When renting a property, both tenants and landlords benefit from having a rental deposit receipt. This document serves as proof that the tenant has paid the deposit amount. It should include key details such as the tenant’s name, the amount paid, the date of the transaction, and the landlord’s contact information. A clear rental deposit receipt protects both parties in case of any future disputes regarding the deposit.

Ensure that the receipt includes a brief description of the property being rented, along with any conditions tied to the deposit, such as its refundable nature or any deductions that might apply at the end of the lease. This transparency helps prevent misunderstandings about the terms of the deposit.

A well-structured template should be easy to fill out, requiring only basic details about the transaction. It should clearly state whether the deposit is refundable, and if so, under what conditions. Make sure both parties sign the receipt to acknowledge the transaction and its terms.

Here are the corrected lines:

Ensure the date format is consistent throughout the receipt. Use clear and concise wording to specify the amount of the rental deposit. Include the tenant’s full name and address to avoid confusion. Always note the payment method used for the deposit.

| Field | Corrected Information |

|---|---|

| Deposit Amount | $500 |

| Date | February 8, 2025 |

| Tenant Name | John Doe |

| Payment Method | Credit Card |

Ensure that the landlord’s contact information is easy to locate. Clearly state any conditions for the return of the deposit. Adjust any unclear language to avoid confusion when both parties review the document.

- Rental Deposit Receipt Template

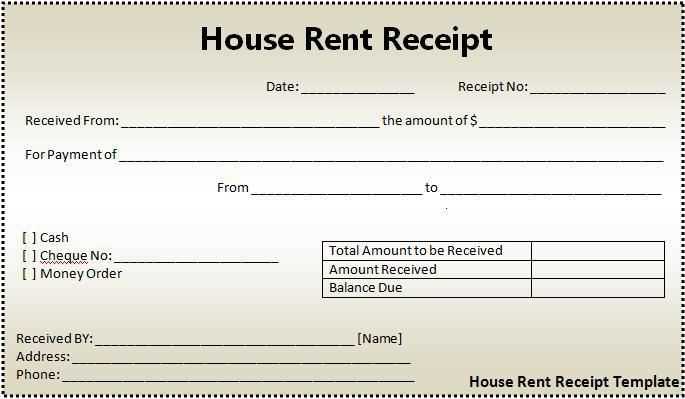

Use this rental deposit receipt template to clearly document the deposit transaction between a landlord and a tenant. It ensures both parties have a reference for future disputes or claims. Below is a simple yet effective structure for a rental deposit receipt:

Template Structure

- Date of Transaction: Clearly mention the date when the deposit was made.

- Tenant’s Information: Include the tenant’s full name, address, and contact details.

- Landlord’s Information: Provide the landlord’s full name and contact information.

- Amount Received: State the exact amount of the deposit received.

- Purpose of Deposit: Indicate that the deposit is for rental purposes, such as securing the rental unit or as security against potential damages.

- Property Information: Include the property address to specify the rental unit being secured by the deposit.

- Payment Method: Mention how the deposit was made (e.g., cash, check, bank transfer).

- Signatures: Both the tenant and landlord should sign the receipt to acknowledge the transaction.

Example

- Date of Transaction: February 8, 2025

- Tenant’s Name: John Doe

- Landlord’s Name: Jane Smith

- Amount Received: $1,200

- Purpose of Deposit: Security deposit for rental of 123 Maple Street

- Payment Method: Bank Transfer

- Tenant’s Signature: _____________________

- Landlord’s Signature: _____________________

This template helps ensure clarity and accountability for both parties. Customize it as needed for your specific rental agreements.

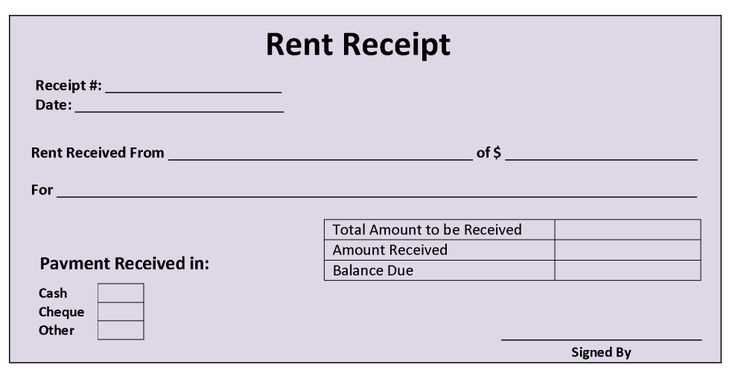

A deposit receipt must clearly outline specific details to ensure both parties are on the same page. Include these key elements:

- Tenant and Landlord Information – Clearly state the names and contact details of both the tenant and the landlord or property manager.

