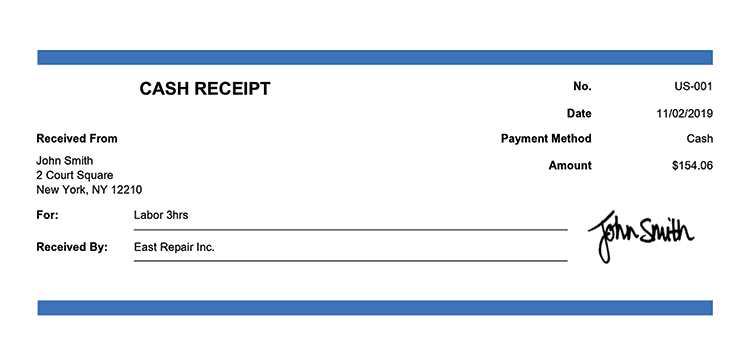

Key Elements of a Receipt

A well-structured receipt ensures clarity for both parties. Include the following details:

- Receipt Number: Assign a unique identifier for tracking.

- Date: Specify when the transaction took place.

- Payer’s Name: Identify who provided the funds.

- Amount Received: Indicate the exact sum and currency.

- Payment Method: Mention cash, check, transfer, or other means.

- Purpose: Briefly describe why the payment was made.

- Issuer’s Name and Contact: Provide information for verification.

- Signature: Authenticate the receipt with a signature or digital confirmation.

Sample Template

Use this structure for a clear and professional receipt:

Receipt Date: [DD/MM/YYYY] Receipt No.: [Unique Number] Received From: [Payer's Name] Amount: [Currency] [Amount] Payment Method: [Cash/Check/Bank Transfer] Purpose: [Brief Description] Issuer: [Name] Contact: [Phone/Email] Signature: ___________

Additional Notes

Ensure all information is accurate before issuing. If sent electronically, a digital signature or stamp can enhance authenticity.

