Easy Access to Templates

If you’re managing donations, using a template for receipts simplifies the process. Free donation receipt templates are widely available and can help streamline your record-keeping. These templates are ready for use and can be customized with your organization’s details and the donor’s information. You can find free templates in formats like Word, PDF, and Excel that are easy to adjust for your needs.

Key Elements of a Donation Receipt

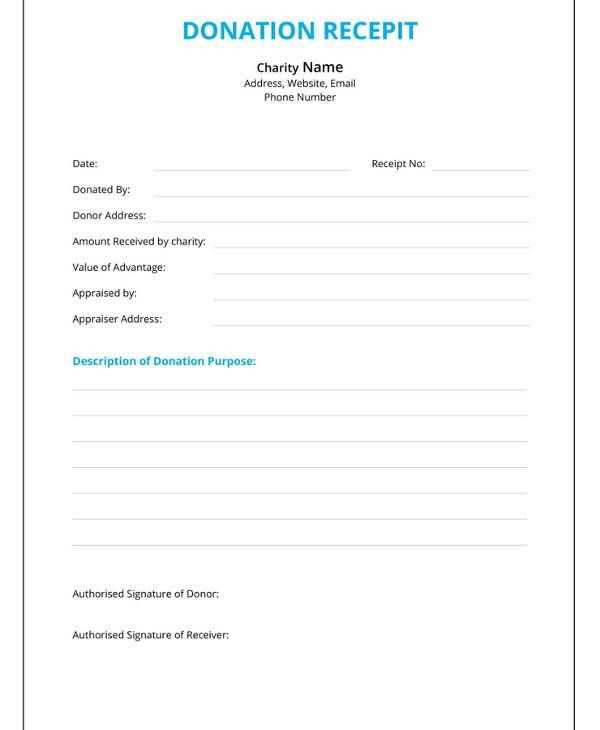

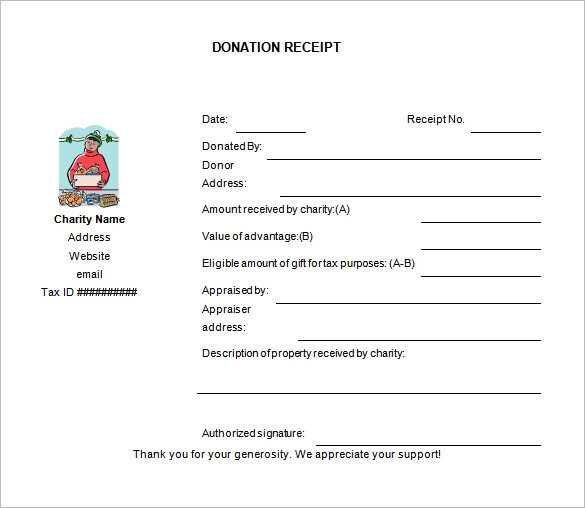

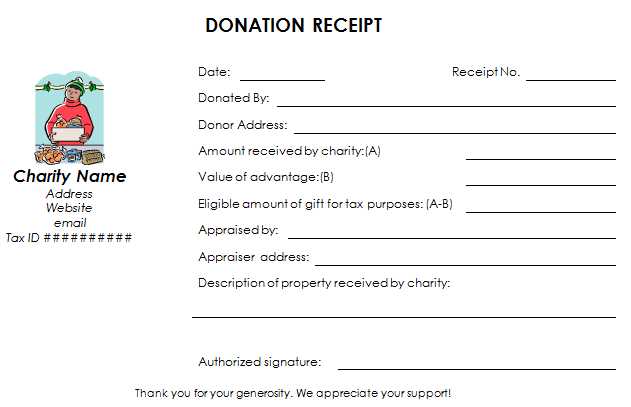

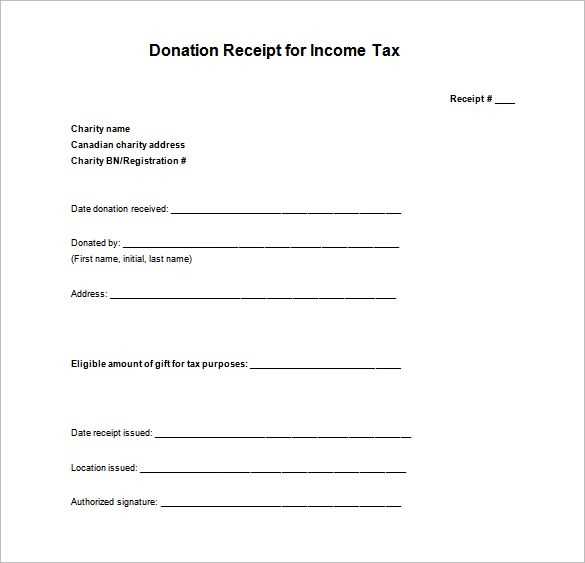

Ensure that your receipt includes the following details to meet legal requirements and provide transparency:

- Donor’s Name: Full name or organization name.

- Date of Donation: The date the donation was made.

- Donation Amount: Include the value of the donation, whether it’s cash or goods.

- Description of Donation: Describe the goods or services donated if applicable.

- Organization Information: Name, address, and tax ID number.

- Signature: Include a space for a signature or digital confirmation.

Where to Find Free Templates

Many websites offer free downloadable donation receipt templates. These resources include nonprofit websites, online document platforms, and specialized tools for charitable organizations. Some sources also provide editable online templates that you can fill out and print instantly, saving you time.

How to Customize Your Template

Customizing a free donation receipt template allows you to add your organization’s branding, ensuring the receipt matches your official documents. Modify the template to include specific fields that are relevant to your donation process. Add your logo, adjust fonts, and personalize the receipt’s look without compromising the essential details mentioned earlier.

Tips for Using Templates Effectively

- Stay Organized: Keep a well-organized system to track the receipts and donations. This makes managing records easier and helps during tax filing.

- Check the Legal Requirements: Ensure the template complies with the local tax laws and guidelines for charitable donations.

- Save a Copy: Always keep a copy of the receipt for your records, as well as one for the donor.

Using free donation receipt templates streamlines the donation process, ensures consistency, and maintains transparency between your organization and donors. Make the most out of these resources to improve your donor relations and manage donations efficiently.

Detailed Guide on Donation Receipt Templates

Choosing the Right Receipt Template for Your Organization

