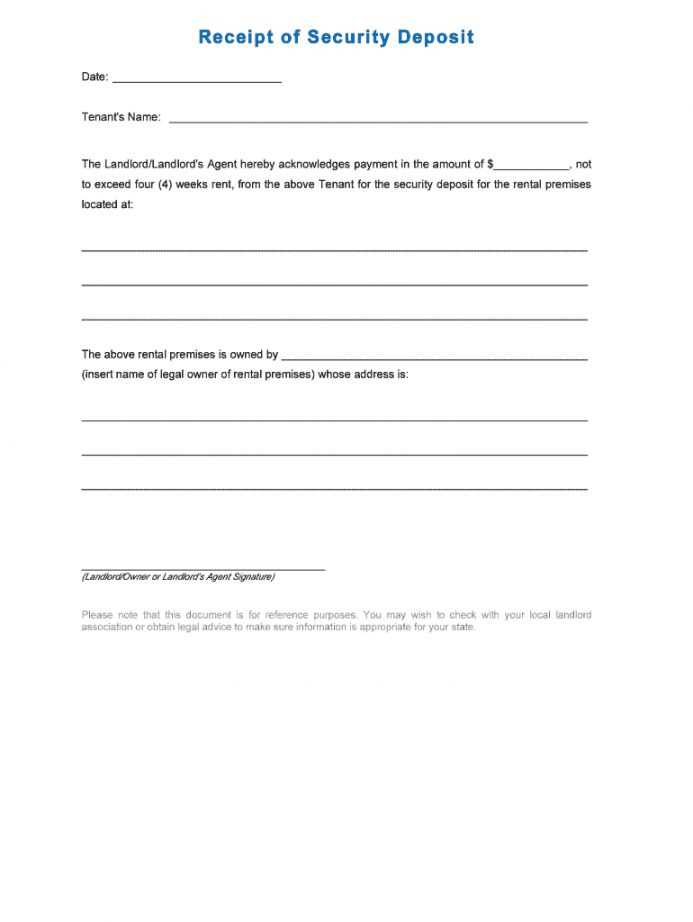

Provide a clear, detailed receipt to your tenants once they pay a rental deposit. This document acts as proof of the transaction, outlining both the amount paid and the terms associated with the deposit. Ensure that the receipt includes important details such as the date of payment, tenant’s name, property address, and deposit amount. A well-organized template can help avoid any confusion down the line.

The rental deposit receipt should also clearly state whether the deposit is refundable and under what conditions, such as damage or unpaid rent. You may want to add a section explaining any deductions that could be made, ensuring transparency for both parties. Additionally, both you and the tenant should sign the receipt to acknowledge the terms.

A simple, straightforward template helps keep records clean and avoids misunderstandings. By including all necessary details in a clear format, you’ll protect yourself legally and create a smooth rental experience for your tenant. Make sure to customize the template for each tenant, adjusting the specifics as needed to match your rental agreement terms.

Here are the revised lines with minimized repetition of words:

