If you’re a landlord or tenant in India, having a rent receipt template at hand is a practical way to keep track of payments. Rent receipts serve as proof of transaction for both parties and can be critical when verifying rental payments for tax purposes or resolving disputes. You can easily download a rent receipt template to suit your needs from various online sources. Here are some steps to follow when looking for the right one.

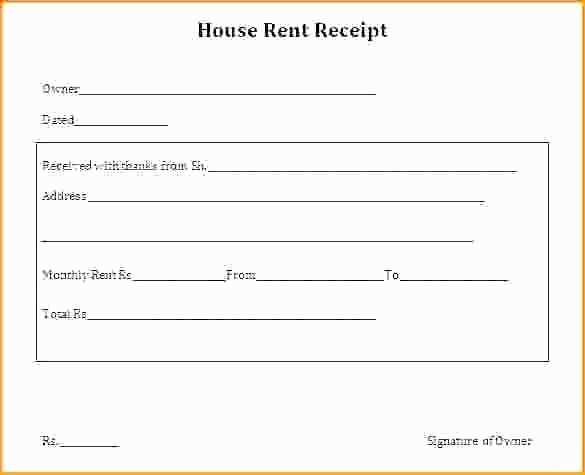

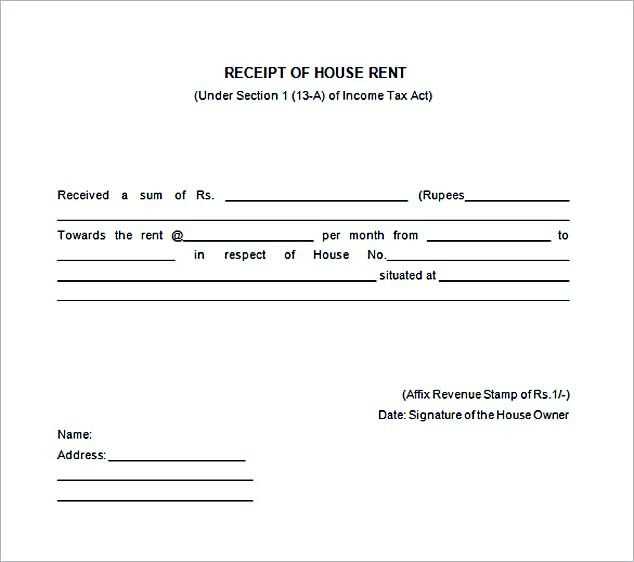

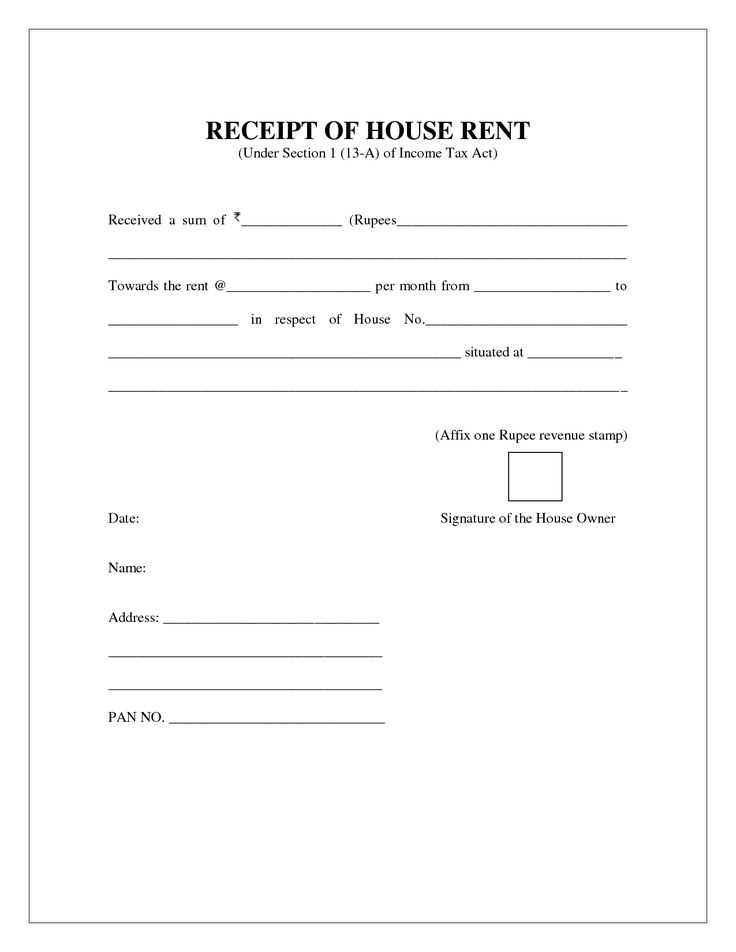

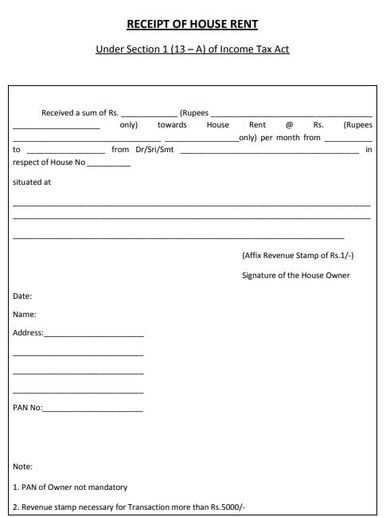

First, ensure that the template is compliant with Indian rental laws. The receipt should include key details such as the date, tenant’s name, landlord’s name, rental amount, property address, and the payment period. Make sure the format is clear and includes all these fields to avoid any confusion down the line.

