If you’re looking for a quick and straightforward way to create cash sale receipts, a free template in Word format can save you time. You can easily customize it to match your business needs, ensuring clear documentation for every transaction.

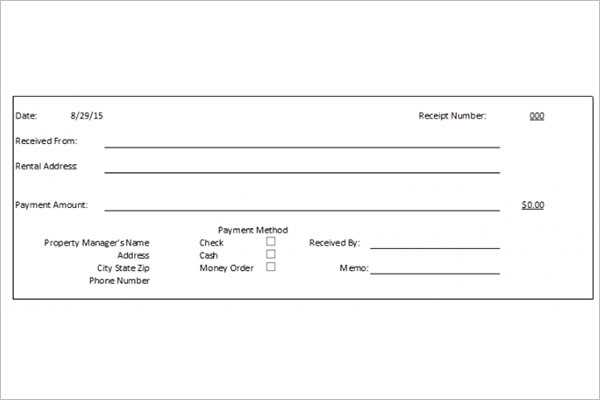

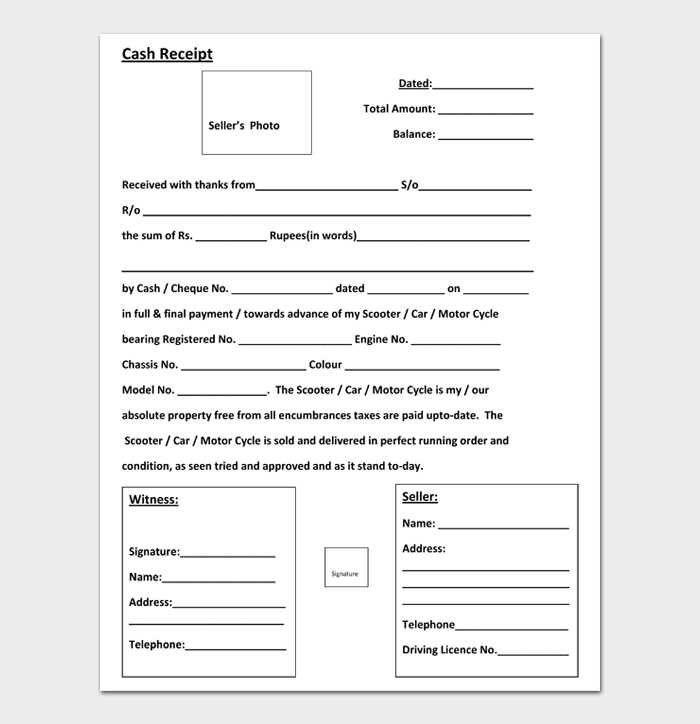

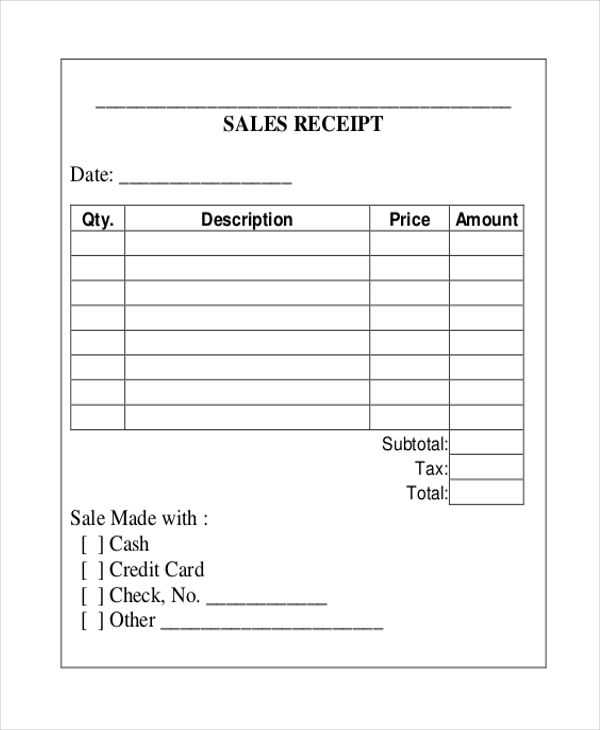

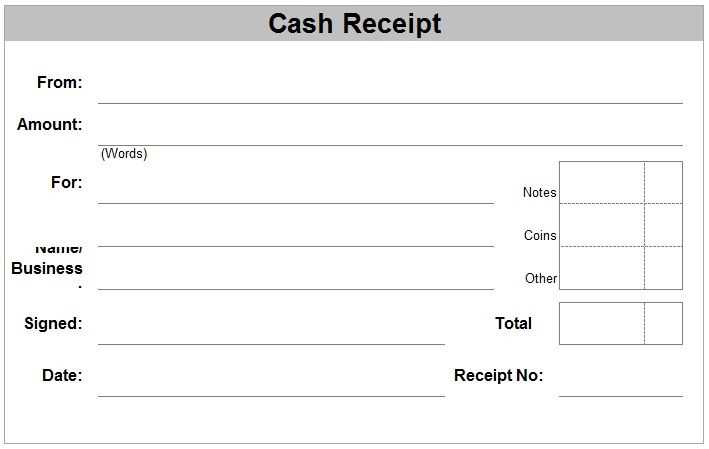

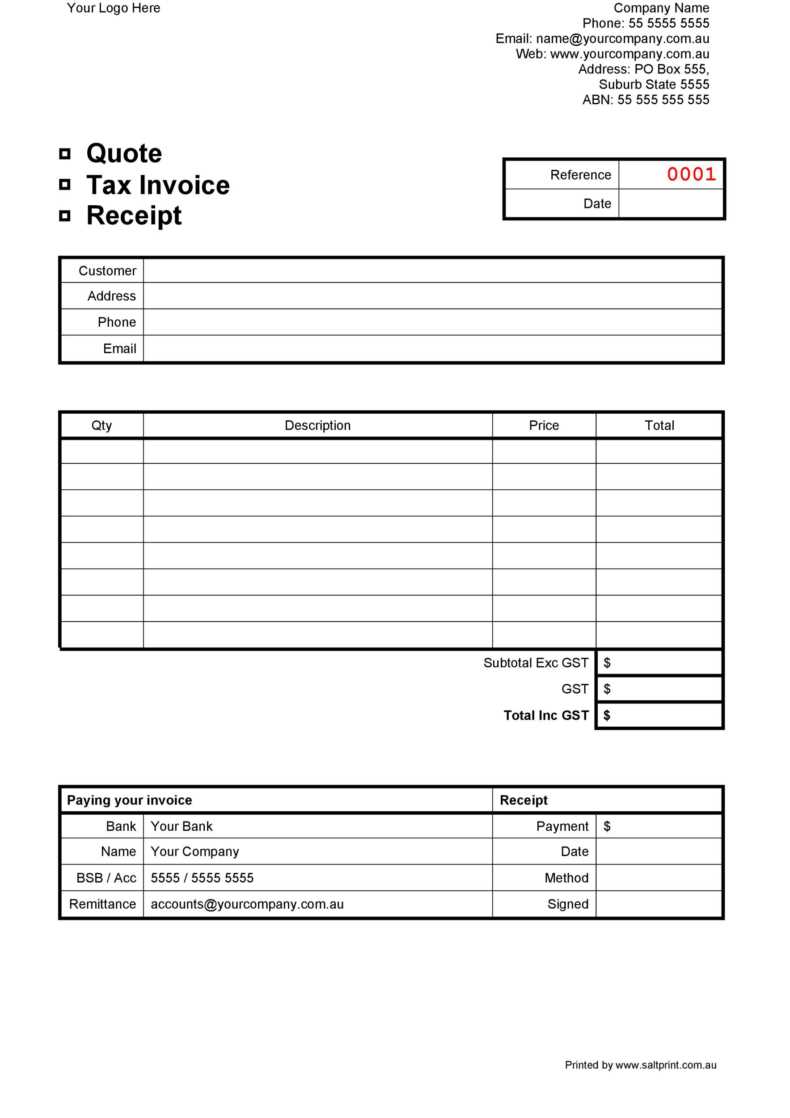

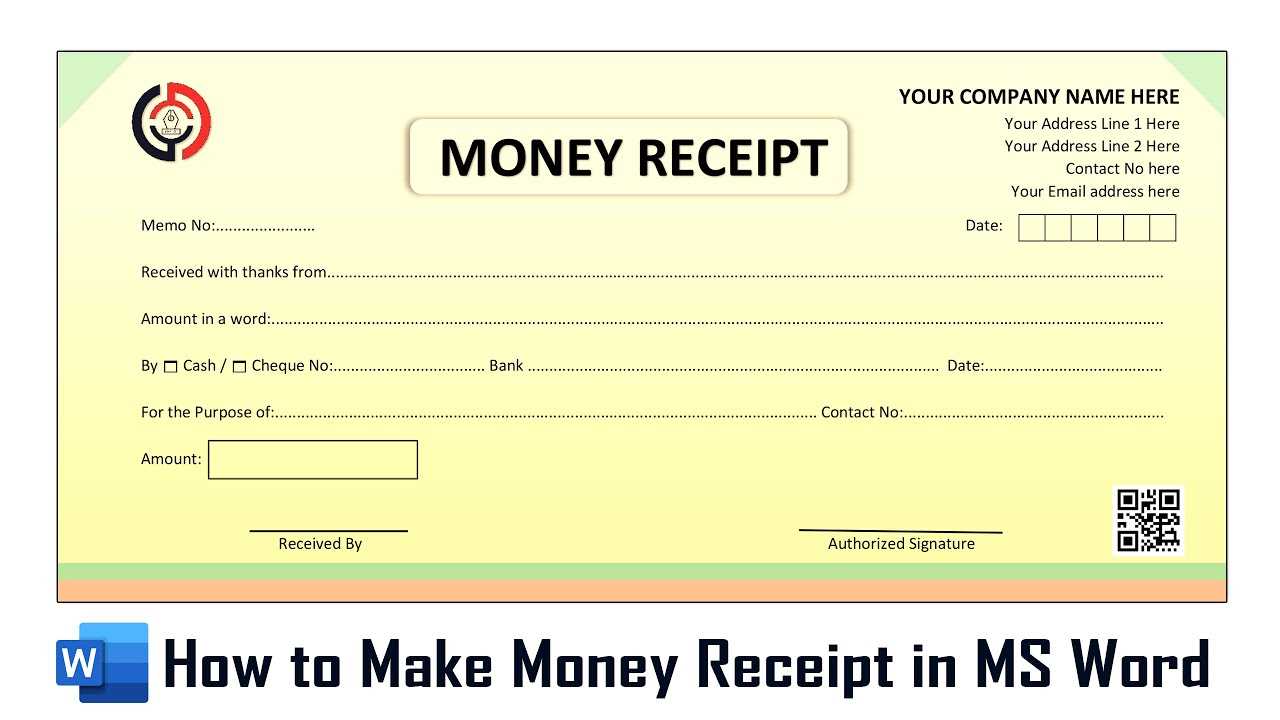

The template includes sections for essential details like the buyer’s information, date of transaction, item description, and total amount. You can fill in the blanks for each sale and print the receipt or send it electronically, making it a versatile tool for businesses of any size.

By using a cash sale receipt template, you maintain organized records and provide customers with a professional document that can be kept for future reference. This approach is simple and efficient, eliminating the need to create receipts from scratch every time.

Here’s the corrected text with reduced repetition:

Focus on creating a clear, concise receipt template. Start by including the essential details: buyer’s name, seller’s name, transaction date, amount paid, and any relevant reference numbers. Ensure the layout is clean, with