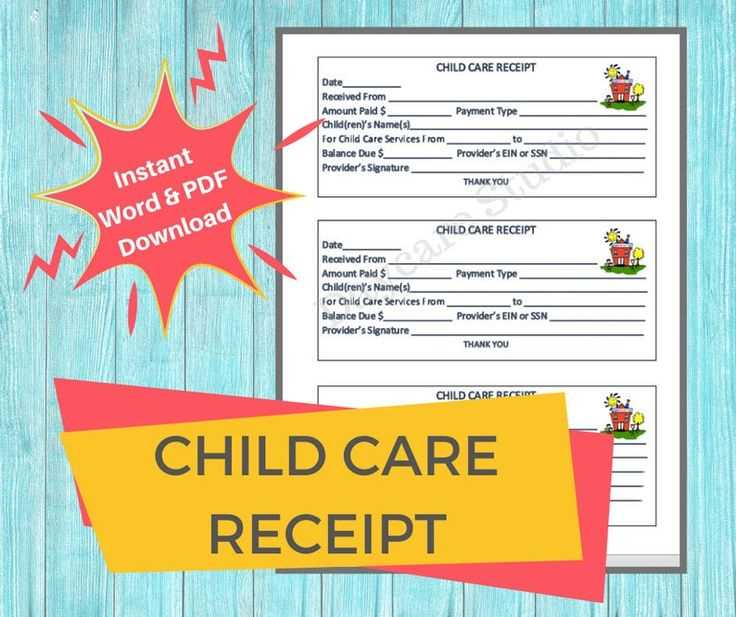

Clear Structure for Daycare Receipts

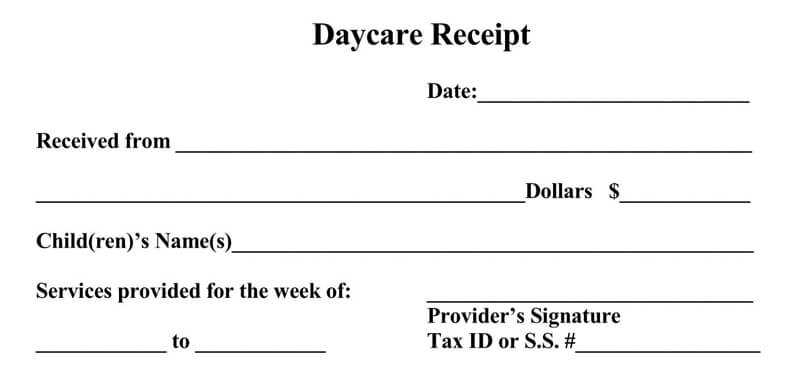

When creating daycare receipts, clarity and accuracy are key. A well-organized template ensures both the provider and the parent have all necessary information for records and tax purposes. The following details should be included in the receipt template:

