A clear and concise cash receipt template can streamline your bookkeeping process and ensure transparency with clients. This simple document will record the payment details, providing a professional and organized approach for both the therapist and the client. Include essential details like the session date, amount received, and payment method to maintain accuracy in your records.

Make sure to include the therapist’s name, business information, and a unique receipt number for easy reference. This helps track payments efficiently and avoids confusion. If a client makes a partial payment, note that clearly along with the balance due.

The format should be easy to read and consistent with your practice’s branding. Consider creating a template you can reuse for every session, ensuring that the receipts are uniform and meet your business’s needs. This will save time and reduce the chances of errors, letting you focus on providing care rather than worrying about paperwork.

Sure! Here’s the adjusted version:

To create an accurate psychotherapy cash receipt template, ensure the following key details are included:

Receipt Information

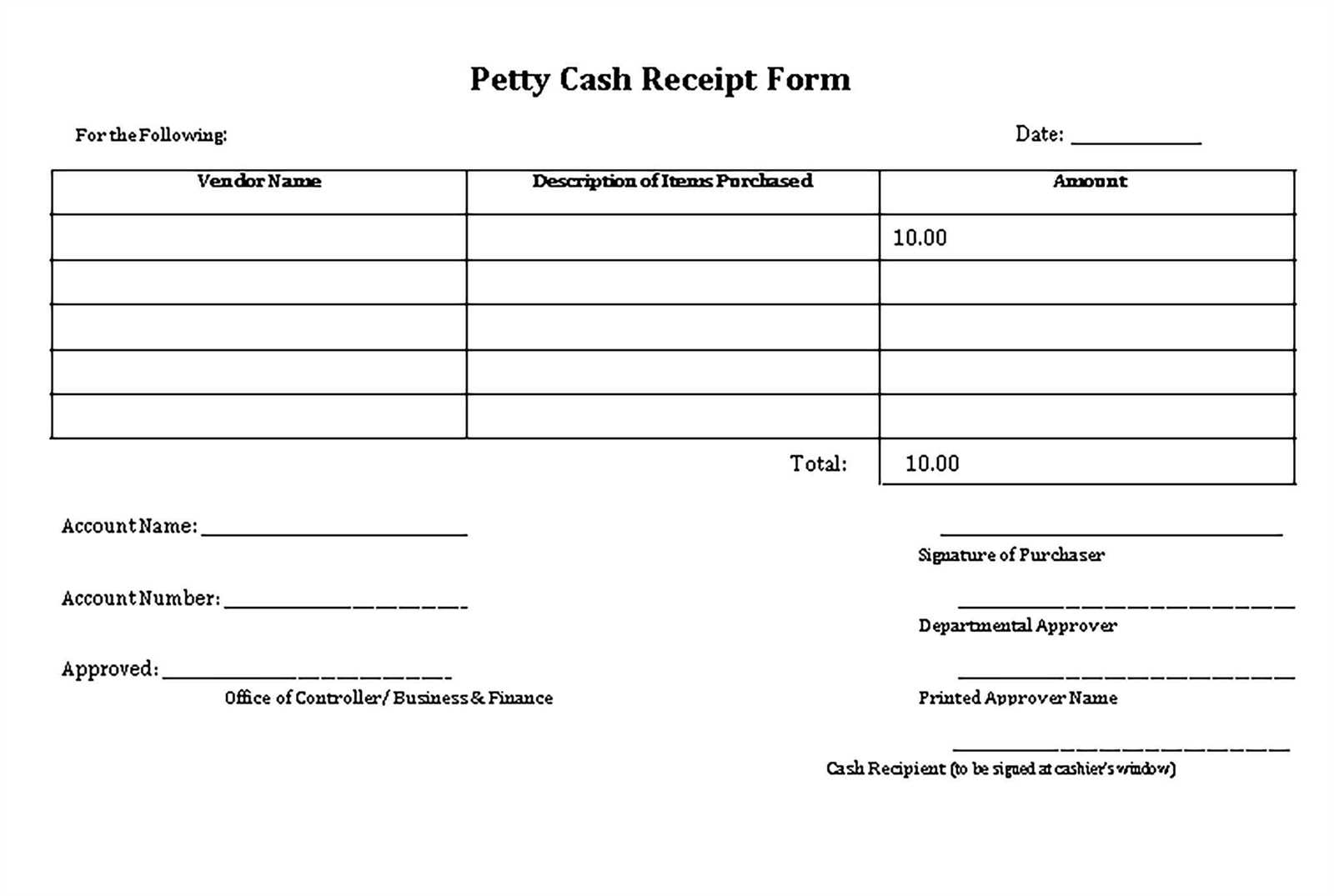

The template must capture the client’s name, session date, and the total amount paid. Also, include payment methods (e.g., cash, check, credit card) to provide a transparent transaction record.

