Key Elements of a Car Insurance Receipt

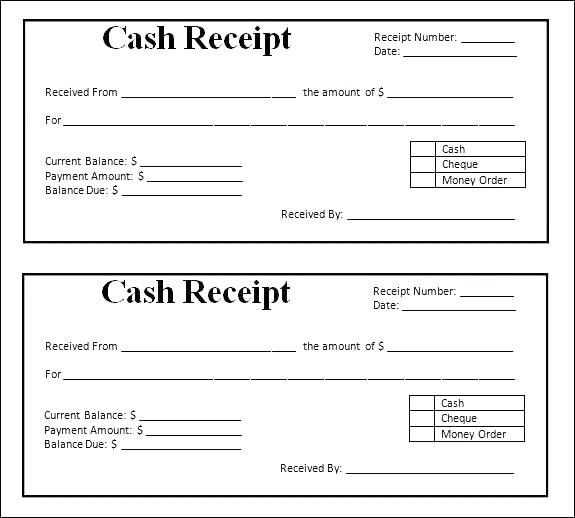

A car insurance receipt should include clear and concise information for both the insured and the insurance company. Here’s a simple template you can use to create an accurate receipt:

- Policyholder’s Name: The full name of the individual who holds the car insurance policy.

- Insurance Company Name: The name of the company providing the car insurance.

- Policy Number: A unique identifier for the insurance policy.

- Premium Amount: The amount paid for the car insurance coverage.

- Payment Date: The date when the premium was paid.

- Coverage Period: The start and end dates of the insurance coverage.

- Receipt Number: A unique identifier for the receipt itself.

- Payment Method: The method used to pay, such as credit card, bank transfer, or cash.

Sample Car Insurance Receipt

Here’s how the receipt can be structured:

Receipt Number: 12345 Date: February 8, 2025 Policyholder Name: John Doe Insurance Company: XYZ Insurance Co. Policy Number: 987654321 Coverage Period: January 1, 2025 - December 31, 2025 Premium Amount: $500.00 Payment Method: Credit Card This receipt confirms the payment of the premium for the car insurance policy.

How to Customize the Template

To tailor the receipt to your specific needs, adjust the following details:

- Replace the placeholder text with actual data such as the policyholder’s name, policy number, and premium amount.

- Ensure that the coverage period matches the duration of the policy you are issuing a receipt for.

- Use a unique receipt number for each payment made, especially when dealing with multiple clients or transactions.

By following this format, you can easily create a clear and professional car insurance receipt that serves as a proof of payment for both parties. Always double-check the details before issuing to avoid errors.

