Use this simple babysitting tax receipt template to provide clear and professional documentation for your clients. By filling in the details, you ensure that both you and your clients have an accurate record of the service provided. This is especially useful for tax purposes, allowing you to report income and your clients to claim expenses when necessary.

Details to include: The receipt should cover essential information such as the date of service, the number of hours worked, the rate per hour, and the total amount charged. Include your full name, address, and contact details for transparency. Clients should also be able to identify the babysitting service, so make sure to specify the number of children cared for and any special requests made during the service.

Always ensure that both parties have a copy of the receipt. This will protect you in case of future disputes and provide clear documentation of your services. Keep your records organized to ensure you can quickly reference any details when filing your taxes or handling financial inquiries.

Here are the corrected lines, with minimal repetition:

When creating a babysitting tax receipt, make sure to list the date of service, hours worked, and hourly rate clearly. Avoid adding unnecessary details to maintain clarity.

Keep the structure simple: include your name and contact information, the child’s name, and the total amount paid. Ensure all numbers are accurate to avoid issues during tax filing.

If the receipt includes any deductions or special terms, explain them briefly, but don’t clutter the document with unrelated information.

Ensure your tax receipt template is easy to read. Consistent formatting and clear sections will help make it more professional and straightforward.

- Simple Babysitting Tax Receipt Template

Creating a tax receipt for babysitting services helps you stay organized and comply with tax requirements. Here’s a simple template to guide you:

