What You Need in a Cash Receipt Book

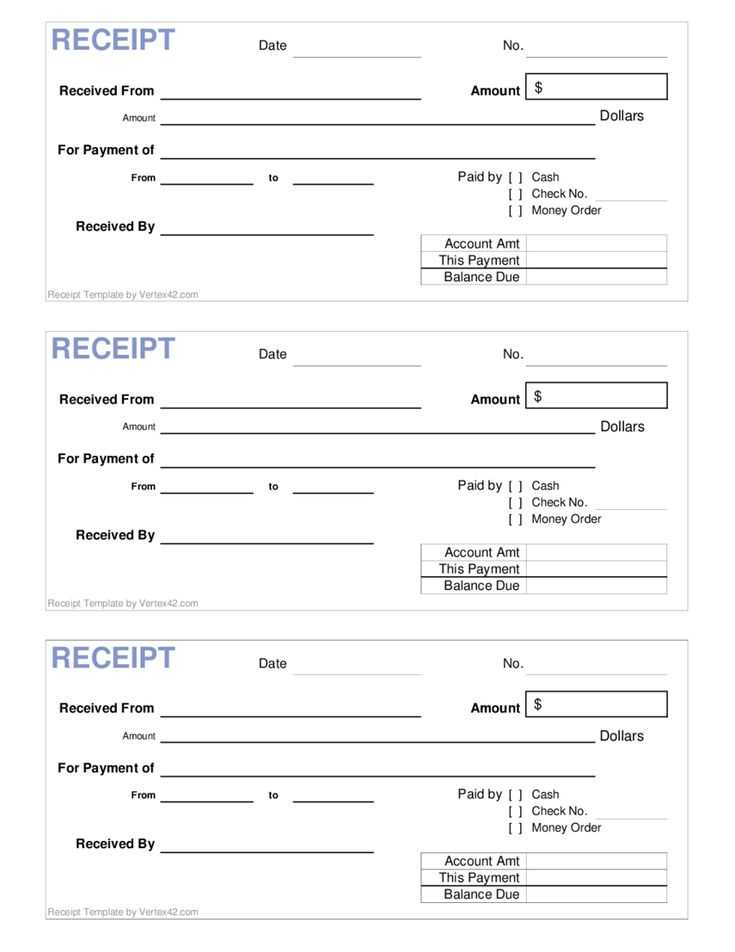

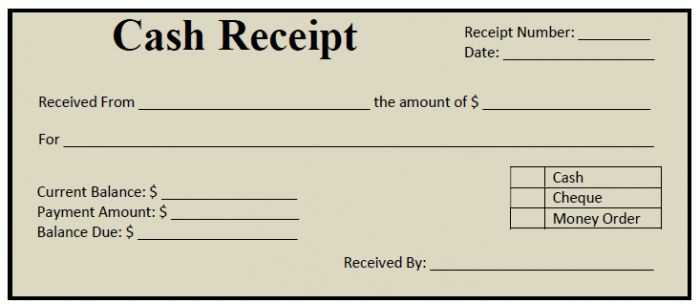

To maintain clear financial records, a cash receipt book must include specific fields. These ensure every transaction is documented properly and is easily traceable. Here’s what to look for:

- Date – The exact date of the transaction.

- Receipt Number – A unique identifier for each entry.

- Received From – Name of the person or company making the payment.

- Amount – The total amount received, clearly written in words and numbers.

- Payment Method – Specify if the payment was made by cash, check, or another form.

- Purpose – A brief description of why the payment was made.

- Signature – Signatures from both the recipient and the person making the payment, if applicable.

How to Organize a Cash Receipt Book Template

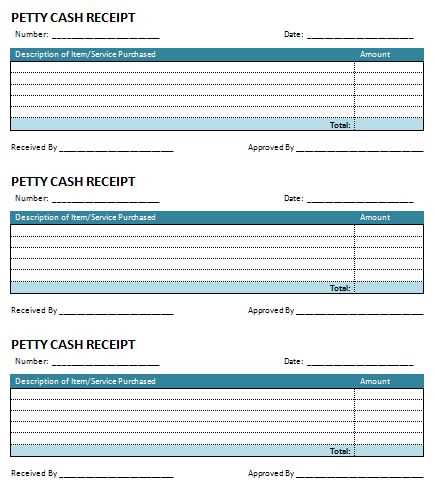

Creating a cash receipt book template is simple. Using a table format can help organize and structure information. Make sure the template is designed for easy filling out and future reference. Here’s a basic structure:

- Header Section: Include the name of your business, address, and contact details. This ensures clarity about where the receipt is coming from.

- Transaction Details Section: Set up columns for the date, receipt number, payer’s name, amount, and payment method.

- Notes Section: Leave space for additional notes or purpose of payment. This keeps important details in one place.

Printing Your Template

If you prefer a physical copy, print the template in a format that’s easy to use and durable. A carbon copy or duplicate system allows both you and the payer to retain a copy of the receipt for your records.

Tracking and Storing Receipts

Store the receipts securely for easy retrieval. A binder or digital filing system is effective for maintaining an organized record of all transactions. You can scan paper receipts into a digital system for extra convenience and backup.

Conclusion

With a straightforward cash receipt book template, you can keep your transactions organized and accurate. Ensuring all fields are filled out properly, and using a reliable system for tracking, will streamline your accounting process and provide transparency for future reference.

Cash Receipt Book Template: A Practical Guide

Key Components of a Receipt Book Template

How to Format a Receipt for Clarity and Accuracy

Customizing a Receipt Book for Different Business Needs

Printable vs. Digital Receipt Books: Choosing the Right Option

Legal and Tax Considerations for Receipt Documentation

Common Mistakes to Avoid When Using a Receipt Book

A clear and structured cash receipt book template simplifies record-keeping and ensures accountability. At the core of a receipt book, you should include essential components such as the receipt number, date of transaction, name of payer, payment method, amount paid, and description of the transaction. Adding fields for tax information and unique transaction identifiers can further enhance the template’s usefulness.

Formatting the receipt correctly will help avoid confusion. Keep the layout clean, with clearly defined spaces for each piece of information. The receipt number should be easily visible, with a separate section for detailed notes or a description of the product or service provided. A logical flow–starting from the payer’s details to the transaction specifics–makes the document more readable.

Customize the receipt template based on your business’s needs. Retail businesses may require sections for itemized purchases, while service-based businesses might focus more on labor charges and taxes. Adjusting the format to fit these specific needs can streamline the process and prevent mistakes. Using consistent fonts and clear spacing ensures professional presentation, regardless of your business type.

Printable and digital receipt books both offer advantages. Printable books allow for quick, tangible records that are easy to store or hand over to customers. On the other hand, digital receipts provide a more eco-friendly option, with easy storage, retrieval, and the ability to integrate with accounting software. Consider your business’s workflow, customer preferences, and environmental impact when choosing between the two.

Legal and tax considerations are key when using receipt books. Keep in mind that receipts are often required for tax reporting and audits. Make sure your template includes the necessary details like tax rates and business identification numbers. In some jurisdictions, receipts must meet specific legal requirements, such as providing accurate amounts, correct tax reporting, and following retention periods for records.

Avoid common mistakes like leaving out key details such as the amount paid or miscalculating taxes. Inaccurate receipt numbers can cause confusion when matching payments to invoices, while illegible handwriting on a paper receipt might lead to disputes. Consistency and clarity in filling out receipts will help avoid errors and enhance your business’s credibility.