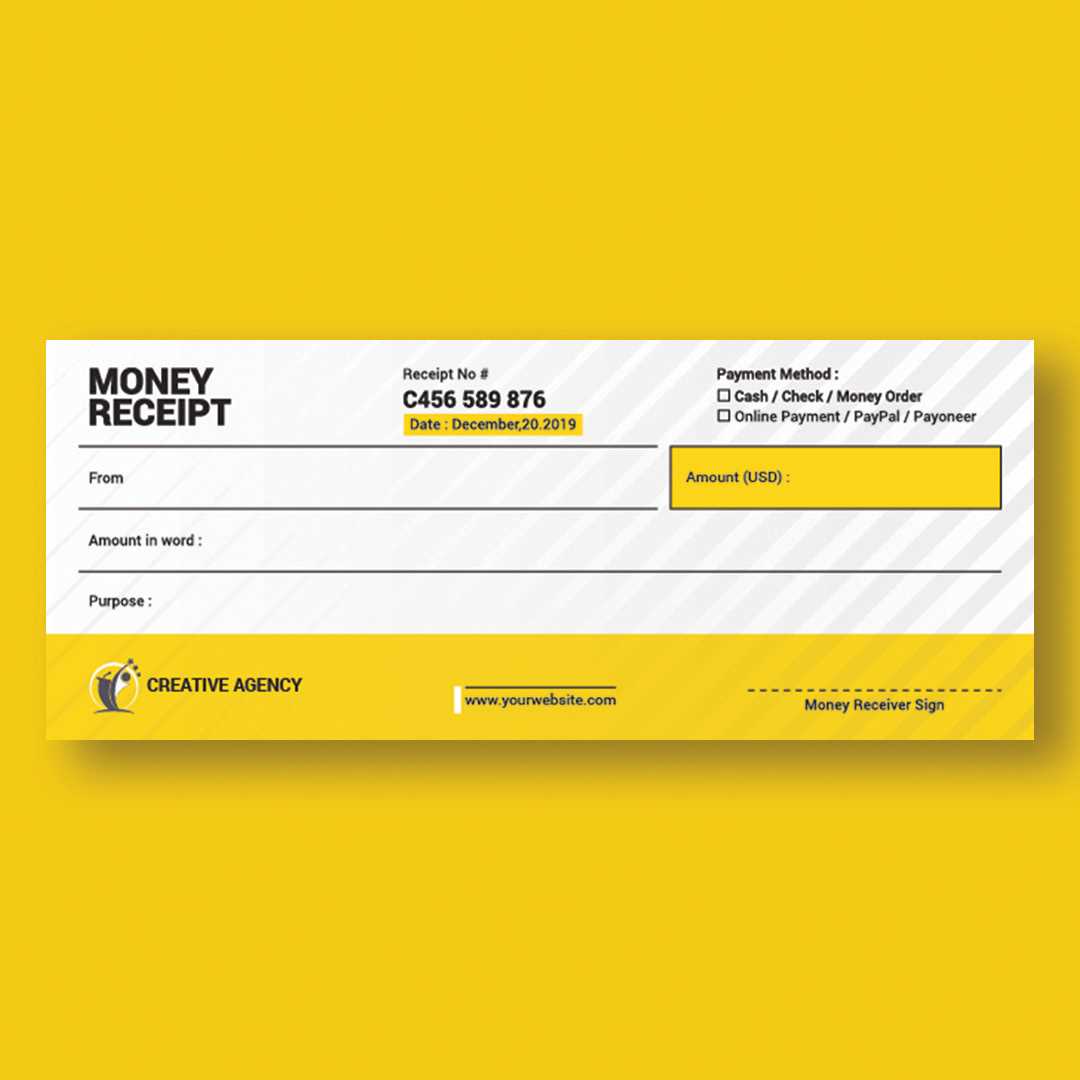

Money Received Receipt Template

Key Elements to Include in a Payment Confirmation

Legal Considerations When Issuing a Transaction Proof

Best File Formats for Creating and Storing Records

Customizing a Template for Different Transactions

How to Ensure Document Authenticity and Avoid Disputes

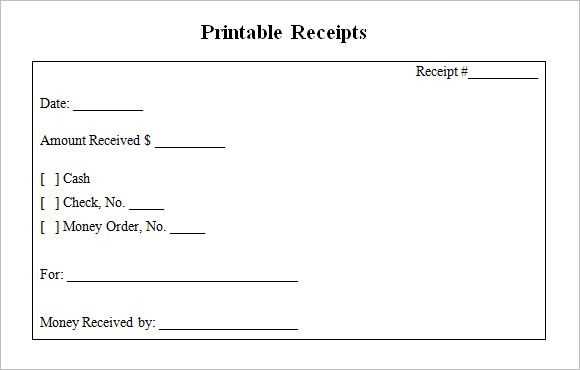

Printable vs. Digital Versions: Pros and Cons

Use a structured format to ensure clarity and compliance. Include the date, payer and recipient details, payment method, amount, and a unique receipt number. A clear description of the transaction prevents misunderstandings. If applicable, add tax details and payment terms.

Verify local laws before issuing a receipt. Some jurisdictions require specific wording or signatures for legal validity. Digital receipts should meet electronic transaction regulations, including timestamping and encryption for security.

Save receipts in widely accepted formats like PDF or CSV. PDFs maintain formatting and are tamper-resistant, while CSV files work well for bulk financial tracking. Choose based on accessibility and long-term storage needs.

Adapt templates for different transactions by modifying fields. Business sales may require itemized breakdowns, while rental payments might include lease details. Custom fields improve record accuracy and usability.

Enhance document authenticity with digital signatures or QR codes linking to a verification system. Avoid disputes by issuing receipts immediately and storing copies securely.

Printed receipts provide a tangible record but can be lost or damaged. Digital versions allow easy storage and retrieval, reducing paper waste. Consider offering both options to meet different preferences.