Every payroll transaction should be documented with a clear and structured payment receipt. This ensures that employees have a detailed record of their earnings, deductions, and final payout. A well-designed template simplifies this process, reducing misunderstandings and disputes.

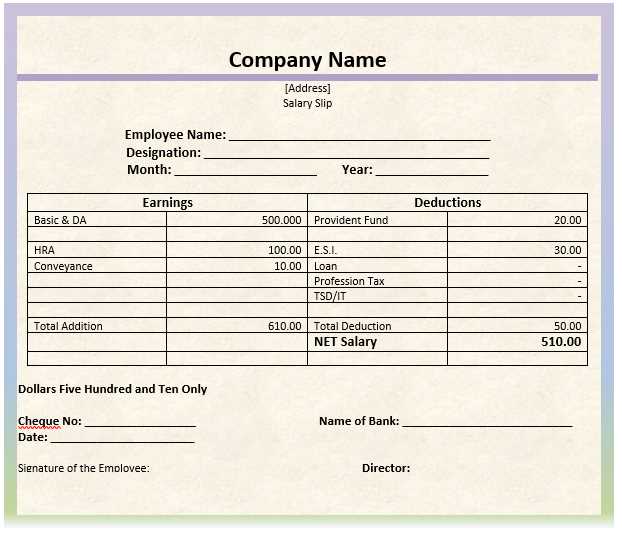

A proper receipt should include the employee’s full name, pay period, payment date, and breakdown of earnings. Essential details like gross pay, tax withholdings, and net salary must be clearly listed. If applicable, deductions for benefits, retirement contributions, or advances should be itemized separately.

Formatting the receipt for readability is just as important as including the right information. Use structured sections, bold headings, and consistent spacing to make the document easy to review. If issuing digital receipts, ensure they are saved in a secure, accessible format such as PDF.

Using a standardized template not only saves time but also ensures compliance with labor regulations. Whether for salaried employees, hourly workers, or freelancers, a well-structured payment receipt protects both employers and employees by maintaining transparent financial records.

Here’s an Option with Reduced Word Repetition While Maintaining Meaning:

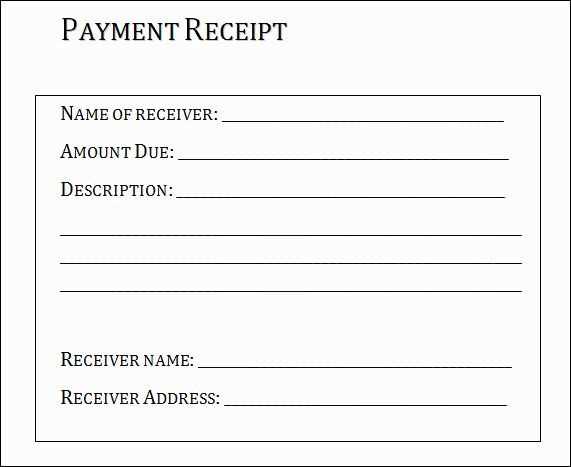

Ensure the receipt includes the employee’s full name, payment date, and amount received. Specify payment type–bank transfer, check, or cash. Include gross pay, deductions, and net pay for clarity. List tax withholdings and benefits separately. If applicable, add overtime pay and bonuses. Confirm employer details, such as company name and contact information. A signature line for acknowledgment strengthens authenticity. Use a clear, readable format to avoid misunderstandings. Digital receipts should include a timestamp and secure verification method. Regularly update templates to reflect legal changes. Store copies securely for future reference.

- Employee Compensation Receipt Template

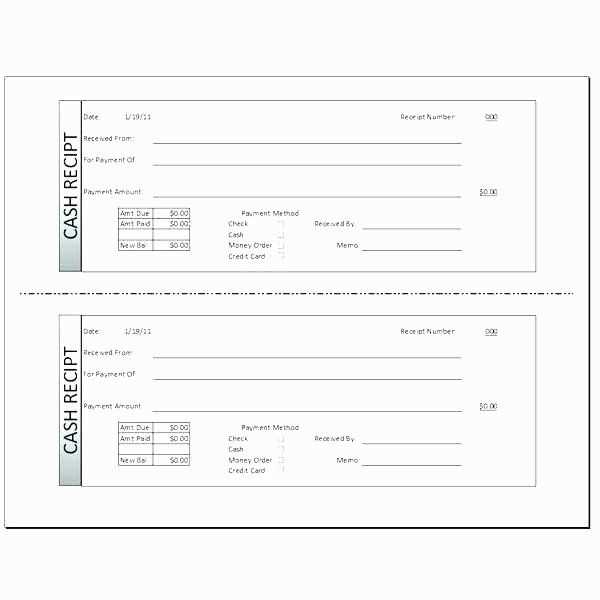

Use a structured template to ensure clear documentation of payments. Include the employee’s full name, payment date, pay period, and total amount received. Specify the payment method, such as direct deposit or check, and break down deductions, taxes, and bonuses for transparency.