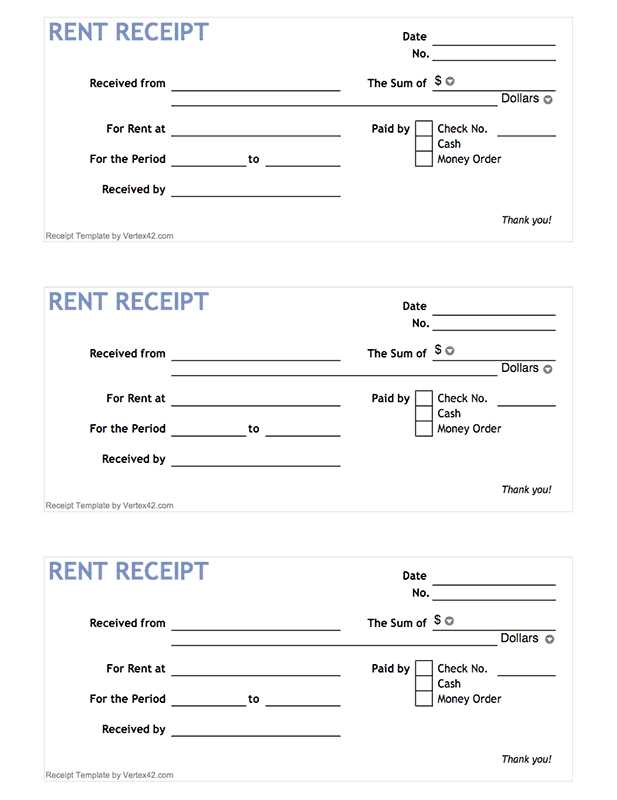

Always ensure the receipt clearly states the amount of the rental deposit, along with the property address and tenant’s name.

Date of receipt is crucial for reference. Include a line acknowledging the landlord’s responsibility to return the deposit at the end of the lease, assuming no damages or unpaid rent.

Note the payment method, whether by cash, cheque, or bank transfer. Specify if any part of the deposit has been deducted for repairs or unpaid fees.

Clearly mention any conditions under which the deposit might not be returned. This provides transparency and reduces potential disputes.

Include a signature from both the landlord and tenant, confirming the receipt and agreement on the deposit’s terms.

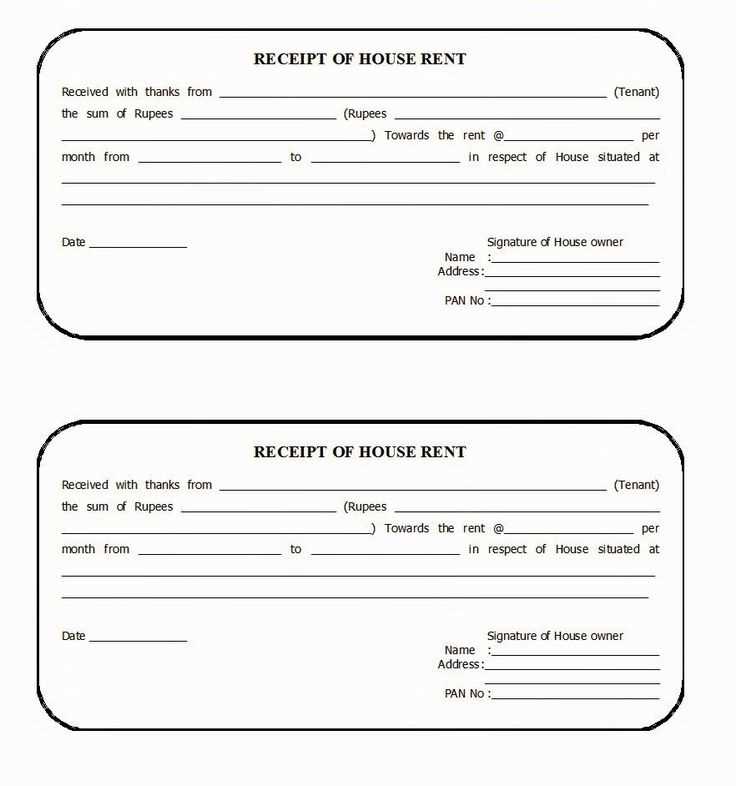

- Receipt of Rental Deposit Template

For clarity and legal protection, a rental deposit receipt should include key details about the transaction. This helps both parties understand the terms and conditions regarding the deposit amount, its purpose, and potential return conditions.

Key Elements to Include in the Receipt

- Tenant Information: Full name and contact details of the tenant.

- Landlord Information: Name and contact information of the landlord or property management.

- Amount of Deposit: Specify the exact sum being received as the deposit.

- Date of Payment: Date the deposit was paid by the tenant.

- Property Address: Clear identification of the rental property.

- Deposit Terms: Conditions under which the deposit will be refunded, including any potential deductions for damages or unpaid rent.

- Signature: Both parties should sign to acknowledge receipt and agreement to the terms.

Why It Matters

Providing a detailed receipt for the rental deposit helps avoid future disputes and serves as a reference in case of any disagreements. Keep a copy for your records, as it may be required for future financial transactions or when moving out.