- Property Address – Include the full address of the rental property to avoid any confusion.

- Deposit Amount – Specify the exact amount paid for the deposit. Be clear whether it’s refundable or non-refundable.

- Date of Payment – Record the date the deposit was received to avoid any discrepancies later.

- Purpose of Deposit – Indicate whether the deposit is for damage, cleaning, or other purposes.

- Payment Method – Note how the payment was made (cash, cheque, bank transfer, etc.) for tracking purposes.

- Terms for Refund – Mention the conditions under which the deposit will be refunded, including the time frame and any deductions.

- Signature – Both parties should sign and date the receipt to confirm agreement.

Ensure that all details are accurate and clearly presented, leaving no room for misunderstandings.

Clearly state the exact amount of the rental deposit using the currency symbol and numbers. For example, write “$500” or “€300” for clarity. Avoid using words like “about” or “approximately” as they can cause confusion. If the deposit amount includes cents, ensure it’s written in the standard decimal format (e.g., “$250.50”). This prevents misunderstandings and ensures both parties are aligned on the expected deposit amount. Additionally, if there are any specific payment terms or breakdowns (e.g., part paid upfront, the rest due by a certain date), clearly list them alongside the total deposit amount.

Use commas to separate thousands if the deposit amount exceeds $1,000 (e.g., “$1,500” instead of “$1500”). This improves readability and ensures the sum is easily understood. For international transactions, always double-check the appropriate currency format for the specific country to avoid errors.

Clearly specifying tenant and landlord details is crucial for a valid rental deposit receipt. Here’s how to do it effectively:

- Tenant Information: List the full legal name of the tenant. Include the current address, contact number, and email address. Make sure this information matches the lease agreement to avoid any confusion.

- Landlord Information: Include the full name of the landlord or property management company. If the landlord is a company, list the business name and registration number, if applicable. Add the contact details of the landlord, such as phone number and email address.

- Rental Property Address: Specify the address of the rental property, including street address, city, and postal code. Ensure this aligns with the lease or rental agreement.

- Signature Fields: Provide spaces for both the tenant and landlord to sign and date the receipt. This step confirms that both parties agree on the terms and amounts listed.

Double Check the Details

Before finalizing the receipt, verify that all names, contact information, and addresses are correct. Mistakes here can lead to confusion in the future, especially if any disputes arise regarding the deposit.

Rental receipts must meet specific legal standards to be valid and protect both landlords and tenants. The receipt should clearly outline the transaction and include details like the amount paid, the date, and the rental period. Failure to include these details may lead to disputes or issues with enforcement in case of legal actions.

Check the local regulations, as requirements may vary depending on the jurisdiction. Some areas require receipts for all rental payments, while others may only mandate them for payments above a certain threshold. It’s recommended to provide receipts for both cash and electronic payments, regardless of the amount.

Here’s a breakdown of the key elements to include in a rental receipt:

| Element | Description |

|---|---|

| Tenant’s Name | Full name of the tenant making the payment. |

| Landlord’s Name | Full name or business name of the landlord or property manager. |

| Payment Amount | The exact amount paid, including any fees or deposits. |

| Date of Payment | The specific date the payment was made. |

| Payment Method | Details of how the payment was made (e.g., check, cash, bank transfer). |

| Rental Period | The period the payment covers (e.g., monthly rent for January 2025). |

Ensure that rental receipts are issued promptly to maintain transparency and comply with any local rental laws. Some jurisdictions may require receipts to be provided in a specific format, such as printed copies or electronic formats. Make sure your receipts comply with the relevant local laws to avoid potential legal issues down the line.

Clearly state the deposit amount. Include the exact sum received and specify the currency. This prevents confusion and ensures both parties are on the same page.

Include relevant details such as the tenant’s name, the rental property address, and the date of the transaction. This information creates a clear connection between the receipt and the rental agreement.

State the purpose of the payment. Mention whether the amount is a security deposit, rent payment, or another form of deposit. This provides clarity on the nature of the transaction.

List any applicable terms related to the deposit. This might include the conditions for refunding the deposit, deductions, or the time frame for returning it. This keeps both parties informed and avoids misunderstandings.

Sign the receipt. Having a signature adds a layer of formality and verifies the authenticity of the document.

