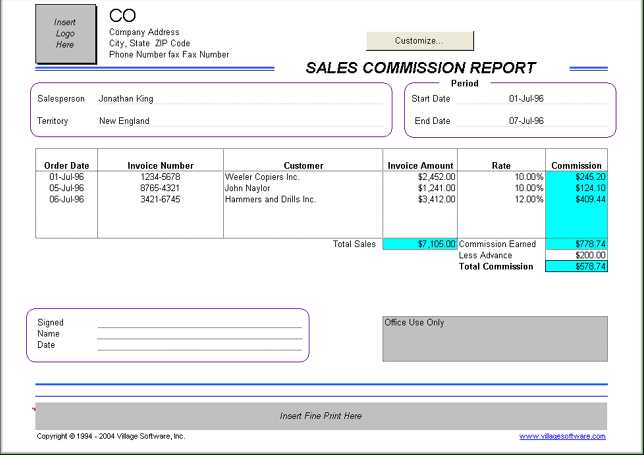

A commission receipt should include clear details about the transaction to ensure transparency and proper documentation. Specify the commission amount, payment date, payer and recipient information, and a brief description of the service rendered. A well-structured template simplifies record-keeping and compliance with tax regulations.

Include essential details such as an invoice or reference number, payment method, and applicable taxes. If the commission is subject to deductions, highlight them clearly. Providing a breakdown prevents disputes and makes financial reporting easier.

Using a standardized template ensures consistency across multiple transactions. Whether for freelancers, sales agents, or brokers, a properly formatted receipt reinforces trust and professionalism while meeting legal requirements. Digital and printable formats allow flexibility depending on business needs.

Commission Receipt Template: Key Aspects and Practical Use

Use a structured commission receipt template to ensure clarity and accuracy in financial transactions. A well-designed template should include essential details such as the recipient’s name, payer information, payment amount, date, and a breakdown of the commission structure. Clear formatting helps avoid disputes and simplifies record-keeping.

Essential Components

Include a unique receipt number for tracking and reference. Specify the commission rate or percentage, along with the service or product related to the payment. Add a section for notes if additional details are required, such as contract terms or payment conditions.

Practical Application

Use digital or printed templates depending on the business needs. A PDF format ensures consistency, while an editable document allows customization. Automating receipt generation with accounting software can improve accuracy and save time. Store copies securely for tax and compliance purposes.

Core Elements of a Commission Receipt Template

A commission receipt must clearly state the key transaction details. Include the date of issuance to confirm when the receipt was created. Specify the parties involved, including the name and contact details of the payer and recipient.

Provide a detailed description of the commission, outlining the service or product that generated the payment. Include the commission amount in both numeric and written formats to prevent misunderstandings. If applicable, list the payment method (bank transfer, check, cash) for reference.

Assign a unique receipt number to maintain accurate records. If taxes apply, display the tax breakdown separately. Add a signature or company stamp to validate authenticity.

Ensure the format is structured for easy reading. Use clear headings and align figures neatly. A well-organized receipt prevents disputes and enhances professionalism.

