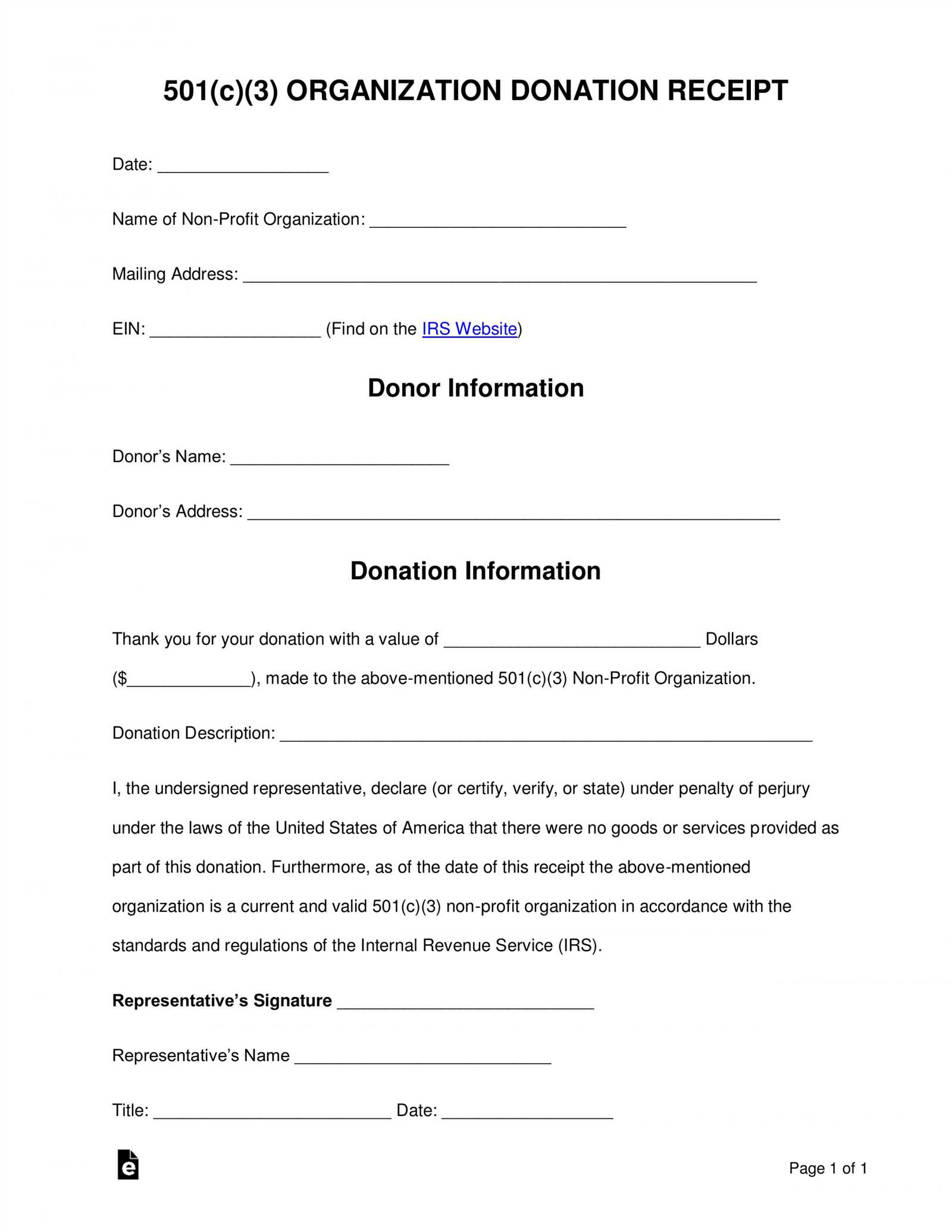

Key Information for a Gift in Kind Receipt

To create a gift in kind receipt, include these crucial details:

- Donor’s Name and Address: Clearly state the donor’s full name and address.

- Date of Donation: Include the exact date the donation was made.

- Item Description: List the donated items with specific details about their nature, quantity, and condition.

- Value of Donation: Indicate the fair market value of the items. If the value isn’t determined, note that the donor is responsible for valuing the gift.

- Purpose of Donation: Briefly describe the intended use of the donation (e.g., supporting charity events or aiding a cause).

- Organization’s Name and Contact Info: Include the name and contact details of the receiving organization.

- Authorized Signature: An authorized representative of the receiving organization should sign the receipt.

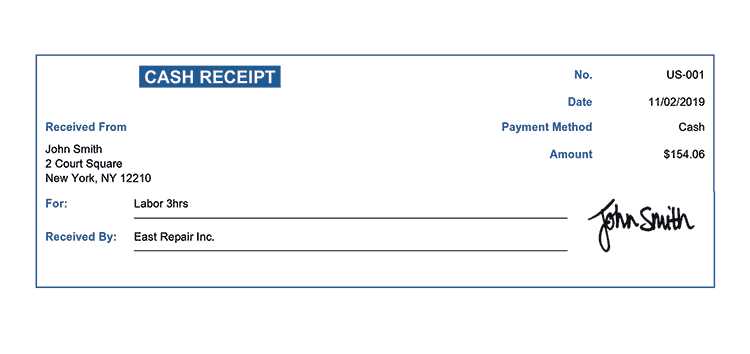

Sample Template

Here’s a sample format for a gift in kind receipt:

Gift in Kind Receipt Donor's Name: ___________________________________________ Donor's Address: _________________________________________ Date of Donation: _______________________________________ Description of Items Donated: 1. _________________________________________________ 2. _________________________________________________ 3. _________________________________________________ Value of Donation: _______________________________________ Purpose of Donation: _____________________________________ Received by (Organization’s Name): Authorized Signature: ___________________________

Additional Tips for Clarity

For transparency, add the following points:

- Specify whether the donor will receive any goods or services in return for the donation. If so, provide a value for these.

