Choosing the right invoice or receipt template simplifies financial transactions and ensures clear documentation. A well-structured template helps businesses track payments, meet tax requirements, and maintain professional relationships with clients.

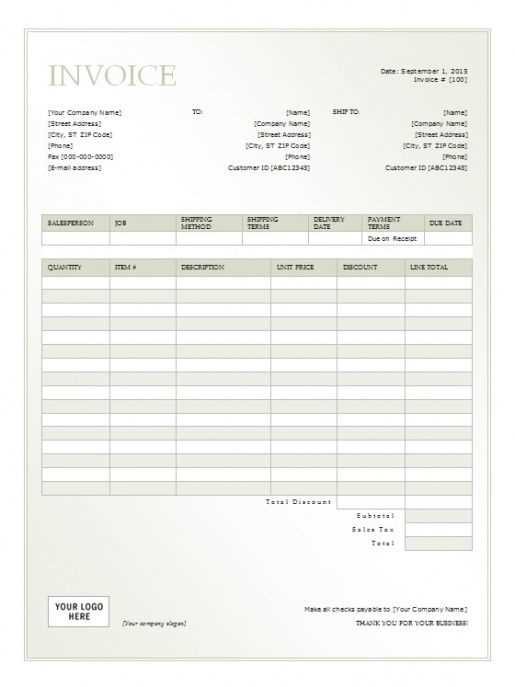

Invoices typically include a breakdown of services, pricing, and payment terms, while receipts confirm that a transaction has been completed. Both documents should contain essential details such as company name, date, unique reference number, and client information.

For small businesses and freelancers, using pre-designed templates in PDF, Excel, or Word format saves time and reduces errors. Online generators and accounting software provide customizable options with automated calculations, tax integration, and branding features.

Clarity and consistency improve financial management. Ensure templates include payment deadlines, accepted methods, and any applicable taxes. A simple, professional design enhances readability and helps clients process payments faster.

Using a structured template eliminates confusion and ensures compliance with accounting standards. Regular updates based on business needs keep records accurate and transactions transparent.

Here is the revised version with reduced repetition of “Invoice”, “Receipt”, and “Template”, while maintaining meaning and correctness:

To simplify the process of creating documents for transactions, you can follow this straightforward format:

Document Header

- Company or business name

- Contact details

- Date of issue

- Unique document number

Transaction Details

- Client or customer name

- Description of goods or services provided

- Amount due

- Payment terms

This streamlined approach ensures clarity, with essential elements for both the payer and payee to track the financial exchange efficiently. By eliminating excess wording, the format remains clean and functional, making it easy for both parties to understand the transaction at a glance.

