Need a quick and easy way to create a professional-looking receipt? A simple receipt template helps you generate clear and organized records for sales, services, or reimbursements. Whether you’re a freelancer, small business owner, or just tracking personal expenses, a well-structured receipt ensures transparency and accuracy.

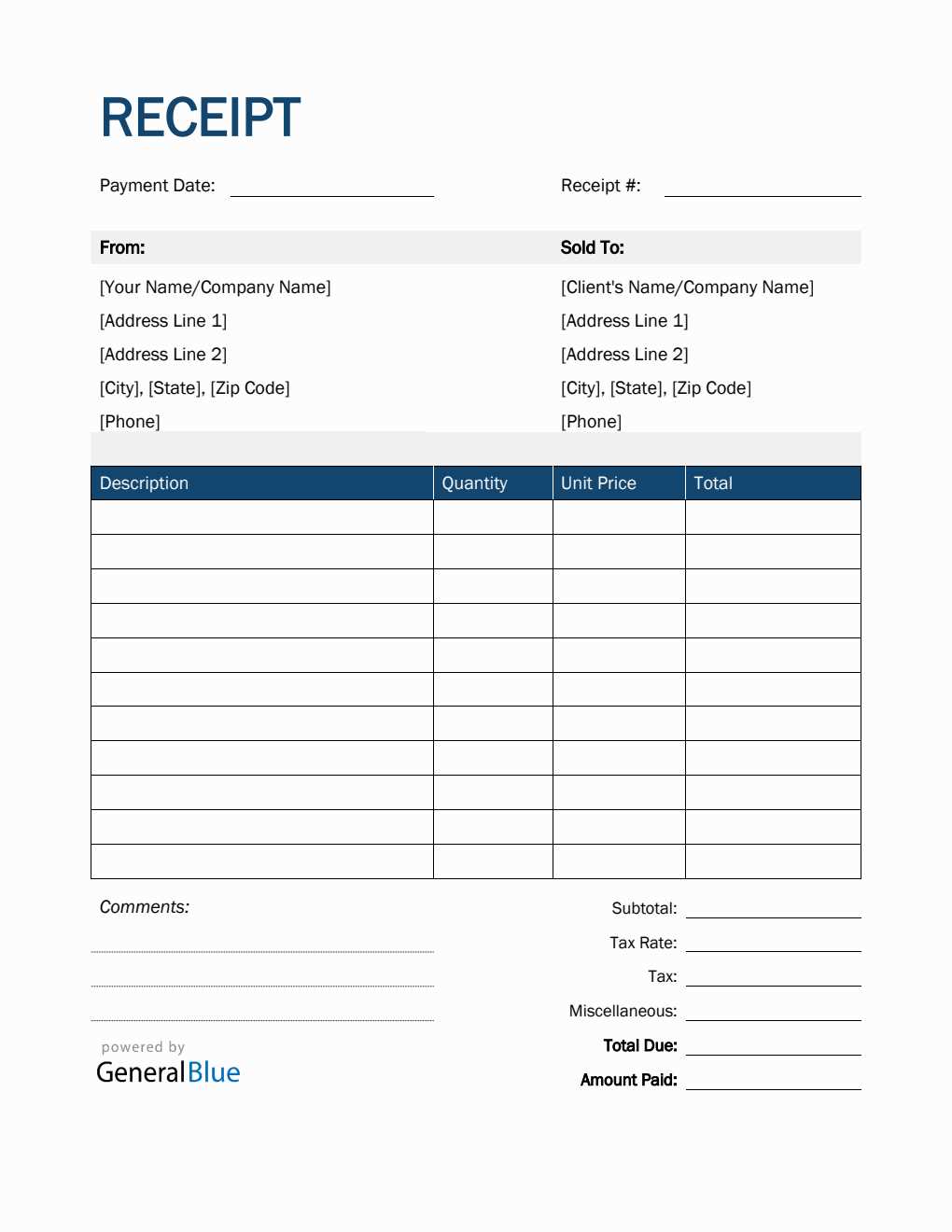

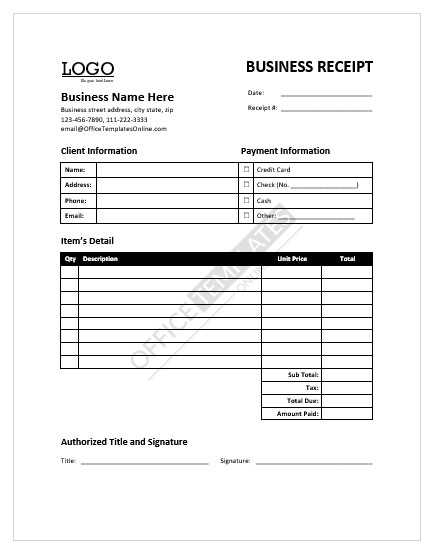

Choose a template that includes essential details such as date, seller information, buyer details, itemized list, total amount, and payment method. A clean layout with well-defined sections makes it easier to read and reduces errors.

