Rent Deposit ReceiptAnswer in chat instead

Rent Deposit Receipt Template

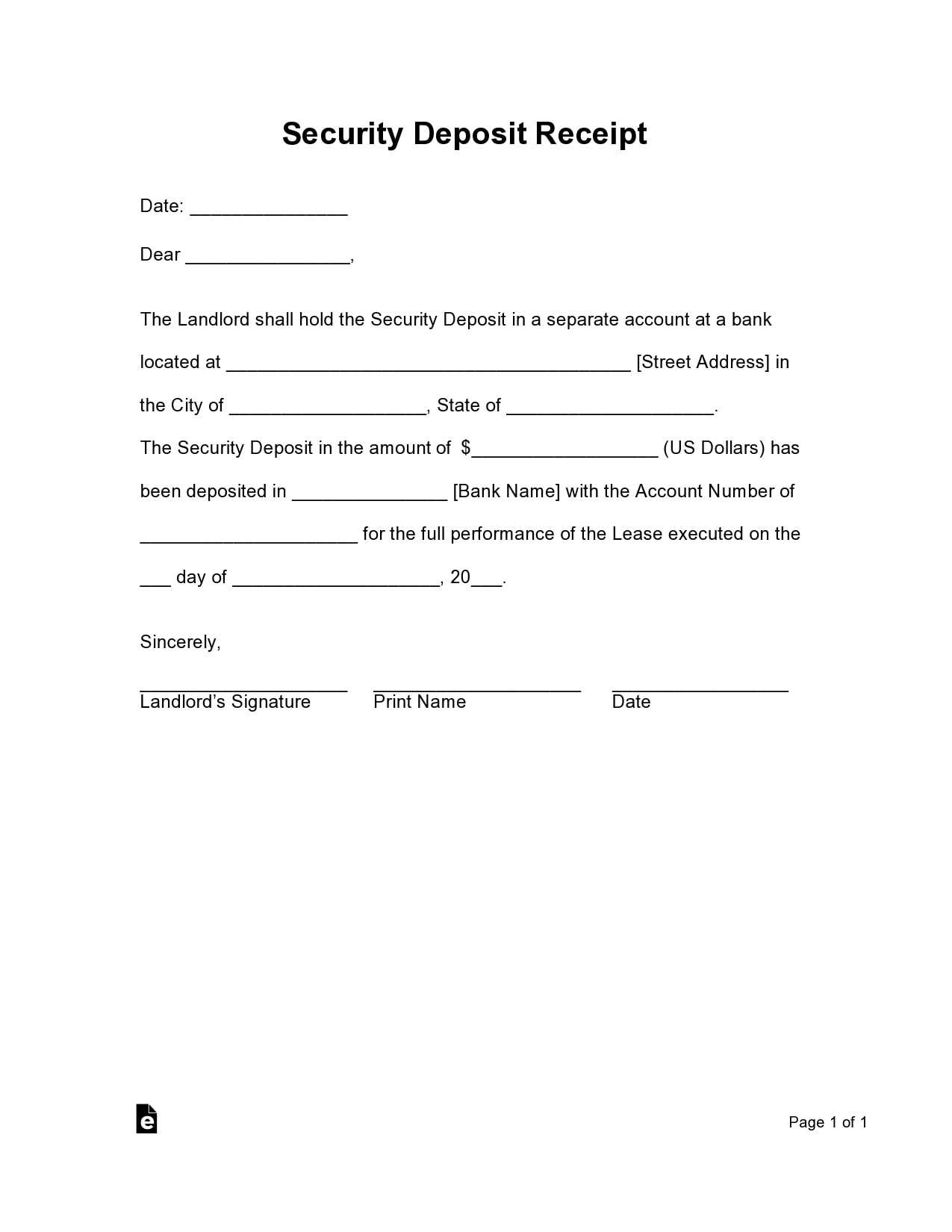

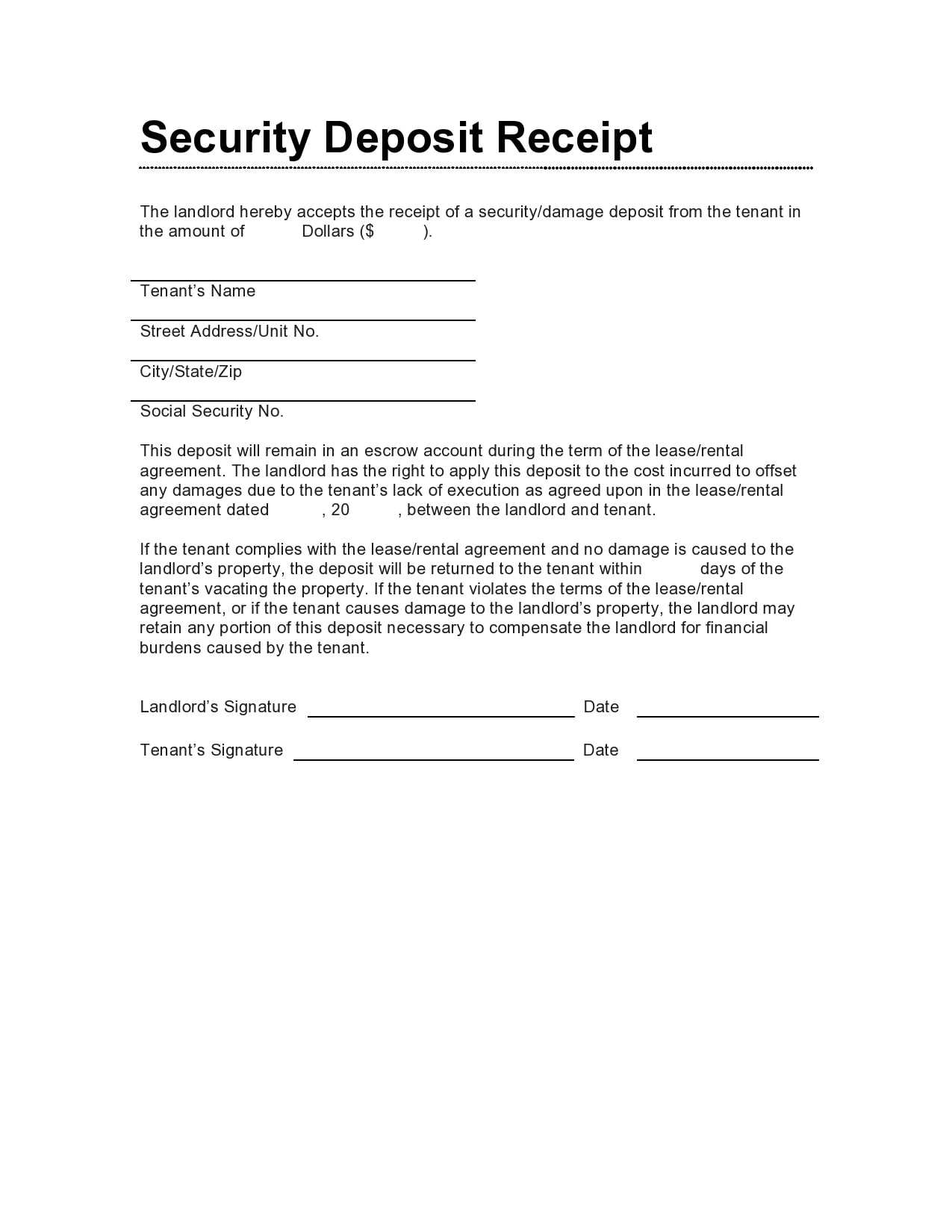

Key Legal Elements to Include in a Deposit Receipt

How to Format a Receipt for Clarity

Required Details for Tenant and Landlord Identification

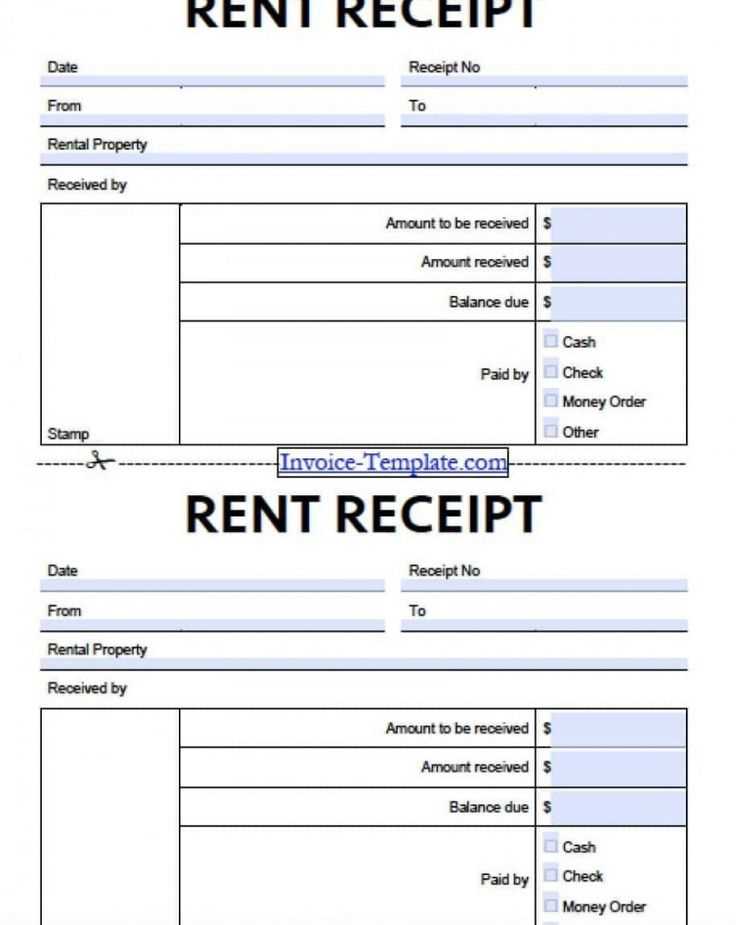

Handling Partial vs. Full Deposit Payments in Receipts

Digital vs. Paper Receipts: Pros and Cons

Common Mistakes to Avoid When Issuing a Deposit Receipt

Key Legal Elements to Include in a Deposit Receipt

Include the full names and contact details of both tenant and landlord. Specify the exact amount received, payment method, and date of transaction. Clearly state the purpose of the deposit and conditions for its return. Mention relevant legal references, such as state-specific landlord-tenant laws, if applicable.