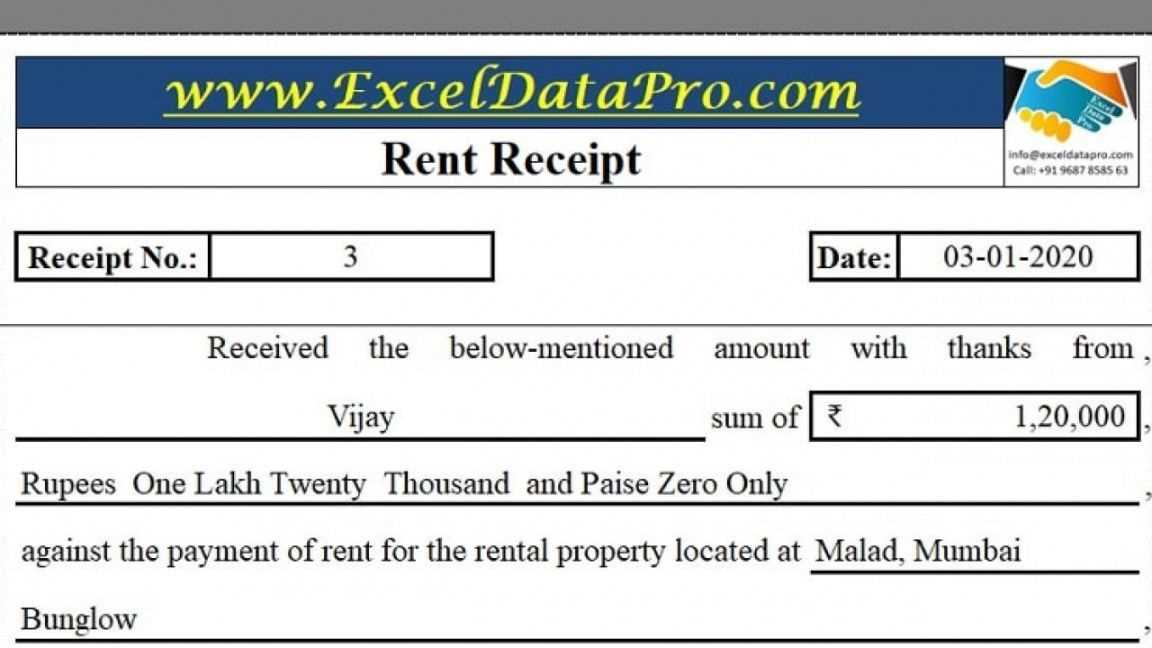

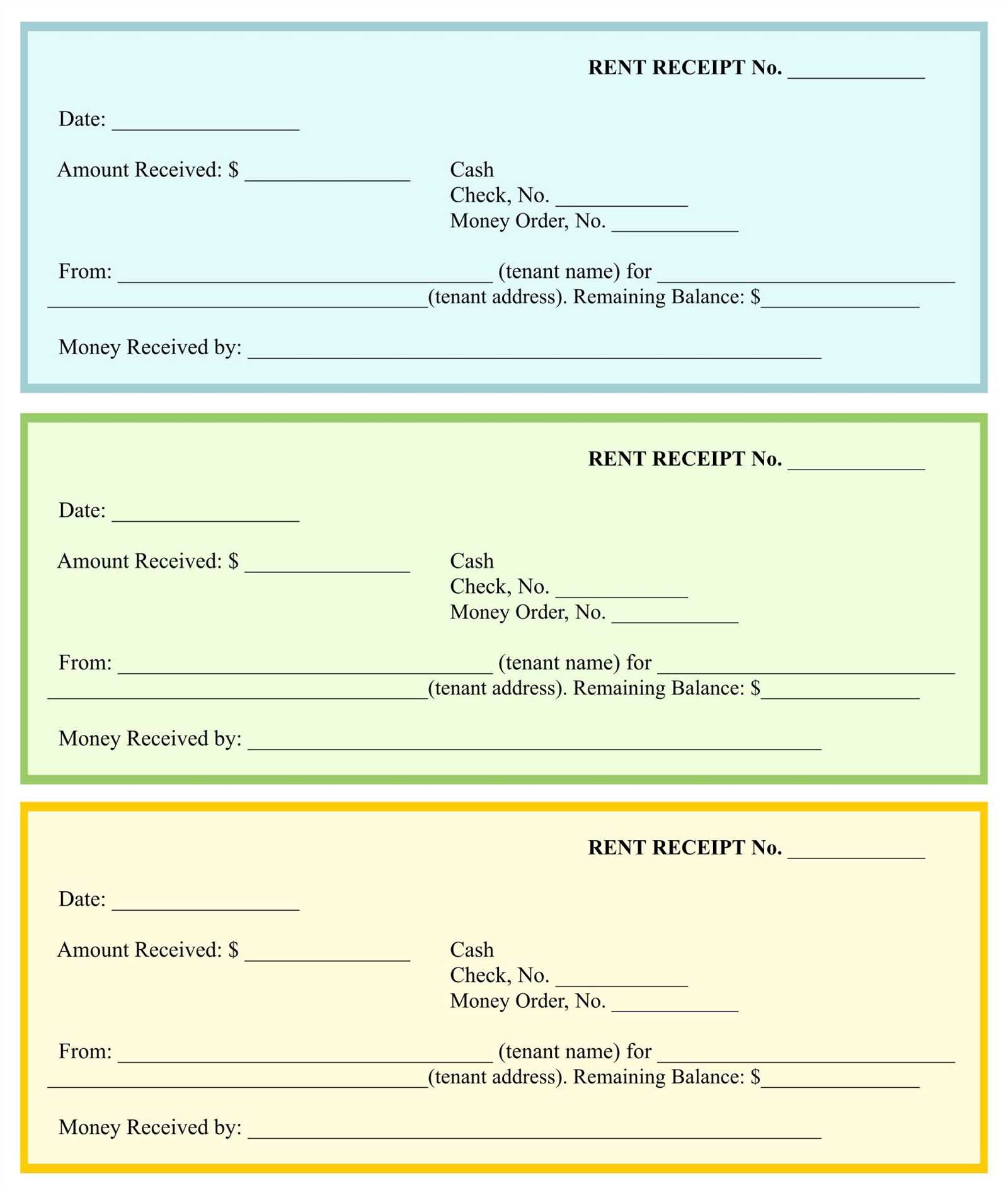

- Receipt Number: Assign a unique number to each receipt for easy tracking.

- Date: Include the date the service was provided.

- Service Description: Clearly state the hours worked and the type of service provided (e.g., babysitting, overnight care).

- Rate: List your hourly or flat rate for the service.

- Total Amount: Calculate the total amount paid by multiplying the hours worked by your rate.

- Client Information: Include the full name and contact details of the client.

- Babysitter Information: Include your full name and contact details.

- Payment Method: Note how the payment was made (cash, check, digital transfer).

This template helps you keep accurate records for tax purposes and ensures transparency in your services.

To create a babysitting tax receipt, follow these steps:

- Include Your Information: Add your full name, address, and contact details at the top of the receipt.

- Client’s Details: Write the client’s name and address. This helps keep the transaction clear for both parties.

- Service Details: Specify the dates and hours worked, including the total hours spent babysitting. Provide a brief description of the services you provided, such as “babysitting for [number] children” or any other specific duties.

- Payment Information: Mention the agreed rate (per hour, per day, etc.) and the total payment received. If applicable, note any tips or bonuses.

- Tax Information: Indicate any taxes you are collecting based on your local tax laws, or mention if you’re exempt from charging tax.