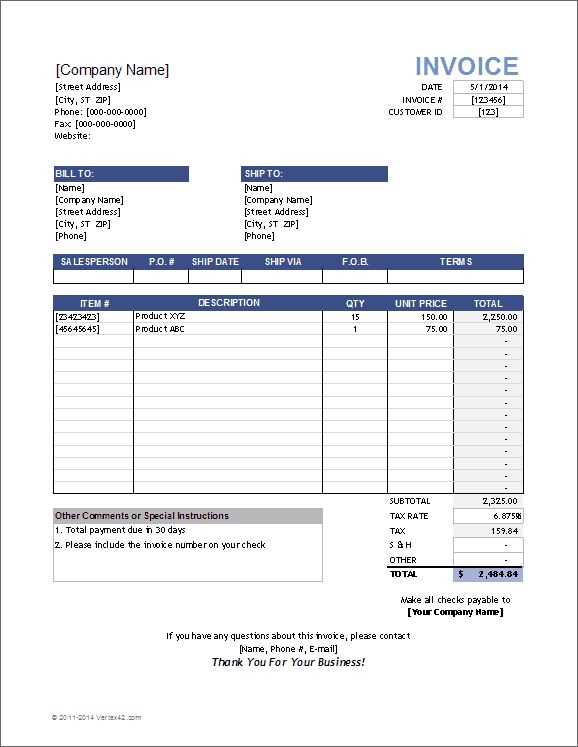

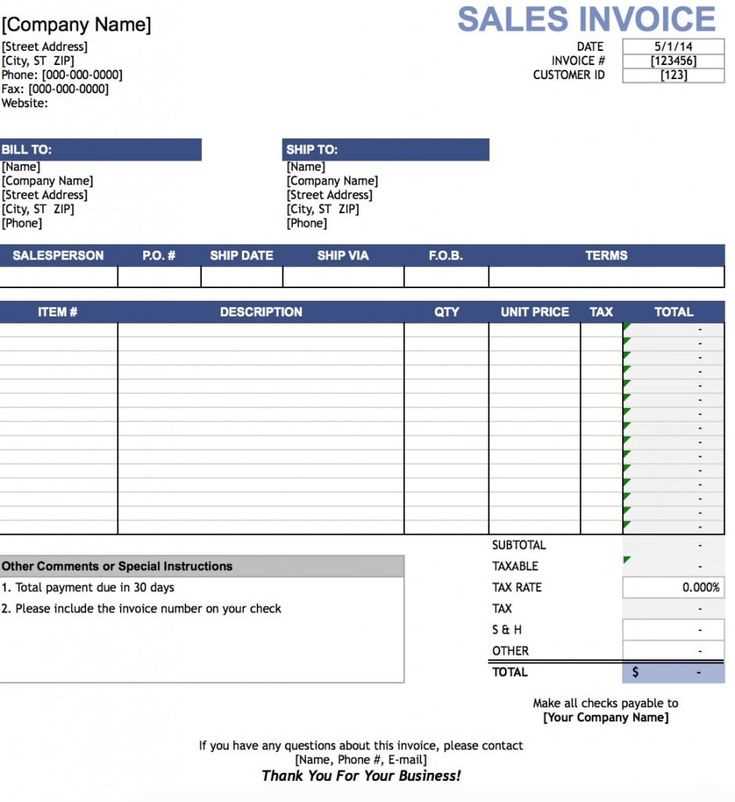

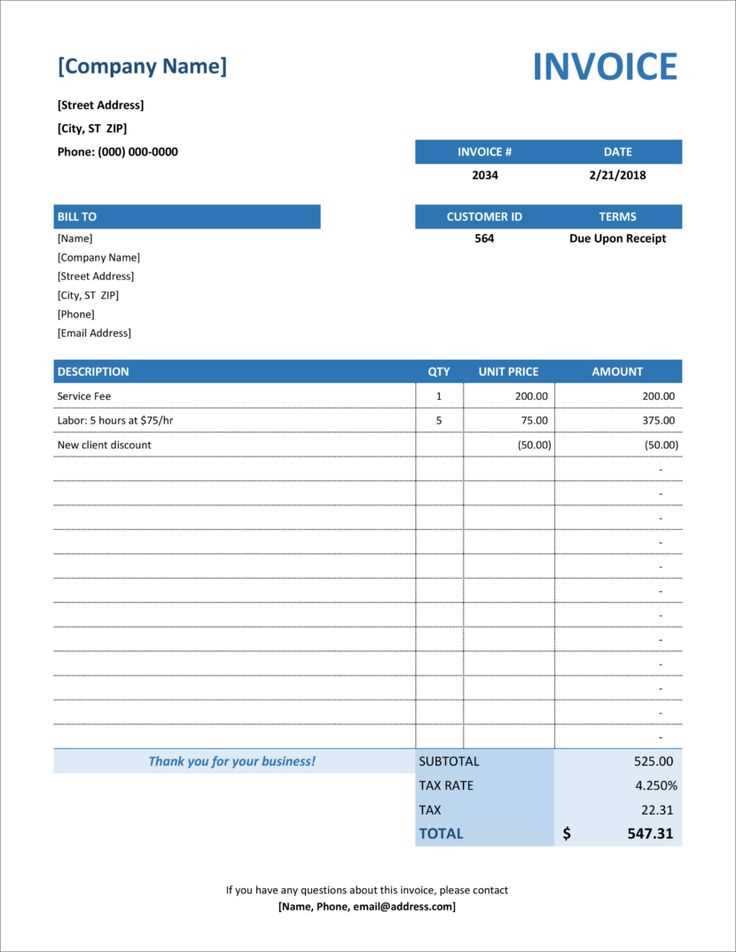

- Invoice or Receipt Template: Practical Guide

Use a clear format for both invoices and receipts to ensure accuracy and professionalism. Begin with your business name and contact details, followed by the recipient’s information. For invoices, include an invoice number and a due date. Each item should be listed with a description, quantity, unit price, and total amount. For receipts, highlight the payment method and date of transaction.

Double-check that the template includes tax details if applicable. Specify whether the price is inclusive or exclusive of taxes. A breakdown of charges can help the customer understand what they are paying for. Keep it simple, but ensure all required fields are included.

Ensure your template includes a section for terms of payment, indicating when payments are due and how late payments will be handled. This avoids confusion and improves cash flow management.

Invoices and receipts are distinct in their purpose and function. An invoice serves as a request for payment, detailing goods or services provided, along with the amount owed. It includes payment terms, deadlines, and may also specify penalties for late payments. On the other hand, a receipt is proof of payment, issued after a transaction is completed. It confirms the buyer has paid the specified amount for the goods or services received.

Purpose and Function

- Invoice: Used to request payment for goods or services before payment is made.

- Receipt: Issued after payment is made to confirm the transaction.

Information Included

- Invoice: Typically includes the seller’s contact details, payment terms, invoice number, and itemized list of products or services.

- Receipt: Contains the payment amount, date of transaction, and often the method of payment (cash, credit, etc.).

Begin with clear contact details for both the issuer and the recipient. Include the full names, addresses, and phone numbers to ensure any necessary follow-up is easy. This transparency avoids confusion if there are any issues regarding the payment.

Include a unique invoice number to track each transaction efficiently. This helps in organizing and referencing past invoices for future correspondence or audits. The invoice date is another key detail, establishing the timeline for payment and any potential late fees.

Describe the services or products provided with a detailed breakdown. Specify quantities, unit prices, and applicable taxes. Make sure the descriptions are clear and concise, preventing any ambiguity that could delay payment.