Many free templates are available in Word, Excel, Google Docs, and PDF formats. Excel templates allow automatic calculations, while Word and Google Docs versions offer easy customization. PDF templates provide a ready-to-use format for printing or digital sharing.

For added convenience, consider using a receipt generator that lets you fill in details online and download a finished document instantly. This option works well for businesses needing fast, standardized receipts without manual formatting.

A simple yet effective receipt keeps financial records organized and provides proof of transactions when needed. Selecting the right template saves time and ensures consistency in your documentation.

Here’s the revised version with fewer repetitions of the word “Receipt” while maintaining the meaning:

To create a simple receipt template, begin by clearly listing the purchase details, including the product name, quantity, price, and total cost. Avoid unnecessary repetition by using terms like “transaction” or “purchase” in place of “receipt” where appropriate. Ensure all fields are clearly labeled, such as “Date,” “Total Amount,” and “Payment Method.” Use a clean layout with enough space for easy readability. The template should also include a section for customer information, if needed. Organize the receipt in a straightforward manner, keeping each piece of information distinct yet related. Conclude with a space for signatures or additional notes.

- Free Simple Receipt Form

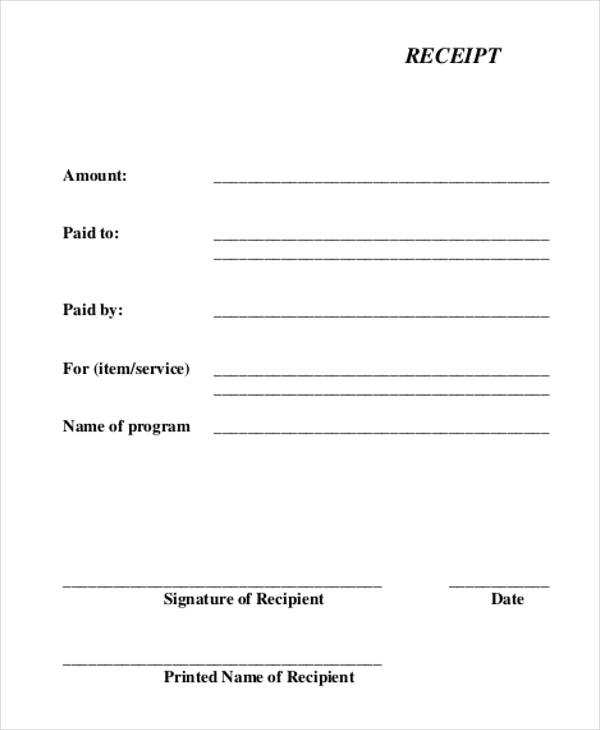

Creating a simple receipt form doesn’t require much complexity. A clean, clear layout with essential details ensures the receipt serves its purpose. Below is a template with key fields to include:

Fields to Include

- Date of Transaction: Include the exact date for record-keeping.

- Receipt Number: A unique identifier helps track transactions.

- Seller’s Information: Name, address, and contact details ensure the buyer knows who provided the goods or services.

- Buyer’s Information: Optional, but can include name and contact for reference.

- Item Description: List each item or service purchased with a brief description.

- Amount Paid: Clearly state the total amount, including taxes if applicable.

- Payment Method: Indicate whether the transaction was made in cash, by credit card, or through another method.

Formatting Tips

Keep the format simple but readable. Use bullet points or tables to present information neatly. Ensure there’s enough space between each section, so everything is legible at a glance.

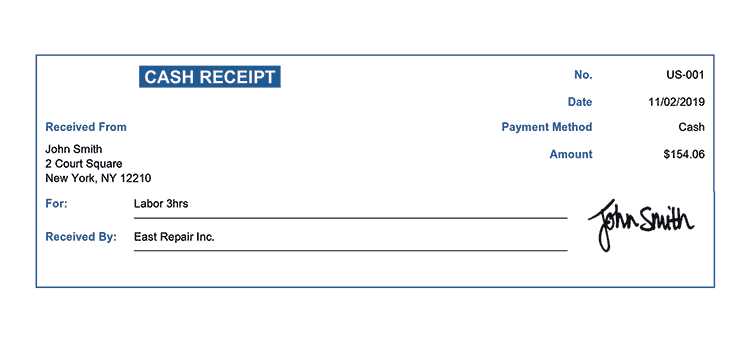

The key elements of a basic payment slip ensure that both payer and recipient have clear documentation of the transaction. Begin with the payer’s information, including their full name and address. This ensures accountability and easy identification in case of any issues. Next, the payee’s details should be provided to confirm where the payment is directed.

Another crucial section is the payment amount, clearly listed in both numbers and words. This avoids confusion and makes sure the exact payment sum is understood. Include the date of payment to mark the transaction’s timing and prevent any discrepancies about the payment period.

A unique reference number or invoice number is helpful for tracking the transaction and for record-keeping purposes. This can also include a description of the goods or services being paid for to clarify the purpose of the payment.

