Get a Clear and Professional Template Instantly

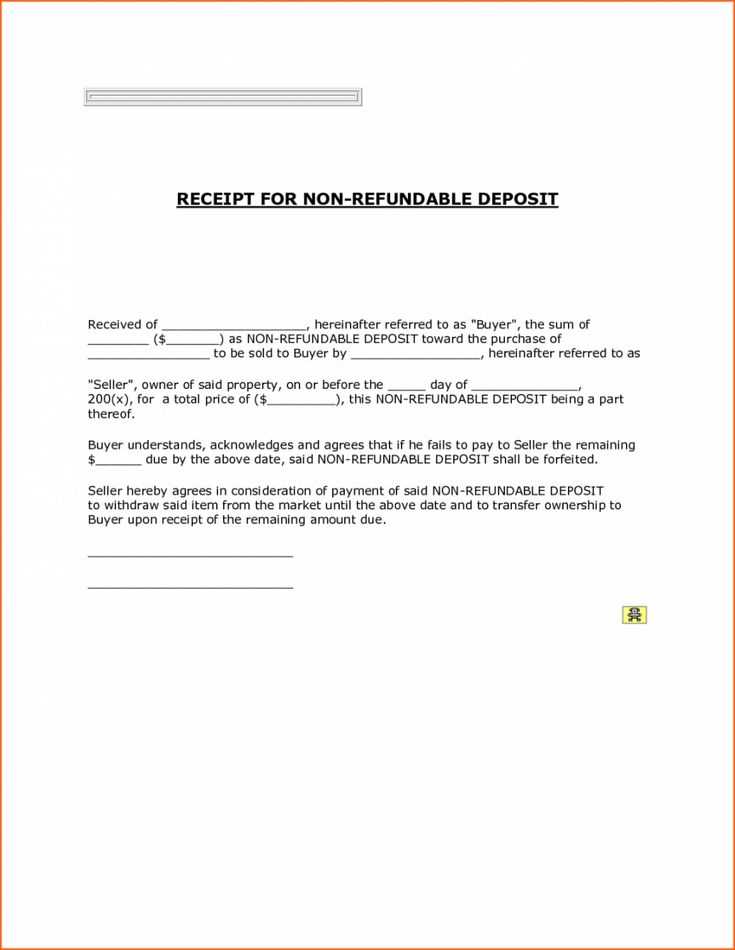

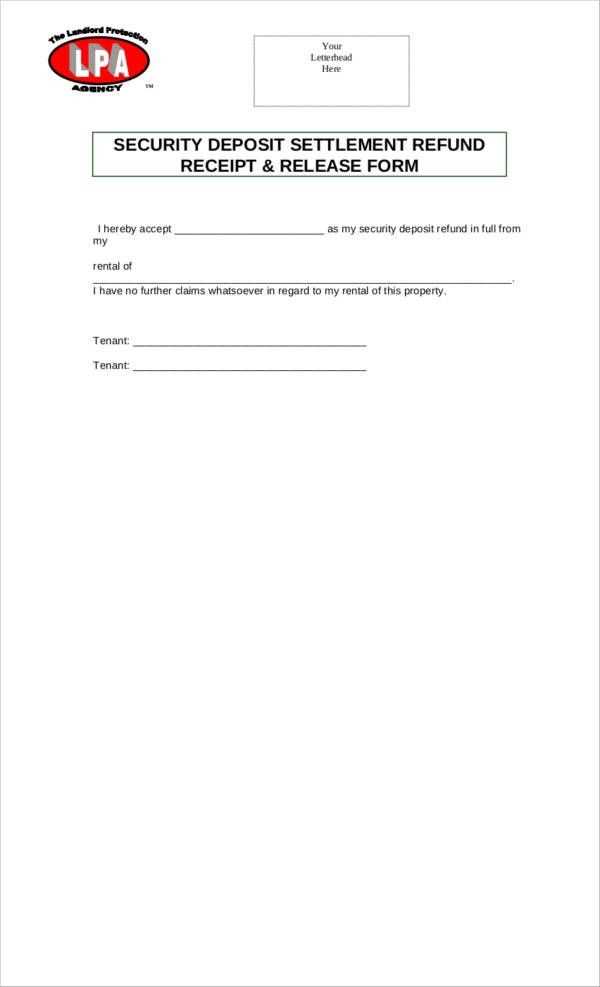

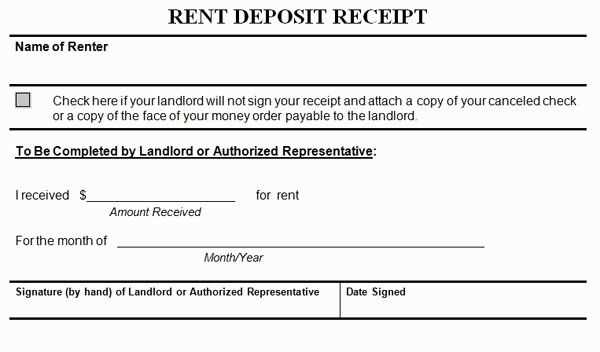

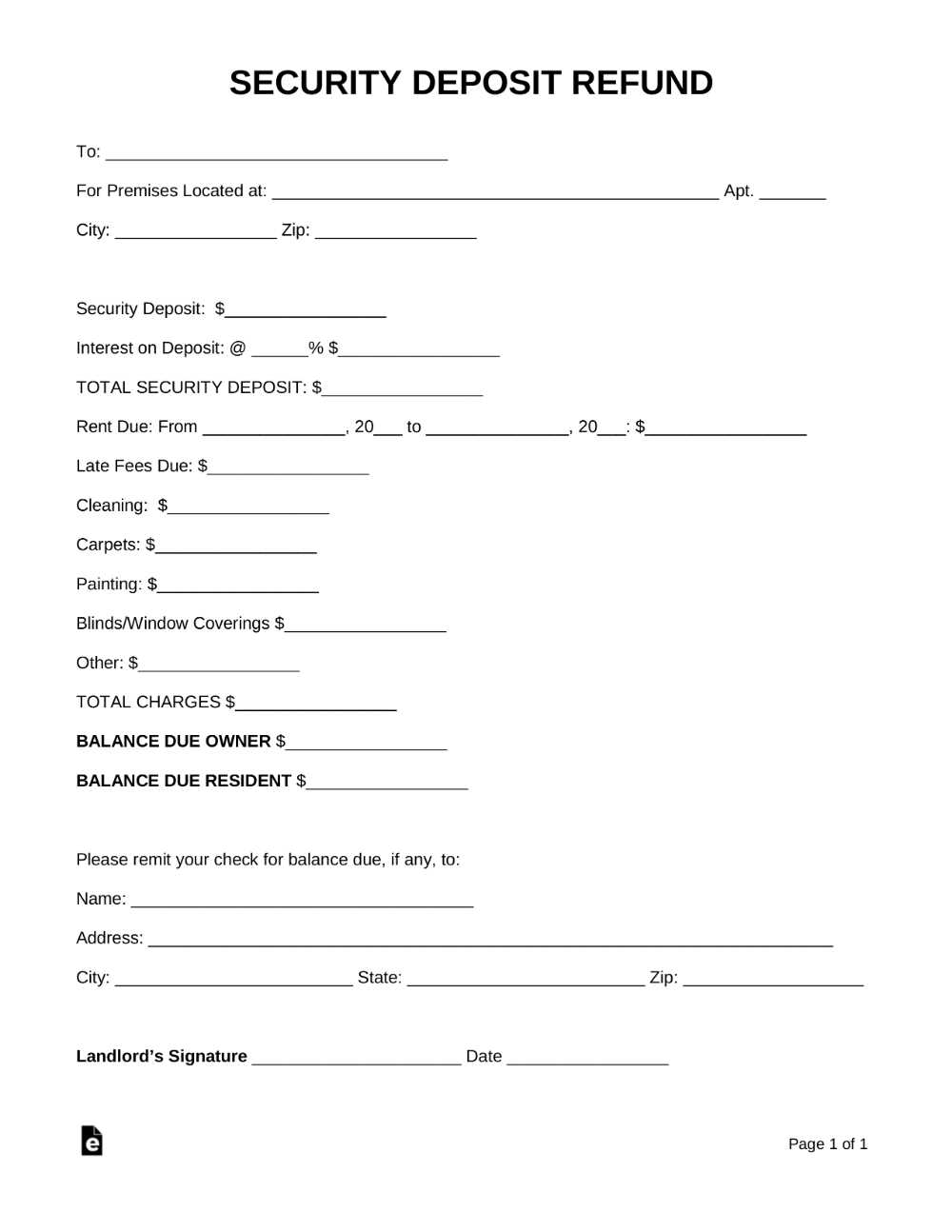

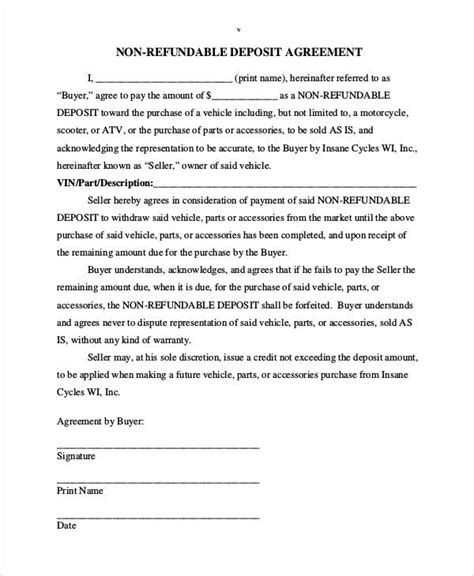

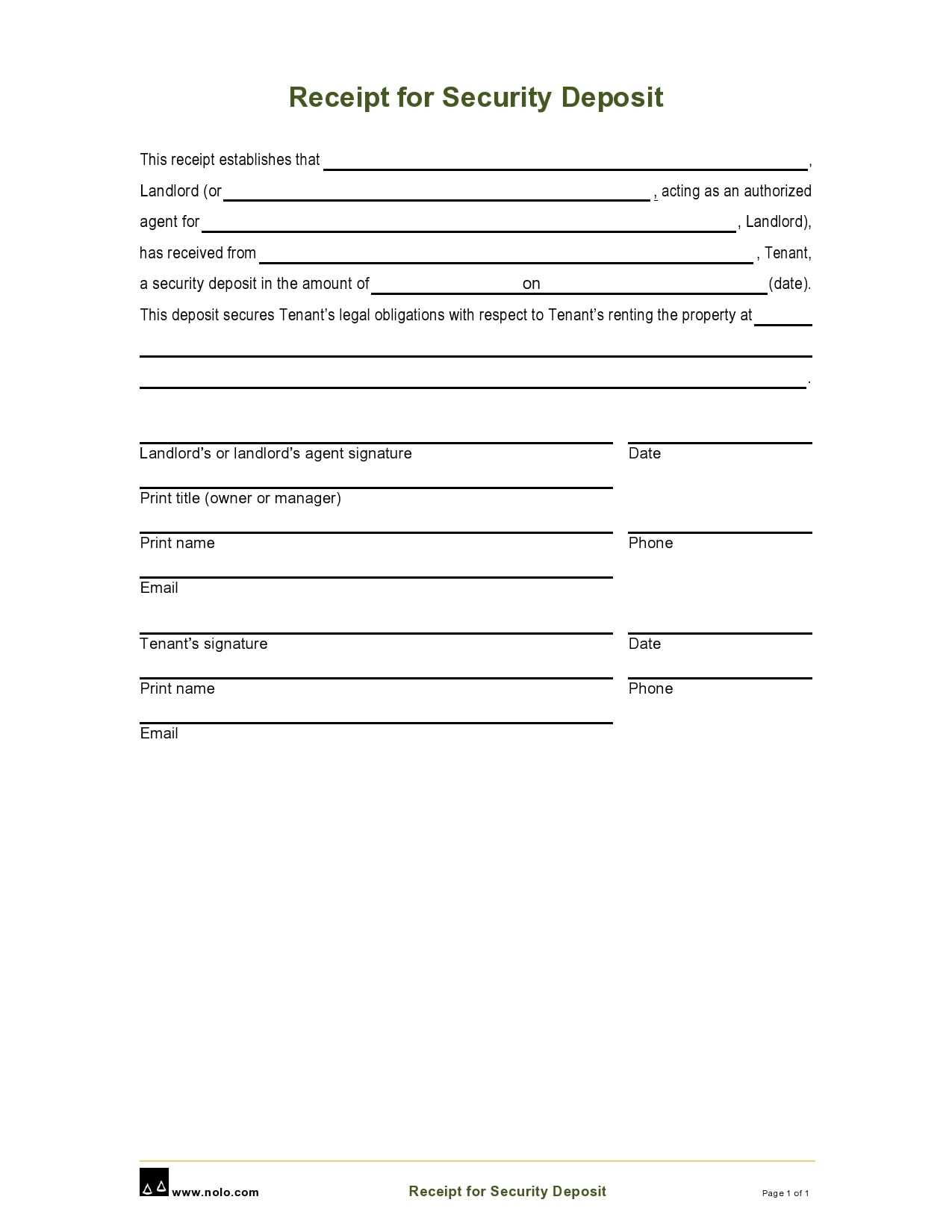

A well-structured refundable deposit receipt ensures clarity in financial transactions. Choose a template that includes key details such as the payer’s and recipient’s names, deposit amount, payment date, refund terms, and a signature section. A concise and transparent format reduces disputes and provides legal protection.

Key Elements to Include

- Transaction Details: Clearly state the amount, date, and method of payment.

- Refund Terms: Specify conditions for returning the deposit, including timeframes and deductions.

