Always provide a clear and professional puppy deposit receipt when accepting a payment for a future pet purchase. This document protects both the buyer and the seller by outlining the terms of the deposit, including the amount paid, payment method, and any conditions regarding refunds or balance payments.

A well-structured receipt should include essential details such as the breeder’s name, the buyer’s information, the puppy’s breed, and the expected pickup date. Adding a unique identification number or microchip reference helps ensure accurate record-keeping.

Specify whether the deposit is non-refundable or if conditions allow a refund under certain circumstances. Clear wording prevents misunderstandings and ensures a smooth transaction for both parties.

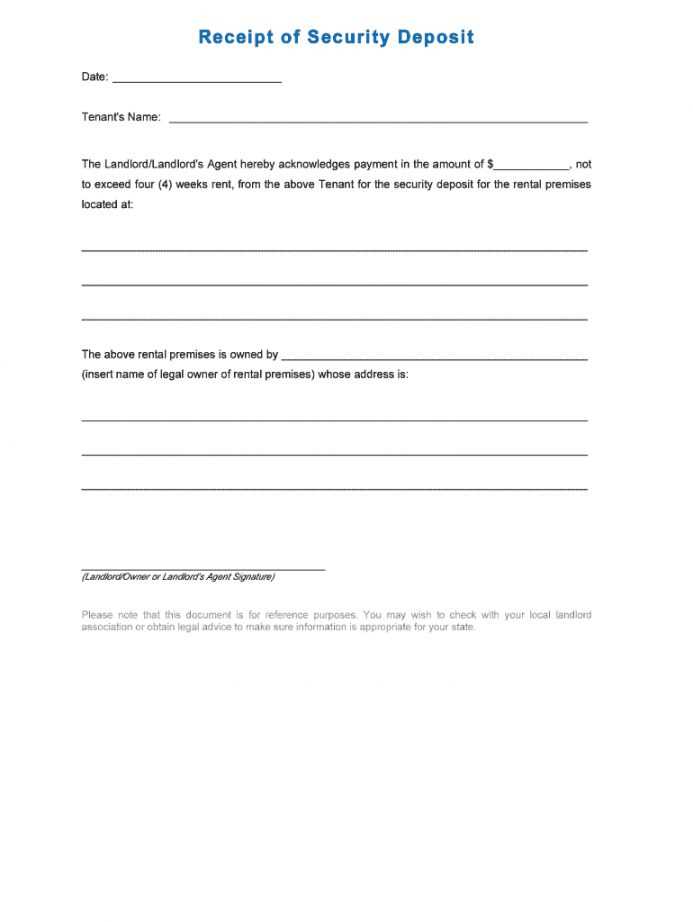

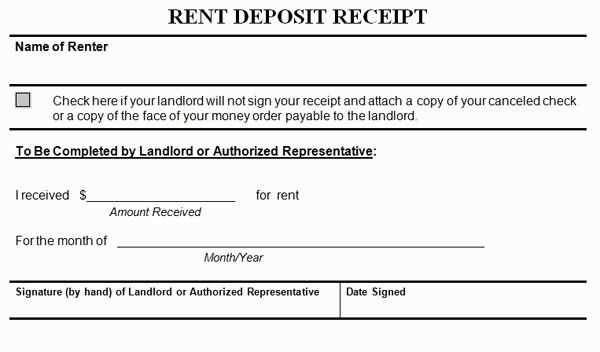

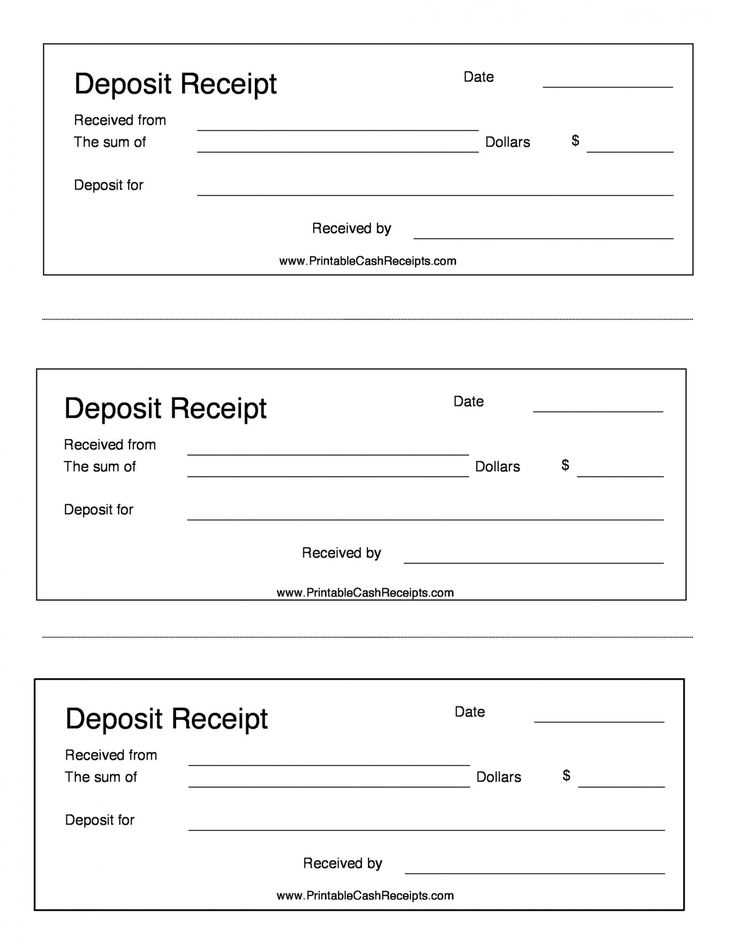

Using a ready-made receipt template saves time and ensures consistency. A well-designed document with signature fields for both parties provides additional security and confirmation of the agreement.

Puppy Deposit Receipt Template

Specify Buyer and Seller Details: Include the full names, addresses, and contact information of both parties. This ensures transparency and makes communication easier.

Record Deposit Amount and Payment Method: Clearly state the deposit sum, currency, and whether it was paid via cash, check, or electronic transfer. Mention any non-refundable terms if applicable.

Describe the Puppy: List the breed, color, date of birth, microchip number (if available), and any registration details. This prevents disputes regarding the specific puppy being reserved.

Outline Terms and Conditions: Indicate the total purchase price, remaining balance, and due date. If health guarantees or vaccinations are included, document them here.

Signatures for Agreement: Require signatures from both the buyer and seller with the date of signing. This confirms mutual understanding and agreement on the deposit terms.

Key Elements to Include in the Receipt

Include the buyer’s and seller’s full names, addresses, and contact details. This ensures both parties have a clear record of the transaction.

Specify the puppy’s details: breed, date of birth, color, gender, and any identification marks. If the puppy has a microchip or registration number, list it.

Clearly state the total purchase price, the deposit amount paid, and the remaining balance. Indicate the payment method used and include the date of payment.

Outline the terms of the deposit, including whether it is refundable or non-refundable. If conditions apply, describe them in detail.

Include a statement confirming receipt of the deposit and the seller’s obligation to hold the puppy until the agreed-upon date.

Both buyer and seller should sign and date the receipt to acknowledge the agreement. A printed name under each signature helps with clarity.

How to Structure Payment Terms Clearly

Define payment terms with exact amounts, deadlines, and conditions. Specify the deposit percentage, due date, and accepted payment methods. Avoid vague phrases like “deposit required soon”–instead, state “a 30% deposit is due by [specific date].”