Finally, ensure the payment method is specified, such as cash, check, or electronic transfer, to confirm how the payment was processed. This adds a layer of transparency and accountability to the document.

To customize a receipt template, begin by adjusting the layout to fit your specific business needs. Focus on sections like the company logo, product description, and pricing. Replace generic placeholders with your details.

Adjust Branding Elements

Insert your logo in the header area to maintain brand identity. Choose colors that match your branding, ensuring the template reflects your business’s personality. Replace any default text with your own company name, contact information, and address.

Modify Receipt Details

Tailor the content according to your service or product. Include space for order numbers, tax rates, and payment methods. Add or remove fields like discount or promotional codes, depending on what is relevant to your receipts.

Ensure the font is readable and the layout is organized for clarity. If the template supports it, make adjustments for additional details such as customer notes or terms and conditions. Make sure to update the footer with your return policies or other necessary information.

Once these modifications are done, save the template and test it by creating a sample receipt. Adjust further if needed, ensuring everything is clear and professional.

For creating printable receipts, PDF and PNG are among the most reliable formats. PDFs offer precise control over layout and are universally compatible across devices and printers. This makes them a solid choice for businesses that require consistent, professional output. On the other hand, PNG files are ideal for receipts that include graphics or logos, as they maintain high image quality without loss of detail.

Choosing between these formats depends on the type of receipt and printing preferences. Below is a comparison table of the two formats to help you decide:

| File Format | Advantages | Disadvantages |

|---|---|---|

| Widely supported, preserves formatting, ideal for professional receipts | Can be large in size, may require a PDF reader to open | |

| PNG | Great for images, high quality, supports transparent backgrounds | Not ideal for text-heavy receipts, file size can be large with high resolution |

For simple receipts without intricate design elements, PDF is often the better choice. However, for receipts where visual elements matter, PNG can offer a cleaner, crisper look.

Always ensure payment templates comply with local laws and regulations. Templates should reflect accurate transaction details to avoid legal disputes.

Contractual Obligations

Ensure that payment templates clearly outline the terms of the transaction, including services rendered or goods delivered, payment deadlines, and amounts. Missing or vague details can lead to misunderstandings or breaches of contract.

Privacy and Data Protection

If the template collects personal or financial data, it must adhere to privacy laws like the GDPR or CCPA. Only necessary information should be requested, and secure data storage is essential to prevent unauthorized access.

- Limit the use of sensitive data to prevent fraud or identity theft.

- Make sure customers are aware of how their information will be used and stored.

Several websites offer free, simple receipt templates that you can download and customize. These forms are typically available in various formats, such as Word, Excel, and PDF. Here are some reliable sources:

- Template.net: This site provides a wide range of free templates, including simple receipt formats. You can filter the results by category, making it easier to find the specific type you need.

- Canva: Known for its easy-to-use design tools, Canva offers customizable receipt templates. You can personalize them with your logo, business name, and other details.

- Microsoft Office Templates: Microsoft offers a collection of free templates for Word and Excel. These are ideal for those who want to create receipts quickly and without much effort.

- Google Docs: Google Docs has free templates available for anyone with a Google account. These are convenient if you need a simple, printable receipt that you can edit directly in your browser.

- Invoice Generator: If you’re looking for a simple tool to create receipts on the fly, Invoice Generator lets you create and download a receipt in minutes, with no sign-up required.

Each of these platforms provides easy access to templates that are simple to use and adjust according to your needs. Whether you’re looking for a basic design or something more detailed, these options cover a wide range of possibilities.

Begin by entering the date of the transaction at the top of the document. This ensures proper record-keeping for future reference.

Next, write the full name of the payer. Double-check for accuracy to avoid any confusion or errors down the line.

Include the recipient’s details, such as their name, address, and payment method. Be precise when noting the method (e.g., bank transfer, cash, check) for clarity.

Clearly state the amount of payment, including both the number and worded form. This reduces the risk of misinterpretation.

Indicate the purpose of the payment. This could be for services rendered, goods purchased, or other specific reasons. It’s key to specify to avoid ambiguity.

Sign the document at the bottom to confirm your agreement with the payment terms and to finalize the transaction record.

Finally, keep a copy of the completed payment document for your records. This will serve as proof in case any questions arise later.

Begin by entering the date of the transaction at the top of the document. This ensures proper record-keeping for future reference.

Next, write the full name of the payer. Double-check for accuracy to avoid any confusion or errors down the line.

Include the recipient’s details, such as their name, address, and payment method. Be precise when noting the method (e.g., bank transfer, cash, check) for clarity.

Clearly state the amount of payment, including both the number and worded form. This reduces the risk of misinterpretation.

Indicate the purpose of the payment. This could be for services rendered, goods purchased, or other specific reasons. It’s key to specify to avoid ambiguity.

Sign the document at the bottom to confirm your agreement with the payment terms and to finalize the transaction record.

Finally, keep a copy of the completed payment document for your records. This will serve as proof in case any questions arise later.