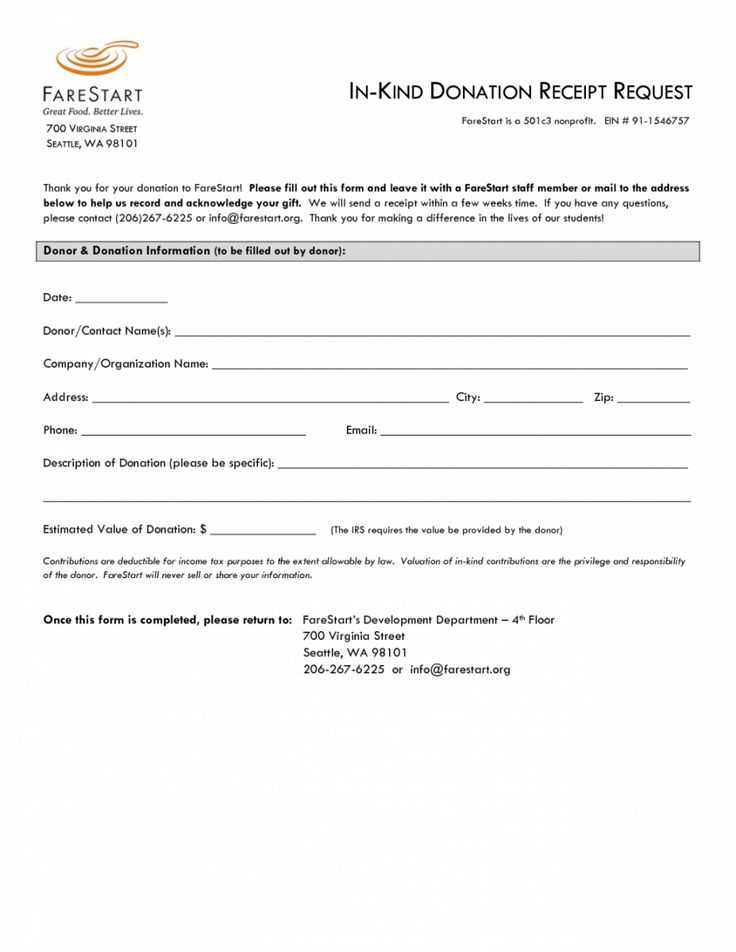

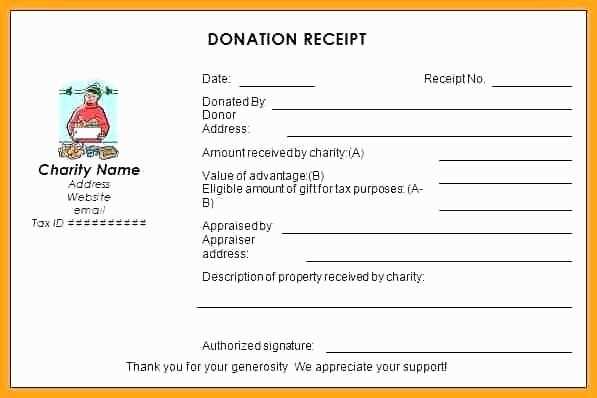

When issuing a donation receipt, it’s crucial to provide a clear and concise good faith estimate, especially for non-cash donations. A well-crafted estimate helps ensure transparency and supports both the donor and recipient with accurate information. This letter can act as both a receipt and an official acknowledgment, making it easier for donors to claim their charitable contributions on taxes.

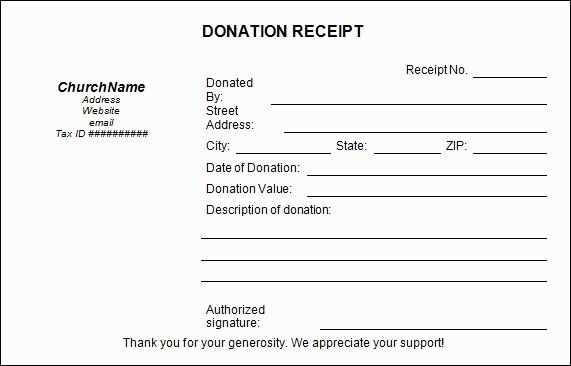

The template should begin with the donor’s name, address, and date of donation. Follow this with a brief description of the item(s) or services donated, and include an estimated value. The estimate should be based on fair market value at the time of donation. For example, if the donor provides a set of furniture, the estimate should reflect current prices for similar used items in good condition.

