Need a Seatac taxi receipt template? Whether for business expenses, reimbursement, or personal records, having a proper receipt is essential. Most taxi services in Seattle-Tacoma International Airport (SEA) provide printed or digital receipts, but if you lost yours or need a customizable version, a template is a practical solution.

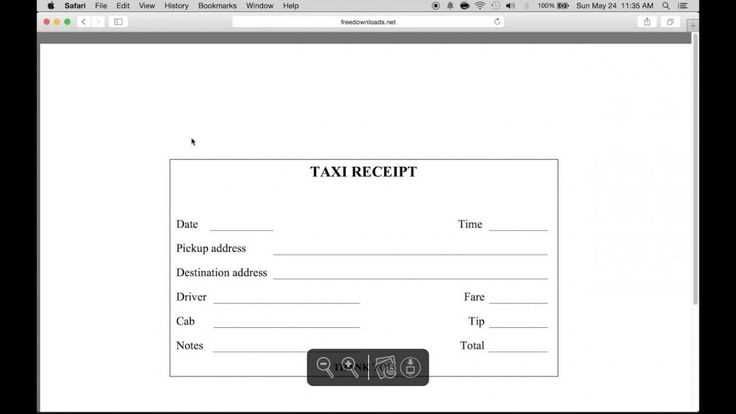

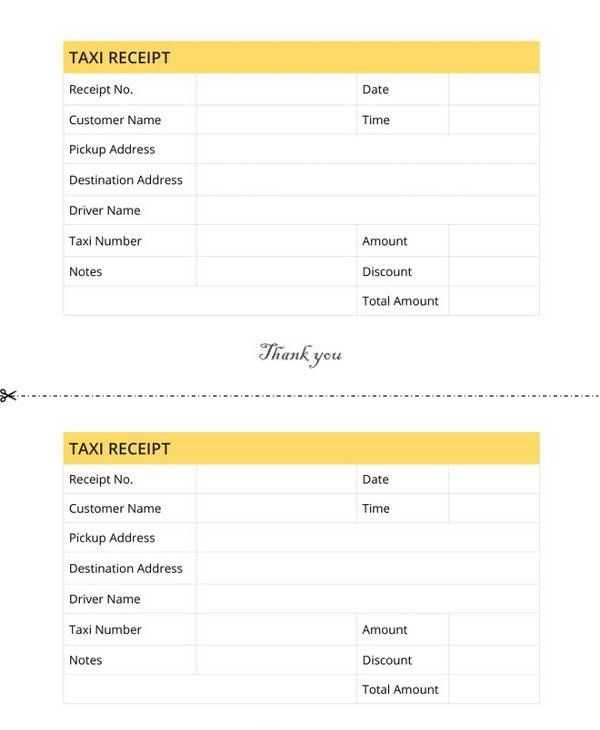

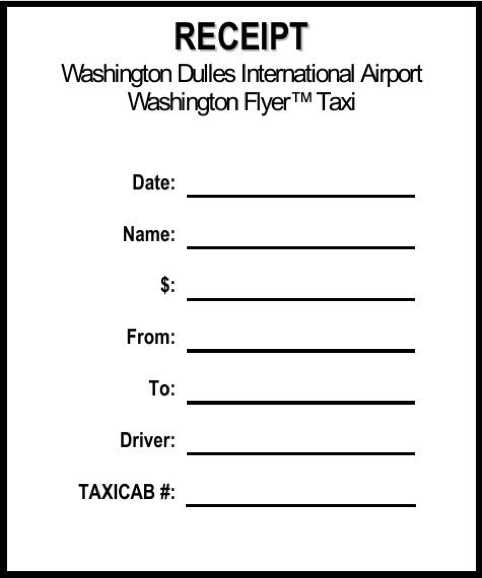

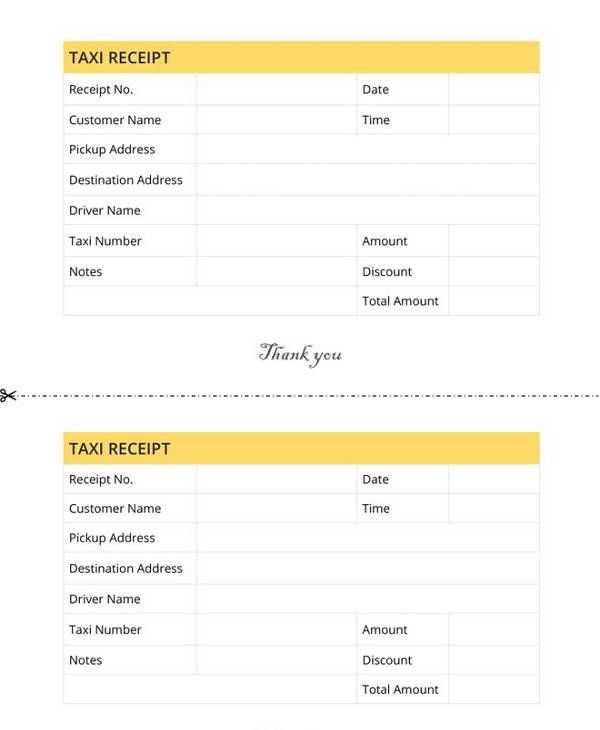

A well-structured receipt should include key details: date and time of the ride, pickup and drop-off locations, fare breakdown, payment method, and taxi company details. If you are creating one yourself, ensure accuracy to avoid issues with expense reports or tax deductions.