Provide a unique receipt number for tracking and include the employer’s name and contact details. A statement confirming receipt of payment adds clarity. If necessary, include a signature section for acknowledgment. Keep digital and printed copies for record-keeping and compliance.

Include the employee’s full name, job title, and unique identification number to ensure accurate record-keeping. Specify the pay period dates and payment date for clarity.

Break down earnings into regular wages, overtime pay, bonuses, and commissions. Show the number of hours worked and the applicable pay rates.

List all deductions separately, including taxes, insurance, retirement contributions, and any voluntary withholdings. Provide clear labels to avoid confusion.

Display the gross pay before deductions, the total amount withheld, and the final net pay. Ensure calculations are accurate and easy to verify.

Include the employer’s name, address, and tax identification number. If payment is made via direct deposit, add bank details for reference.

Provide a summary of accrued benefits such as vacation days, sick leave, or pension contributions. Keeping this information visible helps employees track their entitlements.

Use a clear structure: Arrange information in a logical order. Begin with the company name, employee details, and payment date. Follow with earnings, deductions, and net pay.

Highlight key amounts: Use bold text for gross pay, deductions, and net pay. This ensures quick identification of critical figures.

Provide detailed breakdowns: List hourly rates, hours worked, overtime, and bonuses separately. Specify deduction types, such as taxes, insurance, or retirement contributions.

Keep formatting simple: Use aligned columns and consistent spacing. Avoid excessive formatting, colors, or unnecessary embellishments that reduce readability.

Include payment method and reference: Indicate whether payment was made via bank transfer, check, or cash. Add a transaction number for easy tracking.

Ensure compliance: Check local labor laws for required information. Include tax identifiers or employer registration numbers where applicable.

Offer a summary: A brief recap of total earnings, deductions, and final pay helps employees quickly verify their wages.

Ensure payment receipts include the correct and required information. The specific legal obligations vary by jurisdiction, but common elements should be included across most regions:

- Employee details: Full name and address of the employee receiving payment.

- Employer details: Name and business address of the employer providing the payment.

- Payment amount: The exact figure being paid to the employee, clearly stated, including any deductions or bonuses.

- Payment date: The exact date of payment for the specific pay period.

- Breakdown of deductions: Include taxes, insurance, retirement contributions, and other legal or contractual deductions.

- Gross and net pay: Show both the total amount earned before and after deductions.

- Payment method: Specify whether the payment is made via cheque, direct deposit, or other means.

Following these guidelines will help ensure compliance with labor laws and provide clarity to employees regarding their compensation.

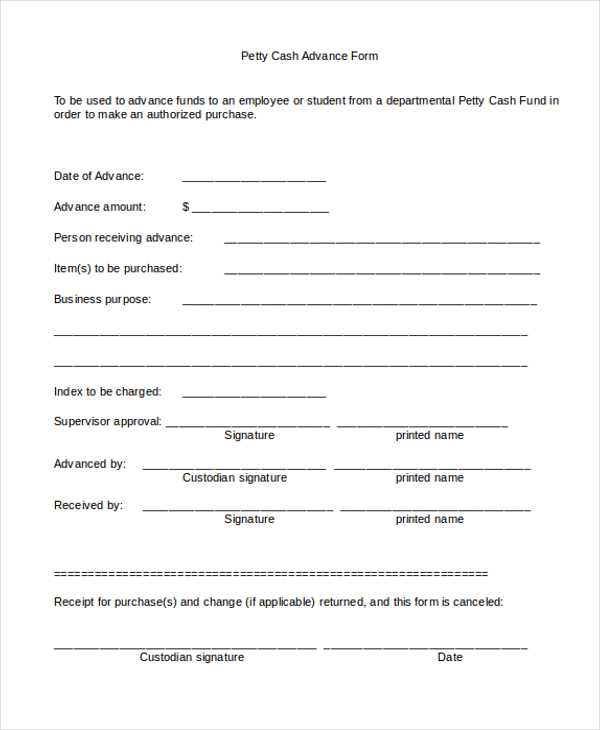

Adjust your employee payment receipt template to match the specific features of each payroll system. Begin by reviewing the data provided by the payroll software, such as gross wages, deductions, and taxes. Customize fields to include or exclude certain details based on the system’s reporting capabilities.