- Signatures: Both parties should sign to confirm agreement on the terms.

- Contact Information: Include names, phone numbers, and addresses for reference.

Best Formats for Your Needs

Choose a format that suits your requirements. A PDF template provides a professional look and ensures consistency. A Word document allows easy editing for customization. An Excel sheet is useful if calculations and automatic updates are necessary.

Download and Customize Your Template

Find a reliable source offering editable receipt templates. Ensure it allows modifications to match specific agreements. Print or send digital copies for better record-keeping. A well-prepared receipt simplifies financial tracking and enhances trust between parties.

Purchase Refundable Deposit Receipt Template

Key Elements to Include in a Refundable Deposit Form

How to Ensure Legal Compliance for Such Receipts

Customizing a Deposit Receipt for Different Transactions

Common Mistakes to Avoid When Creating This Document

Digital vs. Paper Receipts: Pros and Cons

Where to Find Reliable Deposit Receipt Templates

Include the payer’s and recipient’s full legal names, contact details, and the date of the transaction. Specify the deposit amount, the purpose, and the conditions for a refund. If the deposit applies to a rental, service, or product, state the terms clearly. Adding a unique receipt number helps with tracking.

Ensure compliance by checking local regulations regarding refundable deposits. Some jurisdictions require specific language or disclosures. Using a legally reviewed template reduces risks.

Modify the receipt based on the transaction type. A rental deposit may need terms for deductions, while a product-related deposit should outline return conditions. Adjust refund timelines to match industry norms.

Avoid vague refund conditions, missing signatures, and incorrect amounts. Inconsistent terms can lead to disputes, so clarity is key.

Digital receipts offer easy storage and automated tracking, while paper copies serve as physical proof. Choose based on record-keeping preferences and legal requirements.

Reliable templates are available from legal document providers, business software platforms, and financial institutions. Ensure the format suits your needs before finalizing.