- Sign and Date: End the receipt with your signature and the date the service was provided. This makes the receipt official.

Once these elements are included, you’ll have a complete and accurate babysitting tax receipt ready for your records or your client’s tax filing needs.

Each babysitting receipt should clearly include the sitter’s name and contact details. This helps ensure that both parties can identify the transaction. Include the date and time range of the service, specifying the hours worked, to avoid any confusion regarding payment. Indicate the hourly rate and total amount due for the service provided. If applicable, note any additional charges, such as for transportation or special requests, to maintain transparency.

Details to Include

It’s also important to list the client’s name and address, even if it’s optional. This provides an added level of detail for record-keeping. If the sitter has a business or tax identification number, it should be included as well. This makes it easier for both parties during tax filing.

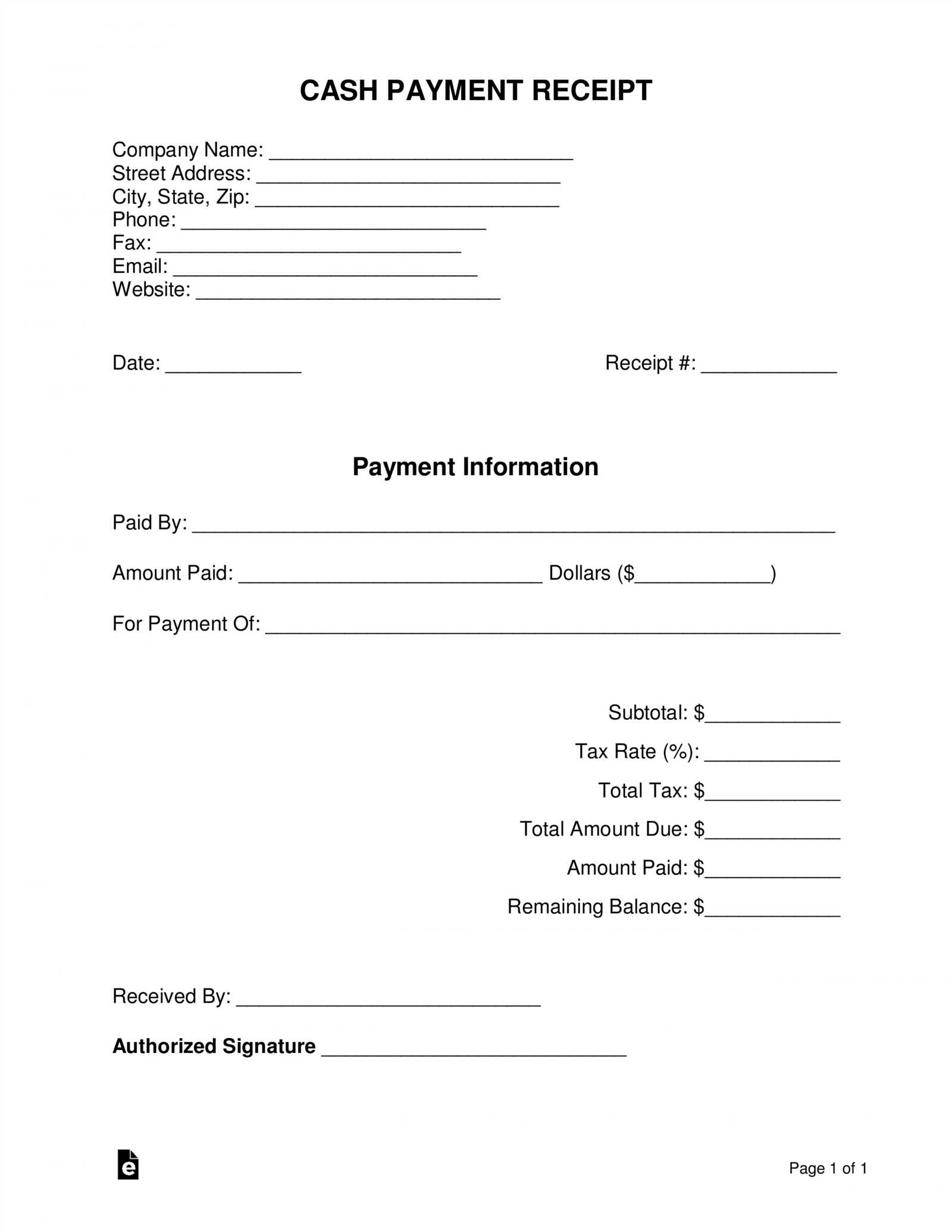

Payment Method

Clarify the payment method, whether it’s cash, check, or electronic payment, so both parties have a record. If the payment was made in installments, note the amount and date of each transaction. A simple receipt ensures proper documentation for tax purposes and any future disputes.