Clearly list the total amount due, making sure any discounts, additional charges, or tax rates are visible and accurately applied. This gives the recipient a clear view of their financial obligation without needing further clarification.

State payment terms, including deadlines and acceptable payment methods. Indicate if late fees apply after a specific date, to encourage timely payment. This transparency reduces misunderstandings and promotes prompt transactions.

Design your receipt template to match your business needs. Include the date, a unique receipt number, and a clear breakdown of purchased items or services. Specify item descriptions, quantities, and prices. Adding tax information and any applicable discounts ensures clarity in the transaction details.

Make sure to add your business name, logo, and contact information. This builds recognition and gives customers an easy way to reach you. If applicable, include payment methods accepted or additional terms that may apply to the transaction.

Keep the design simple and professional. Avoid unnecessary elements that might confuse customers or make the receipt hard to read. Use a clean font and organize the information logically, with clear sections for items, totals, taxes, and payment method.

Consider offering digital receipts alongside printed ones. This adds convenience for customers and supports sustainability. For added security, include a transaction ID or barcode for easy verification.

When creating invoice or receipt templates, ensure the document complies with legal and tax requirements. A proper form should include necessary details such as the seller’s and buyer’s names, business registration number, tax identification number, and payment terms. These elements are often mandatory for tax reporting and auditing purposes.

Tax Reporting Requirements

In most countries, invoices are required for tax reporting. Businesses must report both income and VAT or sales tax. Therefore, an invoice or receipt template should clearly state the amount of tax charged. Failure to include this information may result in penalties during tax audits.

Recordkeeping for Tax Purposes

Maintain accurate records of all transactions. Tax authorities may require businesses to keep copies of invoices and receipts for several years. Electronic copies of these documents should be easily accessible and stored securely.

| Country | Minimum Retention Period for Tax Records |

|---|---|

| USA | 7 years |

| UK | 6 years |

| Germany | 10 years |

Ensure that invoices or receipts reflect the proper tax status (e.g., tax-exempt, taxable, etc.). Specific tax rates may apply depending on the product or service, and accurate classification helps avoid compliance issues.

PDF, Excel, and CSV are the most reliable formats for financial documents. PDF ensures secure and uneditable records, making it the standard for invoices and receipts. Its compatibility across all platforms and devices ensures a smooth experience for both creation and viewing.

For financial documentation, PDF stands out as the preferred option. It preserves the exact formatting and is universally recognized. PDFs can be password-protected and encrypted, offering added security. They also maintain their layout across different devices, making them ideal for official documentation that must remain consistent.

Excel and CSV

Excel files are useful when calculations, complex data analysis, or formulae are required. They provide flexibility and allow for easy editing. CSV files are widely used for transferring tabular data and are ideal for importing financial records into various systems or databases. Both formats allow for quick data handling, yet they are less secure compared to PDF.

When designing forms, prioritize clarity and simplicity. Ensure that fields are clearly labeled and easy to fill out, without overwhelming users with too many choices. Avoid using vague or complex terminology for field labels. For example, instead of “Please specify your preferred communication method,” simply use “Communication method.”

1. Overcomplicating Form Layout

Stick to a straightforward layout. Multiple columns can confuse users, especially on mobile devices. Use a single-column layout to improve readability and prevent errors. Group similar fields together, and consider utilizing sections for lengthy forms. This way, users can focus on one section at a time.

2. Missing Clear Instructions or Guidance

Be explicit with instructions. For example, if a date field requires a specific format, indicate this directly next to the input box. Use tooltips or short explanatory text where necessary to guide users through complex fields like payment or address forms.

3. Inconsistent Field Validation

Ensure that form validation is consistent. If a user enters an incorrect email address or an invalid phone number, provide immediate feedback. Display clear error messages, such as “Please enter a valid email address” instead of vague statements like “Error detected.”

4. Failing to Provide a Confirmation Message

Once a form is submitted, always show a confirmation message. It assures users that their submission was successful and gives them the next steps. Avoid leaving users unsure about whether their form was submitted or if action is still needed.

5. Not Optimizing for Mobile Devices

Test forms across devices. Forms should be responsive, ensuring that they work as effectively on a smartphone as they do on a desktop. Avoid large, non-responsive elements that may be difficult to navigate on smaller screens.

6. Overlooking the Importance of Accessibility

Design forms with accessibility in mind. Ensure proper contrast between text and background colors, add alt text to images, and allow screen reader compatibility. Test forms with accessibility tools to verify they meet the needs of all users.

To create a clear and functional invoice or receipt template, organize the content logically. Begin with the basic information at the top, such as the seller’s name, contact details, and invoice number. Ensure the buyer’s details are also present for easy identification. Use simple fonts and clean layouts to maintain clarity throughout.

Include Payment Information

Provide clear payment terms. Indicate the total amount due, including applicable taxes and discounts. State the payment methods accepted and any relevant due dates. Including this information upfront helps avoid confusion and ensures transparency in transactions.

Incorporate a Clear Breakdown

Divide the charges into categories if necessary. For example, list the items or services with their respective prices. If applicable, detail the quantity and unit price. This structure provides transparency and allows both parties to verify the accuracy of the billing details.