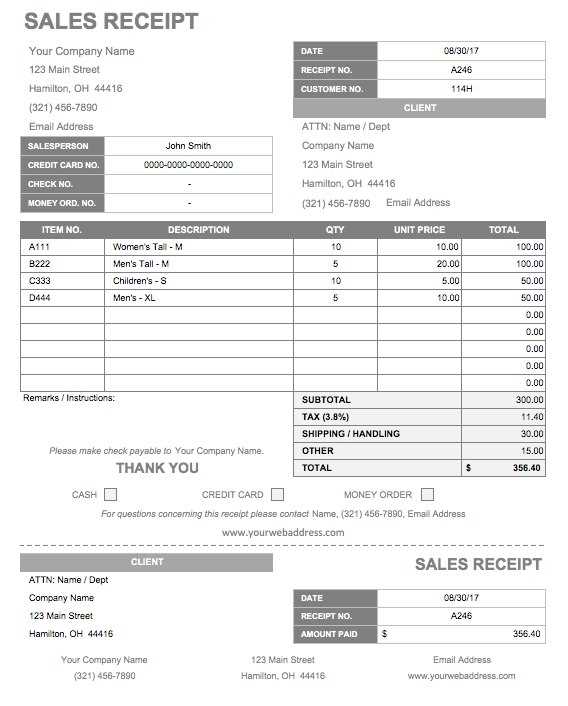

Use a written sales receipt template to ensure clear documentation of transactions. Include all necessary details, such as the buyer’s name, the date of purchase, and a description of the item or service sold. This will make it easy to track sales and provide proof of purchase if needed.

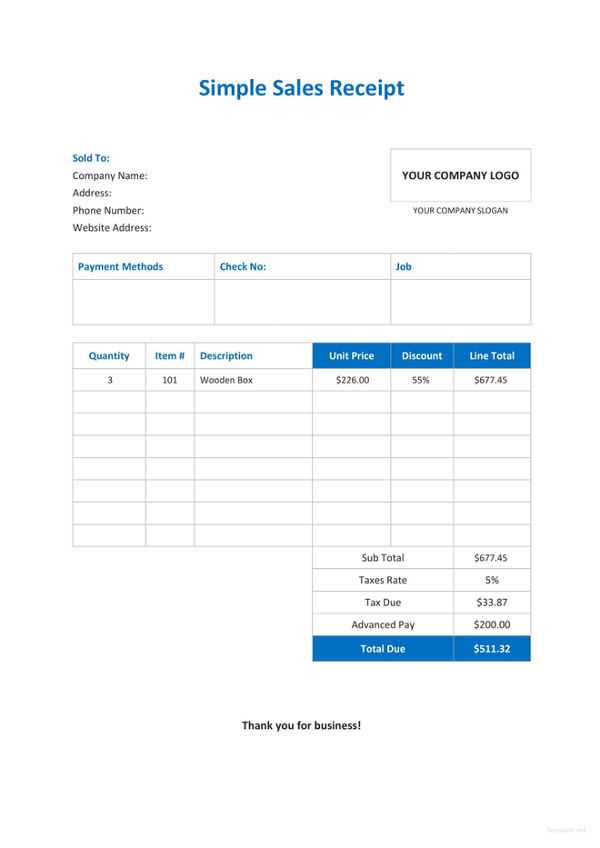

Be sure to include the price, taxes, and any discounts applied. A simple breakdown helps both the buyer and the seller understand the final amount paid. Adding terms of sale or return policies may also be useful for future reference.

For a professional touch, incorporate your business name, logo, and contact information. This not only reinforces brand identity but also assures customers that the transaction is legitimate and secure.

Here is the revised version of your lines:

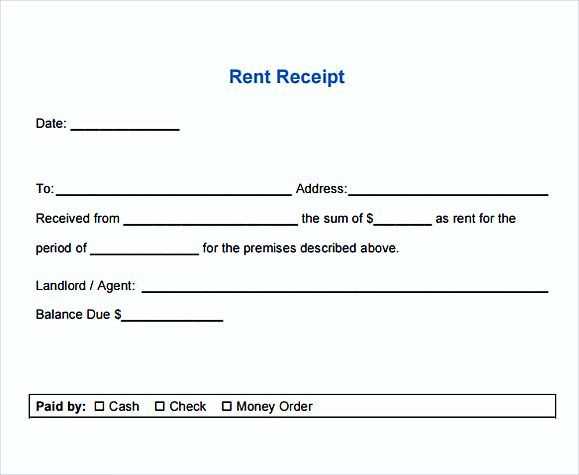

Adjust the format of your sales receipt to include the transaction date, item description, quantity, unit price, total price, and payment method. This will ensure the buyer has all necessary information. Provide clear, concise item descriptions to avoid confusion. If applicable, include taxes separately to clarify the total cost. Make sure to indicate the seller’s contact information and business details for future reference. Keep the font legible and professional to enhance the receipt’s readability. Ensure all calculations are correct and visible to the customer.

