Key Elements of a Chinese Receipt

A Chinese receipt, known as 发票 (fāpiào), serves as an official proof of transaction. To ensure accuracy, include these key elements:

- Title: The word “发票” clearly marked.

- Seller Information: Business name, tax ID, address, and contact details.

- Buyer Information: If applicable, the customer’s name and tax ID.

- Transaction Details: Item description, quantity, unit price, and total cost.

- Tax Amount: VAT percentage and the calculated tax.

- Date & Serial Number: The issuance date and unique receipt number.

- Official Seal: A red company stamp is required for validity.

Common Receipt Formats

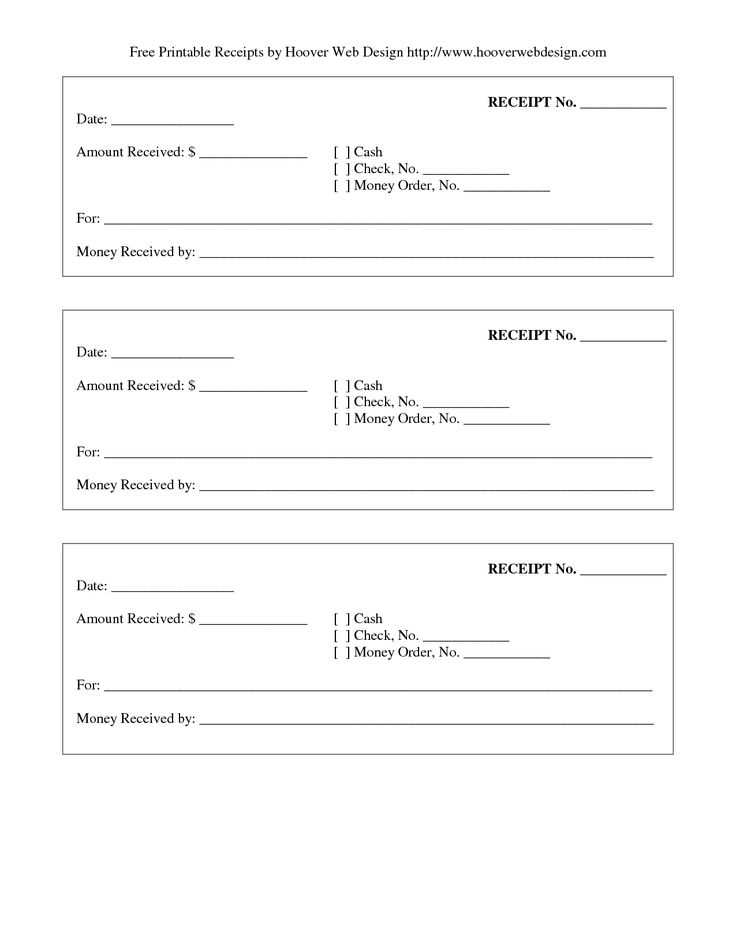

Basic Handwritten Receipt

For informal transactions, a handwritten format is acceptable. Example:

收据 (Shōujù)

- Received from: [Buyer’s Name]

- Amount: [Total Amount in RMB]

- For: [Description of Goods/Services]

- Date: [YYYY-MM-DD]

- Issuer: [Seller’s Name & Signature]