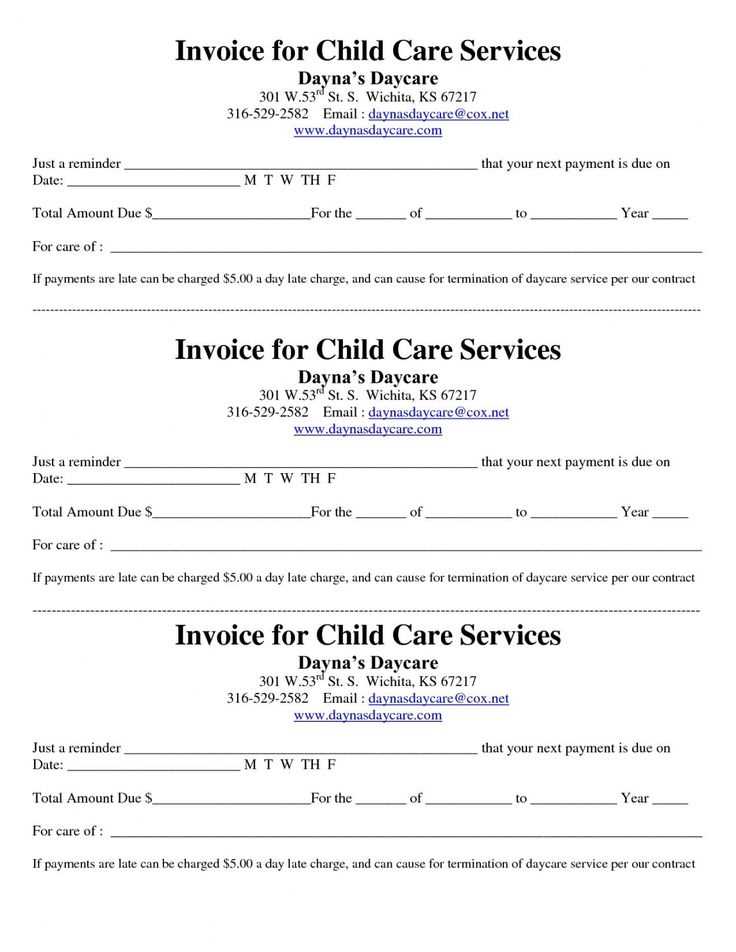

- Provider Information: Name, address, and contact details of the daycare provider.

- Parent Information: The name of the parent or guardian receiving the daycare services.

- Service Details: Description of the services provided, including dates and hours of care.

- Total Amount Paid: The total payment made for the service rendered.

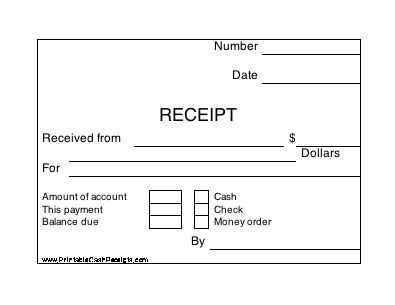

- Payment Method: Specify whether the payment was made by check, cash, or card.

- Receipt Date: The date the receipt is issued to the parent.

Why a Template is Necessary

A template simplifies the process of generating receipts, making it easier to stay organized. It reduces the risk of missing important information and ensures consistency across all receipts. A well-structured template can be reused for multiple transactions, saving time and effort. Moreover, using a template can help both parties avoid confusion and streamline accounting processes, especially during tax season. Here is a simple layout for a daycare receipt template:

Daycare Provider Receipt -------------------------------- Provider Name: [Insert Name] Provider Address: [Insert Address] Provider Contact: [Insert Phone/Email] Parent Name: [Insert Parent's Name] Service Date(s): [Insert Date Range] Hours of Care: [Insert Hours] Total Paid: $[Amount] Payment Method: [Check/Cash/Card] Receipt Date: [Insert Date] Thank you for your payment!

Customization Tips

Adjust the template based on your specific needs. For example, if you offer multiple services (e.g., after-school care, weekend care), break down the charges separately. You can also add a space for discounts or late fees if necessary. If the daycare service offers tax-deductible care, remember to include the appropriate tax ID number on the receipt for the parent’s tax filing.

Using the Template for Record-Keeping

It’s advisable for both daycare providers and parents to keep a copy of each receipt for their records. Digital receipts can be stored in a secure folder, while physical receipts should be organized in a file or binder. These records are useful not only for personal tracking but also for any potential audits or tax filings.

Daycare Receipts Template Guide

How to Create a Simple Receipt Template for Daycare

Key Information to Include on Your Receipt

Customizing Your Template for Various Payment Methods

How to Organize Receipts for Tax Purposes

Ensuring Legal Compliance in Childcare Receipts

Tools for Designing and Managing Receipt Templates

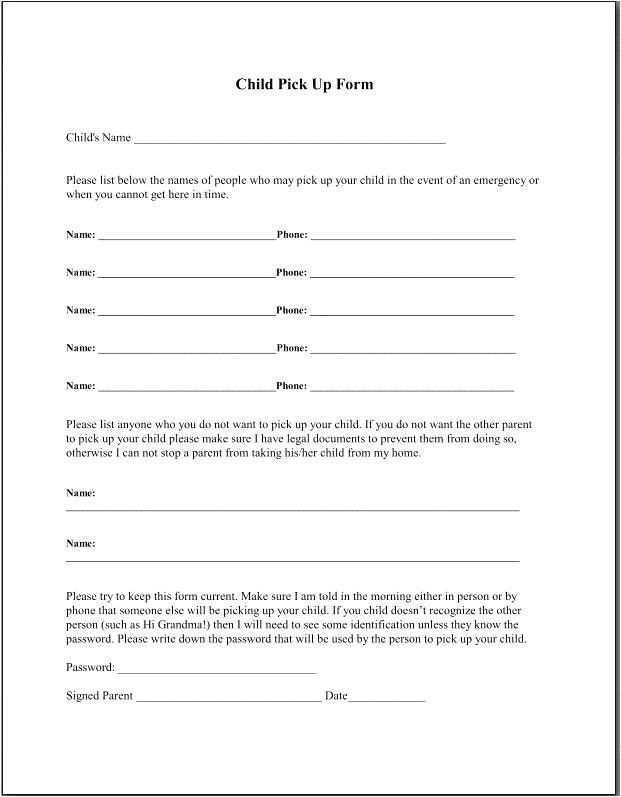

Creating a simple receipt template for daycare services starts with gathering key details. Include the date of service, the child’s name, and the amount paid. Make sure to list the services provided, such as hourly rates or flat fees, and include the total amount due or paid. For transparency, include both the provider’s and the payer’s information.

