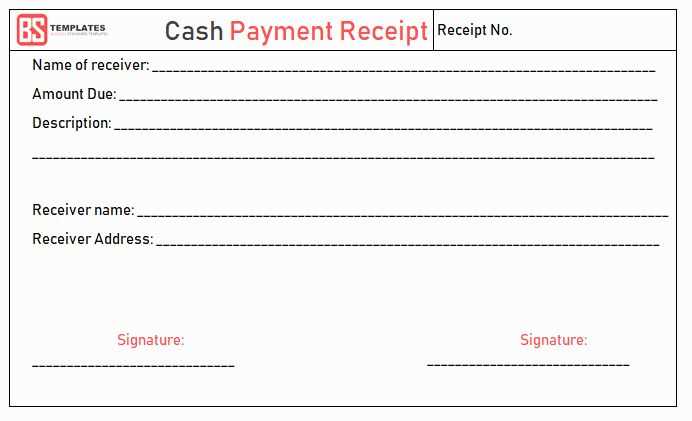

Key Elements to Include

When creating a payment refund receipt, make sure to cover these key elements for clarity and proper documentation:

- Refund Reference Number: Assign a unique identifier to the refund for tracking purposes.

- Company Information: Include the full name of the business, address, and contact details.

- Customer Details: Provide the name, address, and contact information of the customer receiving the refund.

- Original Payment Information: Include details of the original transaction, such as the payment method, amount, and date.

- Refund Amount: Clearly state the refunded amount along with any applicable taxes or fees.

- Reason for Refund: Specify why the refund is issued (e.g., product return, service issue).

- Date of Refund: Indicate when the refund was processed.

- Refund Method: Mention how the refund was issued (e.g., credit card, bank transfer).

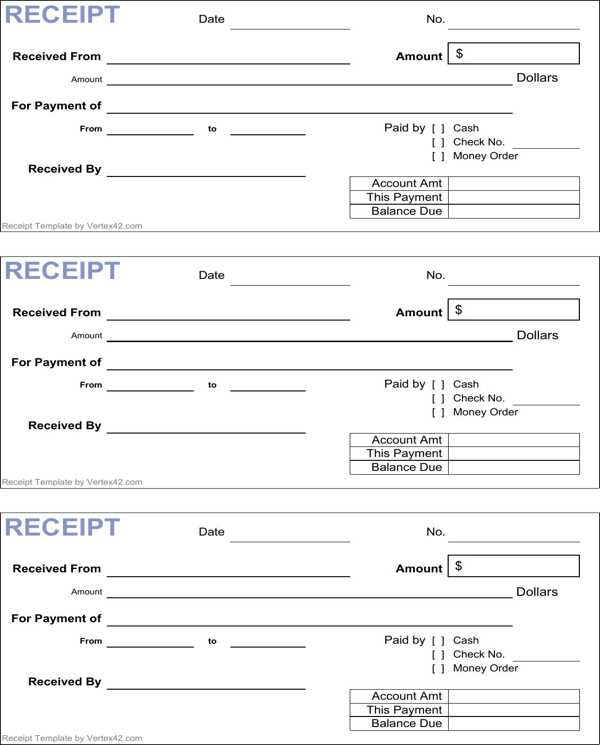

Template Example

Below is a simple payment refund receipt template that can be tailored to your needs:

Receipt Number: [Insert Reference Number] Date: [Insert Date] Refund Issued To: [Customer Name] [Customer Address] [Customer Contact Information] Refund Details: Original Payment Amount: $[Insert Amount] Refund Amount: $[Insert Amount] Reason for Refund: [Insert Reason] Refund Method: [Insert Method] Refund Processed By: [Business Name] [Business Address] [Business Contact Information] Thank you for your business!

How to Customize the Template

Adapt the template above to reflect your specific business needs by updating the placeholders with accurate details. Ensure that each refund receipt is distinct to maintain proper records and communication with your customers.

Payment Refund Receipt Template

Key Elements to Include in a Reimbursement Receipt

Formatting Guidelines for a Clear Return Document

Legal Considerations When Issuing a Compensation Receipt

Customizing a Return Receipt for Different Transactions

Common Errors in Reimbursement Receipts and How to Avoid Them

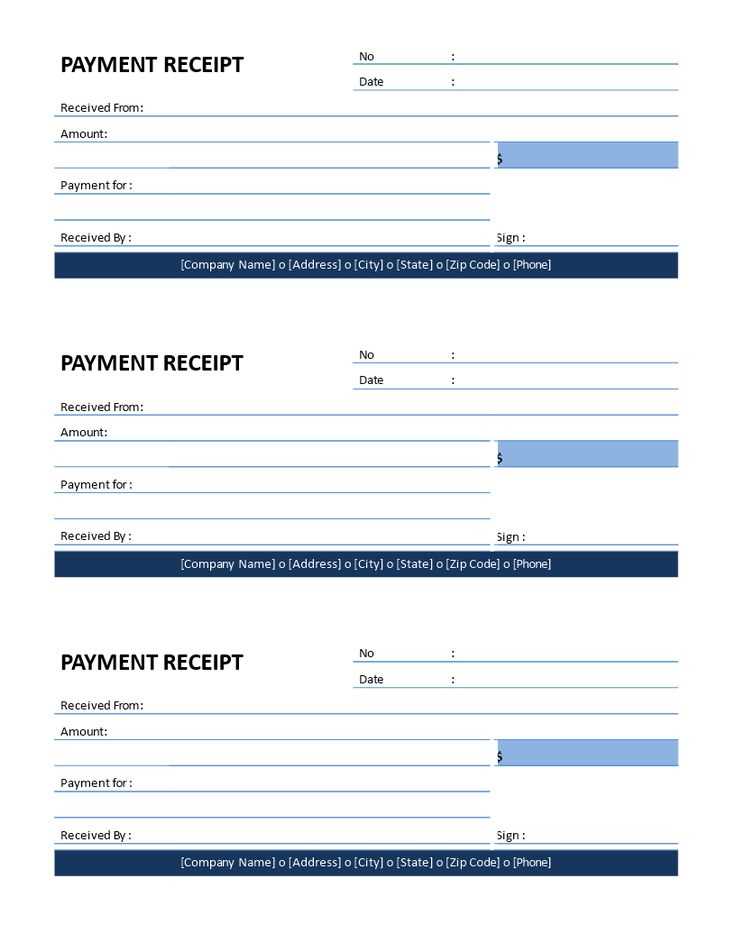

Printable and Digital Return Receipt Template Options

Include the transaction date, the amount refunded, the method of payment, and a brief description of the items or services involved. Make sure to list the name of both the payer and payee for clarity.

Ensure the document has a clear, structured layout with distinct sections for the buyer’s and seller’s information, transaction details, and a refund confirmation statement. Use easy-to-read fonts and proper spacing between elements.

Verify that the refund receipt complies with any applicable local or international laws. For example, ensure that it contains the necessary tax identification numbers or business registration details if required by law.

Tailor the receipt to the specific transaction type, whether it’s for a product return, service cancellation, or billing error correction. Different types of refunds might require different wording or details.

Avoid common mistakes such as missing transaction identifiers, unclear descriptions of the refund reason, or incorrect amounts. Always double-check that the refund amount matches the original transaction.

Both printable and digital formats are widely accepted. You can choose between a PDF for easy printing or an email-friendly format for quicker digital processing.