enough space to avoid clutter. Use tables to organize data neatly and make it easy to read. Avoid unnecessary elements that can confuse the reader or distract from the main information. A straightforward design will keep the focus on the transaction itself. Consider adding customizable fields so the template can be adjusted as needed. Double-check for accuracy and consistency in the information presented.

- Free Cash Sale Receipt Template in Word

To create a cash sale receipt in Word, choose a template that includes all necessary details for a smooth transaction. This includes the date of sale, item description, quantity, unit price, total cost, and buyer information. Add payment details such as cash received and the salesperson’s signature. Ensure the template is customizable, allowing you to adjust fonts and logos to match your business branding. A professional-looking receipt not only serves as a proof of purchase but also enhances trust with your clients.

When selecting a format for your cash sale receipt, prioritize clarity and simplicity. Choose a template that clearly outlines all transaction details. Avoid overly complex layouts that could confuse both parties.

Consider Key Information

- Include the transaction date and time.

- Ensure the product or service description is clear.

- State the amount paid, taxes, and total in separate lines.

- Provide contact information for your business for reference.

Choose an Accessible File Type

- Opt for Word or PDF formats for easy editing and sharing.

- Avoid formats that may require specialized software or complicate access.

Begin by modifying the header of your cash sale document. Include your company logo, name, and contact details in a clear and professional format. Ensure that the document reflects your brand identity and contact information, which makes it easy for customers to reach out if needed.

Next, adjust the itemized list section. Make sure the description of each product or service is clear and precise, with quantities, unit prices, and any applicable taxes included. Double-check that the total price matches the sum of individual items to avoid confusion.

Customize payment terms based on your business needs. Add fields for payment methods, such as cash, credit card, or bank transfer, and specify any required deposit or payment deadlines. You can also include an option for payment confirmation, ensuring clarity for both parties.

Update the footer to include any additional relevant information, such as return policies or warranties. You can also add a personalized thank-you note to leave a positive impression on your customers.

