Essential Components of a TV Receipt

A well-structured TV receipt ensures clarity in transactions and serves as a valid proof of purchase. It should include:

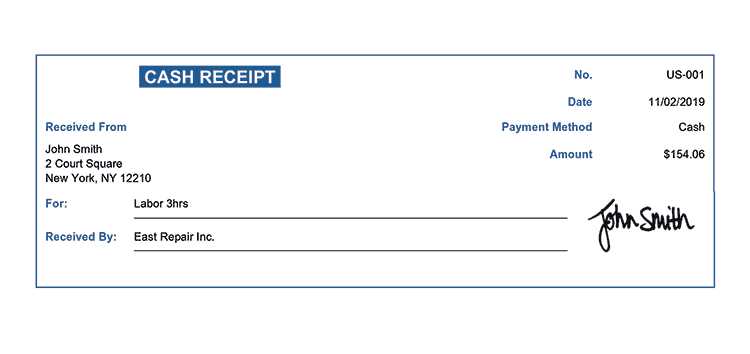

- Store Information: Name, address, contact details, and tax identification number.

- Buyer’s Details: Full name and contact information if applicable.

- Purchase Date: Exact date and time of the transaction.

- Itemized List: Brand, model, serial number, and specifications of the TV.

- Price Breakdown: Base price, taxes, discounts, and total amount paid.