It’s important to clearly state that no goods or services were provided in exchange for the donation unless applicable. This helps maintain the integrity of the donation and assures the donor of their tax-deductible status. You may also want to include a statement specifying that the recipient organization is a qualified charitable organization under IRS regulations, confirming the donor’s eligibility for deductions.

Here is the improved version with word repetitions minimized while maintaining clarity and correctness:

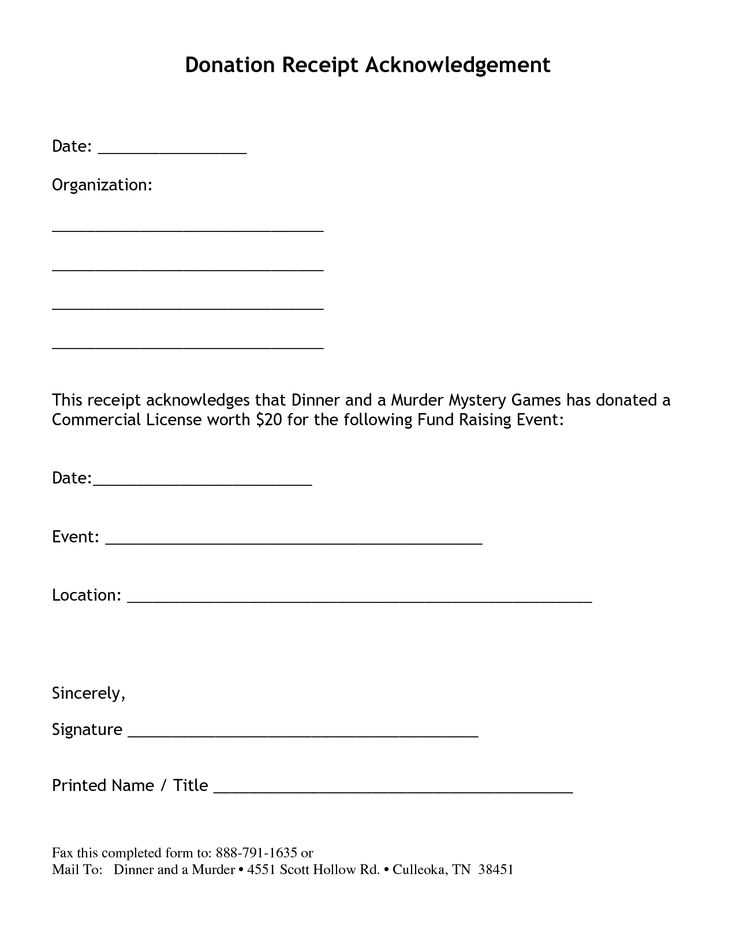

Begin by stating the organization’s full name, address, and the date the donation was received. Specify the donor’s name and address as well. It’s important to list the items or services donated and their estimated value based on current fair market value.

Be clear and precise in estimating the value of the donation. If the donation is non-cash, explain how the valuation was determined. Include a statement confirming that no goods or services were provided in exchange for the donation, if applicable. In cases where something was given, provide a description and value of those items or services.

Ensure the letter includes a clear declaration that the donor will be using this receipt for tax purposes. Add a space for both the organization’s authorized signature and the date. This step confirms the authenticity of the donation receipt.

Conclude by thanking the donor for their generosity and reiterating how their contribution benefits your cause.

- Donation Receipt and Good Faith Estimate Letter Template

Provide a clear breakdown of the donation and estimated value to ensure transparency. Include the donor’s name, address, and the date of the donation. Specify the type of donation (cash, goods, or services), and, if applicable, provide a description of the items or services donated. Mention the fair market value of the donation, or if uncertain, explain that the donor is responsible for determining the value.