Lastly, review and adjust the layout. Ensure there is adequate white space between sections for easy reading. Use a simple font and clear headings to improve the document’s readability and professionalism.

Make sure to include the legal requirements on the sale receipt to protect both the buyer and the seller. This includes the business name, tax identification number, and a clear description of the items sold. Additionally, include any relevant terms and conditions related to returns, refunds, or warranties, as these ensure both parties understand their rights and responsibilities. If your business is subject to sales tax, include the tax rate and total tax amount charged.

| Legal Information | Details |

|---|---|

| Business Name | Name of the seller or business entity |

| Tax ID Number | Tax identification number for the business |

| Item Description | Clear, accurate description of the goods or services sold |

| Return and Refund Policy | Terms regarding returns, exchanges, and refunds |

| Sales Tax | Amount of sales tax, if applicable, and the tax rate used |

Integrating a free cash sale receipt template into your sales tracking process helps streamline record-keeping and enhances accuracy. Use the template to automatically capture crucial sale details such as item names, prices, discounts, taxes, and payment methods. This allows for consistent, easy-to-update records without needing manual input for each transaction.

Automated Data Entry

By incorporating a template, you reduce the risk of human error in entering sales information. The template can be customized to capture all the necessary data, such as the customer’s contact details, purchased products, and payment confirmation. With this setup, the data is saved in a structured format that simplifies future sales analysis.

Syncing Sales Data with Inventory

Ensure the template connects with your inventory management system. Automatically update stock levels based on the sales recorded in the template. This integration minimizes the risk of overselling and ensures that your inventory remains accurate in real time.

Inaccurately filling in the fields is a common mistake. Always ensure that the data you input is correct and specific to your transaction. Double-check the buyer’s details, payment method, and product description to avoid any errors.

Another mistake is neglecting to customize the template. Templates are designed as a starting point, not a one-size-fits-all solution. Modify the text to fit your business’s needs, such as adding your company logo or adjusting the layout for clarity.

Forgetting to add necessary information can lead to confusion. Ensure all essential fields, like the receipt number, transaction date, and tax details, are included. Omitting any of this information can create problems down the line.

Not saving a backup of your template can result in lost data. It’s essential to save multiple versions of your documents to avoid accidental deletion or file corruption.

Another frequent issue is using outdated templates. Always verify that your template reflects current business practices, such as the latest tax rates or legal requirements. Templates that are too old may not comply with new regulations.

Finally, overcomplicating the layout can make the receipt harder to read. Keep the design simple and focused on the key details, ensuring that all relevant information is easy to find and understand.

| Mistake | Solution |

|---|---|

| Inaccurate data entry | Double-check all fields for accuracy |

| Neglecting customization | Tailor the template to your business |

| Missing essential details | Ensure all required fields are filled |

| Not saving backups | Store multiple copies to avoid loss |

| Using outdated templates | Update the template to meet current standards |

| Overcomplicated layout | Maintain a clean, readable design |

Many websites offer free templates for sale receipts. These are easy to customize and can save you time. Here are a few reliable options:

- Microsoft Office Templates: Go to the official Office website or open Word to search for receipt templates. They offer a variety of simple designs you can modify as needed.

- Google Docs: You can find sale receipt templates in Google Docs’ template gallery. They are free to use and can be edited online.

- Template.net: This site provides a wide range of free sale receipt templates. Choose from professional or casual designs depending on your business style.

- Canva: Canva has customizable templates for free. You can easily adjust the layout and elements to suit your needs.

- Vertex42: Known for providing Excel templates, Vertex42 also offers free receipt templates in various formats, including Word.

These options allow you to quickly find a template that fits your business, saving both time and effort in creating your receipts. Pick the one that suits your needs and customize it to match your brand.

To create a cash sale receipt template in Word, first focus on clarity and simplicity. Begin by including key elements such as the transaction date, buyer and seller details, item description, price per unit, and the total amount. Use clear sections to separate these details, ensuring each one is easy to locate. Incorporate lines for signatures or initials to confirm the transaction. Consider a clean, structured layout with defined margins and consistent font styles for readability.

Ensure the template includes space for additional notes, if necessary. This helps when extra information is required, like discounts or payment terms. Use bullet points or tables to organize items and amounts effectively. Keep the design simple and professional, avoiding unnecessary decorations that could distract from the essential information.

When designing the template, make sure the receipt is adaptable to various businesses. Adjust fields based on the nature of the transaction. For example, for service-based businesses, include a field for the service description and hours worked. After completing the layout, save the template as a reusable Word document, so it can be filled out quickly for future transactions.