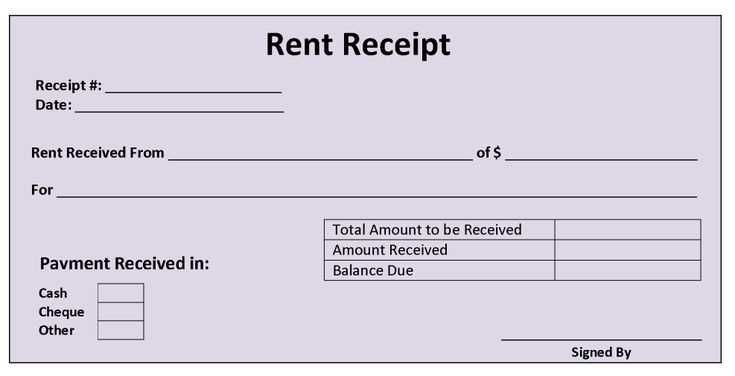

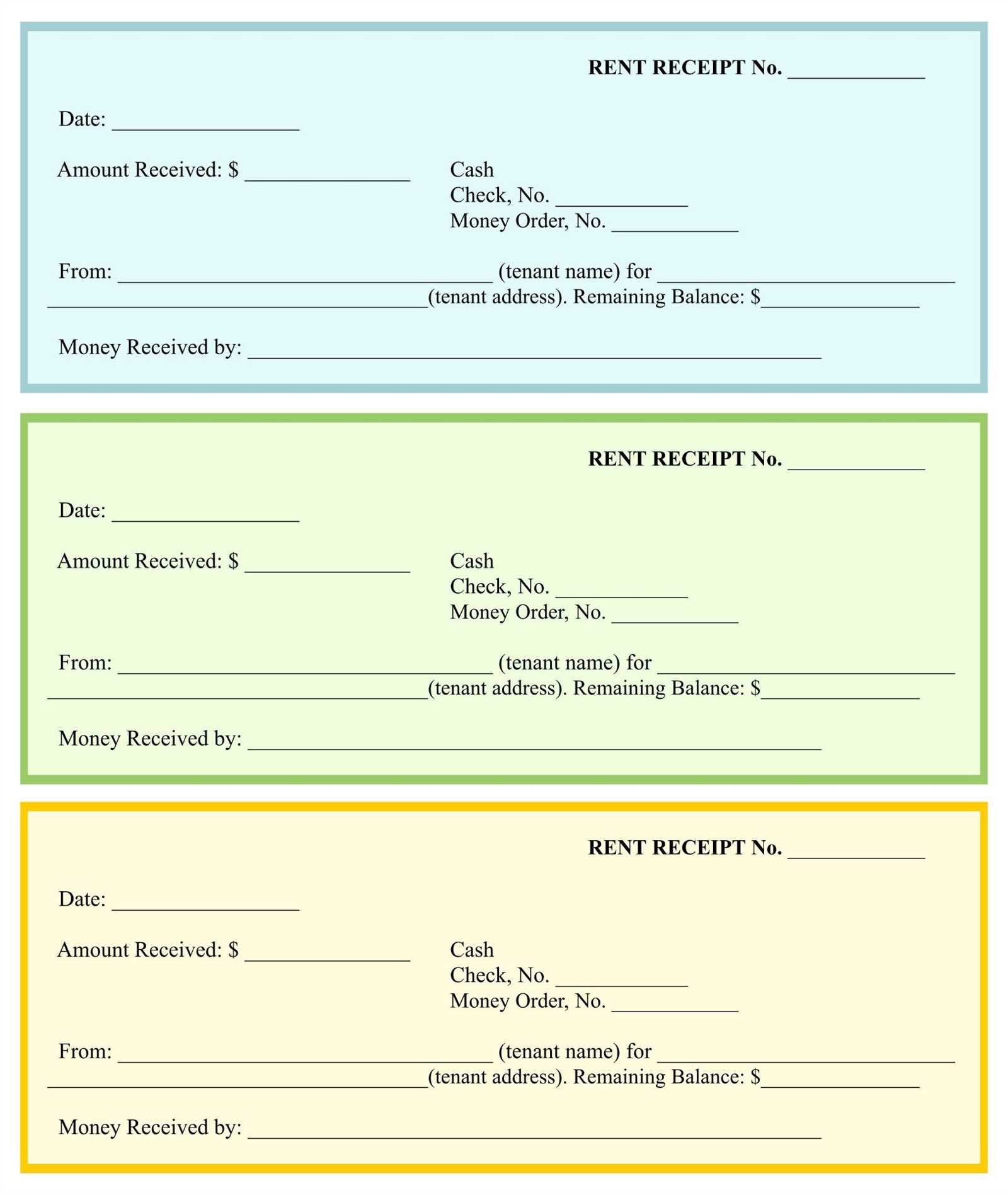

- Payment Method: Cash, credit card, digital payment, or financing details.

- Warranty Information: Coverage period and terms.

- Receipt Number: Unique identifier for tracking and validation.

