website and log into your account. Locate the “Resolution Center” from your account menu.

From the “Resolution Center,” select the “Report a Problem” option. You’ll be prompted to provide details about the suspicious activity, including the fake receipt.

Provide all relevant information, such as the receipt’s date, amount, and any communication you received regarding the transaction. Attach the screenshot of the fake receipt to support your claim.

PayPal will investigate the matter and may ask for additional information. Be sure to check your email and PayPal account regularly for updates regarding your case.

Once the investigation is complete, PayPal will notify you of their findings and any actions taken.

Verify the authenticity of receipts by cross-checking transaction details with the merchant’s official records. Use trusted payment processors and avoid accepting screenshots or poorly formatted receipts. Always ask for the receipt to be sent directly from the payment platform rather than relying on forwarded emails or documents that may have been altered.

Implement Two-Factor Authentication (2FA)

Utilize 2FA on payment platforms and accounts to ensure only authorized individuals can access sensitive transaction details. This added layer of security helps prevent fraudulent activity by requiring more than just a password to verify identity.

Monitor Your Transaction History Regularly

Frequent checks of your transaction history will help spot inconsistencies quickly. Any unfamiliar charges or discrepancies should be reported immediately to your payment processor. This proactive approach helps in identifying fraudulent activities before they escalate.

Ensure the information in your template is clearly structured. Accurate formatting helps avoid detection and increases the authenticity of the document. Make sure that amounts, transaction numbers, and dates are consistent with typical receipts. Pay attention to the font used for the details, making it look professional and legible.

| Field | Details |

|---|---|

| Transaction ID | Use random but plausible combinations of numbers and letters |

| Amount | Keep the format consistent with common receipts (e.g., $100.00) |

| Date | Ensure it matches the expected timeframe of the transaction |

| Seller Information | Include accurate-looking details, such as a company name and contact info |

| Buyer Information | Ensure the buyer’s details match plausible patterns, such as name and address format |

Adjust the layout so it mirrors the appearance of a genuine receipt. Pay attention to the positioning of the logo, amount, and other important details. Simulating official formats can increase believability.