When creating a taxi credit card receipt, ensure that the template is clear and easy to understand for both customers and business owners. Include all relevant details, such as the date, time, fare amount, tax, and payment method. Make sure to display the name and contact information of the taxi service, along with a unique transaction number for reference.

Include the following key elements:

- Taxi Service Information: Name, address, phone number, and website.

- Passenger Details: If applicable, include the name of the passenger or a unique identifier.

- Journey Details: Pickup and drop-off locations, distance traveled, and time of the ride.

- Payment Details: Amount paid, payment method (credit card), and the last four digits of the card number for reference.

- Tax Information: Breakdown of applicable taxes and tips.

Ensure the format is consistent across all receipts for professionalism and transparency. Using a simple template with clear sections makes it easier to track expenses and prevent confusion during audits or disputes.

Here’s a refined version with minimal repetition:

Use a clear layout with key details, such as the date, time, pick-up location, drop-off destination, fare, and payment method. Include the total amount and a breakdown of the charges. This ensures transparency for both the driver and the passenger.

Design Tips for Clarity

Avoid clutter by limiting the text to necessary information only. Use distinct sections for each type of information, such as one for fare details and another for payment method. This makes the receipt easy to follow and reduces confusion.

Accurate Payment Information

Always include the last four digits of the credit card used and the payment method, whether it’s a credit card, mobile payment, or cash. This provides proof of the transaction and avoids misunderstandings.

- Steps to Create a Credit Card Payment Receipt for Taxi Rides

Follow these steps to create an accurate and clear credit card receipt for taxi services:

- 1. Gather Required Information: Ensure the receipt includes the passenger’s name, the date of the ride, the total fare, and the amount charged to the credit card.

- 2. Include Taxi Details: List the taxi company name, contact information, and the driver’s name or ID number.

- 3. Show Payment Method: Clearly mention the payment method used (credit card), and include the last four digits of the card number for reference.

- 4. Add Transaction Details: Include the transaction date and time, authorization code, and any applicable taxes or fees.

- 5. Issue Receipt Number: Assign a unique receipt number to each transaction for easy tracking and reference.

- 6. Print or Send: Provide the receipt in either paper form or electronically via email, depending on customer preference.

Inaccurate Dates: Always double-check the date on the receipt. Incorrect dates can lead to confusion or disputes regarding payment. Ensure that the date is current and corresponds to the time of the ride.

Missing Tax Information: Make sure the receipt includes the correct tax details, such as tax rate or total tax amount. Failing to include this information can make the receipt incomplete and unprofessional.

Unclear Fare Breakdown: Provide a clear itemization of the fare, including base fare, distance charge, time charge, and any additional fees. Avoid vague descriptions like “Total fare” without breaking down the individual costs.

Incorrect Payment Method: Always verify the payment method on the receipt. Whether it’s a credit card or cash, ensure that the payment type matches the transaction. An error here can lead to unnecessary confusion.

Legibility Issues: Make sure the text on the receipt is easy to read. Avoid small font sizes or poor formatting that could make important details hard to see. Legible receipts help prevent miscommunication.

Omitting Contact Information: Include your contact details on the receipt. This ensures that customers can reach out in case they have questions or need further clarification about their fare.

To ensure compliance with local tax regulations, begin by keeping thorough records of every transaction. Each taxi fare should be documented with clear details including the amount, date, time, and location of service. This is crucial for accurate reporting to tax authorities.

Incorporate the appropriate tax rates on all credit card receipts. Make sure the tax rate reflects the specific requirements of the locality where the service was provided. Regularly review local tax guidelines to stay updated on any changes.

Use a reliable software system that generates receipts automatically, with fields for tax information. This reduces the risk of errors and helps maintain consistency across receipts. Ensure the software is regularly updated to reflect local tax laws.

Consult with a tax professional to verify that your record-keeping methods and receipt formats comply with local tax rules. They can also assist in identifying any tax benefits you might be entitled to and help streamline your reporting process.

Finally, keep receipts and transaction records organized and accessible for audits. Store electronic copies securely, and back up all records to avoid potential issues with tax authorities.

For efficient credit card receipt generation in taxi services, Taxi Receipt Generator is a leading software. It allows easy customization of receipts, integrating payment information directly from credit card terminals. With seamless integration to various payment platforms, it ensures accurate billing details and hassle-free management.