- Detailed Guide for a Sales Receipt Template

A well-designed sales receipt template includes specific details to ensure clarity and accuracy for both the seller and buyer. Start with a clear header that identifies the document as a sales receipt.

Key Elements of a Sales Receipt Template

- Seller Information: Include the business name, address, phone number, and email. This helps in identifying the seller quickly.

- Receipt Number: Each receipt should have a unique identifier to prevent confusion with other transactions.

- Date of Transaction: Indicate the exact date and time of purchase to provide a reference point for both parties.

- Itemized List of Goods or Services: List each item sold, including quantity, price per unit, and total amount. This ensures both clarity and transparency in the sale.

- Payment Method: Note how the buyer paid (e.g., cash, credit card, bank transfer), to avoid confusion in case of returns or disputes.

- Total Amount: Clearly display the total amount due, including any applicable taxes or discounts.

Design Tips for Clarity

- Use a Clean Layout: Keep the receipt template easy to read with well-organized sections. Avoid clutter and ensure proper spacing between elements.

- Include a Footer: In the footer, add return policies, terms, or other helpful notes. This can serve as a reminder to the buyer.

Keep the sales receipt template simple, yet complete, ensuring all essential details are covered. This helps maintain smooth transactions and builds trust with your customers.

Begin with a clear header that includes your business name and contact details, such as address and phone number. This helps customers easily identify the transaction source. A simple design with a clean font ensures that the receipt is easy to read.

Receipt Details

Include the date and time of the transaction. This makes it easier to track purchases and provides context for any future inquiries. If applicable, provide a receipt number for reference. This can be particularly useful for returns or exchanges.

Itemized List

List all purchased items with a brief description, quantity, and price. If relevant, add tax and total amounts at the bottom for transparency. A subtotal before tax helps customers understand the breakdown of their payment.

Finally, include a thank you note or a reminder of your return policy at the end of the receipt. This helps improve customer satisfaction and clarifies the next steps if necessary.

Make sure your sales receipt includes clear and precise details to avoid misunderstandings. Here’s a list of key information to include:

- Business Details: Always include your business name, address, and contact details. This allows customers to reach you easily if they have any issues.

- Transaction Date: Clearly state the date of the transaction for accurate record-keeping and reference.

- Itemized List of Purchases: Include each item purchased, the quantity, price per unit, and the total cost. This helps customers verify their purchase.

- Sales Tax: Specify the applicable tax rate and total tax amount separately to show transparency.

- Payment Method: Indicate whether the payment was made by cash, credit card, or other methods. This can help resolve disputes over payment later.

- Receipt Number: Add a unique receipt number for tracking purposes. This number simplifies returns and exchanges.

- Return Policy: Briefly mention your return policy if applicable, especially if there are any specific conditions or time frames for returns.

By providing all this information, you make the receipt not only a proof of purchase but also a helpful reference for your customer in case of future queries or issues.

Arrange the receipt with a clear structure. Begin with the transaction date and unique receipt number at the top. This ensures quick identification for both the buyer and seller.

Organize the items or services listed in a neat column format. Use separate lines for each item, showing the description, quantity, unit price, and total. This approach makes it easier to check the details at a glance.

Group related charges together, such as taxes or discounts, under their respective headings. Clearly distinguish these from the main product list to avoid confusion.

Highlight totals by making them bold or placing them at the bottom of the receipt. This directs attention to the final amount and enhances readability.

Use simple, legible fonts and ensure the spacing between sections is sufficient. A clean layout prevents the receipt from looking cluttered, helping the buyer quickly review the information.

Include contact information and business details at the bottom, ensuring they are easily accessible for any future queries.