To generate a professional-looking receipt, use a template that allows easy customization. Many free options are available in PDF, Word, or Excel formats. Simply input the trip details and save or print the document. If you need a receipt with an official taxi logo, check if the company provides downloadable receipts through their website or customer support.

For frequent travelers, using an expense-tracking app with receipt generation features can save time. These tools can store ride details automatically and generate receipts instantly. If a manual template is preferred, keep a consistent format for all your taxi receipts to maintain clear financial records.

Here’s the revised version with redundant repetitions removed while maintaining the original meaning:

To create a clear and professional Seatac taxi receipt template, follow these guidelines:

Key Elements

Ensure the receipt contains the following information:

- Taxi company name and contact details

- Driver’s name or ID

- Pickup and drop-off locations

- Fare breakdown (base fare, distance, time, any additional charges)

- Tax amount

- Total amount paid

- Date and time of the ride

- Payment method used

Template Example

| Taxi Company | Seatac Taxi Co. |

|---|---|

| Driver | John Doe |

| Pickup Location | Seattle-Tacoma International Airport |

| Drop-off Location | 1234 Main St, Seattle, WA |

| Fare | $25.00 |

| Tax | $2.50 |

| Total | $27.50 |

| Payment Method | Credit Card |

| Date/Time | February 8, 2025, 2:00 PM |

This structure will ensure your receipt looks professional and contains all the necessary details.

- Seatac Taxi Receipt Template

For a clear and professional taxi receipt from Seatac, include the following details:

- Taxi Company Information: Include the name, address, and contact number of the taxi service.

- Passenger Information: List the passenger’s name or the name associated with the fare.

- Ride Details: Specify the date, time of pick-up, and drop-off locations. Mention the total trip distance and any intermediate stops.

- Fare Breakdown: Itemize the fare, including base rate, any additional charges (such as airport fees, tolls, or surcharges), and tips.

- Payment Information: Note the method of payment, whether it’s cash, credit, or debit, and the total amount paid.

- Taxi Driver Information: List the driver’s name and identification number or license number.

- Receipt Number: Assign a unique receipt number for easy reference and record-keeping.

Using this template format ensures clarity for both the taxi service provider and the passenger, helping with proper record-keeping and smooth financial transactions.

A Seatac taxi fare receipt should clearly present all necessary details to ensure transparency and easy reference. Below are the key components that make up a comprehensive and accurate receipt.

1. Taxi Information

The receipt must list the taxi company name, vehicle number, and driver identification. This allows for identification in case of inquiries or disputes. Some receipts also include the vehicle’s license plate number for additional verification.

2. Fare Breakdown

Clear breakdowns of the fare should be provided. This includes the base fare, any applicable surcharges (such as airport or night fees), and additional charges for waiting time or extra luggage. It’s important to list each component separately to avoid confusion.

3. Date, Time, and Location

Include the date and time of the ride, along with pick-up and drop-off locations. This ensures accuracy in case the receipt is needed for accounting or reimbursement purposes. For trips originating at Seatac Airport, specifying the exact terminal or gate is helpful.

4. Payment Information

Payment method details should be listed, whether the fare was paid by cash, card, or another method. If payment was made by card, the receipt should include the last four digits of the card number for reference.

5. Total Amount

The total fare amount should be displayed prominently, summarizing all individual charges. This is the amount paid for the service, including taxes or tips if applicable.

Creating a printable taxi receipt for Seatac is a straightforward process. Use a receipt template or create one from scratch with the essential details. Follow these steps to ensure all necessary information is included.

1. Include Ride Details

- Taxi company name and contact information

- Date and time of the ride

- Pickup and drop-off locations

- Fare breakdown: base fare, extra charges, tips

- Total amount paid

2. Add Payment Information

- Payment method used (credit card, cash, etc.)

- Last four digits of the card (if applicable)

Ensure the layout is clean and the text is legible. You can create a template using a word processor or online receipt generator for quick access. Save it as a PDF for easy printing.

Tailor your taxi receipt to meet business needs by including specific details that support tax reporting and expense tracking. Start by ensuring that the receipt displays the taxi service name, driver details, and trip information like date, time, and duration. For businesses, it’s key to have a clear breakdown of charges, including base fare, additional fees (e.g., airport fees), and tip amounts. This transparency aids in accurate accounting.