Professional Details

Include the therapist’s name, license number, and contact information for verification purposes. This helps maintain professionalism and compliance with industry standards.

Example Template Structure:

| Client Name | Session Date | Amount Paid | Payment Method | Therapist’s Name | License Number |

|---|---|---|---|---|---|

| John Doe | 2025-02-08 | $120.00 | Credit Card | Jane Smith, LCSW | 123456 |

By following this format, you ensure a professional, clear, and legally sound receipt for each psychotherapy session.

- Psychotherapy Cash Receipt Template

A psychotherapy cash receipt template serves as a clear record of payment for services rendered. It should include key details such as the date of service, therapist’s name, patient’s name, the amount paid, and the payment method. This template helps maintain accurate records for both the therapist and client, ensuring transparency and accountability in transactions.

Key Elements of the Template

Ensure the template includes the following elements:

- Date of Service: Specify the date the therapy session took place.

- Therapist’s Name: Include the full name of the therapist providing the session.

- Patient’s Name: Record the name of the patient receiving the therapy.

- Amount Paid: Clearly state the total amount the patient paid for the session.

- Payment Method: Indicate how the payment was made (e.g., cash, credit card, check).

- Receipt Number: Assign a unique receipt number for easy tracking.

How to Use the Template

Once filled out, provide the patient with a copy of the receipt. Keep a copy for your own records, and store it securely for future reference. This template can be customized based on the specific needs of the practice, but it’s important to maintain consistency in format for organizational purposes.

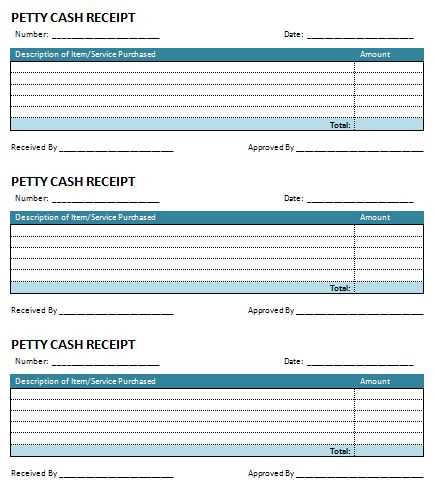

Customize your cash receipt template to reflect your practice’s branding and streamline your record-keeping process. Here’s how you can do it:

- Add Your Practice Details: Include your practice name, address, contact information, and logo at the top of the receipt. This creates a professional appearance and helps clients identify your practice easily.

- Include Payment Details: Clearly display the service provided, the amount charged, and any taxes or additional fees. Add a section for payment method (cash, card, check) to provide clarity.

- Personalize with Client Information: Include the client’s name and appointment date for easy reference. This helps both you and your clients keep track of past transactions.

- Invoice Number: Add a unique invoice number to help organize and track receipts for bookkeeping purposes. This number can also be used for future reference or in case of any disputes.

- Terms and Conditions: Briefly outline any policies related to refunds, cancellations, or payment terms. This helps prevent misunderstandings and keeps clients informed.

- Keep the Layout Clean: A simple, easy-to-read layout ensures the receipt is user-friendly. Avoid cluttering the template with unnecessary elements.

- Consider Digital Options: If you are using a digital format, consider adding a QR code or a link for online payments or appointment scheduling to make future transactions smoother for clients.

Once you have customized the template, test it with a few transactions to ensure everything is displayed clearly and accurately. Regular updates to the template might be needed to keep up with changes in your practice or regulations.

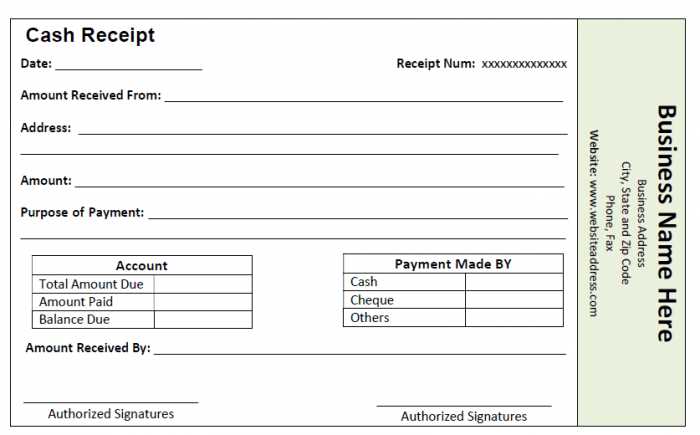

Ensure your cash receipt includes these key fields for accuracy and clear documentation:

Date of Service

Clearly state the date the therapy session took place. This ensures both you and the client can refer to the correct session when needed.