For goods or services, include a statement that the organization did not provide goods or services in exchange for the donation, unless a specific, non-deductible portion is identified. If a benefit was provided (such as tickets to an event), the value of the benefit should be deducted from the total donation amount.

Ensure that the letter includes the organization’s name, address, and tax-exempt number (if applicable). Additionally, add a statement affirming that no goods or services were exchanged, or, if there were, provide the necessary details. Conclude with a thank-you note for the donor’s contribution.

Begin by clearly identifying your organization’s name and contact details. Include the donor’s full name, address, and the date the donation was received. This establishes transparency and helps both parties keep accurate records.

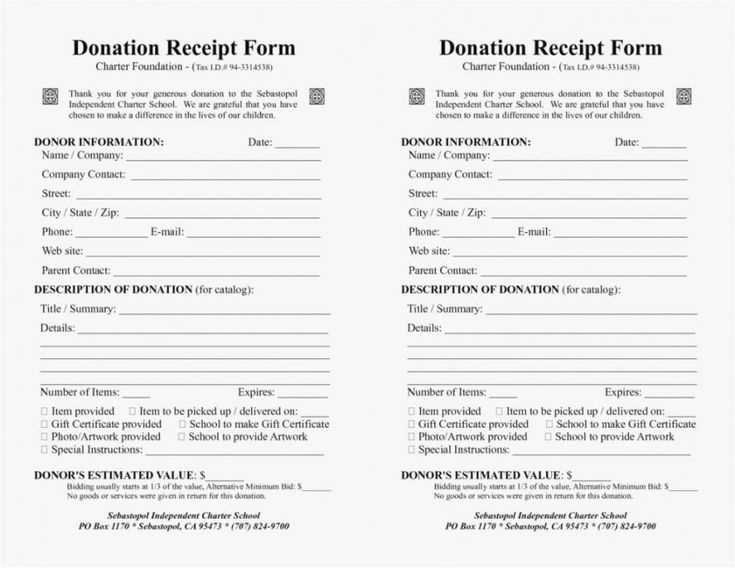

Donation Amount and Description

Specify the amount or a detailed description of the donation received, whether it is monetary or in-kind. For non-monetary contributions, describe the item or service, including its estimated value if possible. This helps to confirm the donor’s contribution and can be important for tax purposes.

Statement of No Goods or Services Provided

Include a clear statement regarding the value of goods or services provided, if applicable. If no goods or services were exchanged for the donation, explicitly state that the contribution was made in full, with no benefits received in return. This ensures compliance with IRS guidelines for charitable donations.

Conclude the acknowledgment by thanking the donor for their generosity and support. Offering a personal note of appreciation can strengthen the relationship and encourage future contributions.

Provide a clear description of the donated items, listing each one individually with its estimated value. Be as specific as possible, including the condition of the items (e.g., new, gently used) and any distinguishing features.

Indicate the method used to determine the value of each item. This could include market research, appraisals, or established guidelines for valuing similar donations.

Include the date of the donation. This helps ensure the estimate aligns with tax reporting periods and strengthens the document’s validity.

Clearly state that the estimate is provided in good faith. This confirms that the values are provided honestly and with careful consideration.

If applicable, mention any non-cash contributions, such as volunteer hours, and provide an estimated value for these contributions based on industry standards or comparable services.

Ensure your contribution estimate is accurate and aligns with the IRS requirements. Misleading or inflated valuations can result in penalties for both donors and the receiving organization. Follow these steps to comply with legal expectations:

- Document the fair market value: Always base the estimate on the fair market value of the donated items at the time of the contribution. This value should reflect what the items would sell for in a competitive market.

- Provide a detailed description: Include a clear, specific description of the items donated. Vague or generic descriptions may raise red flags in an audit.

- Avoid overstatements: Avoid inflating the value of donated goods. The IRS expects a reasonable estimate, not an exaggerated one. Donors should work with appraisers for high-value items, especially if the donation exceeds $5,000.