Provide a copy to the tenant. Both parties should have a copy for their records. This ensures transparency and helps resolve disputes if they arise.

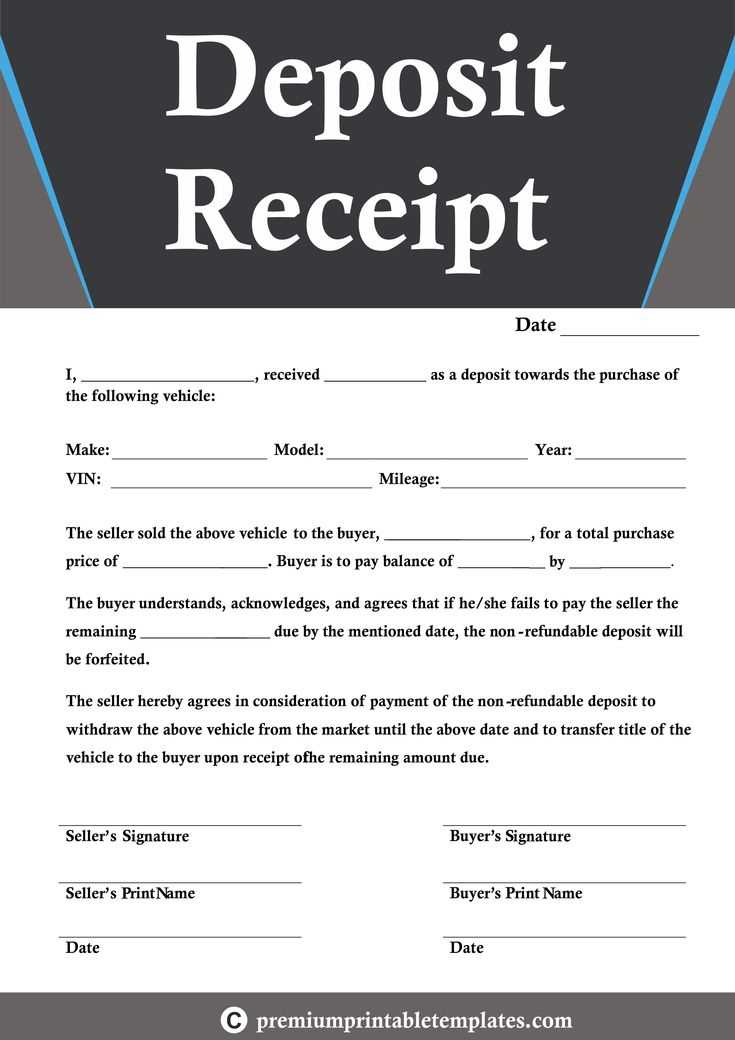

Adjust your rental deposit receipt template by tailoring it to the details of each agreement. Ensure the template reflects the unique terms between the landlord and tenant. For example, include any specific conditions like pet fees, utilities, or property damage provisions. These elements often vary from one agreement to another and should be clearly outlined on the receipt.

Adjusting for Lease Terms

If the lease includes special clauses, such as a lease-to-own option or early termination penalties, incorporate those into the template. Ensure that these specific terms are listed separately from the general deposit information, highlighting any relevant charges or deductions that apply under those conditions. Be clear about the refund process and the timeline based on the lease agreement.

Accounting for Regional or Property-Specific Needs

Take into account local regulations or property-specific requirements when customizing your receipt. Different states or regions may have laws regarding deposit amounts or refund timelines. Include any relevant statutory language or clauses that align with these rules, ensuring compliance and transparency. Additionally, if the property has specific instructions or restrictions (e.g., no smoking, maintenance responsibilities), include them to clarify what is covered by the deposit and how deductions may be applied.

Use a clear and organized format when creating a rental deposit receipt. A well-structured receipt ensures both parties understand the terms and protects against future disputes. Start by including the date of the transaction, the amount paid, and the reason for the deposit. Specify the property address and include the tenant’s name. If applicable, list any conditions tied to the return of the deposit, such as cleaning requirements or damages.

Key Elements to Include

Make sure to outline the exact amount received, the payment method, and any references to prior agreements or deposits. Specify whether the deposit is refundable and the conditions under which it will be returned. Clearly state the time frame for return, or indicate that deductions may apply based on property condition or lease terms.

Format and Organization

A clean layout is key. Use bullet points or numbered lists to break down each section of the receipt for easy reference. Include a signature line for both the landlord and tenant, along with contact details for both parties. This ensures that both the tenant and the landlord have a record of the transaction, which can be useful for future reference or disputes.