Need a quick and reliable way to confirm a Zelle transaction? The easiest solution is to generate a custom receipt. While Zelle itself doesn’t offer official receipts, you can create your own to document payments for business or personal use.

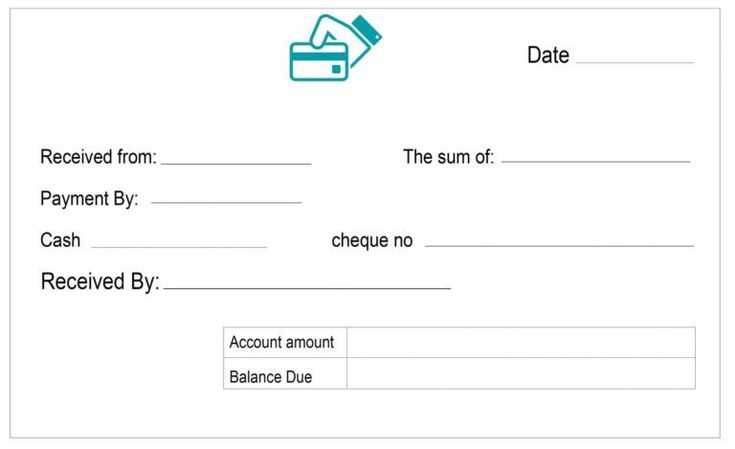

A well-structured Zelle receipt should include key details: sender and recipient names, transaction date, amount, payment purpose, and a unique reference number. Adding a company logo and contact information gives it a professional touch. If you’re using receipts for business, consider numbering them sequentially to maintain accurate records.

For a simple receipt, a template in Google Docs, Excel, or PDF format works best. If automation is a priority, invoicing software like QuickBooks or Wave can generate receipts with Zelle payment details. Keep digital copies for easy access and bookkeeping.

Whether you’re confirming rent payments, freelance work, or personal reimbursements, a structured receipt eliminates confusion and provides a clear record of each transaction.

Here’s the corrected version, eliminating redundancies while maintaining the meaning:

When creating a Zelle money receipt, ensure that you clearly include the following details to avoid confusion:

1. Sender and recipient names – Both should be spelled correctly, reflecting the exact names used for the Zelle transaction.

2. Transaction date and time – Mention the exact date and time when the money was transferred. This helps establish a clear timeline of the transaction.

3. Transaction amount – Clearly state the amount of money transferred. Round figures should be represented with decimals for clarity.

4. Reference number or confirmation number – Include the unique transaction reference number provided by Zelle to confirm that the payment has been processed successfully.

5. Purpose of payment – If relevant, briefly describe the reason for the payment. This is helpful for both parties in tracking and categorizing the transaction.

By sticking to these key points, you can ensure the receipt remains clear, professional, and helpful for future reference.

- Zelle Money Receipt Template: A Practical Guide

A Zelle money receipt template helps you document and verify financial transactions quickly and clearly. It’s a useful tool for both personal and business purposes. Here’s how you can create an easy-to-use template for your Zelle transactions.

Key Elements of a Zelle Receipt Template

Include the following information in your Zelle money receipt template for completeness:

- Date: Record the exact date of the transaction.

- Sender Information: Include the sender’s name, email, or phone number linked to their Zelle account.

- Recipient Information: Provide your name, email, or phone number linked to your Zelle account.

- Amount: Clearly state the transaction amount.

- Transaction ID: Always reference the unique transaction ID for tracking purposes.

- Reason for Payment: Briefly describe the purpose of the transaction (e.g., payment for services, goods, or repayment of a loan).

Why Use a Zelle Receipt Template?

Using a template ensures that all relevant details are recorded accurately. It also provides a clear record in case of any disputes or misunderstandings. Keep this receipt for your personal records or share it with the sender if needed. You can create a template in a word processor, spreadsheet, or even use an online form. Customize it based on your needs and ensure it includes all the necessary transaction details.

When using Zelle to send or receive money, payment confirmation serves as proof of the transaction’s completion. Zelle automatically sends an email or text notification once a transfer is processed. This confirmation is an important aspect to track, especially for those using Zelle for personal transactions.

Key Details in Zelle Payment Confirmation

The confirmation message typically includes transaction details like the sender’s name, the amount sent, and the date of the transfer. It’s important to ensure that these details match your expectations. In case of discrepancies, the confirmation can act as an initial reference for resolving any issues with the transaction.

Limitations of Zelle Payment Confirmation

Although Zelle provides confirmation, it has limitations. For instance, there is no direct receipt or invoice feature like with traditional bank payments. This means if you need a formal receipt for bookkeeping or tax purposes, you may need to take a screenshot of the confirmation or manually record the transaction details.

Another limitation is that Zelle does not offer buyer protection or dispute resolution for personal payments. If you send money to the wrong person or a transaction turns out to be fraudulent, it can be difficult to recover the funds since Zelle operates as a peer-to-peer network and transfers are typically irreversible.

Always double-check the recipient’s contact information before completing a payment to avoid unnecessary complications. If you are unsure about any part of the transaction, contacting Zelle’s support team or reviewing the details within your bank’s app is the best course of action.

