Need a simple yet reliable way to document a transaction? A temporary receipt template helps you issue a proof of payment instantly. Whether you’re selling a product, providing a service, or handling a cash deposit, having a structured template ensures clarity and professionalism.

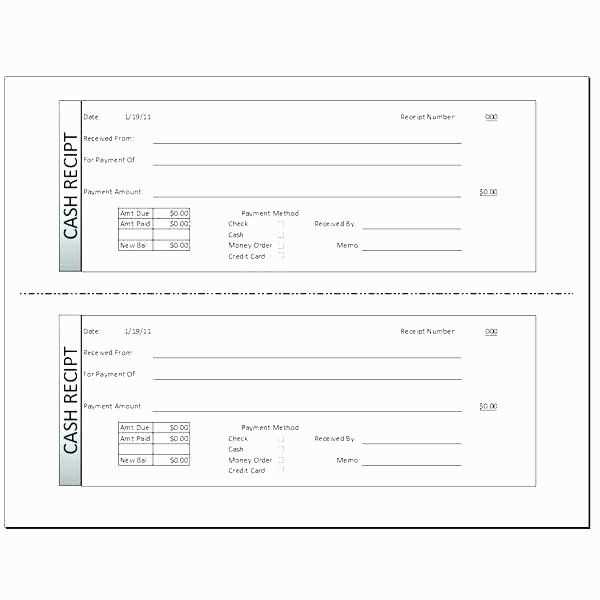

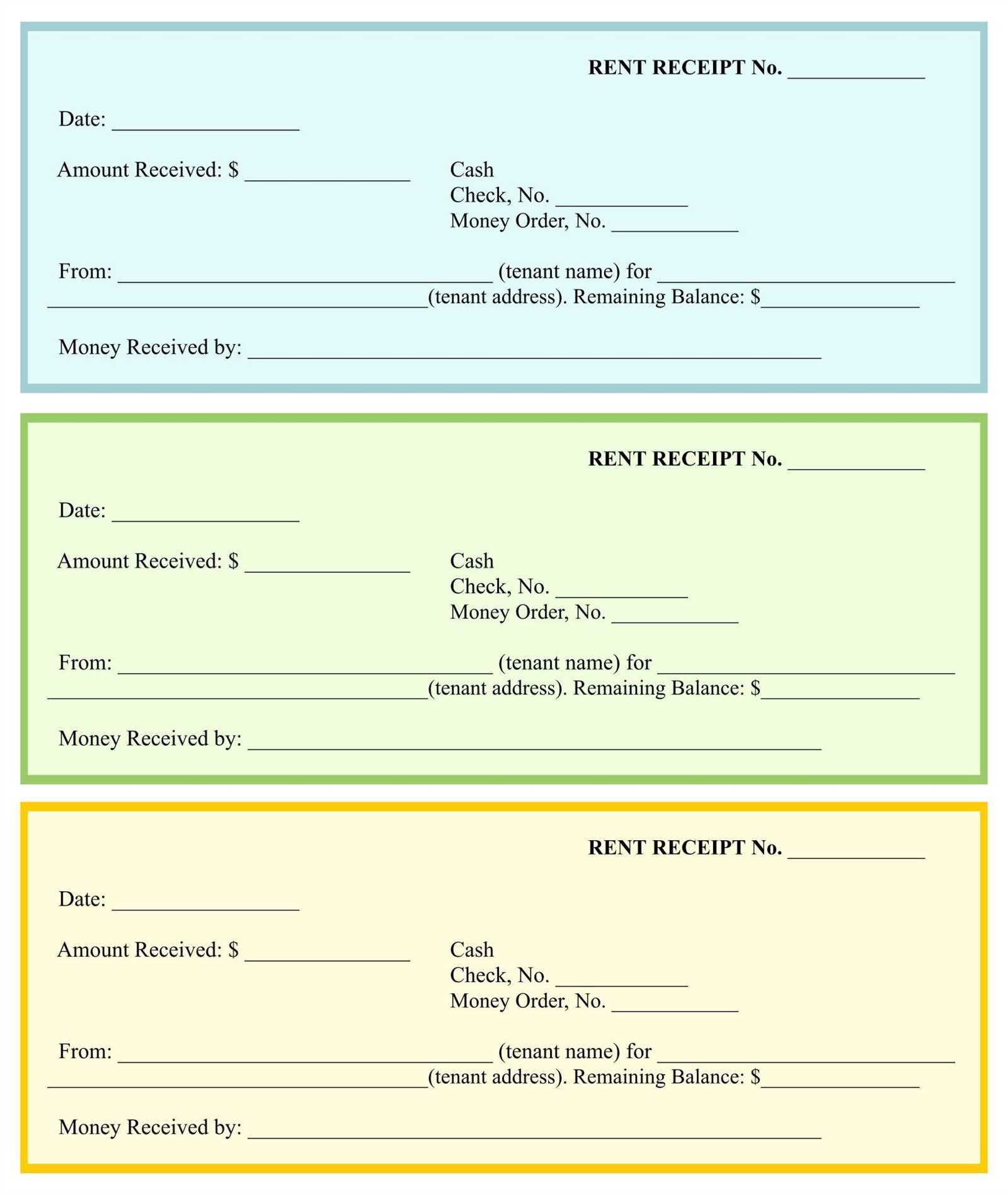

A well-designed receipt should include key details: date, amount, payer and payee information, payment method, and a brief description of the transaction. Adding a unique receipt number improves tracking and prevents duplication. If applicable, a signature field can enhance authenticity.

Digital and printable formats both have advantages. A fillable PDF or spreadsheet template allows quick input and easy sharing via email. A printable version works best for cash transactions and in-person dealings. Choose the format that suits your needs to maintain organized financial records.

Creating a custom template takes just minutes. By keeping the layout clear and including all necessary details, you ensure that both parties have a proper record of the exchange. Below, you’ll find practical examples and tips for designing an effective receipt.

Here is the edited list with duplicates removed, preserving the meaning:

Ensure each item in your temporary receipt template has clear headings, such as “Transaction Date” and “Amount Paid”. This avoids any confusion and provides easy navigation. Group similar details together, like payment methods and transaction status, to improve readability. Keep item descriptions concise but informative, so the recipient can understand the content quickly. If needed, include a space for additional notes to capture any important details that don’t fit into the standard fields.

Maintain a consistent format for dates and amounts to avoid any misinterpretations. Standardize the font size and style for all sections. This makes the receipt visually uniform and user-friendly. Use clear labels for every section to ensure transparency and accuracy. Double-check that all data aligns correctly and does not overlap or repeat unnecessarily.

Lastly, include a footer with your contact information or any disclaimers relevant to the receipt. This ensures that the recipient knows how to reach out if they have questions or concerns.

- Temporary Receipt Template

A temporary receipt template should clearly indicate the transaction details while maintaining simplicity. Include sections for transaction date, customer name, items purchased, and total amount paid. The design should facilitate easy tracking of receipts for record-keeping or further processing.