Include Business-Specific Details

Incorporate your company’s branding–such as logo and contact details–on the receipt. Adding a reference to the purpose of the trip (e.g., “business meeting” or “client visit”) ensures the expense can be easily categorized. If your business requires, add custom fields like project or department codes. This helps streamline expense reports and simplifies reimbursement requests.

Leverage Electronic Receipts

Opt for digital receipts, which allow you to store and organize data efficiently. Many Seatac taxi services offer electronic receipts that can be sent directly to your email or integrated into your accounting software. This not only reduces paper waste but also speeds up record-keeping, making it easier for your team to track business-related transportation costs.

Choosing between digital and paper receipts for your Seatac taxi ride depends on your preferences and specific needs. Each type offers distinct advantages and challenges that can affect your overall experience.

Digital Receipts

Digital receipts are increasingly popular due to their convenience. Once your ride ends, you can receive a receipt directly to your email or through a mobile app, reducing paper waste and simplifying storage. It’s easy to access past receipts at any time, making it simple to track your expenses for business or personal budgeting. They also provide an option for faster refund processes and can be shared electronically for any claims or reimbursements.

However, a downside is the reliance on technology. If you encounter connectivity issues or lack a smartphone, receiving a digital receipt could become a hassle. Additionally, some users might feel less secure when sharing personal information over the internet, raising privacy concerns.

Paper Receipts

Paper receipts are still widely used, providing a tangible proof of payment. You get an immediate record at the end of your ride, and it doesn’t require any technological setup. For those who prefer physical documents, paper receipts can be handy for in-person submissions or for keeping a physical trail of their transactions. Some passengers might feel more confident having a printed receipt in hand, especially if there’s an issue that requires quick resolution.

On the other hand, paper receipts can easily get lost, become damaged, or clutter up your wallet or office. Storing paper receipts over time can create unnecessary waste and take up physical space, which isn’t ideal for long-term record keeping.

In conclusion, digital receipts provide efficient and eco-friendly solutions for those comfortable with technology, while paper receipts remain a reliable option for those who prefer traditional methods. Consider what suits your preferences and needs the most when opting for your next receipt type after a Seatac taxi ride.

Taxi drivers and companies in Seatac must ensure their receipts comply with both local and federal tax regulations. Taxi receipts are important documents for both passengers and drivers, and they have specific legal requirements to meet. Drivers must provide a detailed breakdown of the fare, including the base rate, any additional charges (like luggage or tolls), and the total amount. The receipt should also include the taxi’s unique ID number, the driver’s name or ID, and the date and time of the ride.

From a tax perspective, taxi drivers in Seatac are subject to sales tax on the fare. The city’s tax laws require the collection of sales tax on fares, which should be reflected on the receipt. It’s crucial for taxi operators to report all income accurately for tax purposes. Failure to include the sales tax on receipts may result in penalties or audits from the Washington State Department of Revenue.

Additionally, receipts must be easily readable and stored in a way that allows for quick retrieval during audits. Drivers should be aware that providing false or incomplete receipts can lead to legal complications, including fines or business license suspension. Maintaining proper records is also beneficial for passengers who may need receipts for expense reports or tax deductions.

If you need a Seatac taxi fare receipt, there are a few reliable ways to obtain or create one. Here are some options:

- Official Airport Websites – Check Seatac Airport’s official website for downloadable templates. These often offer a standardized format, including all necessary information like fare details, pick-up and drop-off points, and date.

- Taxi Company Websites – Many local taxi companies operating at Seatac provide downloadable receipt templates on their websites. Visit the company’s page to see if they have a section for passenger resources or receipts.

- Online Receipt Generators – Several websites offer free receipt generators where you can input the details of your trip. You can create a custom Seatac fare receipt by entering data like trip cost, service provider, and location.

- PDF Templates – Look for downloadable PDF receipt templates from third-party sites that are easy to fill out manually or digitally. These templates typically offer blank fields to insert the necessary trip details.

- Taxi Apps – If you used a ride-hailing app like Uber or Lyft at Seatac, these apps often provide digital receipts directly in the app or through email after the ride is completed.

Make sure to verify that the generated receipt includes all key information for expense reporting or travel purposes, such as fare breakdown, service provider details, and travel date. Choose the method that fits your needs and allows for easy customization or retrieval of a valid receipt.

Seatac Taxi Receipt: Key Details You Need

When creating a receipt for taxi services at Seatac Airport, it’s vital to ensure clarity and accuracy. Include the driver’s name, vehicle details, and trip information. Be sure to state the start and end points of the trip, including the date and time, for a smooth transaction.

Breakdown of Essential Elements

The breakdown should list the base fare, any additional charges, and applicable taxes. Make the fare amounts clear, so passengers know exactly what they are paying for. Add a unique reference number to each receipt for easy tracking.

Formatting Tips

A clean and readable format is essential. Use legible fonts and organize the data in sections. This way, even with a quick glance, the recipient can easily access all necessary information, reducing confusion and increasing transparency.