Client’s Information

Include the client’s full name and contact details. This confirms the payment is linked to the right individual.

Service Description

Describe the type of therapy or session provided. For example, “Individual psychotherapy session” or “Cognitive behavioral therapy session.” This provides clarity on the service being paid for.

Amount Paid

Clearly show the total amount the client paid. Include the payment method (e.g., cash, check, card) for further transparency.

Practitioner’s Details

Include your full name, title, and contact information. This verifies the provider of the service and allows clients to reach out if necessary.

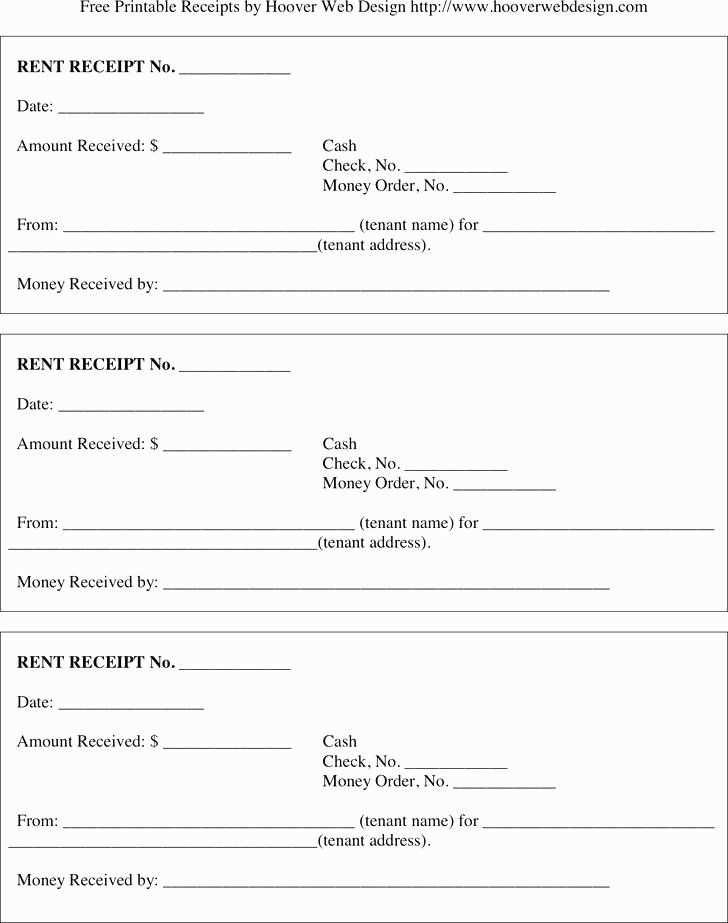

Transaction Number or Receipt ID

Include a unique transaction number or receipt ID for easy reference and record-keeping. This helps track payments in case of any future inquiries.

Payment Terms

If applicable, state the payment terms, including whether the session was pre-paid or if there is a balance due. This ensures there’s no confusion about the payment arrangement.

By keeping these fields consistent and clear, you maintain a professional record and support your clients’ understanding of their payments.

Implement a consistent system for documenting payments as soon as they are received. This helps avoid errors and ensures accuracy in financial records. Every transaction should have a corresponding receipt for verification and reference.

- Use a Digital Payment System – Opt for software that integrates with your accounting system to streamline payment tracking. This allows for easy reconciliation of payments against invoices, minimizing the risk of missing or duplicate entries.

- Maintain Separate Folders for Receipts – Create digital or physical folders for different payment types, such as insurance, self-pay, or third-party. This enables quick access and organization, making it easier to spot discrepancies or review past transactions.

- Include Specific Payment Details on Receipts – Include the client’s name, the service rendered, payment amount, date, and any applicable taxes on each receipt. This will reduce confusion and enhance transparency.

- Set Up Payment Reminders – Use automated reminders for clients to ensure timely payments. Automated systems can also notify you of any overdue invoices, improving cash flow management.