Key Elements

Here’s what you should include in the template:

- Transaction ID or reference number

- Itemized list of goods or services

- Individual and total price for each item

- Payment method (e.g., cash, credit card)

- Business name and contact details

- Date of transaction

Template Example

| Item | Description | Price |

|---|---|---|

| 1 | Product Name | $10.00 |

| 2 | Another Product | $15.00 |

| Total | $25.00 | |

Ensure clarity and consistency with your template layout to prevent confusion during future reference or transactions. A clean, professional look also reflects positively on the business’s brand.

A temporary proof of payment should include specific details to ensure it serves its intended purpose effectively. The following key elements should always be present:

- Payment Amount: Clearly state the amount paid to avoid confusion or disputes.

- Payment Date: Indicate the exact date the payment was made, ensuring it is recent and relevant to the transaction.

- Payment Method: Specify the method used for payment (e.g., credit card, cash, bank transfer, etc.) for clear traceability.

- Payee Information: Include the name of the recipient or company receiving the payment to verify the transaction’s legitimacy.

- Transaction Reference Number: A unique reference number helps track and validate the payment.

- Temporary Nature of the Document: Clearly indicate that the proof is temporary, ensuring the recipient knows it is not a final or permanent record.

Including these details ensures that the temporary receipt is both reliable and legally acceptable in any necessary future context. Clear and concise information helps prevent errors and misunderstandings.

Short-term receipts must include key legal elements to ensure compliance and clarity. Ensure the receipt clearly states the transaction amount, the date, and the parties involved. This can serve as proof of purchase or service, reducing any future disputes.

Businesses should verify if their receipts meet local regulations, which may require specific wording or format for tax purposes. Some regions demand a clear identification of the seller and buyer, including tax identification numbers where applicable.

Keep receipts for a defined period as stipulated by local tax laws. This period varies but is often around five years. Inaccurate or incomplete receipts could result in penalties, especially if they are used for tax reporting or claims.