Focus on clarity and accuracy when creating a payment receipt template. Here are the key elements you should include:

- Payment Date: The date the transaction was completed. This helps both parties reference the specific transaction time.

- Transaction ID: A unique identifier for the payment. This will be crucial for record-keeping and resolving any future issues.

- Sender and Receiver Details: Include the names and contact information of both the payer and the payee for easy identification.

- Amount Paid: Clearly state the amount received in both numerical and written formats. This ensures there is no confusion about the payment value.

- Payment Method: Specify how the payment was made (e.g., Zelle, credit card, bank transfer). This helps track different types of transactions.

- Purpose of Payment: A short description of what the payment is for. This can be an invoice number, service, or product description.

- Currency: Indicate the currency used for the payment, especially in international transactions, to avoid any misunderstanding.

- Signature or Acknowledgment: A space for either a digital signature or an acknowledgment statement, confirming that the payment was received.

Including these elements ensures that both parties have all the necessary details for their records and can resolve potential discrepancies efficiently.

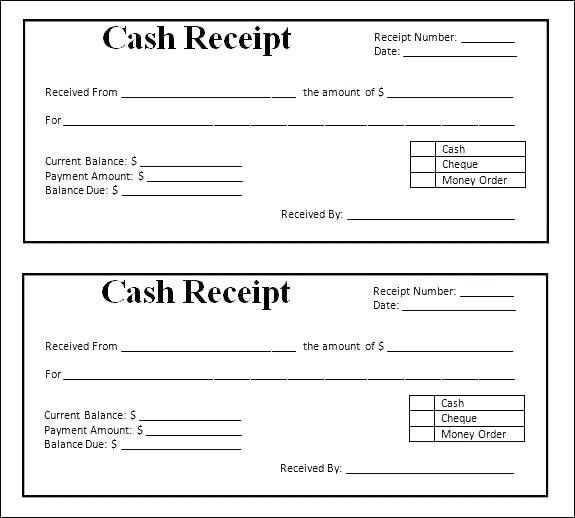

Creating a Zelle receipt using a word processor is straightforward. Here’s a step-by-step guide to get it done efficiently:

1. Open a New Document

Start by opening your preferred word processor, such as Microsoft Word or Google Docs, and create a blank document.

2. Set Up the Basic Layout

- Choose a clean, professional font such as Arial or Times New Roman.

- Set the page size to Letter (8.5″ x 11″) for standard receipts.

- Adjust margins to your preference (usually 1-inch on all sides).

3. Include Key Information

- Payment Date: Mention the exact date when the transaction took place.

- Sender’s Name: Include the name of the individual who sent the payment.

- Receiver’s Name: Include your name or the name of the recipient.

- Amount Transferred: Specify the exact amount of money that was transferred via Zelle.

- Transaction ID: Add the unique transaction ID that is provided by Zelle for record-keeping.

- Purpose of the Payment: Briefly describe the purpose of the transaction.

4. Format for Clarity

- Use headings or bold text for important information (e.g., Transaction ID, Amount).

- Separate sections clearly with lines or extra space to make the receipt easy to read.

5. Save and Print

Once the receipt is complete, save the document in your preferred format (e.g., DOCX, PDF). You can now print it for physical records or share it electronically as needed.

