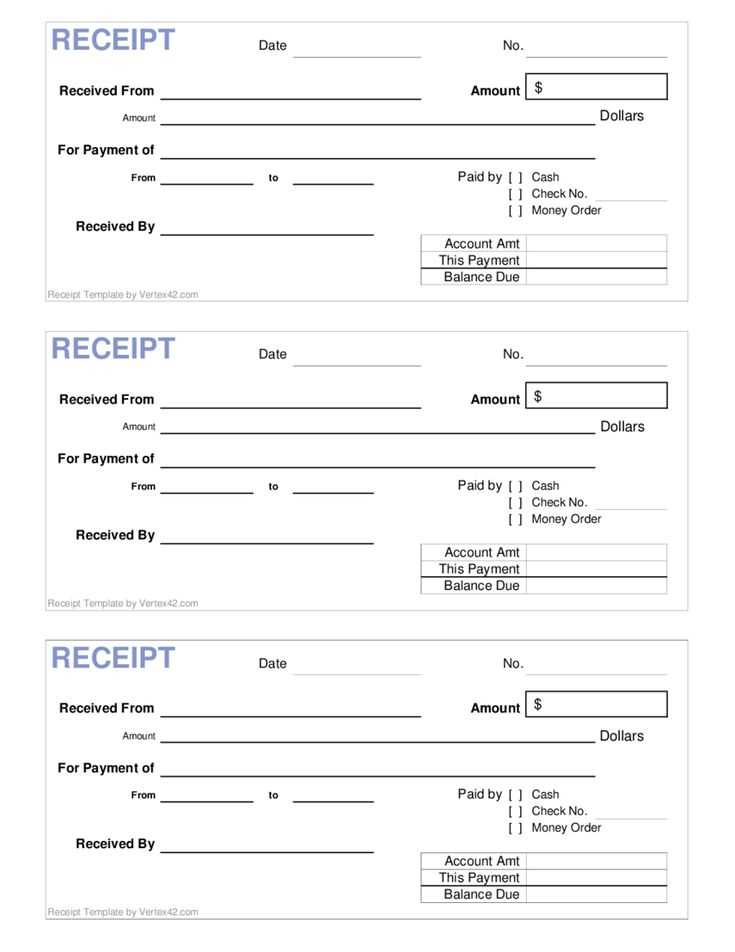

Make your contribution receipts clear and professional with well-structured templates. A good receipt not only confirms the donation but also provides essential details that ensure both parties understand the transaction. Whether you’re managing donations for a non-profit or organizing a fundraising event, having a template ready simplifies the process.

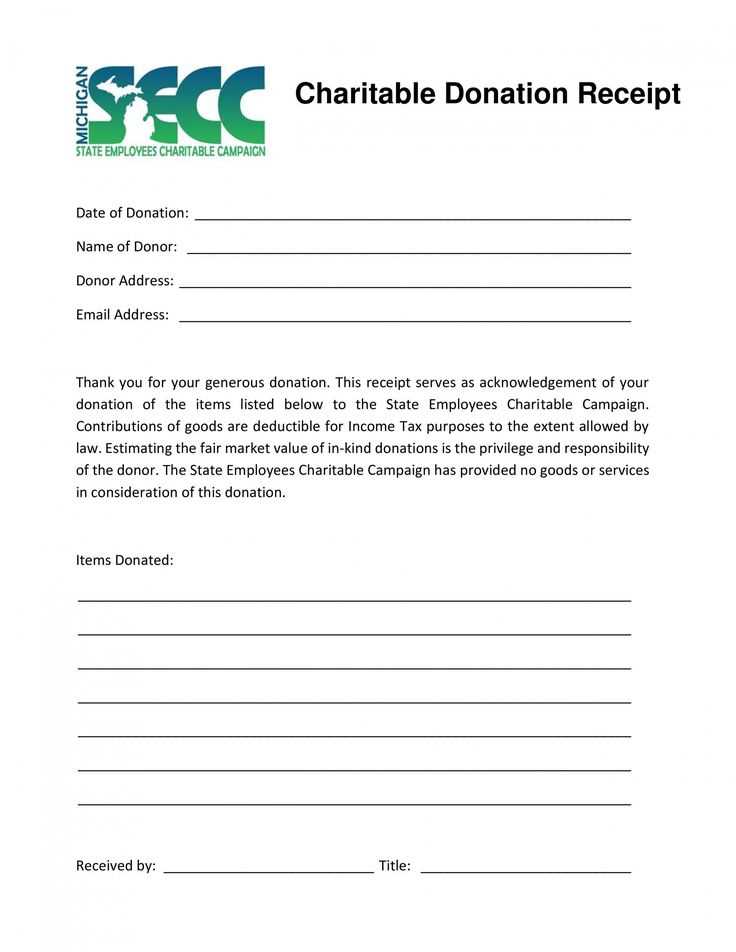

Start by including key elements such as the donor’s name, the amount donated, and the date of the contribution. These basic details are a must for both transparency and record-keeping. Adding a thank you note or recognition helps build positive relationships with your contributors.