How to Format a Receipt for Clarity

Use a structured layout with distinct sections for tenant details, landlord information, payment specifics, and terms. Keep fonts legible, highlight key figures in bold, and avoid clutter. Ensure all amounts are numerically and textually represented to prevent misinterpretation.

Required Details for Tenant and Landlord Identification

Include full legal names, phone numbers, and addresses. If available, add email contacts for digital communication. Landlords should provide business or management company details if acting through an agency.

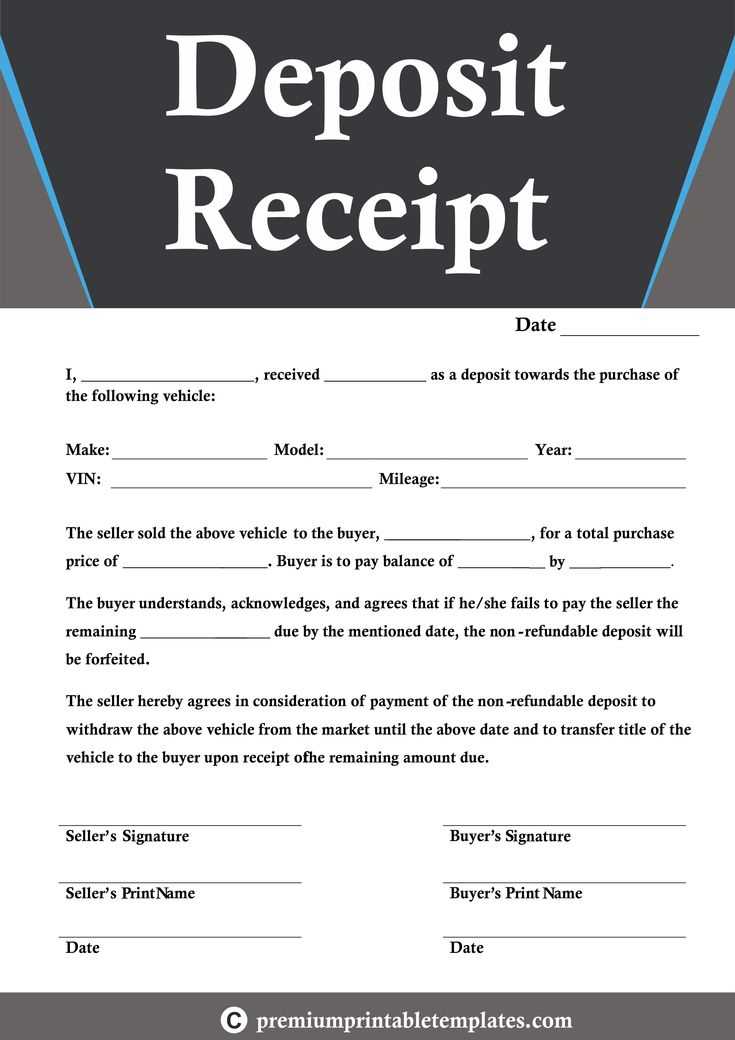

Handling Partial vs. Full Deposit Payments in Receipts

For partial payments, clearly state the amount received, the outstanding balance, and the due date for the remaining sum. Indicate whether future installments are subject to late fees or specific conditions. For full payments, confirm the total deposit amount and any applicable deductions in advance.

Digital vs. Paper Receipts: Pros and Cons

Digital receipts offer easy tracking, instant delivery, and automatic backups but may require secure storage for legal validity. Paper receipts provide a tangible record but risk being lost or damaged. Choose based on convenience and legal enforceability in your jurisdiction.

Common Mistakes to Avoid When Issuing a Deposit Receipt

Omitting signatures can invalidate a receipt. Vague descriptions of deposit terms may lead to disputes. Incorrect calculations or missing payment dates create confusion. Always review for accuracy and provide copies to all parties involved.