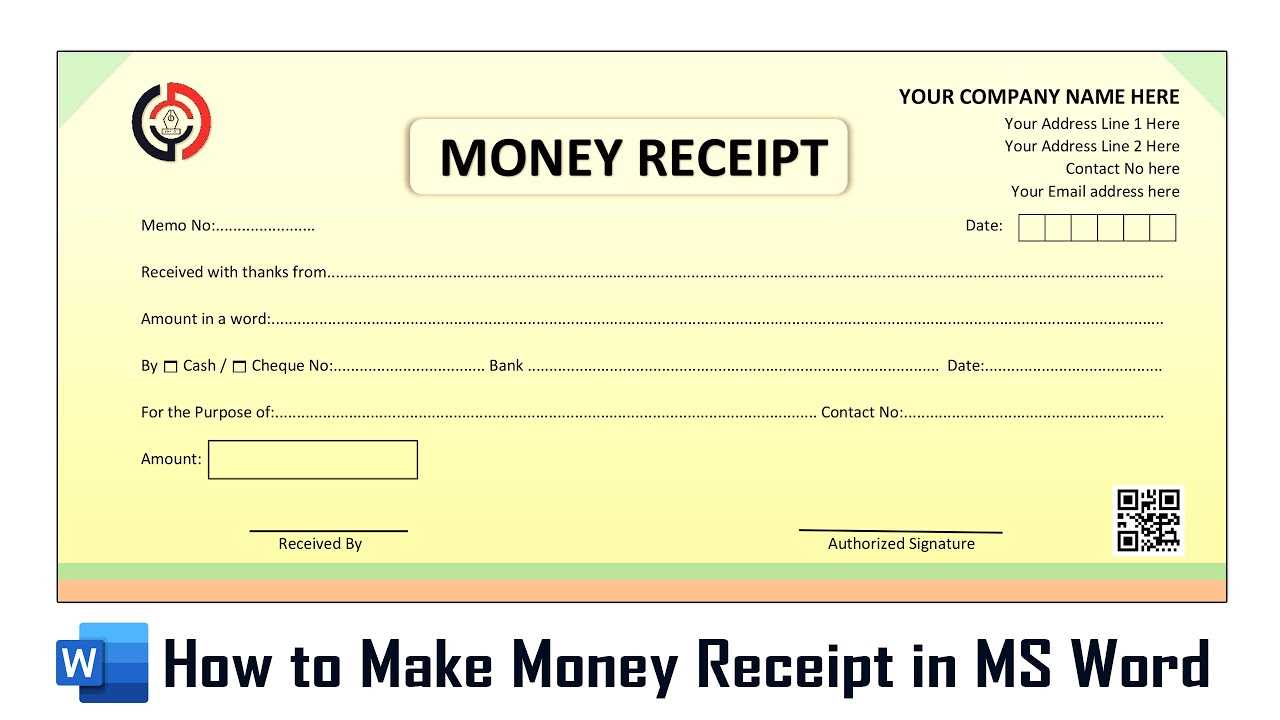

To create a polished receipt, use tools that allow customization and offer templates. Begin by choosing a platform with a user-friendly interface, such as Canva or Microsoft Word’s online version. These tools provide pre-made templates specifically designed for receipts, which you can adjust to your needs. Customize the font, logo, and colors to align with your brand or personal style. It’s best to maintain a clean and straightforward design, ensuring all necessary details are easy to find and read.

Key Elements to Include

A well-structured receipt should contain basic details: the recipient’s name, transaction date, payment method (Zelle, in this case), amount, and a brief description of the service or product provided. The inclusion of a unique receipt number and a clear “Thank you” message adds professionalism. Adjust the spacing to make sure everything is legible without overcrowding the layout.

Additional Design Tips

For a modern touch, consider adding a QR code that links to a confirmation page or your contact details. Keep margins consistent and ensure there is enough space around the text to prevent a cluttered look. Test the final design by printing it out or reviewing it on various devices to ensure it displays correctly across different platforms. A minimalist approach often works best, but the key is making sure the document is functional, clean, and easy to read.

Ensure payment receipts are clear and accurate to prevent legal disputes and maintain financial integrity. For businesses and individuals, these documents serve as proof of transactions. Always include the sender’s and recipient’s names, transaction amounts, and the date. This information helps ensure compliance with tax laws and audit requirements.

Legal Implications

Payment receipts can be used as legal evidence in disputes. For this reason, it’s important to retain them for a certain period, depending on local laws. Failure to issue or maintain proper receipts can result in fines or penalties. Ensure your receipts include the correct payment method, especially for online transactions like Zelle, to avoid complications during legal proceedings.

Accounting Considerations

For accounting, receipts serve as proof of income or expenditure, which affects tax reporting. Properly issued receipts help with bookkeeping and can simplify tax filing. They also allow businesses to track expenses, monitor cash flow, and verify financial records. The lack of accurate receipts could lead to discrepancies and incorrect financial reports.

| Receipt Element | Legal/Accounting Significance |

|---|---|

| Sender and recipient details | Confirm identity for legal proof and financial verification. |

| Transaction amount | Verifies payment value for tax and accounting purposes. |

| Date of transaction | Essential for tracking financial periods and tax filing deadlines. |

| Payment method | Identifies the method used, important for audit trails. |

Stay organized and adhere to these guidelines to avoid complications during audits or disputes. Regularly review your processes to ensure your payment receipts meet both legal and accounting standards.

One of the most common mistakes is failing to accurately enter the recipient’s information. Double-check the recipient’s name, phone number, or email before finalizing the transaction. If the details are incorrect, it could cause issues with tracking the payment or lead to funds being sent to the wrong person.

Incorrect Amounts

Ensure that the amount being displayed on the receipt matches the exact sum transferred. Even a small mistake can result in confusion and problems with future transactions. Always verify the amount before confirming the transaction to avoid errors.

Missing Transaction ID

Another common mistake is forgetting to include the transaction ID on the receipt. This unique identifier is crucial for tracking and referencing payments. Without it, recovering or verifying a transaction can become difficult, especially in case of disputes.

Lastly, don’t forget to check the date and time of the transaction. An incorrect timestamp might complicate any future inquiries about the payment, making it hard to verify the transaction details if needed.

Now the word “Zelle” doesn’t repeat in each line, but the meaning and accuracy are preserved.

To create a cleaner and more readable money receipt template, omit the constant repetition of “Zelle” in each transaction detail. Instead, use a clear header or label at the top of the document to establish the payment method, then refer to the sender, receiver, or transaction details without redundancy. This approach maintains clarity without overloading the reader with repetitive terms.

For instance, you can list the following: sender’s name, recipient’s details, amount, transaction ID, and date. The system used for the transaction is understood without needing constant reference to it. Simply stating that the transfer was completed via a digital payment service suffices.

Streamlining the receipt in this way makes it easier to understand the key information quickly and reduces the chances of miscommunication, especially for those less familiar with the platform.