Many templates are available in both editable Word or PDF formats, allowing you to customize the details for each tenant. Whether you are a small-time landlord or managing multiple properties, having a ready-to-use template can save you time and keep your records organized.

For added convenience, some websites offer free download options, ensuring accessibility for everyone. Always check the credibility of the website to ensure you are downloading a secure and accurate template. Keep your records handy for any future reference or potential tax filings.

Here are the corrected lines with minimized repetition:

When creating a rent receipt template, it’s important to simplify language and avoid redundancy. For example, instead of writing “This is a receipt for the rent payment made by the tenant for the month of January, for the rental property located at [address],” you can streamline it to “Rent receipt for January payment, property at [address].”

Another common repetition occurs with dates. Instead of saying, “The payment was made on the 5th day of January, 2025,” you can simplify this to “Paid on January 5, 2025.” This removes unnecessary words and makes the receipt more concise.

Also, avoid restating the same information in different ways. For instance, the phrase “tenant’s rent payment” is redundant when it can simply be “rent payment” as the tenant is already implied. Similarly, the term “the landlord” can be shortened to “landlord” without affecting clarity.

By focusing on clear and direct language, your rent receipt template will be more user-friendly and professional, reducing confusion and making it easier to process information quickly.

- Download Rent Receipt Template India

If you need a rent receipt template in India, it is crucial to choose one that adheres to the legal requirements and ensures clarity in communication between landlord and tenant. These receipts are important for both record-keeping and tax purposes. Below, you’ll find specific guidelines and options for downloading a rent receipt template suitable for India.

Features to Look For

- Details such as tenant’s and landlord’s name, property address, and rental amount.

- Date of payment and the period it covers (e.g., monthly or quarterly).

- Signature of the landlord for authenticity.

- Space to mention any applicable tax details, such as GST if relevant.

- Clear mention of payment method (cash, cheque, or online transfer).

Where to Download Rent Receipt Templates

- Official government websites often offer free templates that meet the legal requirements in India.

- Several online platforms provide customizable templates that you can download in formats like Word, PDF, or Excel.

- You can also use dedicated accounting software to generate rent receipts, which often include templates tailored to Indian standards.

Make sure the template you download includes all the required information and is easy to use for both parties. A good template ensures you meet the documentation needs without hassle.

Several websites offer free rent receipt templates specifically for Indian users. These templates can be easily downloaded, customized, and printed. Some of the most reliable sources include:

1. IndiaFilings

IndiaFilings provides a range of free templates, including rent receipt formats. These are legally valid for tax purposes and can be downloaded in various formats like Word and PDF.

2. Template.net

Template.net has a variety of rent receipt templates that you can download for free. You can search through different styles and formats, ensuring you find one that meets your needs.

Here’s a comparison of some popular websites offering free rent receipt templates:

| Website | Available Formats | Additional Features |

|---|---|---|

| IndiaFilings | PDF, Word | Tax-compliant templates |

| Template.net | PDF, DOCX | Multiple design options |

| Hloom | PDF, Word | Easy customization |

All of these platforms ensure that you can access professional-quality templates without spending a dime. You can quickly download the templates and adapt them to your requirements.

To customize a rent receipt in India according to legal standards, make sure the document includes all the necessary details that are required for both landlord and tenant. The receipt must clearly outline the terms agreed upon, such as the rent amount, duration, and payment method. Additionally, you must include both the tenant’s and landlord’s full names, addresses, and contact details. The inclusion of GST (Goods and Services Tax) is mandatory for rental agreements involving commercial properties or where the rent exceeds a specified limit.

Key Elements to Include in the Rent Receipt

| Field | Details |

|---|---|

| Tenant’s Name | Full name of the tenant |

| Landlord’s Name | Full name of the landlord |

| Property Address | Complete address of the rented property |

| Rent Amount | Exact rental amount paid by the tenant |

| Payment Date | Date the payment was made |

| GST (if applicable) | GST percentage, if applicable |

| Receipt Number | Unique number for the receipt |

| Signatures | Signatures of both parties |

How to Incorporate GST and Legal Provisions

If the rental amount is subject to GST, make sure to include the tax rate applicable (usually 18%) and clearly state the GST amount. This is particularly relevant for commercial property rentals or when the rent crosses the GST threshold limit. The rent receipt should comply with the Indian tax laws and include the necessary GST number of the landlord, if they are registered for GST purposes.