Formatting and Layout Considerations

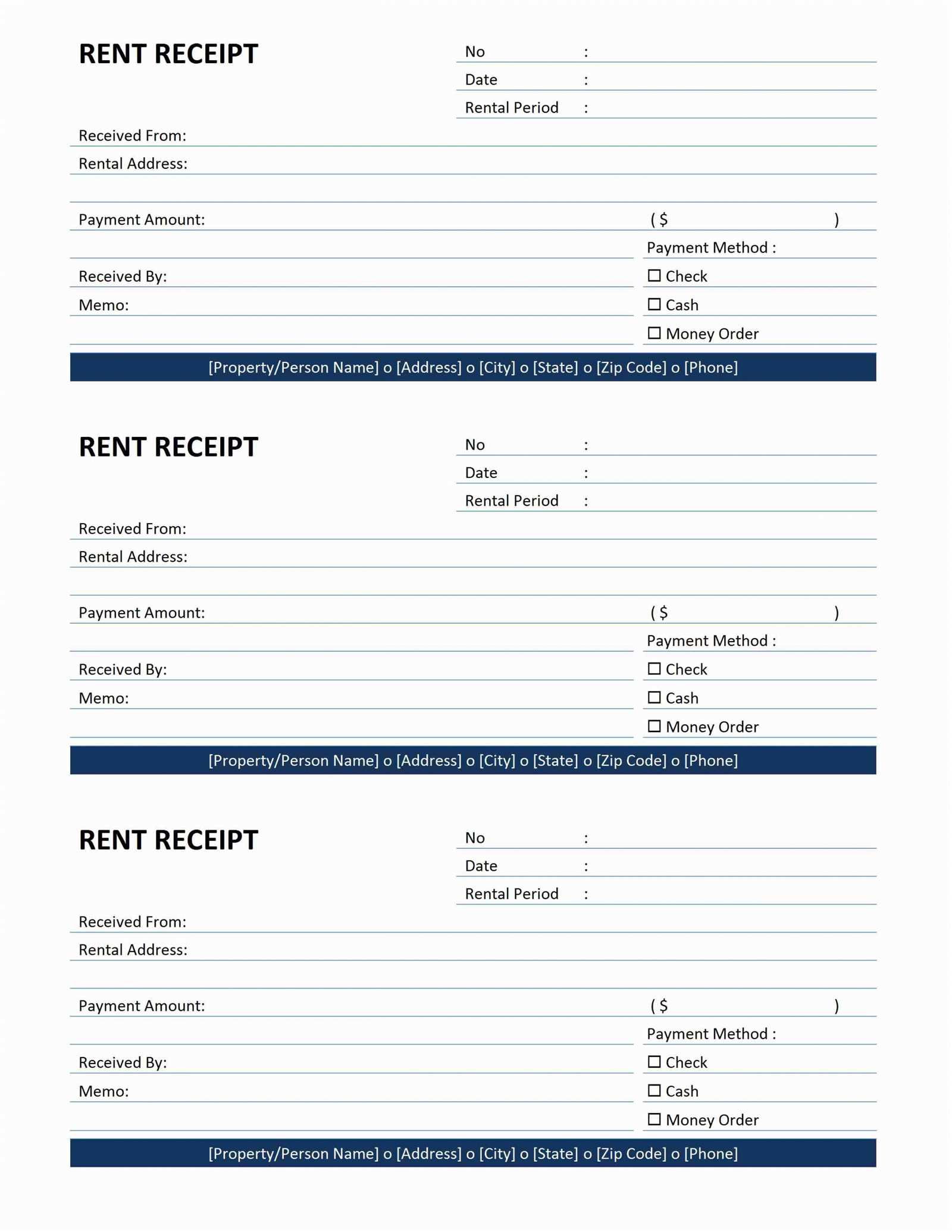

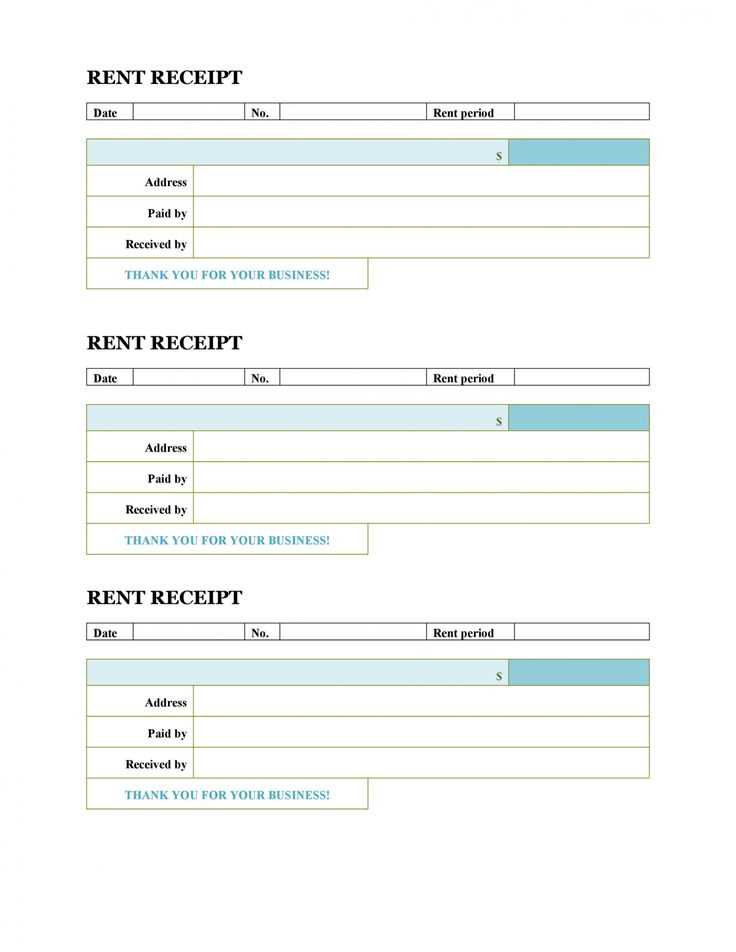

Use a clean and structured layout to enhance readability. Align text consistently, ensuring that key details such as commission amount, date, and recipient information are clearly visible. A standard format includes:

- Header: Business name, logo (if applicable), and document title.

