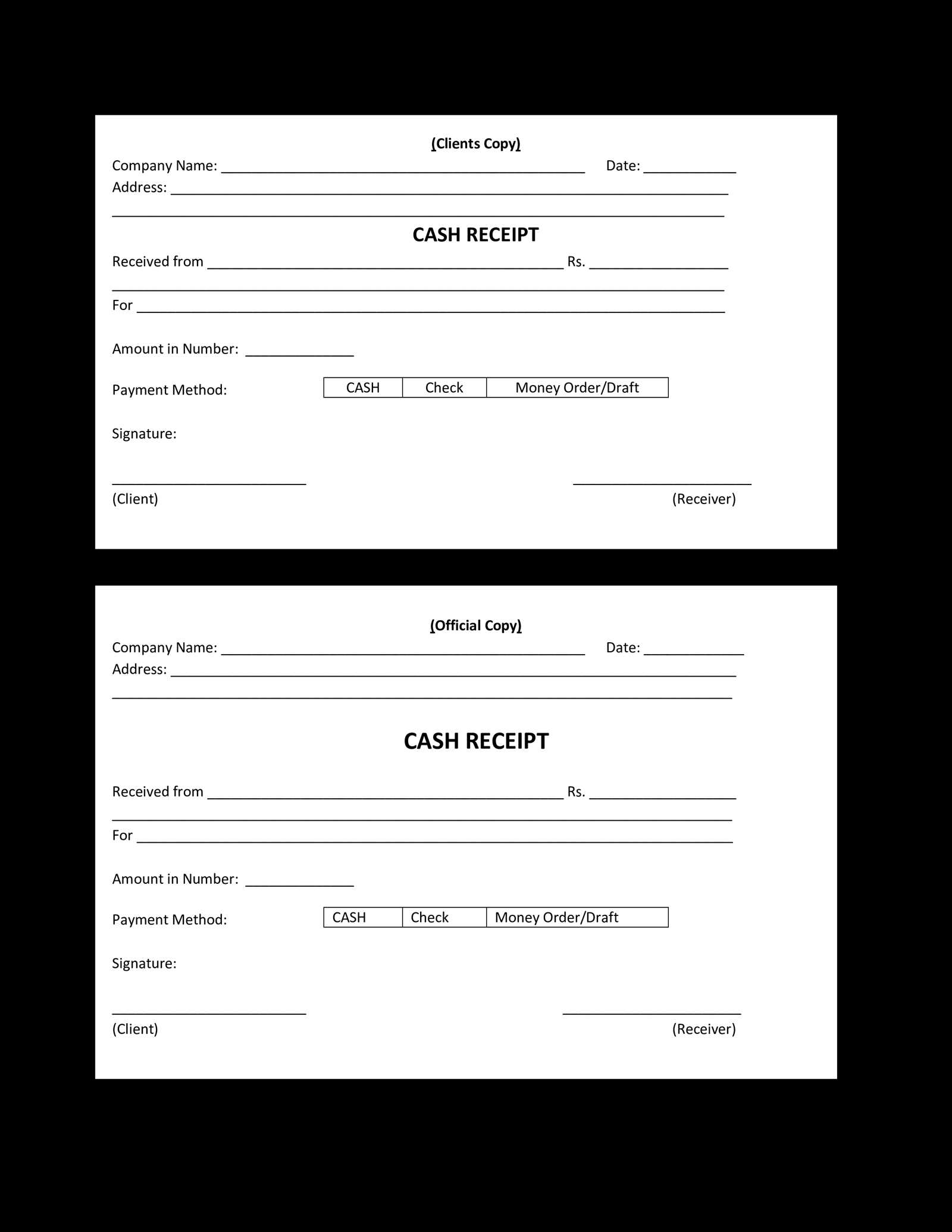

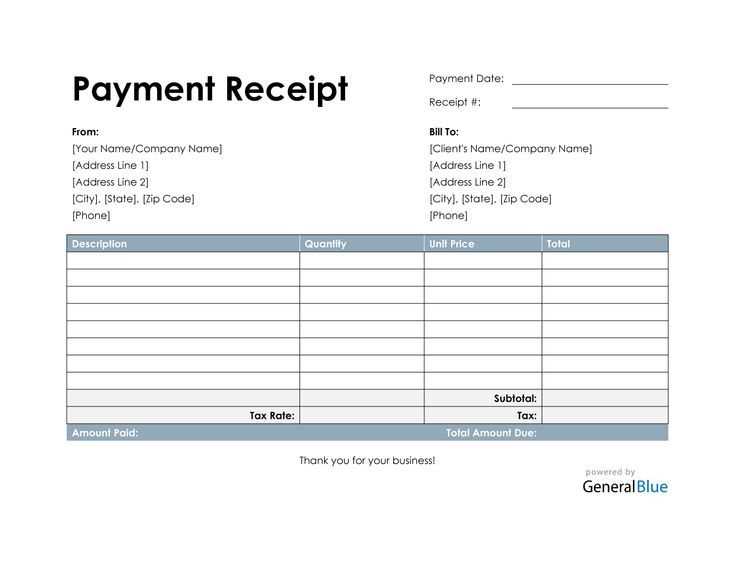

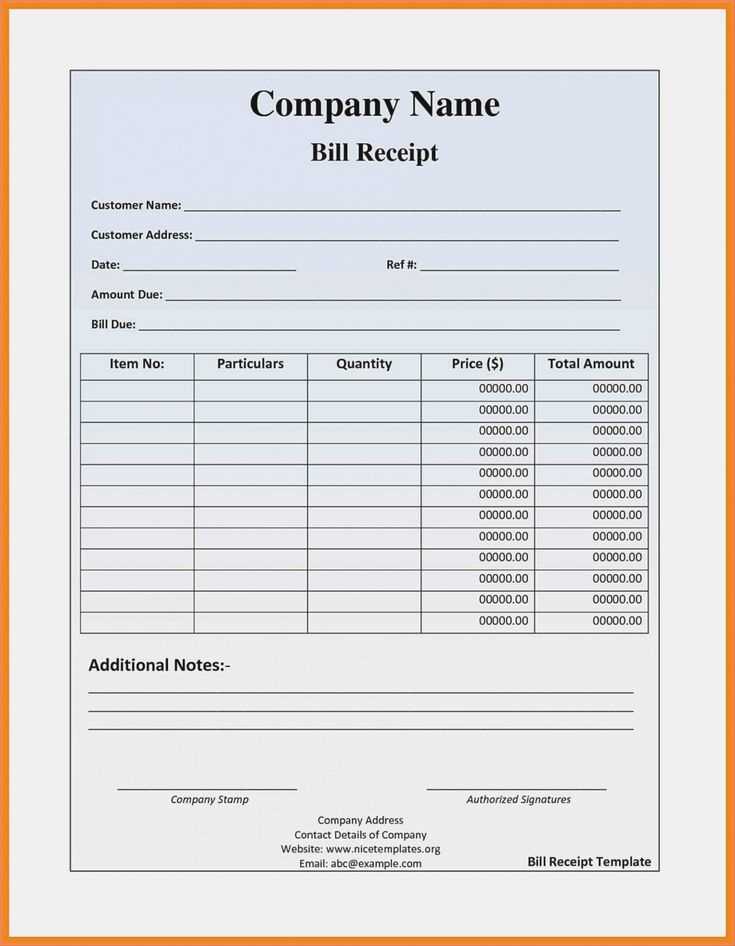

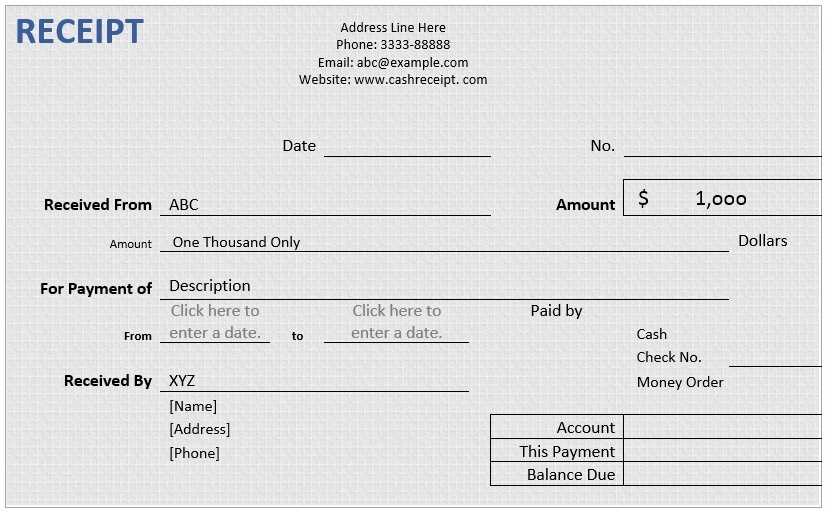

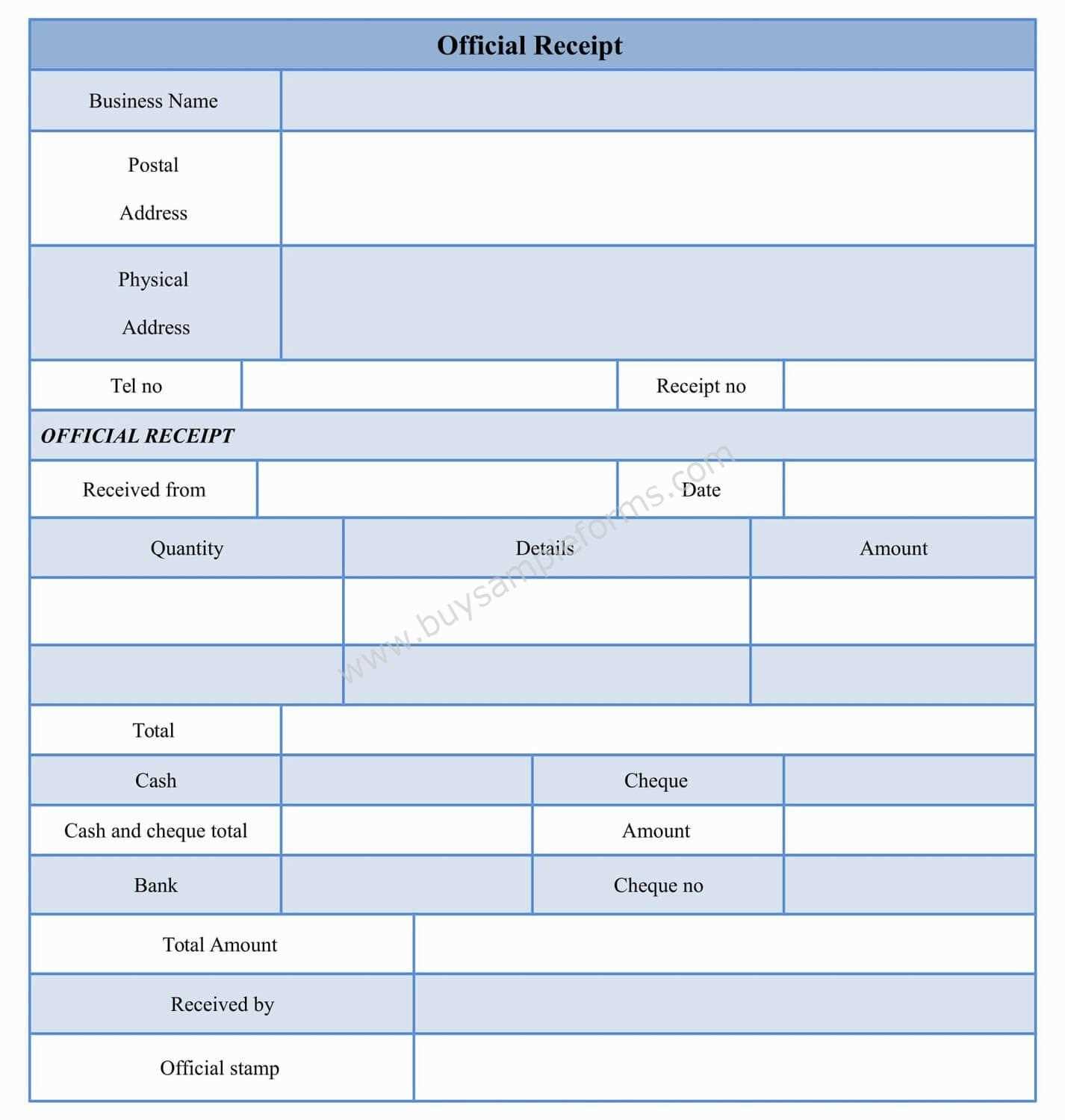

Ensure every purchase is properly documented with a structured receipt template. Whether you’re managing a small business, selling personal items, or keeping records for tax purposes, a well-formatted receipt provides clear proof of the transaction. Choose a template that includes key details such as item descriptions, prices, payment method, and seller information.