How to Create a Professional TV Receipt

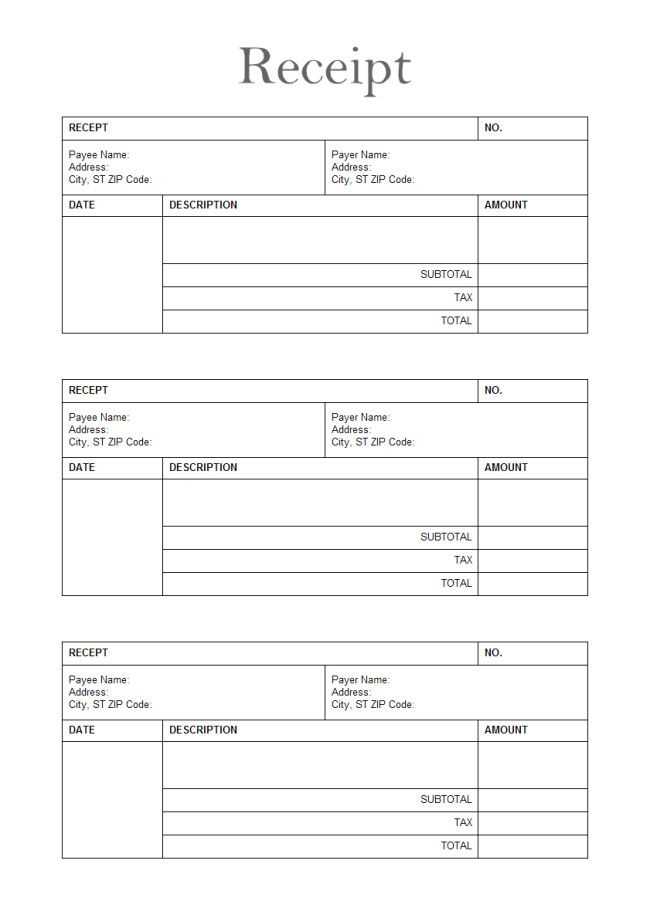

Using a Pre-Made Template

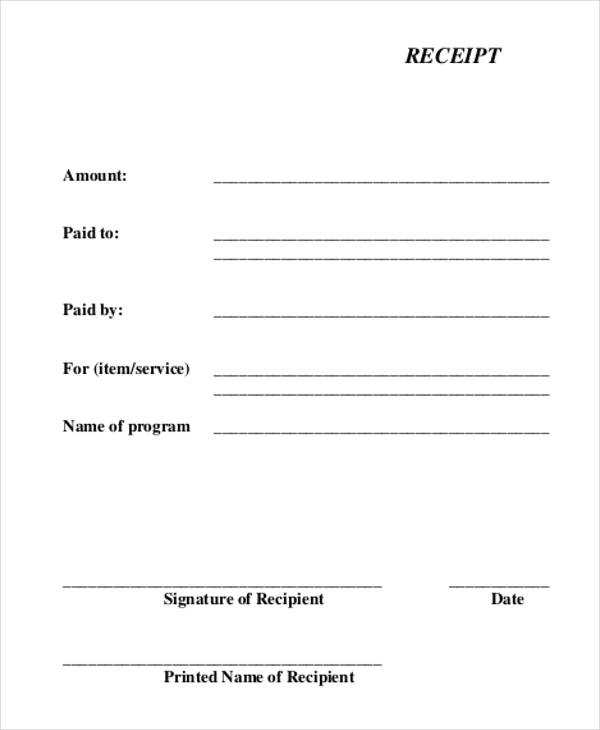

Many businesses use pre-designed templates to save time. These templates come in various formats, including PDF, Word, and Excel. When selecting a template, ensure it supports customization for your business details and complies with legal requirements.

Customizing a Receipt for Your Business

For a personalized touch, create a receipt from scratch or modify an existing template. Include your company’s logo, adjust fonts for readability, and use clear sections to highlight essential details. Digital receipts should also support electronic signatures and automated numbering.

Ensuring Legality and Compliance

Every receipt should meet tax regulations and consumer protection laws. Verify that it includes required tax details, return policies, and any necessary disclaimers. For electronic receipts, ensure they are securely stored and easily retrievable for future reference.

Providing a well-documented TV receipt benefits both businesses and customers, reducing disputes and ensuring a seamless post-purchase experience.

TV Receipt Template: Key Aspects and Practical Considerations

Essential Elements to Include in a Receipt Template

How to Structure a Receipt for Clarity and Accuracy

Legal and Tax Compliance in TV Receipts

Customizing a Template for Various Use Cases

Common Mistakes to Avoid When Creating Receipts

Digital vs. Paper Receipts: Pros and Cons

Include Clear Item Descriptions

List the TV model, serial number, and specifications such as screen size and resolution. This prevents disputes and ensures warranty validity.

Specify Pricing and Tax Details

Break down the total cost, including unit price, discounts, and applicable taxes. A precise breakdown clarifies the final amount and aids tax reporting.

Ensure Proper Date and Time Stamping

Include the exact date and time of purchase. This detail is crucial for warranties, return policies, and tax documentation.

Provide Seller and Buyer Information

List the seller’s business name, address, and contact details. If required, include the buyer’s details, especially for high-value transactions.

Use a Logical Layout

Align sections clearly, ensuring easy readability. Place critical details at the top, followed by itemized information and payment confirmation.

Ensure Legal Compliance

Verify that the receipt meets tax and consumer protection laws. Some jurisdictions require specific disclaimers or registration numbers.

Adapt for Different Use Cases

For warranty claims, include serial numbers. For business purchases, ensure tax identification details are present. Adjust templates based on transaction needs.

Avoid Common Errors

Check for missing or incorrect amounts, vague item descriptions, and inconsistent formatting. Errors can complicate returns, tax filings, and audits.

Consider Digital and Paper Formats

Paper receipts provide a physical record but can be lost. Digital versions offer easy storage and retrieval. A hybrid approach ensures accessibility.