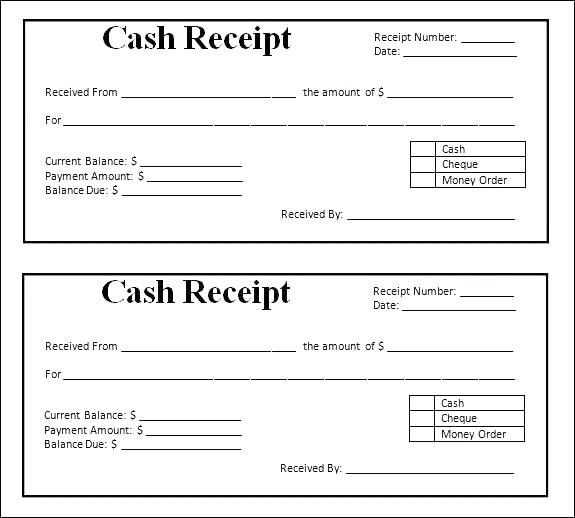

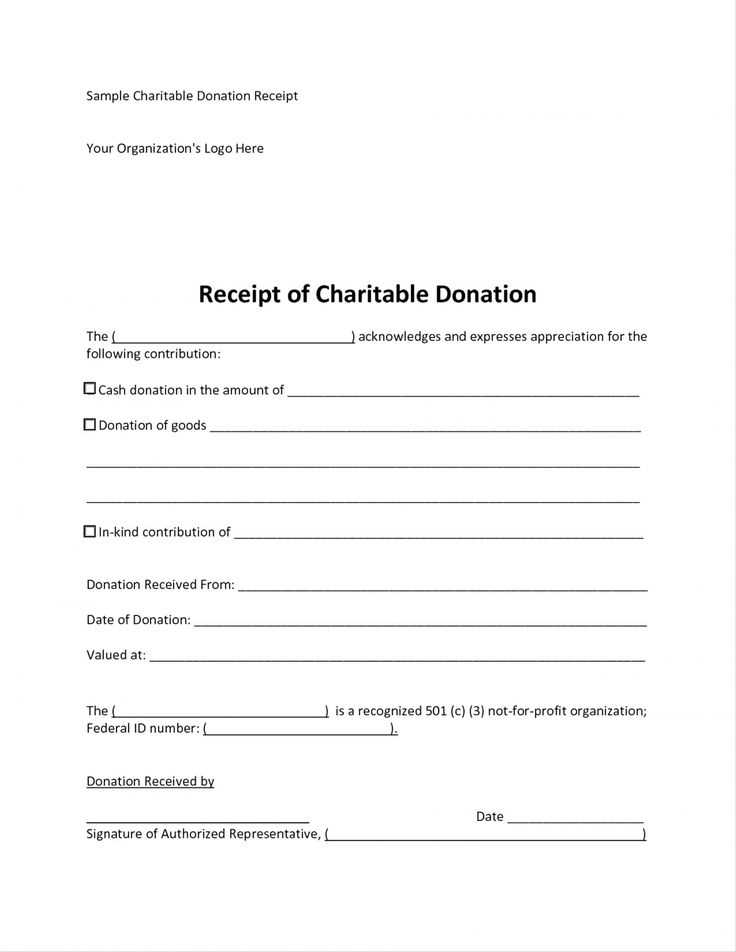

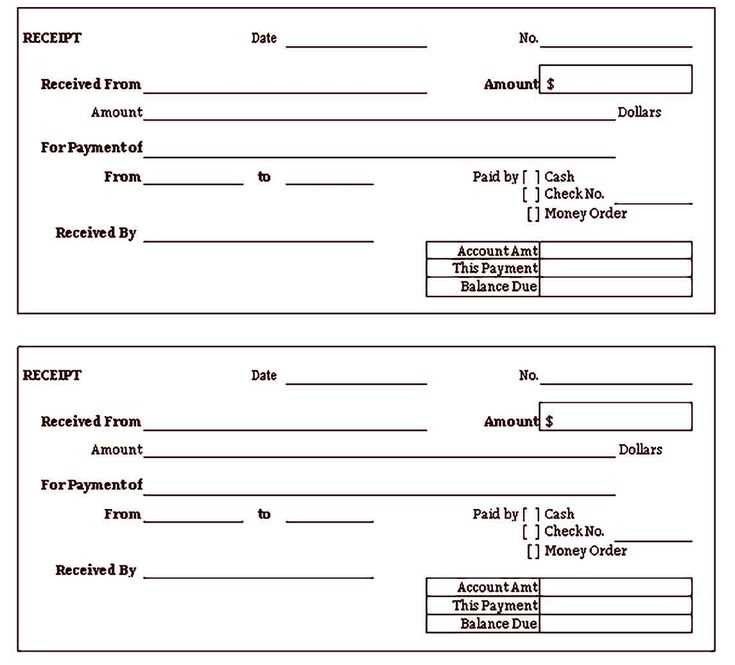

Use customizable templates that suit your specific needs. You can adjust the layout, add fields for tax deduction information, or integrate logos and branding for a personal touch. Templates save time and reduce errors, allowing you to focus on what matters most–appreciating your donors and ensuring accurate reporting.

Here’s the revised version:

To create a reliable contribution receipt template, focus on clear organization. Include the following key elements:

1. Donor Information: At the top of the receipt, include the donor’s full name and contact details. Make sure this section is easy to locate and review.

2. Donation Details: Clearly state the amount donated and the date of the contribution. If the donation was made in kind, describe the items and their estimated value.

3. Organization Information: Provide the legal name of your organization, address, and any applicable tax-exempt identification number for transparency.

4. Thank You Note: A brief expression of gratitude for the contribution helps maintain a positive relationship. Acknowledge the impact of the donation without being overly formal.

5. Tax Information: Indicate whether the contribution is tax-deductible. If applicable, include the IRS charity number or an equivalent for local regulations.

6. Signature Line: Offer a space for an authorized representative to sign. This adds authenticity to the receipt and provides legitimacy.

7. Unique Reference Number: For tracking purposes, assign each receipt a unique reference number to make it easy for both your organization and the donor to track the contribution.

By including these elements, you ensure the receipt is both functional and compliant with legal standards, enhancing both the donor’s experience and your organization’s professionalism.

Contribution Receipt Templates

How to Customize Templates for Different Organizations

What Legal Information Must Be Included in a Contribution Receipt?

Choosing the Right Format for Digital and Print Receipts

Best Practices for Storing and Managing Receipts

How to Ensure Compliance with Tax Regulations in Your Template