For professional use, consider templates with automatic calculations for subtotals, taxes, and totals. Digital formats like PDF or Excel make sharing and archiving easier, while printable versions offer a quick paper-based solution. Including a section for signatures or notes can further enhance the receipt’s credibility.

Customization is essential for branding and clarity. Add a company logo, adjust fonts for readability, and ensure all necessary legal information is present. If dealing with international customers, multiple currency options and tax rate adjustments may be beneficial.

Save time by using pre-designed templates available online, or create a custom version tailored to specific needs. A properly structured receipt not only protects both buyers and sellers but also simplifies financial tracking and dispute resolution.

Buying Receipt Template: Key Aspects and Practical Applications

Choose a format that aligns with your needs. A structured layout ensures clarity, while a simple design speeds up processing. Include sections for item descriptions, prices, and tax calculations to maintain accuracy.

Ensure legal compliance by incorporating necessary business details, including the seller’s name, address, and tax identification number. For digital transactions, add payment confirmation details and a unique reference number for tracking.

Optimize usability by making fields editable if the template is for repeated use. Predefined categories help standardize entries, reducing errors and inconsistencies. A well-organized template saves time and enhances record-keeping efficiency.

For businesses, integrating a receipt template with accounting software streamlines financial tracking. Automated calculations prevent discrepancies, while digital storage simplifies retrieval and auditing.

Regularly update the template to reflect tax changes and industry standards. Customization options, such as branding elements and payment method specifications, enhance professionalism and adaptability.

Core Elements to Include in a Purchase Receipt

Every purchase receipt should clearly outline key transaction details to ensure transparency and easy record-keeping. Missing information can lead to disputes or confusion, so include the following elements in a structured format.

Key Information to Display

Ensure that all necessary data points are present. Organizing them in a clear manner improves readability and usability.

| Element | Description |

|---|---|

| Receipt Number | A unique identifier for tracking and reference. |

| Date of Purchase | The exact date when the transaction occurred. |

| Seller Details | Business name, address, and contact information. |

| Buyer Information | Name and contact details if applicable. |

| Itemized List | Each product or service with quantity, price, and total cost. |

| Subtotal | Cost before taxes or additional charges. |

| Taxes and Fees | Any applicable taxes or service fees. |

| Total Amount | The final amount paid by the customer. |

| Payment Method | Indication of cash, card, or other payment options. |

| Return Policy | Brief note on refund or exchange terms. |

Enhancing Clarity

Use consistent formatting and spacing for legibility. If applicable, include a barcode or QR code for digital verification. A well-structured receipt not only builds trust but also simplifies financial tracking for both parties.

Formatting Guidelines for Clear and Professional Documentation

Use a consistent font size and type to maintain readability. A sans-serif font like Arial or Helvetica at 11–12pt ensures clarity, while larger headings improve navigation.

Align text to the left for a structured appearance. Justified text may create uneven spacing, reducing readability.

Apply bold formatting sparingly for emphasis. Reserve it for key labels, section titles, or important details rather than entire sentences.

Keep margins at least 1 inch on all sides. This prevents overcrowding and allows space for annotations.

Use bullet points for lists to enhance readability. Numbered lists work best for sequential steps, while unordered lists suit grouped information.

Ensure line spacing of at least 1.15 to improve legibility. Excessively tight spacing makes text hard to scan, while too much white space wastes space.

Structure sections with clear headings. A logical hierarchy (H2 for main topics, H3 for subtopics) organizes content effectively.

Maintain uniform date and number formatting. Use YYYY-MM-DD for dates and separate large numbers with commas for clarity.

Use tables for structured data where necessary. Proper column alignment and clear headers make comparisons easy.

Review spacing between elements. Avoid crowding text against borders or images to prevent a cluttered look.

Legal Considerations When Designing a Transaction Record

Ensure that every transaction record includes key details required by law, such as date, amount, and parties involved. Missing critical elements can render the document invalid or lead to disputes.