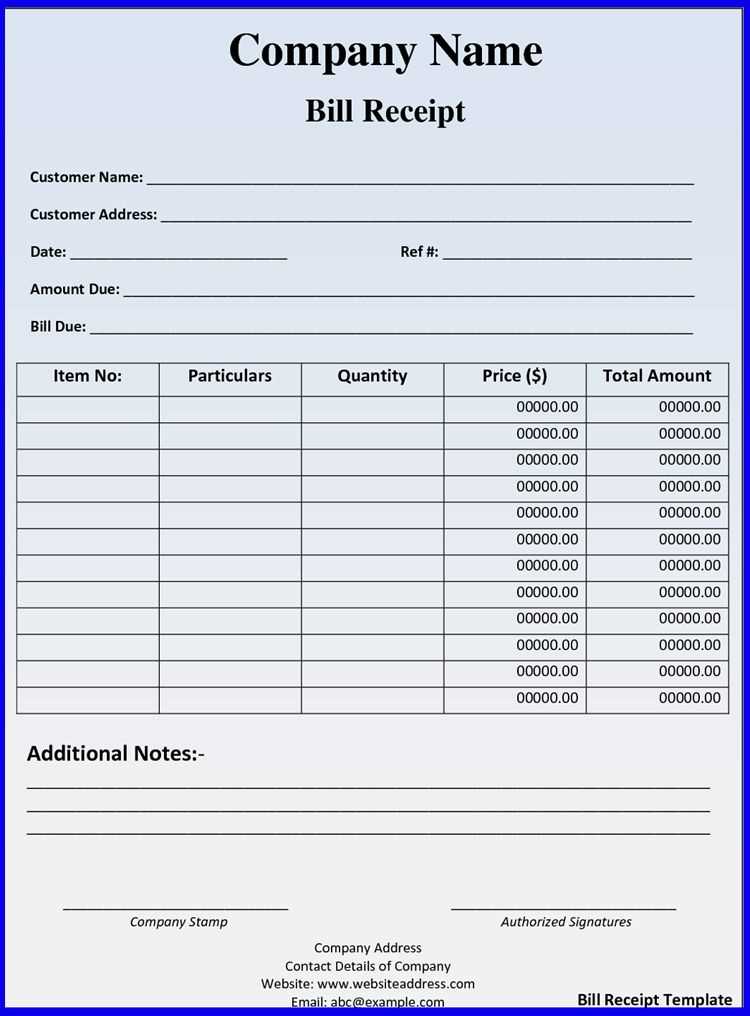

Standard Printed Invoice

Businesses use official VAT invoices issued through tax authorities. A typical format includes:

- Title: 增值税专用发票

- Invoice Code & Number

- Buyer & Seller Tax Information

- Itemized List with Tax Breakdown

- QR Code for Verification

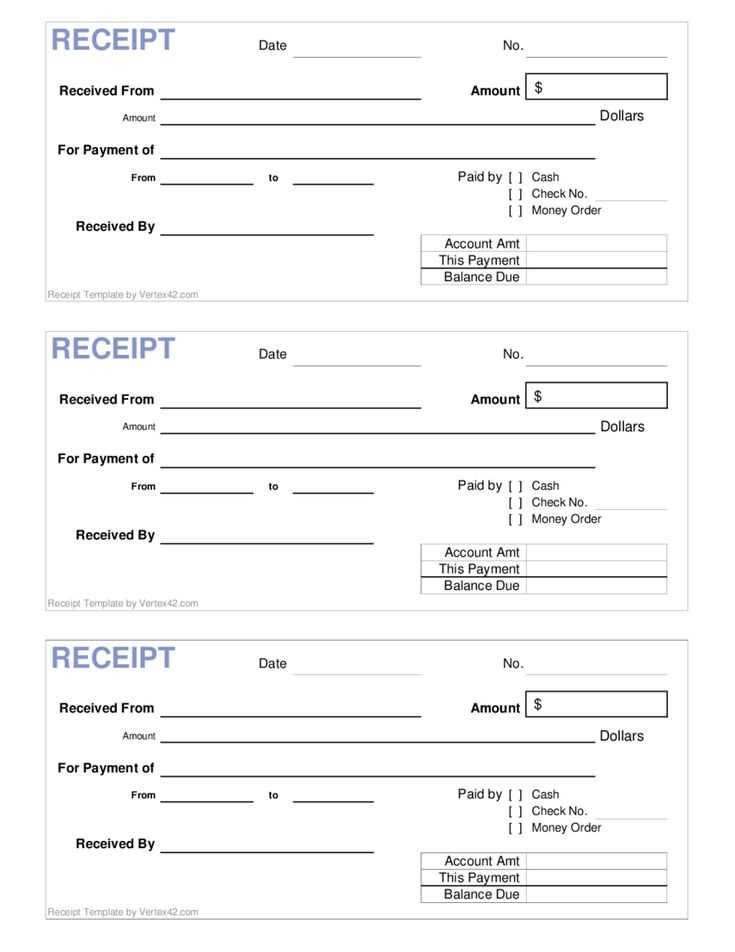

Electronic Receipts

Digital receipts are common in e-commerce and mobile payments. They typically contain:

- Business Name & License Number

- Transaction ID & Timestamp

- Itemized Charges & Tax Details

- Download Link or QR Code

Ensuring a correctly formatted receipt helps with tax compliance and business credibility.

Receipt Template in Chinese

Key Aspects of a Chinese Receipt

Formats for Business and Personal Use

Legal Standards for Receipts in China

Translation Guide for Receipt Terms in Chinese

How to Create a Printable Version

Best Tools for Generating Receipts

Key Elements of a Chinese Receipt

A standard Chinese receipt includes the issuing entity’s name, tax identification number, transaction date, and total amount. For businesses, receipts must contain an official red stamp (发票专用章) to be legally valid. Personal receipts may omit the stamp but should still include the payer and payee details for clarity.

Legal Standards and Compliance

Businesses must use government-issued fapiao (发票) for tax reporting. Unauthorized receipts can lead to penalties. Electronic receipts are gaining acceptance, but they must be issued through approved platforms like the Golden Tax System. Ensure compliance by verifying receipt formats against local tax authority guidelines.