A deposit receipt serves as proof of a financial transaction between a tenant and a landlord. It confirms that the tenant has provided a deposit to secure a rental property. The document should clearly outline the deposit amount, the date it was paid, and the purpose of the deposit. This transparency protects both parties in case of disputes regarding the rental agreement or property condition at the end of the tenancy.

Key Information Included in a Deposit Receipt

- Tenant’s name and contact details

- Landlord’s name and contact details

- Amount of deposit paid

- Property address

- Payment date

- Conditions under which the deposit may be refunded or withheld

Why a Deposit Receipt is Important

- It provides legal evidence of the deposit transaction, which may be needed for future reference or dispute resolution.

- It helps clarify the financial obligations of both parties and avoids misunderstandings about the deposit’s terms.

- It ensures the tenant has proof of payment if the landlord fails to return the deposit within the agreed timeframe.

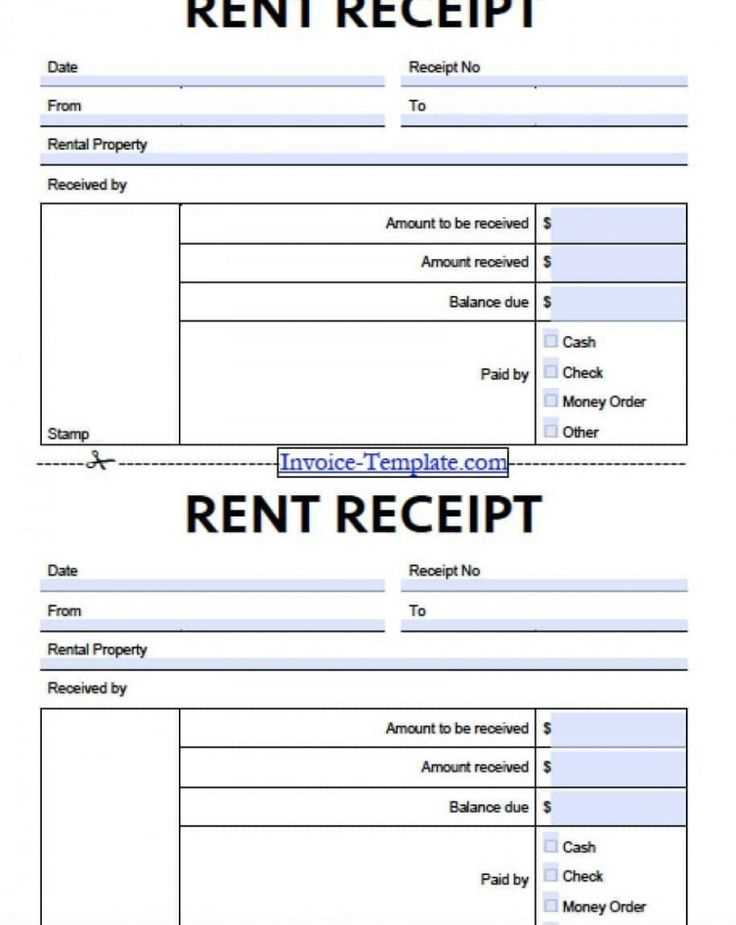

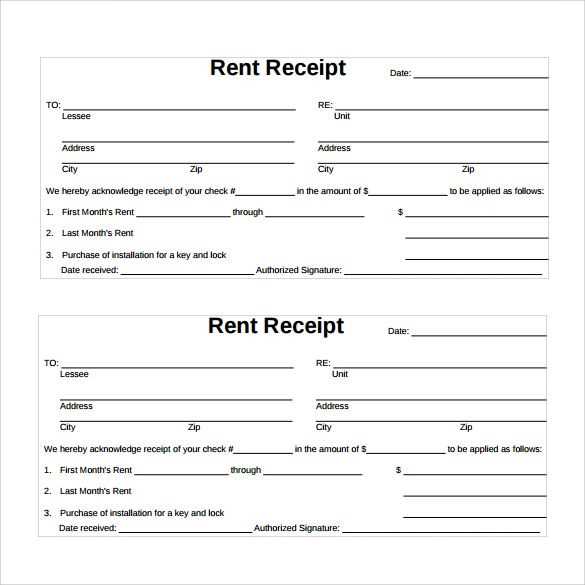

Include the full name and contact details of both the landlord and tenant. Clearly state the rental property address and the rental period covered by the deposit. Specify the exact amount of the deposit, including any applicable taxes. Record the payment method and date of payment to confirm the deposit has been received. Include a section explaining the conditions under which the deposit may be refunded or withheld, such as damage to the property or unpaid rent. Be sure to add a receipt number or other reference for tracking purposes. Finally, both parties should sign the receipt to acknowledge agreement on the terms outlined.

To create a clear deposit receipt, use a straightforward layout with key details easy to find. Start by listing the date of the transaction, the amount received, and the payer’s full name. Include the property address or specific rental details, and clearly label the receipt as a “Deposit Receipt” at the top.

Here’s how to structure it:

| Field | Details |

|---|---|

| Date | Enter the exact date the deposit was received |

| Amount | State the full amount of the deposit |

| Payer’s Name | Write the full name of the person making the deposit |

| Property Details | Provide the property address or relevant rental info |

| Signature | Leave space for the payer’s signature, if needed |

Use clear, legible fonts and avoid overcrowding the receipt with too many details. This will ensure all the key information is easy to reference later.

A rental deposit receipt must contain specific details to meet legal standards. It must include the tenant’s and landlord’s full names, rental property address, and the deposit amount. These details ensure both parties are clear on the terms of the deposit.

Key Information to Include

The receipt should specify the date the deposit was received and outline the conditions for its return. Any deductions, such as for property damage, should be mentioned to avoid future disputes.