Car Insurance Receipt Template

Key Elements of an Auto Coverage Receipt

How to Format a Digital and Paper Copy

Common Mistakes in Document Creation

Legal Requirements for Coverage Records

Customizing a Form for Various Policies

Best Practices for Storing and Accessing Records

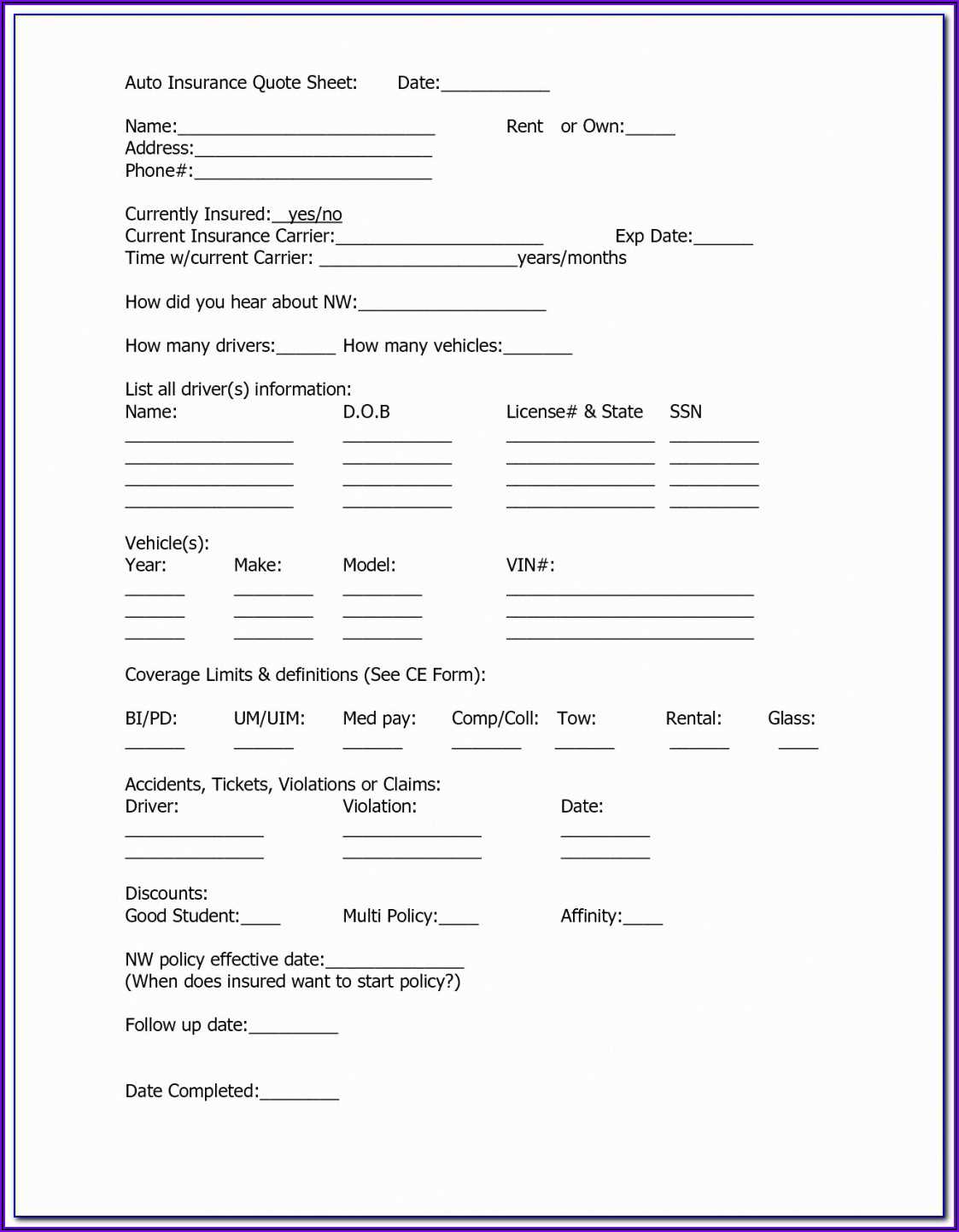

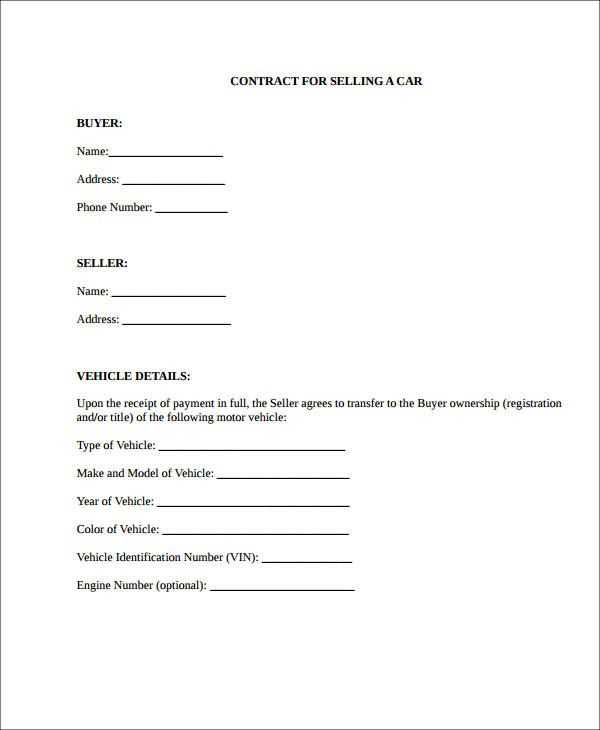

Start with Basic Information: Ensure that the receipt includes the policyholder’s name, insurance provider details, policy number, and vehicle information. These are necessary for validation and future reference.

Key Details for the Receipt:

Include the date of purchase, coverage start and end dates, payment method, and the premium amount paid. It’s crucial to have a breakdown of what coverage is included, such as liability, comprehensive, and collision insurance.

Formatting for Digital and Paper Copies:

For paper copies, make sure the document is clear and easy to read. Use a consistent font size and layout. For digital copies, ensure the file format is universally accessible, such as PDF, and that it can be easily opened on any device.

Avoid Common Mistakes: Double-check for any missing information, such as the insurer’s contact details or incorrect dates. Ensure that all amounts are correctly calculated and displayed. A common mistake is forgetting to include the policyholder’s address, which can be critical in case of disputes.

Legal Requirements for Coverage Records:

Each state or country has its own legal requirements for auto insurance documentation. Verify that your receipt complies with local regulations, especially regarding the presentation of policy terms, payment amounts, and contact information. Keep in mind that some regions may require a specific format for receipts.

Customize the Template for Different Policies: Customize your template according to the coverage type. For example, if it’s a short-term policy or a temporary insurance certificate, adjust the details accordingly. Tailor the receipt to reflect the specifics of the policyholder’s agreement, such as deductibles and special clauses.

Store and Access Records Safely: For easy retrieval, store receipts in both physical and digital formats. Digital copies should be backed up in a secure location, such as a cloud storage service, and organized for quick access. If storing physical copies, use a filing system that is simple to maintain and locate when needed.