Downloadable Paid Receipt Templates

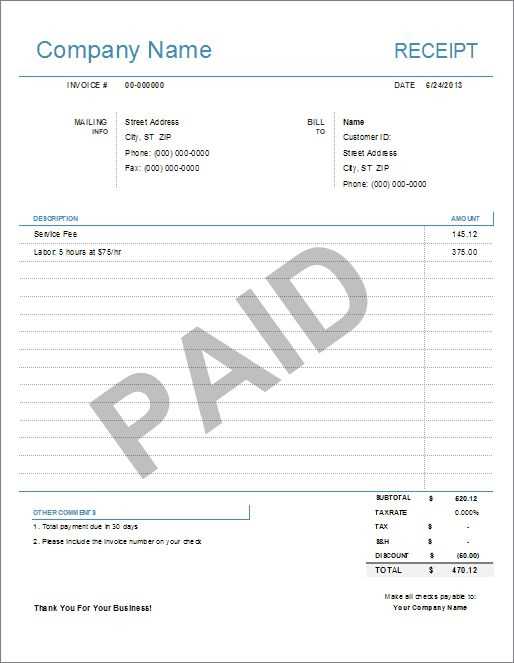

Save time with ready-to-use paid receipt templates. Choose a format that suits your needs–PDF for a fixed layout, Word for easy editing, or Excel for automatic calculations. Below are common templates:

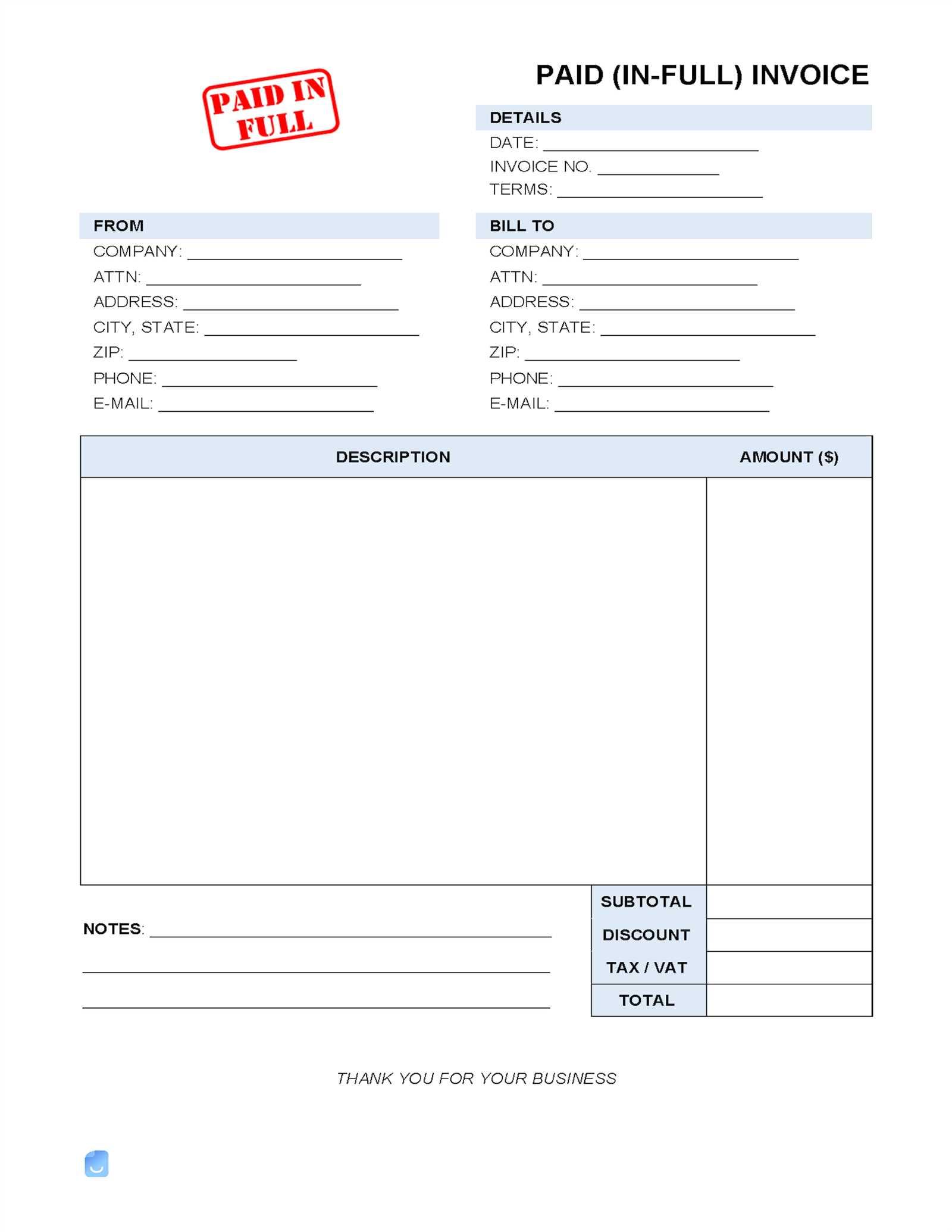

- Basic Receipt: Includes date, amount, payment method, and recipient details.

- Itemized Receipt: Lists purchased items, unit prices, and taxes.

- Business Receipt: Features a company logo, tax ID, and payment breakdown.

Download a template, fill in the details, and print or send it digitally.

What to Include in a Paid Receipt

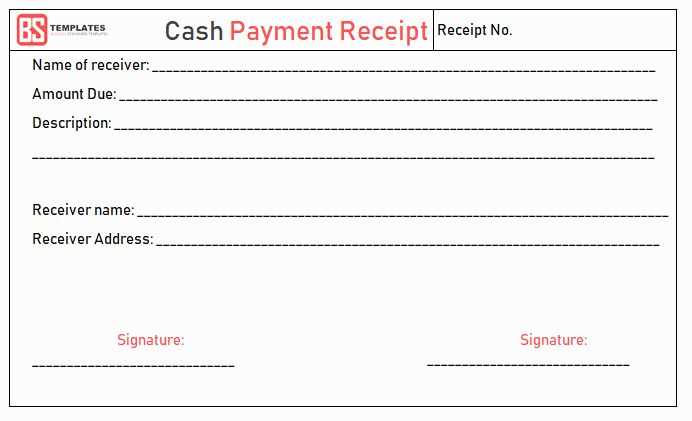

A well-structured receipt ensures clarity for both parties. Key elements:

- Header: Business name, address, and contact details.

- Receipt Number: Unique identifier for tracking.

- Payment Information: Amount, currency, and payment method.

- Payer Details: Name and contact information.

- Description of Payment: Goods, services, or invoice reference.

- Transaction Date: When the payment was received.

- Authorized Signature: Optional but adds credibility.

Using a Template in QuickBooks

QuickBooks allows users to create and customize receipt templates. Go to Settings > Custom Form Styles, select New Style, and choose Receipt. Modify fields, add a logo, and save the template for future transactions.

Printing and Sending Digital Receipts

For paper receipts, use high-quality printing for legibility. If sending digitally, PDF format ensures compatibility. Many online tools allow secure email delivery and tracking.

Legal Considerations

Ensure compliance with tax regulations by including required details. For large transactions, retain copies for record-keeping. If unsure, consult a financial professional.

Use a template to streamline payment documentation and maintain organized records.

Paid Receipt Template

Key Elements to Include in a Paid Receipt Form

How to Customize a Paid Receipt for Different Transactions

Best File Formats for a Payment Receipt Template

Legal Considerations When Using a Receipt Template

Where to Find Free and Premium Payment Receipts

How to Automate Receipts with Accounting Software

Key Elements to Include in a Paid Receipt Form

Include the date of payment, unique receipt number, payer and payee details, payment method, itemized list of goods or services, total amount, and applicable taxes. Ensure clear labeling for quick reference.

How to Customize a Paid Receipt for Different Transactions

Adjust fields based on transaction type. For retail, add product details and quantities. For services, include hourly rates or fixed fees. Rental receipts should specify lease periods. Digital transactions may require an email confirmation section.

PDF and Word formats work well for printed receipts, while Excel allows easy modifications. Legal compliance varies by region, so verify local requirements before issuing receipts.