Break Down Payment Stages

Split payments into clear milestones. A structured approach prevents confusion and ensures smooth transactions. Consider this format:

| Payment Stage | Amount | Due Date |

|---|---|---|

| Deposit | 30% of total | At reservation |

| Second Installment | 50% of total | [Date] |

| Final Payment | 20% of total | Pickup day |

Clarify Refund and Forfeiture Terms

State whether the deposit is refundable or non-refundable. If non-refundable, explain under what conditions. For example: “If the buyer cancels after [specific date], the deposit is forfeited.” This prevents disputes and keeps expectations aligned.

Keep the language precise and easy to understand. If using legal terms, provide a brief explanation to ensure clarity for all parties.

Legal Considerations for Deposit Agreements

Specify refund conditions clearly. Define whether the deposit is refundable or non-refundable and under what circumstances. If a refund is possible, outline the process, timeline, and any deductions.

Include Buyer and Seller Details

List full names, addresses, and contact information for both parties. This helps prevent disputes and ensures the agreement is legally binding.

Outline Payment Terms

State the deposit amount, payment method, and due date. If the deposit applies to the final price, specify how and when it will be deducted.

Define Breach Consequences. Explain what happens if either party fails to fulfill their obligations. If the buyer backs out, clarify whether the deposit is forfeited. If the seller cancels, outline the refund process.

Use clear language. Avoid vague terms that can lead to misinterpretation. Simple, direct wording makes enforcement easier if legal action is needed.

Consulting a legal professional can ensure compliance with local regulations. State laws vary, and a well-drafted agreement protects both parties.

Customizing the Template for Different Breeds

Adjusting a puppy deposit receipt template based on breed-specific factors ensures clarity and professionalism. Consider the following modifications:

- Size and Growth Expectations: Include estimated adult weight and growth milestones. Large breeds may require longer reservation periods.

- Health Testing Details: Specify genetic tests relevant to the breed. For example, hip scoring for German Shepherds or eye exams for Border Collies.

- Coat and Grooming Needs: Indicate if a non-refundable deposit covers initial grooming for breeds with high maintenance coats, such as Poodles.

- Temperament Notes: Add details on early socialization efforts for breeds requiring structured training, like Belgian Malinois or Akitas.

- Breeding Rights and Restrictions: If the puppy is sold as a pet-only, mention spay/neuter agreements, particularly for breeds with breed club regulations.

Customizing these sections provides buyers with breed-specific insights and sets clear expectations from the start.

Digital vs. Paper Receipts: Pros and Cons

Choose digital receipts for convenience and security. They eliminate paper clutter, reduce the risk of loss, and simplify tax reporting. Most businesses now offer email or app-based receipts, making it easy to organize records without physical storage. Additionally, digital receipts are harder to forge and provide better fraud protection.

When Paper Still Matters

Paper receipts remain useful for legal or warranty purposes when digital copies aren’t accepted. Some customers also prefer them for immediate access without relying on devices. However, they fade over time and can be misplaced easily, making digital backups a smart choice.

Balancing Both Methods

For maximum flexibility, use digital receipts whenever possible and keep scanned copies of essential paper receipts. Many apps allow easy scanning and categorization, ensuring access when needed. If a paper receipt is required, store it securely to avoid damage or loss.

Common Mistakes to Avoid When Creating a Receipt

One of the most common mistakes is leaving out crucial details like the date, the amount paid, and the payment method. Ensure all of this information is clearly listed to avoid confusion.

Missing or Inaccurate Payment Information

Always double-check payment amounts and transaction details. A small error in the total price or missing information about how the payment was made (e.g., cash, credit card) can lead to disputes.

Not Including Clear Identifiers

Failure to include unique identifiers like an invoice number or receipt ID can make it difficult to track payments, especially for refunds or warranty claims. Make sure your receipts are traceable.

- Invoice number

- Transaction ID

- Seller’s contact information

These details offer a structured and reliable way to organize receipts for both you and the buyer.

Omitting Terms and Conditions

If applicable, include the terms of sale, return policy, or warranty information. Omitting these can lead to misunderstandings if issues arise with the product or service provided.

- Clear refund policies

- Service terms

These simple additions ensure transparency and prevent possible disagreements later.