Syncing with Payroll Software

Ensure that your template integrates seamlessly with the payroll system. Fields like tax information, bonuses, and overtime should be clearly defined to reflect how the system calculates these values. Double-check that the template automatically updates based on data inputs from the payroll software.

Addressing System-Specific Requirements

Some payroll systems may require additional information like employee benefits or statutory deductions. Customize the template by adding these sections, making sure they are formatted according to the system’s specific rules. Keep the layout clean and easy to read for clarity on payment details.

Consistency in design and data presentation across templates for various payroll systems helps employees easily track and understand their pay slips, while maintaining compliance with different payroll processing tools.

Ensure accuracy in every detail of a salary receipt to avoid costly errors. Common mistakes often involve incorrect deductions, missing bonuses, and miscalculated taxes. Double-check all figures and categories to keep your receipts clear and error-free.

1. Incorrect Tax Calculations

One of the most frequent errors is miscalculating the tax deductions. Always update the tax rates according to the latest government regulations. Use a reliable payroll software to automatically adjust these rates to ensure correct tax deductions.

2. Overlooking Bonus or Overtime Pay

Bonuses and overtime should be calculated separately and displayed clearly. Failing to do so may lead to discrepancies between the actual pay and what the employee expects. Always include an itemized breakdown of overtime hours and bonus payments.

3. Unclear Pay Periods

Make sure to state the pay period clearly, as confusion around start and end dates of the period can create misunderstandings. Ensure the dates align with the actual pay cycle and are easy to identify.

4. Miscalculating Benefits

When including benefits, verify that the figures are consistent with company policy. For example, health insurance, retirement contributions, and other benefits should reflect the correct values based on company guidelines.

5. Missing Deductions for Absences

If an employee took unpaid leave or had absences, ensure deductions are made. Failure to deduct for missed workdays can create frustration and disputes. Keep track of attendance records and confirm deductions are properly accounted for.

| Error Type | How to Avoid It |

|---|---|

| Incorrect Tax Calculations | Update tax rates regularly, use automated payroll software for accuracy |

| Overlooking Bonus or Overtime | Itemize overtime and bonuses separately with clear calculations |

| Unclear Pay Periods | Clearly state the start and end dates of each pay period |

| Miscalculating Benefits | Double-check benefit amounts based on company policies |

| Missing Deductions for Absences | Track attendance accurately and apply deductions for unpaid leave |

Store payroll records in a secure, organized system that ensures easy access when necessary. Implement both physical and digital backups to protect against data loss.

1. Use Secure Digital Storage Systems

- Opt for cloud-based solutions with encryption to store payroll data safely.

- Ensure only authorized personnel have access to sensitive payroll information.

- Regularly update passwords and security protocols to prevent unauthorized access.

2. Regularly Back Up Records

- Perform weekly backups of all payroll records to prevent accidental loss.

- Store backups in a separate, secure location, whether cloud-based or offline.

- Set up automated backups to ensure consistency and reduce human error.

3. Maintain Organized Recordkeeping

- Label each payroll file clearly with dates and employee details for easy identification.

- Organize records by year, month, or pay period to ensure fast retrieval.

- Ensure paper records are stored in a locked, fireproof file cabinet for protection.

4. Keep Payroll Records for the Required Time

- Familiarize yourself with local laws on the retention period for payroll records.

- Generally, retain records for at least 3–7 years depending on jurisdiction.

- Dispose of outdated records securely, using shredders or secure document disposal services.

Payment and Receipt Terminology Changes

The terms “payment” and “receipt” are now used less frequently, but the core meaning remains intact. To stay aligned with modern usage, consider using alternatives like “transaction confirmation” or “fund transfer record” where applicable. If further variation is necessary, feel free to adjust the wording to maintain clarity and relevance.