- Track Payment Methods – Record the payment method (e.g., credit card, cash, insurance) along with the receipt. This provides a complete overview of your income sources and helps with tax preparation.

- Review Transactions Regularly – Schedule monthly or quarterly reviews of your payment records to ensure no payments have been overlooked or inaccurately recorded. This also provides a chance to reconcile your receipts with bank statements.

- Backup Receipts – Create backups of all receipts to protect against data loss. Use cloud storage for easy access and sharing when needed.

By incorporating these practices, you can efficiently track payments and invoices, ensuring accurate financial reporting and smoother business operations.

Ensure your payment receipts include clear details about the transaction to stay compliant with legal requirements. Each receipt should specify the therapist’s name, business name (if applicable), the service provided, the date of the session, and the amount paid. Also, include a statement indicating the receipt is for a psychotherapy session to avoid confusion with other services.

Include Required Tax Information

For legal compliance, include your tax identification number (TIN) or business tax ID if required by your jurisdiction. This helps validate the receipt for both clients and tax authorities. Consult with a tax professional to ensure your documentation meets local and federal requirements for psychotherapy services.

Be Transparent About Payment Methods

Clearly state the method of payment used (credit card, cash, check, etc.) on each receipt. This adds transparency to financial transactions and supports recordkeeping for both your clients and your practice.

Digital receipts offer significant advantages for a psychotherapy business, primarily through convenience and eco-friendliness. Clients can easily access their receipts anytime via email or client portals, cutting down on the physical storage space required for paper copies. This also means no risk of lost receipts, a common problem with paper. Digital systems can automatically store and organize receipts, making accounting and tax preparation more streamlined.

On the other hand, paper receipts may still appeal to clients who prefer tangible records or have limited access to technology. Paper receipts can provide a sense of security and trust, especially for older clients or those unfamiliar with digital tools.

- Storage and Access: Digital receipts can be accessed instantly from any device, saving you time and reducing paper clutter in your office. Paper receipts, however, require physical storage space and may be easily misplaced.

- Environmental Impact: Digital receipts eliminate paper waste, supporting sustainability in your practice. With paper, your practice contributes to deforestation and waste accumulation.

- Client Preferences: Some clients may feel more comfortable receiving a paper receipt, while others prefer the convenience of digital records. Offering both options can cater to a wider range of preferences.

- Cost Efficiency: Digital receipts reduce the costs of printing, paper, and physical storage space. Paper receipts require more overhead and resources, increasing operational expenses over time.

Ultimately, digital receipts simplify bookkeeping, reduce costs, and align with a more sustainable business model. However, maintaining an option for paper receipts can help accommodate clients who prefer them, providing flexibility and enhancing client satisfaction.

Ensure that your receipts contain accurate and clear information. Double-check patient details such as name, date of session, and amount paid. Mistakes in these fields can lead to confusion and potential legal issues. Avoid generic templates that may leave out crucial data.

1. Failing to Include Required Information

Receipts should always include specific details such as the therapist’s name, contact information, and tax identification number. Missing this data could result in non-compliance with financial regulations or make it difficult for clients to use the receipt for reimbursement or tax purposes.

2. Not Providing a Clear Breakdown of Services

Provide a clear breakdown of the services rendered, including session type and duration. Ambiguous descriptions or lack of clarity can cause misunderstandings, especially if clients need the receipt for insurance purposes or reimbursement claims.

By avoiding these mistakes, you maintain professionalism and ensure that your receipts fulfill their purpose without causing confusion or inconvenience to either party.

To create a reliable psychotherapy cash receipt template, include key elements to ensure both clarity and legal compliance. Begin by specifying the patient’s name, session date, and therapist’s details. Ensure that the service description, duration, and cost per session are clearly outlined.

| Detail | Description |

|---|---|

| Patient Name | Include the full name of the patient receiving therapy. |

| Session Date | Provide the exact date when the therapy session took place. |

| Therapist Information | List the therapist’s name and professional credentials. |

| Service Provided | Describe the type of psychotherapy provided (e.g., individual therapy, couples counseling). |

| Session Duration | Specify the length of the therapy session in hours or minutes. |

| Amount Charged | State the total fee for the session. |

| Payment Method | Indicate how the payment was made (e.g., cash, credit card, check). |

Finally, include a receipt number and space for the patient’s signature, confirming the transaction. This template ensures transparency and smooth record-keeping for both the therapist and the patient.