Make sure the receipt is easy to understand and free of misleading information, as unclear details can complicate any legal claims. If the receipt involves a refund, return, or exchange policy, ensure these terms are disclosed clearly on the document.

Provisional receipts are often used in scenarios where immediate acknowledgment of a transaction is needed, but a detailed receipt is not yet available. These receipts can serve as placeholders, ensuring that customers have proof of purchase while waiting for official documentation.

Retail Transactions: In retail settings, provisional receipts are frequently issued for online orders, especially when payment has been processed, but the goods are not yet shipped. This allows customers to track their purchase while awaiting confirmation or delivery details.

Service-Based Businesses: Service providers, such as repair shops or consultants, use provisional receipts to confirm that a service has been rendered or payment has been made. This receipt can help maintain a clear record while finalizing invoices or reports.

Events and Ticket Sales: For events like concerts or conferences, provisional receipts are issued immediately after a ticket purchase, often before the official ticket is sent. This ensures the customer receives confirmation of their payment, allowing them to attend the event without delay.

Tax and Refund Processing: Businesses may issue provisional receipts to confirm a customer’s payment while the full accounting process is being completed. These receipts can be used temporarily until the final tax receipt or refund confirmation is available.

To tailor a receipt to specific needs, first identify the purpose it serves. For a retail business, include item descriptions, quantities, and prices. For a service-based business, focus on the service provided, along with duration or hourly rates. Customizing fields like tax rates or discounts can also enhance clarity and transparency for customers.

For invoices, integrate space for detailed payment terms, due dates, and customer contact information. If creating receipts for online transactions, add digital payment methods like credit card details or payment gateway information for better traceability.

Consider adding a company logo and contact details for professional branding. Customizing fonts and layout can further align with your brand’s visual identity while keeping the information clear and easy to read. Keep the format simple but functional, ensuring all necessary data fits without overwhelming the user.

For different industries, you can highlight specific information. A restaurant receipt, for example, can show tip amounts, while a travel agency receipt may include booking references or flight details. Adjust the template based on your specific audience’s expectations and needs to improve usability.

Temporary receipts can be created in both printable and digital formats, each offering distinct advantages depending on the user’s needs. Printable receipts are ideal for customers who prefer physical copies for their records or in case they need a hard copy for return or warranty purposes.

- Printable Receipts: These are typically generated through a printer from a pre-designed template. Ensure the format includes all required transaction details, such as item descriptions, amounts, tax rates, and the date of the transaction. These receipts should be easy to print and clear to read, with enough space for any additional notes if needed.

- Digital Receipts: Digital receipts are shared electronically, often through email or SMS. They are easily stored on devices and can be retrieved instantly. For better organization, it is helpful to use formats like PDF or email templates that are compatible with a variety of devices and email clients. Digital formats also allow for easy tracking and searching, making them convenient for managing multiple transactions over time.

Consider the preferences of your audience when deciding which format to use. Printable receipts are great for in-person transactions, while digital receipts are a better choice for online purchases or when customers need immediate, eco-friendly options.

Check payment records for accuracy by matching transaction amounts, dates, and payer details with bank statements or payment platform confirmations. Double-check that all figures align with invoices or receipts. If discrepancies arise, address them immediately with the relevant parties to ensure proper reconciliation.

Verifying Payment Details

Examine each payment record against the corresponding source document. This includes ensuring the amount paid matches the agreed terms, confirming payment methods (credit card, bank transfer, etc.), and checking the transaction date. Always ensure that payment references are clear and traceable.

Storing Payment Records

Store payment records securely by categorizing them in an organized manner. Digital formats such as PDFs or Excel files are ideal for easy access and backup. Use a cloud storage solution with strong encryption or physical storage in secure, labeled folders for physical receipts. Always back up digital files to prevent loss.

Now the same word doesn’t repeat too often, but the meaning remains accurate.

Focus on using synonyms or restructuring sentences to avoid redundancy while maintaining clarity. For instance, replace repetitive words with alternatives that fit the context. This enhances readability and keeps the content engaging. You can also use pronouns or rephrase statements to convey the same idea in a fresh way.

Consistency in language is key, but variation in phrasing makes text flow naturally. This strategy prevents monotony and ensures the message stays clear and effective. Adjusting sentence structure can also help in reducing word repetition while keeping the meaning intact.

In practice, vary the vocabulary slightly, but ensure the main message isn’t lost. The goal is precision, not excess. By keeping the balance between clarity and variety, you create content that is both accurate and dynamic.