Key Information to Include on Your Receipt

Each receipt should clearly display the following details:

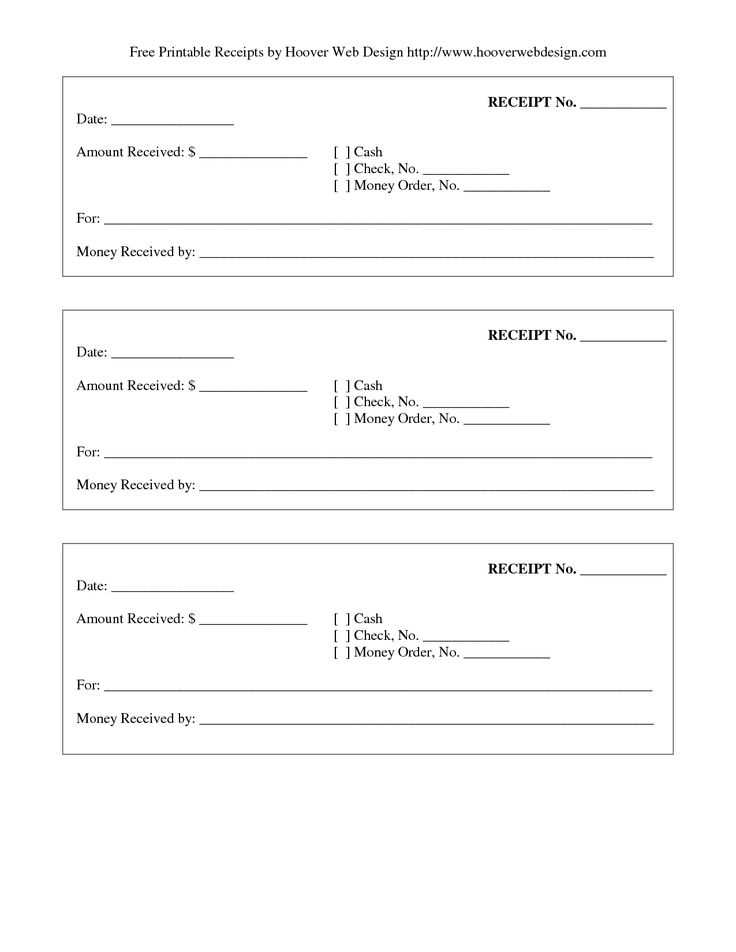

- Receipt Number – Assign a unique number for easy tracking.

- Date – Ensure the date is accurate for both the service and payment.

- Child’s Name – Identify the child receiving the service.

- Service Description – Specify whether it’s a full day, part-time, or special service.

- Payment Method – Include cash, check, or credit card details.

- Total Amount – Clearly show the amount paid or due.

- Provider’s Contact Information – Include the daycare’s name, address, phone number, and email.

Customizing Your Template for Various Payment Methods

Adapt your template to suit different payment methods. For cash payments, note the exact amount received and any change given. For checks, include the check number. When processing credit card payments, list the transaction ID or approval code for record-keeping.

Make sure your receipt template remains adaptable for any payment method. This flexibility ensures that every transaction is clearly documented, regardless of how it’s paid.

How to Organize Receipts for Tax Purposes

Organize receipts by month or quarter for easy access when preparing taxes. Keep copies of all receipts in a secure file or accounting software. This organization helps ensure all deductible expenses are accounted for and simplifies your bookkeeping process.

Ensuring Legal Compliance in Childcare Receipts

Check local regulations to ensure your receipts comply with legal standards. Many regions require childcare providers to include specific tax information or maintain detailed records of payments for auditing purposes. Regularly review these requirements to stay compliant.

Tools for Designing and Managing Receipt Templates

Use tools like Microsoft Word, Google Docs, or specialized accounting software to design and manage your receipt templates. These tools allow you to customize templates with your branding and automate receipt generation. Some options even integrate payment systems to streamline the process.