Compliance with Local Laws

Different regions may have specific legal requirements for deposit receipts. Always verify the requirements in your jurisdiction to ensure full compliance and prevent future legal complications.

Ensure the rental deposit receipt includes the correct tenant and landlord names, the exact amount received, and the date of the transaction. Any missing information can lead to confusion or disputes later on.

- Don’t skip listing the reason for the deposit. Clearly state whether it’s for damages, key replacements, or another purpose.

- Avoid vague descriptions. Specify whether the deposit is refundable or non-refundable, and under what circumstances it can be withheld.

- Never omit the method of payment. Always include if the deposit was paid in cash, via bank transfer, or another method.

- Check that the receipt is signed by both parties. A signed receipt protects both the tenant and landlord in case of disagreements.

Confirm that all the details are accurate and complete. Missing or incorrect information can lead to misunderstandings and complicate the return of the deposit at the end of the rental period.

Store your deposit receipts in a secure, easily accessible location. Use encrypted digital storage or a dedicated, locked physical file. Cloud storage services with strong encryption are a reliable option. Avoid storing receipts on unsecured devices or public servers.

To share receipts, use secure methods like password-protected files or secure email services. Avoid sending receipts via unsecured email or messaging platforms. If physical copies need to be shared, consider using tracked and insured mail services.

Here’s a simple breakdown for storing and sharing receipts:

| Method | Security Level | Recommended Use |

|---|---|---|

| Encrypted Cloud Storage | High | Digital receipts, easy access, remote sharing |

| Secure Email | High | Sharing with trusted parties |

| Locked Physical Storage | Medium | Physical copies, less accessible but safe |

| Tracked Mail Services | Medium | Sharing physical copies securely |

Always keep a backup of your receipts, either digitally or physically, in case of loss or damage. For digital receipts, ensure regular updates and backups to protect against data loss.

Receipt of Rental Deposit

When drafting a rental deposit receipt, include the date of transaction, the full amount received, and the property address. Ensure both parties (tenant and landlord) sign the document for validation.

Details to Include

Write the tenant’s full name and the landlord’s business name or individual details. Specify the purpose of the deposit and any conditions related to its return, such as deductions for damages or unpaid rent. If applicable, outline the timeline for returning the deposit after the tenant vacates the property.

Recordkeeping

Keep a copy of the signed receipt for your records. Ensure both the landlord and tenant acknowledge the amount and terms in writing. This provides clear documentation for both parties in case of disputes later.