- Transaction Details: Invoice number, date, and payment reference.

- Commission Breakdown: Itemized list with percentages or fixed amounts.

- Total Amount: Bolded for emphasis, with currency symbols.

- Payment Instructions: Accepted methods and deadlines.

- Signatures (if needed): Space for both parties to sign.

Choose a readable font such as Arial or Times New Roman, keeping font size between 10pt and 12pt. Maintain sufficient white space to separate sections, avoiding cluttered text. Borders and shading can help distinguish different sections without overwhelming the design.

For digital formats, ensure proper alignment across various screen sizes. PDFs should be optimized for printing, while email versions should use responsive HTML tables for consistency. Including a footer with contact details and legal disclaimers adds professionalism.

Legal and Tax Compliance Factors

Ensure that every commission receipt includes the recipient’s tax identification number and the payer’s business details. This prevents issues with tax reporting and audit compliance.

Mandatory Receipt Elements

Include the commission amount, payment date, and a breakdown of any applicable taxes. If the commission is subject to VAT or sales tax, specify the rate and total tax amount separately.

Regulatory Compliance

Verify whether local laws require specific wording or formats for commission receipts. Some jurisdictions mandate electronic receipts or digital signatures for validity. Keep records for the legally required period to avoid penalties.

Consult a tax professional if handling commissions across different tax zones. Incorrect tax classification may lead to fines or unexpected liabilities.

Customization for Different Business Models

Tailoring a commission receipt template to fit a specific business model ensures clarity and compliance. Start by adjusting the format to match industry standards. A real estate agency may require detailed property descriptions, while an affiliate marketer might need tracking codes for campaign performance.

Service-Based Businesses

Include sections for service descriptions, hourly rates, and project milestones. Adding a breakdown of labor costs and applicable taxes helps clients understand the charges. For consulting firms, incorporating a payment schedule and retainers can prevent disputes.

Product-Based Businesses

Retailers and distributors should focus on itemized lists, SKU numbers, and discounts. Highlighting return policies and warranty terms on the receipt can improve transparency. E-commerce businesses benefit from including order numbers and payment gateways for streamlined reconciliation.

Adapt the template with dynamic fields for tax variations, currency conversions, and custom branding. Automated calculations for tiered commissions simplify reporting, reducing manual errors. Selecting a flexible format, such as PDF or CSV, ensures compatibility with accounting software.

Digital vs. Printed Commission Receipts

Choose digital receipts for instant delivery, easy storage, and automated tracking. Printed receipts work best when clients require physical documentation or legal compliance demands hard copies. The right choice depends on business needs, record-keeping preferences, and client expectations.

| Feature | Digital Receipts | Printed Receipts |

|---|---|---|

| Delivery Speed | Instant via email or cloud storage | Requires printing and manual handover |

| Storage & Accessibility | Stored digitally, searchable anytime | Physical copies require filing space |

| Security | Encrypted, password-protected | Can be lost, stolen, or damaged |

| Environmental Impact | Paperless, reducing waste | Consumes paper and ink |

| Legal Compliance | Accepted in most jurisdictions | May be required for audits |

Businesses handling high transaction volumes benefit from automated digital receipts, minimizing paperwork and reducing errors. When clients prefer physical copies, thermal printing offers a fast solution without ink expenses. Evaluate workflow needs before deciding on the best format.

Common Mistakes and How to Avoid Them

One common mistake in commission receipt templates is failing to include the correct date. Always ensure the date is clearly stated at the top, as it’s key for record-keeping and verification purposes. Double-check this detail to avoid confusion.

Another issue is incorrect or incomplete payment details. Missing transaction numbers or inaccurate amounts can create discrepancies. Always verify the figures and cross-check with bank statements or payment logs before finalizing the document.

Leaving out the recipient’s contact information is another frequent error. This information is necessary for follow-ups or potential queries. Ensure the name, phone number, and email are clearly visible on the receipt.

Avoid vague descriptions of the commission. Provide specific details about the services rendered, the commission rate, and the total amount due. This clarity helps avoid misunderstandings and potential disputes later on.

Omitting signatures is a simple yet significant mistake. Both parties should sign the receipt to confirm its accuracy. Always include a section for both the payer and payee to sign.

Ensure the formatting is clean and easy to read. Cluttered receipts with excessive or unnecessary information can cause confusion. Keep the layout simple, with clearly marked sections for each detail.