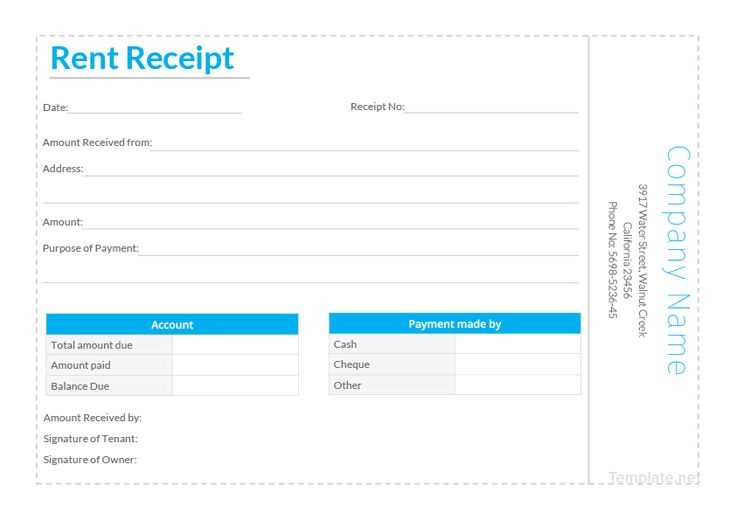

Use a clear, concise, and professional format that highlights all the necessary details. The receipt should include the date, total hours worked, hourly rate, and the total amount paid. Make sure to mention the name of the person being babysat, as well as the name of the babysitter, for accurate records. Keep the design simple but organized–use a table format or bullet points for easy readability.

Ensure that the format is compatible with both physical and digital records. For digital receipts, make sure to save them in a universally accessible format, such as PDF. This ensures that you or your client can easily print or email the receipt for future reference or tax filing. If you choose to use an online receipt template, double-check that it includes space for all relevant information, like payment methods and any additional charges (e.g., transportation costs).

Incorporate the proper tax identification or social security number if necessary, depending on local tax requirements. This will provide extra security and professionalism to the receipt. Finally, remember to keep a copy for your records. A well-organized tax receipt format helps ensure smooth record-keeping and avoids confusion during tax filing.

To calculate your earnings from babysitting for tax purposes, track all the income you receive from your babysitting jobs. Include cash payments, checks, and any other form of compensation. It’s important to note that the IRS requires you to report all income, regardless of whether it’s paid in cash or by other means.

- Start by adding up all payments you received throughout the year. This includes hourly rates, bonuses, and any additional tips you received from families.

- Consider the number of hours worked. If you charge by the hour, multiply your hourly rate by the number of hours you worked. For example, if you charge $15 per hour and worked 10 hours in a week, you earned $150 that week.

- Keep a log of the dates and times of each babysitting job to provide evidence in case of an audit. This will help ensure accurate reporting.

- Subtract any allowable business expenses related to your babysitting activities, such as transportation costs or supplies. If you use your car for travel, you may deduct mileage, but be sure to keep a detailed record of the miles driven for work purposes.

Once you have an accurate total of your earnings and expenses, report this information on your tax return. Babysitters are typically considered self-employed, so you will likely need to file a Schedule C (Profit or Loss from Business) form to report your income and expenses. If you earn more than $400 in a year, you may also need to pay self-employment tax.

When creating a babysitting receipt, ensure it includes all necessary details for proper record-keeping and tax reporting. These details will help clarify the transaction for both parties and fulfill legal requirements.

1. Accurate Record of Services

Include the date and hours worked on the receipt. Be specific about the start and end times, as this serves as a legal record for payment and hours worked. In some jurisdictions, this may be required for tax purposes or when seeking deductions.

