For those handling trust distributions, creating a clear and organized receipt template is key. A well-structured document helps both parties involved maintain transparency and clarity. It outlines the details of the distribution, ensuring everything is in order for record-keeping and tax purposes.

Start with including the full name of the trust, the trustee, and the beneficiary. Specify the distribution amount, the date, and the method of transfer. Be sure to mention any specific instructions or restrictions related to the distribution, if applicable.

After the basic details, add space for signatures from both the trustee and beneficiary. This confirms that both parties acknowledge the distribution details and agree to the terms. Keep the language simple and direct to avoid misunderstandings. A well-crafted receipt template can save you time and prevent unnecessary complications down the line.

Here is the corrected version with repetitions removed:

Remove any repeated sections within the receipt to streamline the content. This eliminates redundancy and ensures clarity in the document. Each part of the receipt should contain unique information that doesn’t overlap with other sections. Ensure that the same data is not restated in multiple places unless it is absolutely necessary for legal or procedural reasons.

Clear Structure

Organize the receipt logically. Start with the trust details, then list distributions, followed by the amounts, and finish with the signatures or acknowledgments. This creates a straightforward flow and eliminates unnecessary duplication of information. If any field or section is repeated, remove or consolidate them to improve readability.

Accurate Data Entry

Ensure that all details are entered accurately. Cross-check for any repeated figures or statements that could lead to confusion. Avoid providing identical information in different sections unless it adds clarity or is required for verification purposes.

Trust Distribution Receipt Template: A Practical Guide

Understanding the Purpose of a Trust Distribution Receipt

Key Information Required in a Trust Distribution Document

Steps to Create a Trust Distribution Template

Legal Considerations When Using a Distribution Receipt

How to Customize Your Trust Receipt Template

Common Mistakes to Avoid When Drafting a Distribution Receipt

A Trust Distribution Receipt serves as a record for the transfer of assets from a trust to a beneficiary. It provides both parties with proof of the transaction, ensuring transparency and accountability. Without this document, it can become challenging to track the details of trust distributions, potentially leading to disputes or misunderstandings.

Key Information Required in a Trust Distribution Document

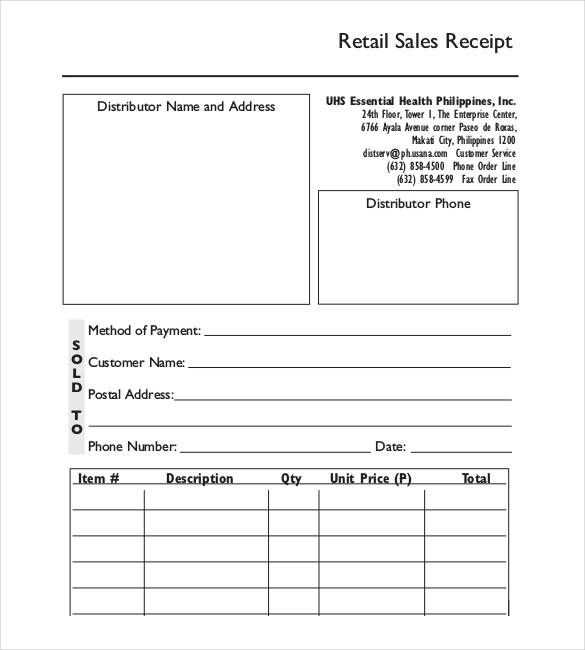

Include the following details in every distribution receipt:

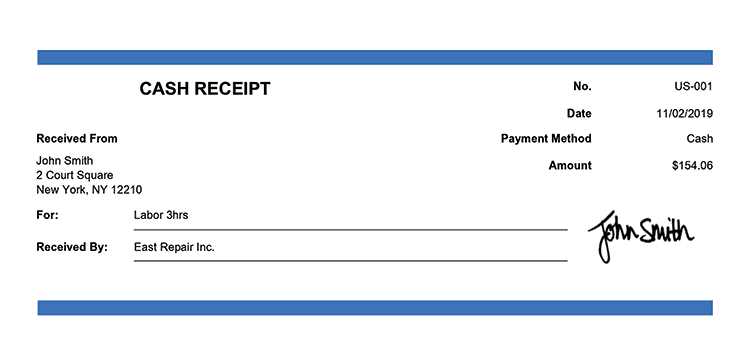

- Full names of the trustee and beneficiary

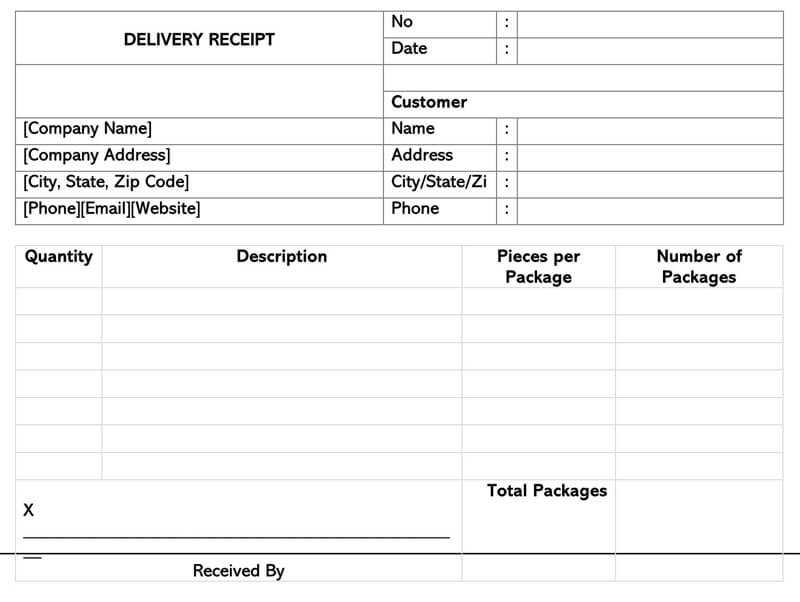

- Description of the distributed assets (monetary value or specific items)

- Date of the distribution

- Trust name and reference number

- Amount or value of the distribution

- Signature of the trustee and beneficiary

Steps to Create a Trust Distribution Template

To create a template, follow these steps:

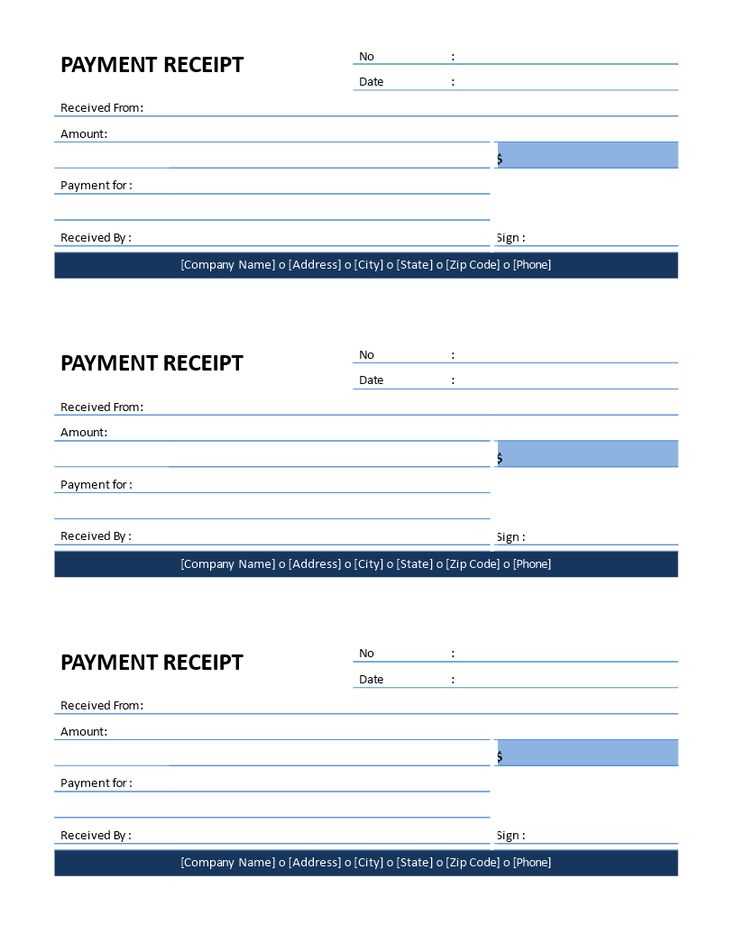

- Start with the heading, clearly stating the document as a “Trust Distribution Receipt.”

- Incorporate fields for all necessary details, such as names, asset description, and amounts.

- Include a section for the trustee’s and beneficiary’s signatures, along with the date of the transaction.

- Ensure space for any additional notes or comments, in case further clarification is needed.

Be sure to structure the template in a way that makes it easy to update for each distribution. A standard template reduces errors and streamlines the process.

In legal contexts, it’s important to keep a copy of each signed receipt for your records. This ensures the accuracy of trust management and is a safeguard if any legal concerns arise.

Legal Considerations When Using a Distribution Receipt

Distribution receipts must comply with relevant trust laws and any tax implications that may arise from the transfer of assets. Keep in mind that some jurisdictions require specific wording or additional clauses. Always consult with a legal professional to ensure compliance with local laws, especially in cases of large or complex distributions.

Another key factor is making sure that distributions are documented correctly in the trust’s financial records. This helps in annual accounting and reporting to beneficiaries, as well as adhering to tax regulations.

How to Customize Your Trust Receipt Template

Customizing a template allows you to adjust it for specific situations or the needs of the trust. You may need to modify language to reflect the terms of the trust agreement or add extra details regarding certain types of assets, like real estate or securities. Consider including provisions for partial distributions or deferred payments, if relevant to your situation.

Common Mistakes to Avoid When Drafting a Distribution Receipt

Avoid these common mistakes when creating or using distribution receipts:

- Failing to clearly describe the assets being distributed

- Omitting required signatures or dates

- Not keeping copies of receipts for record-keeping

- Not including any contingencies or special conditions in the distribution

- Overlooking tax implications or other legal requirements