- Keep the receipt simple and clear to avoid confusion on both sides.

- Ensure the donor has all the information they need for tax purposes, as gift in kind donations may be deductible.

When drafting a receipt, make sure it serves both the donor and the receiving organization, providing the necessary documentation without excessive details.

Gift in Kind Receipt Template: A Practical Guide

How to Structure a Gift in Kind Receipt

Key Legal Information to Include in Your Receipt

Valuing Non-Cash Donations in Gift Receipts

Best Practices for Customizing a Gift in Kind Template

Common Mistakes to Avoid When Issuing a Receipt

How to Ensure Compliance with Tax Regulations for Receipts

When issuing a Gift in Kind receipt, ensure it is clear and concise, providing all necessary details for both the donor and the recipient. Start by including the donor’s name, address, and the date of the donation. Clearly describe the items donated, including the quantity and condition, as this helps with documentation and potential tax benefits.

Key Legal Information to Include in Your Receipt

Legal requirements vary by country, but most receipts must include the donor’s name, the name of your organization, a statement of the donation type (whether cash or non-cash), and a detailed description of the donated items. If you receive goods, you should not assign a monetary value to the items, but it is crucial to indicate the fair market value provided by the donor or an appraiser. The receipt must also confirm that no goods or services were provided in return for the donation, unless otherwise specified.

Valuing Non-Cash Donations in Gift Receipts

Valuing donated items is a key part of the process. While non-cash donations are often valued by the donor, it’s important to ensure the valuation is reasonable and based on the current market value of similar items. Include a note on how the valuation was determined, whether by the donor or with professional assistance. If your organization provides appraisal services, specify this in the receipt.

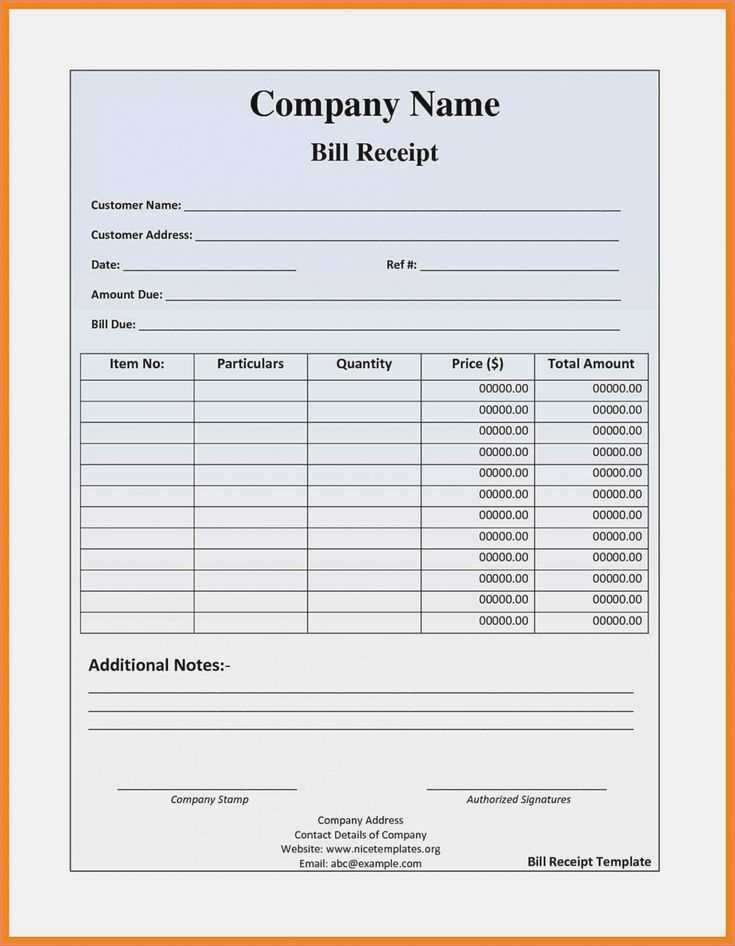

Customizing your Gift in Kind template is important for maintaining consistency and professionalism. Ensure the layout is simple and includes all the necessary details. Avoid clutter and ensure that the most important information stands out, such as the description of the donation and the fair market value.

Common mistakes include failing to list the condition of the donated items or miscalculating the value. Double-check all the information for accuracy before issuing receipts to prevent future complications. Additionally, ensure compliance with tax regulations in your country by familiarizing yourself with local guidelines. In some regions, receipts may need to be submitted with tax returns for deductions to be considered valid.