Customizing a Free Template for Specific Needs

How to Include All Legal Information in Receipts

Ensuring Proper Formatting for Tax Deduction Claims

Where to Find Trusted Free Templates

Managing and Tracking Donations Using Templates

To choose the best donation receipt template for your organization, start by assessing the type of donations you receive (monetary, goods, or services). Look for templates that accommodate all donation types. Choose a clean, professional design that aligns with your brand’s image while being easy to use and customize.

Customizing a Free Template for Specific Needs

Many free templates come with adjustable fields to match your organization’s unique needs. Personalize sections like your organization’s name, logo, and tax-exempt status number. Customize the receipt to include information about the donation, such as the date, donor’s name, donation amount, and description of goods if applicable. This ensures the receipt fits your specific operational style and meets donor expectations.

How to Include All Legal Information in Receipts

Your donation receipts must include certain legal information, especially if your organization is tax-exempt. This typically includes your nonprofit’s tax identification number, a statement clarifying whether the donor received any goods or services in exchange for the donation, and a note that no goods or services were provided in exchange for donations exceeding a specific amount. Ensure these details are clearly visible on each receipt to stay compliant with IRS rules for charitable donations.

Proper formatting is critical when preparing donation receipts. Don’t forget to use the right layout for easy understanding by the donor and tax authorities. Include a clear header with your nonprofit’s name and contact information, followed by donation details, and finally a footer with legal disclaimers. Double-check that the template is printable and looks professional when saved or printed.

Free templates for donation receipts can be found on trusted nonprofit websites, legal service platforms, or donation management tools. Be cautious about downloading from unreliable sources to avoid fraudulent or incorrect formats. Look for templates offered by organizations with a solid reputation for nonprofit services.

Donation templates are also useful for tracking donations in your records. Set up a system for entering and saving the receipts. You can integrate your templates into donor management software to streamline the process, reducing the likelihood of errors and improving transparency for tax reporting.