- Maintain proper records: Keep detailed records of the donation, including receipts, photographs, and any appraisals for significant items. This documentation will be crucial if the IRS audits the donation.

- Understand the non-cash contribution rules: The IRS has specific rules for non-cash donations. Ensure both donors and organizations are familiar with these regulations to avoid complications during tax filing.

When specifying the donor’s gift value, it is crucial to provide clear and accurate information. The donation’s value should be stated in a way that is both understandable and verifiable. This helps ensure compliance with tax regulations and promotes transparency between the donor and the recipient organization.

Valuation Methods

The value of the gift can be determined through a few standard methods. If the donation is in the form of cash, the value is simply the amount donated. For non-cash gifts, such as items, the donor can either assign a value based on their assessment or rely on an independent appraisal. For tangible goods, a detailed description and estimate of the fair market value at the time of donation should be included.

Non-Cash Gifts

Non-cash gifts require more detailed documentation. A good practice is to list each item or group of items individually, with the associated value for each. If the donor is unable to provide an appraisal, they should include a reasonable estimate based on current market values. The organization should also include a statement indicating that it is not responsible for assigning values to non-cash gifts.

| Gift Type | Method of Valuation | Documentation Required |

|---|---|---|

| Cash | Exact amount | Receipt with amount and date |

| Physical Goods | Fair Market Value (FMV) | Description, appraisal (if over a certain threshold) |

| Securities | Market Value on the date of donation | Stock transfer receipt or brokerage statement |

| Real Estate | Appraised value | Appraisal report, deed |

Always ensure that the valuation is precise and the necessary documentation is available for the donor to claim their tax deduction, if applicable. Avoid vague or inaccurate descriptions, as this could lead to confusion or complications later on.

Keep your estimate letter structured with clear sections. Start with a concise heading indicating the purpose of the letter, such as “Donation Estimate” or “Good Faith Estimate.” This sets expectations from the outset.

Include Clear Itemization

List all items or services being estimated with brief descriptions and corresponding values. Use bullet points or a table for easy readability. This approach avoids confusion and ensures transparency.

Highlight Key Details

Ensure key elements like donation value, applicable dates, and any disclaimers are clearly visible. Bold or italicize important sections to guide the reader’s attention. This prevents any vital information from being overlooked.

Use simple language to explain terms and conditions. Avoid jargon that could create ambiguity. By maintaining straightforward, easy-to-understand language, you improve the clarity of your message.

Use this template for creating a donation acknowledgment letter. It ensures the donor has the necessary details for their records while expressing appreciation:

Donation Acknowledgment Letter Template

- Donor’s Name: Dear [Donor’s Full Name],

- Donation Amount or Description: We are pleased to acknowledge your donation of [Amount or Description of Item] received on [Date].

- Tax-Deductible Status: No goods or services were provided in exchange for your gift. This donation is tax-deductible as permitted by law.

- Impact Statement: Your support helps [Specific Purpose or Program], furthering our mission to [Goal or Cause].

- Gratitude: Thank you for your generosity. Your contribution makes a meaningful difference.

- Contact Information: If you have any questions, feel free to contact us at [Phone Number or Email Address].

- Closing: Sincerely,

[Your Name]

[Your Title]

This letter serves as a clear and concise record of the donation, allowing both you and the donor to maintain accurate tax records and communication.

Provide a clear and accurate breakdown of the donation amount and value in the letter. List the donated items and their fair market value. Ensure the donor knows that the letter serves as a good faith estimate rather than an official tax receipt.

| Item Description | Fair Market Value |

|---|---|

| Clothing | $50 |

| Furniture | $150 |

| Electronics | $200 |

It’s important to include a statement clarifying that the organization has not appraised the value and the donor should keep detailed records for tax purposes. Remind the donor to seek professional advice if needed for accurate valuation.

Ensure that the letter is signed and dated by an authorized representative of the organization to validate the estimate. Include the organization’s contact information for follow-up inquiries.