Mandatory Information

- Identification of Parties: Full legal names and contact details of the buyer and seller.

- Transaction Date: Clearly specify when the exchange took place.

- Itemized List: A detailed description of goods or services provided, including quantities and unit prices.

- Payment Terms: Method of payment, due date, and any agreed-upon conditions.

- Applicable Taxes: Clearly state any sales tax, VAT, or other mandatory charges.

Legal Compliance

- Electronic Records: Ensure digital copies meet local e-signature laws if used as legal proof.

- Retention Period: Store records for the required duration to comply with tax and business regulations.

- Privacy Protections: Mask sensitive information where necessary to comply with data protection laws.

- Refund and Warranty Clauses: If applicable, outline return policies and guarantees to prevent disputes.

Use clear language to avoid misinterpretation. Ambiguities can weaken enforceability, making disputes harder to resolve. Regularly update templates to align with regulatory changes and industry standards.

Customizable Fields to Adapt the Receipt for Various Needs

Modify key fields to match specific transaction requirements. Adjust these elements to improve clarity and compliance:

- Business Information: Include company name, address, tax ID, and contact details. Ensure consistency with branding.

- Customer Details: Capture buyer’s name, contact info, and billing address for better record-keeping.

- Transaction Date & Time: Use a format that aligns with local regulations and enhances tracking.

- Itemized List: Specify product names, descriptions, quantities, and unit prices. Add SKU numbers for inventory management.

- Taxes & Discounts: Display tax rates, applied discounts, and subtotal calculations clearly.

- Payment Method: Indicate whether the payment was made via cash, card, bank transfer, or other methods.

- Custom Notes: Add messages such as return policies, warranty details, or special terms.

Ensure the format remains clean and readable. Test different layouts to find the most user-friendly arrangement.

Common Mistakes to Avoid in Structuring a Purchase Record

Skipping Unique Identifiers

Omitting a unique transaction number creates confusion when tracking orders. Each record should include a sequential or randomized identifier to prevent duplication and ensure easy reference.

Neglecting Date and Time Stamps

Leaving out the exact date and time of a transaction makes it difficult to verify purchases later. Always include a timestamp formatted as YYYY-MM-DD HH:MM to maintain consistency.

Ignoring Payment Details

A missing payment method can lead to disputes and accounting issues. Clearly specify whether the purchase was made via card, cash, or transfer, and include partial payment references where applicable.

Forgetting Item Descriptions

Vague product descriptions cause misunderstandings and disputes. Include clear names, quantities, unit prices, and any applicable discounts to provide a full breakdown.

Omitting Buyer and Seller Information

Both parties should be identifiable in the record. Ensure names, addresses, and contact details are included, especially for transactions requiring future communication.

Excluding Tax and Additional Charges

Failing to itemize taxes, fees, or shipping costs can lead to incorrect calculations. Display each charge separately to ensure clarity and compliance with financial regulations.

By addressing these issues, you create a structured, reliable purchase record that eliminates confusion and ensures smooth financial tracking.

Digital vs. Paper-Based Receipts: Pros and Cons

Opt for digital receipts for their convenience and accessibility. With digital formats, you can easily store and retrieve receipts on various devices, reducing clutter. They are often sent directly to your email, ensuring you never lose track of them.

On the other hand, paper receipts offer a tangible option that some users prefer. They are easy to store in a physical filing system, which can be beneficial for those who dislike screens. Additionally, some retailers and service providers still primarily issue paper receipts, making them unavoidable in certain transactions.

Environmental impact plays a significant role in this discussion. Digital receipts reduce paper waste and contribute to eco-friendly practices. However, ensure that your digital storage is secure to protect sensitive information.

In terms of customer service, digital receipts often come with easy return processes. You can quickly forward an email or show a QR code at the store, streamlining refunds and exchanges. Paper receipts may require physical handling, increasing the risk of loss or damage.

Consider the ease of organization with digital receipts. Applications and software can automatically categorize and search your receipts, making financial tracking simpler. Paper receipts require manual sorting, which can be time-consuming.

Choose based on your lifestyle and preferences. If you frequently make purchases, digital receipts may save time and hassle. For those who appreciate physical documentation, paper receipts remain a solid option. Evaluate your needs and select the method that aligns best with your habits.