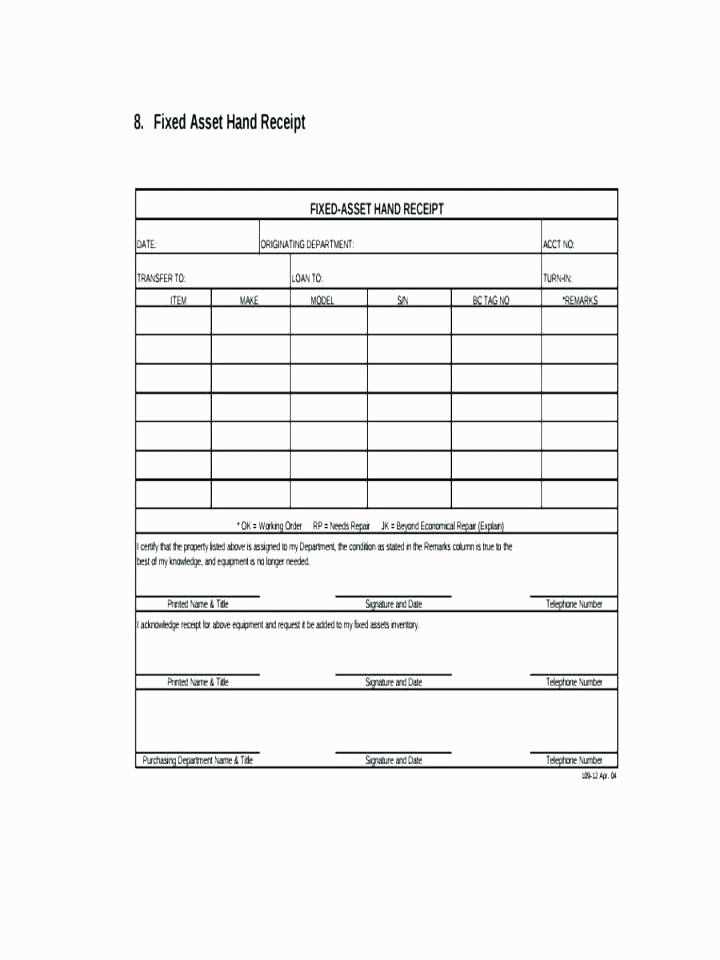

Adjusting a sales receipt template to fit specific industry requirements involves adding relevant fields and formatting. For example, retail businesses might require a detailed list of items purchased, along with their quantities and prices. Adding tax breakdowns and discount sections is often necessary. On the other hand, service-based industries should include sections for labor charges, hourly rates, and service descriptions.

Retail Industry Adjustments

In retail, include item descriptions, SKU numbers, and barcodes. Clearly display itemized prices along with any applicable taxes. Incorporating discount codes or promotions as a separate line item can help track sales more efficiently. Use a layout that makes it easy for customers to quickly review the total cost of their purchase.

Service Industry Adjustments

For service industries, ensure there’s enough space to detail labor hours, rates, and any additional charges. Adding a “description of services” section helps clarify what the customer is paying for. If applicable, break down materials or products used during the service to enhance transparency.

To save your receipt template, click “File” and select “Save As” to choose a location on your computer. Choose a file format, such as PDF or Word, to maintain the template’s layout and ensure it’s accessible on multiple devices. If you plan to reuse the template, save it in a designated folder for easy access later.

Sharing the template is straightforward. Use email to send the file to others or upload it to cloud storage services like Google Drive or Dropbox for instant sharing. You can also generate a shareable link for convenience. Make sure the recipients have the necessary software to open and edit the file, or provide instructions on how to use the template effectively.

Ensure that your receipt includes all required details to meet legal and tax obligations. Start with accurate seller and buyer information, including names and addresses. Clearly specify the transaction date, item or service purchased, and the agreed-upon price. This ensures transparency and supports tax reporting processes.

If you’re issuing receipts for business transactions, include your tax identification number (TIN) or VAT number, as applicable. This is necessary for businesses to comply with tax laws and helps with tax filing or audits. Including the tax rate and amount is also important for transparency and tax reporting.

Keep records of all receipts for the required duration as dictated by local laws. Depending on your location, retaining receipts for anywhere from 3 to 7 years is common. This is essential for tax returns or any potential legal disputes, ensuring that you can prove the legitimacy of your transactions if needed.

Use clear and concise formatting in your written sales receipt template. Make sure the necessary information is easily readable and accessible to the customer. Include the following details:

| Item | Description | Price |

|---|---|---|

| Product Name | Short description of the product or service | Price |

| Taxes | Applicable taxes (e.g., sales tax) | Amount |

| Total | Total price including taxes | Total Amount |

For accurate record-keeping, it’s crucial to include the date of the transaction and the unique receipt number. This will help both the business and the customer in case of returns or exchanges.

Lastly, ensure that contact details and refund policies are clearly stated. This shows professionalism and creates trust between your business and customers.