QuickBooks Online is another solid option, offering built-in templates for taxi services. It syncs with credit card systems and allows for detailed receipt customization. This software helps automate the process, ensuring receipts are always compliant with financial regulations.

Receipt Boss simplifies credit card receipt creation by offering mobile apps for both drivers and companies. It’s designed for small businesses, providing real-time receipt generation. This software also tracks payment history, making it easy to manage customer data.

Square for Taxi integrates directly with the Square POS system, enabling taxi services to generate receipts that include card details, fare information, and tips. This solution is ideal for drivers looking for a seamless tool without additional hardware needs.

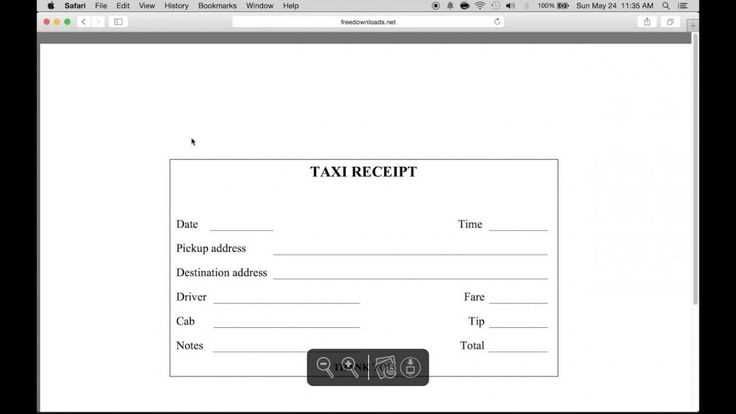

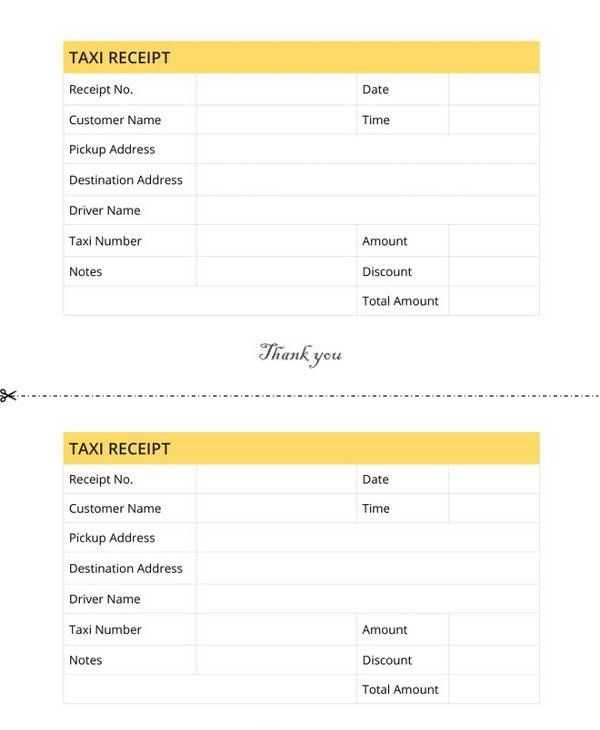

When creating a taxi credit card receipt template, ensure it includes key details that clearly identify the transaction. A clear structure helps avoid confusion and meets customer expectations. Include the following elements:

- Taxi service provider: Name, address, and contact information of the taxi company.

- Date and time: Specify the exact time and date of the ride to document the transaction.

- Trip details: Start and end locations, distance traveled, and duration of the ride.

- Amount charged: Show the total amount with a breakdown, including fare, taxes, and any extra charges.

- Payment method: Indicate the use of a credit card, along with the last four digits of the card number for reference.

- Transaction ID: Provide a unique transaction identifier for tracking purposes.

- Taxi driver information: Include the driver’s name or identification number for clarity.

Formatting Tips

Keep the layout clean and organized. Use tables or bullet points for clarity. Ensure font sizes are legible and all information is aligned properly to prevent misinterpretation.

Additional Recommendations

Incorporate a footer with company policies or terms of service. It’s helpful to include a note for customers to report any discrepancies with their ride or charges.