Accurately completing a rent receipt is important for both landlords and tenants. Here’s how to do it right:

- Include Tenant’s and Landlord’s Details

Begin by adding the full name, address, and contact details of both the tenant and the landlord. This ensures both parties are easily identifiable in the document.

- Provide Rent Payment Details

Specify the exact amount of rent paid, the period for which it covers (e.g., January 1–31, 2025), and the payment method used (e.g., cash, bank transfer, cheque).

- State the Date of Payment

Record the exact date when the rent was paid. This helps both parties confirm that the payment was made on time.

- Note the Property Address

Always include the complete address of the rental property. This avoids confusion in case of multiple rental agreements.

- Provide a Receipt Number

Assign a unique receipt number for each payment. This allows for easy tracking of payments and helps in case of any disputes.

- Signature of Landlord

Ensure that the landlord signs the receipt. This signature acts as confirmation that the payment has been received and acknowledged.

- Issue a Copy to the Tenant

After completing the receipt, provide a signed copy to the tenant. This gives them proof of the transaction for their records.

Ensure you include the complete address of the landlord and tenant on the receipt. Omitting this detail can cause confusion and may create issues in case of disputes. Both parties should know exactly where the transaction took place.

1. Incorrect Dates

Always double-check the date on the receipt. A receipt with the wrong date can create discrepancies when verifying payment records. It’s important that the date matches the actual transaction to avoid any confusion.

2. Missing or Incorrect Payment Amount

Confirm the payment amount before issuing a receipt. Any discrepancies between the rent paid and the amount written on the receipt can lead to problems later on. Make sure both the numerical value and the words match precisely.

3. Incomplete Signature

Leaving out the landlord’s or tenant’s signature is a common mistake. A signature adds credibility to the receipt and confirms that both parties acknowledge the transaction. Without it, the receipt may not be valid as proof of payment.

4. Lack of Payment Method

Always specify the method of payment used (cash, bank transfer, cheque, etc.). A vague or missing payment method could create ambiguity if the receipt is needed for future reference.

5. Failing to Provide a Receipt for Every Transaction

Make it a practice to provide a receipt for every payment made. Not issuing a receipt, even if it’s a small amount, can make it difficult to track payments or resolve any potential conflicts.

6. Missing Rent Period

State the period for which the rent is being paid. A common mistake is forgetting to mention whether the payment covers a specific month, a portion of the year, or multiple months. This helps clarify the purpose of the transaction and avoids future disputes.

To include GST details in a rent receipt, clearly mention the GSTIN (Goods and Services Tax Identification Number) of the landlord. This should be placed near the top of the receipt, typically under the landlord’s name and address. Make sure to specify whether GST is applicable on the rent being charged. If applicable, include the percentage of GST (usually 18% for residential properties, unless specified otherwise).

For a transparent breakdown, mention the amount of rent, GST rate, and the corresponding GST amount separately. The total rent paid, including GST, should be clearly highlighted at the bottom of the receipt. This ensures both the tenant and landlord can easily identify the tax amount being paid along with the base rent amount.

If the tenant is GST-registered, add their GSTIN to the receipt. This can assist in tax credits for the tenant. Double-check the GST percentage and ensure the format of the receipt complies with local tax regulations. Keep records for both parties as per tax requirements.

If your tenant asks for a correction on a rent receipt, first review the details on the document to confirm whether there’s an error. If the mistake is clear, quickly issue a revised version with the correct information. Ensure the corrected receipt includes the same details as the original, such as the rent amount, payment date, and tenant name, but with the updated information where necessary.

If the tenant’s request doesn’t seem to be based on an actual mistake, communicate openly. Ask for clarification to understand their concern, and verify the original information. Sometimes, tenants may confuse payment dates or amounts. Address their concerns directly to avoid unnecessary misunderstandings.

If no error is found and the tenant insists, provide a detailed explanation with supporting evidence, such as bank transaction records or previous receipts. This shows transparency and helps resolve disputes smoothly.

Always ensure that your receipts are accurate moving forward. Set up a system to avoid common errors, such as double-checking amounts and dates before issuing the receipts. Clear documentation can prevent most issues and maintain a smooth relationship with your tenants.

To download a rent receipt template for India, follow these clear steps to ensure a smooth process:

Choose a Reliable Source

Start by selecting a trusted website that offers rent receipt templates specific to Indian formats. Some popular sites include government portals, online document platforms, and accounting software providers. Ensure the website provides templates that are legally recognized in India.

Download the Template

Once you find a suitable template, look for a download link. Most templates come in PDF or Word formats. Choose the one that best suits your needs. Make sure the template includes sections for the tenant’s name, address, rent amount, payment date, and landlord’s details.

Tip: Look for templates with automatic calculations for rent amounts and due dates to save time on manual entry.

Edit and Customize

After downloading, open the template in a suitable editor. Fill in all the required fields, such as tenant details, rent amount, and the month of payment. Double-check for any errors before finalizing the receipt.

Note: Some platforms may offer customization options, such as adding your company logo or specific terms related to the lease agreement.

Save and Print

Once you’re satisfied with the template, save it in a secure folder. You can print it for physical distribution or email it to your tenant as a digital receipt.