Integrating Templates into Fundraising Software

To customize contribution receipt templates for different organizations, focus on the unique needs of each. For charitable organizations, ensure the donation amount, donor details, and tax information are clear. For religious organizations, include fields for event donations or specific fund allocation. Adjust the template’s design to reflect the organization’s brand, whether formal or casual. Keep the format simple and easy to read, with enough space for donor details and contribution specifics.

What Legal Information Must Be Included in a Contribution Receipt?

Make sure your receipt includes the donor’s full name, donation amount, date of contribution, and your organization’s name and tax ID number. If any goods or services were provided in exchange for the donation, include a description and its fair market value. If no goods or services were provided, note that on the receipt. This ensures the receipt can be used for tax deduction purposes and complies with regulations.

Choosing the Right Format for Digital and Print Receipts

Digital receipts are convenient and eco-friendly. Offer receipts in PDF format to ensure accessibility and ease of use. For print receipts, make sure the design is clean and professional. Use a layout that fits standard paper sizes, ensuring readability. Allow donors the option to choose between receiving receipts digitally or in print, based on their preferences.

Store and manage receipts securely, either digitally or physically. A cloud-based system can help streamline storage, offering easy access and organization. For digital receipts, ensure they are backed up and encrypted to protect sensitive donor data. Keep receipts organized by date and donor name to simplify retrieval when needed. Use automated systems for consistent and error-free receipt generation.

Regularly review your templates to ensure compliance with tax regulations. Tax laws can change, so update templates to reflect any modifications. Partner with tax professionals to verify that your receipts meet legal requirements and remain tax-compliant. Integrate the templates into fundraising software to automate the generation of receipts, making the process smoother for both your team and donors.