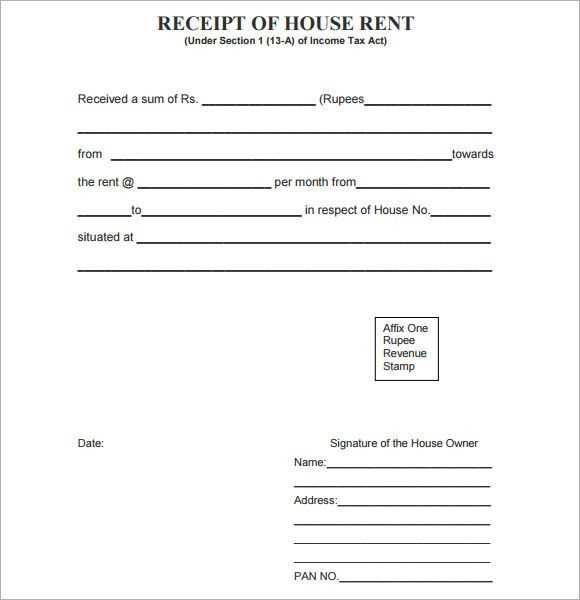

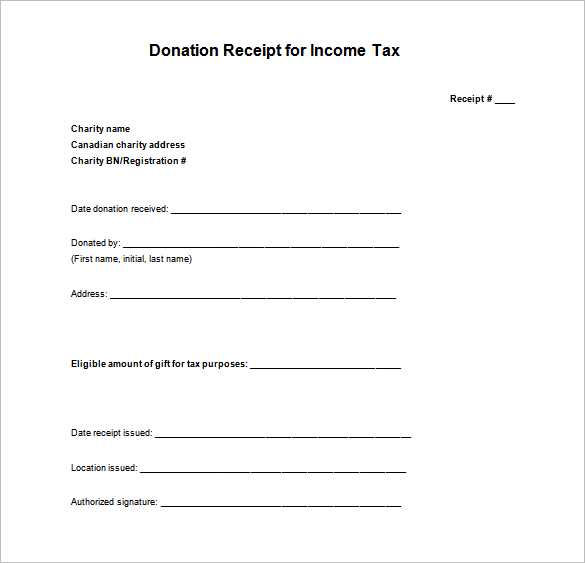

2. Correct Tax Identification Information

For freelance or independent babysitters, it’s important to include the correct tax ID number, either a Social Security Number (SSN) or Employer Identification Number (EIN) if applicable. This is especially necessary for those who report earnings on tax forms such as the 1099. Check local regulations to confirm if you need to include this information on receipts.

3. Clarity in Payment Terms

Indicate the payment rate per hour, total amount paid, and any applicable taxes. This helps prevent misunderstandings and provides clarity in case of disputes. If a deposit or additional fee was included, clearly state that on the receipt.

4. Record of Tax Payments (If Required)

If you are required to collect or pay taxes, it’s crucial to indicate the applicable tax amount on the receipt. Some locations may have sales tax requirements for babysitting services or may require self-employed workers to report these payments on their tax returns.

5. Keep Copies of All Receipts

Both the babysitter and the client should keep a copy of the receipt for future reference. This is important in case of audits or disputes over payment or tax filings. Storing these receipts in a digital format can also make future reporting easier.

6. Legal Implications for Non-Compliance

Failure to issue proper receipts or keep detailed records can lead to issues with tax authorities, especially for those who are self-employed. Ensure all receipts are accurate and comply with the local laws governing childcare services.

| Receipt Element | Description |

|---|---|

| Date and Hours Worked | Record the specific date(s) and exact hours worked during the babysitting session. |

| Payment Rate | State the agreed-upon rate per hour for the babysitting service. |

| Total Payment | List the total amount paid for the session, including any applicable taxes or fees. |

| Tax Identification Number | Provide your tax ID (SSN or EIN) if required for tax reporting. |

To issue a babysitting receipt for multiple sessions, break down each session on a separate line, including the date, hours worked, and rate for that particular day. Be sure to list the total amount due for each session, then sum these amounts for the final total at the bottom of the receipt.

1. Break Down the Sessions

Start by listing each babysitting session separately, starting with the date and the number of hours worked. Specify the hourly rate charged for each day to show how the total for that session was calculated.

2. Total the Amount

After listing each session, add up the individual amounts for the final total. Include any applicable discounts or additional charges (such as transportation fees) if necessary. Make sure the total matches the sum of all the individual sessions listed above.

Tip: Double-check the dates and total hours for each session to ensure accuracy before issuing the final receipt.

Simple Babysitting Tax Receipt Template

Include the following details in your babysitting tax receipt:

| Item | Description |

|---|---|

| Date of Service | Enter the date(s) when babysitting was provided. |

| Child’s Name | Include the child’s first name for clarity. |

| Hours Worked | Specify the total hours worked during the session. |

| Hourly Rate | State the agreed-upon hourly rate. |

| Total Amount | Calculate the total payment by multiplying hours worked by the hourly rate. |

| Payment Method | Note the method of payment (e.g., cash, check, Venmo). |

| Signature | Both the babysitter and the client should sign to confirm the transaction. |

This template helps keep a clear record of services rendered and payments received for tax reporting purposes. Customize it according to the specifics of each job.