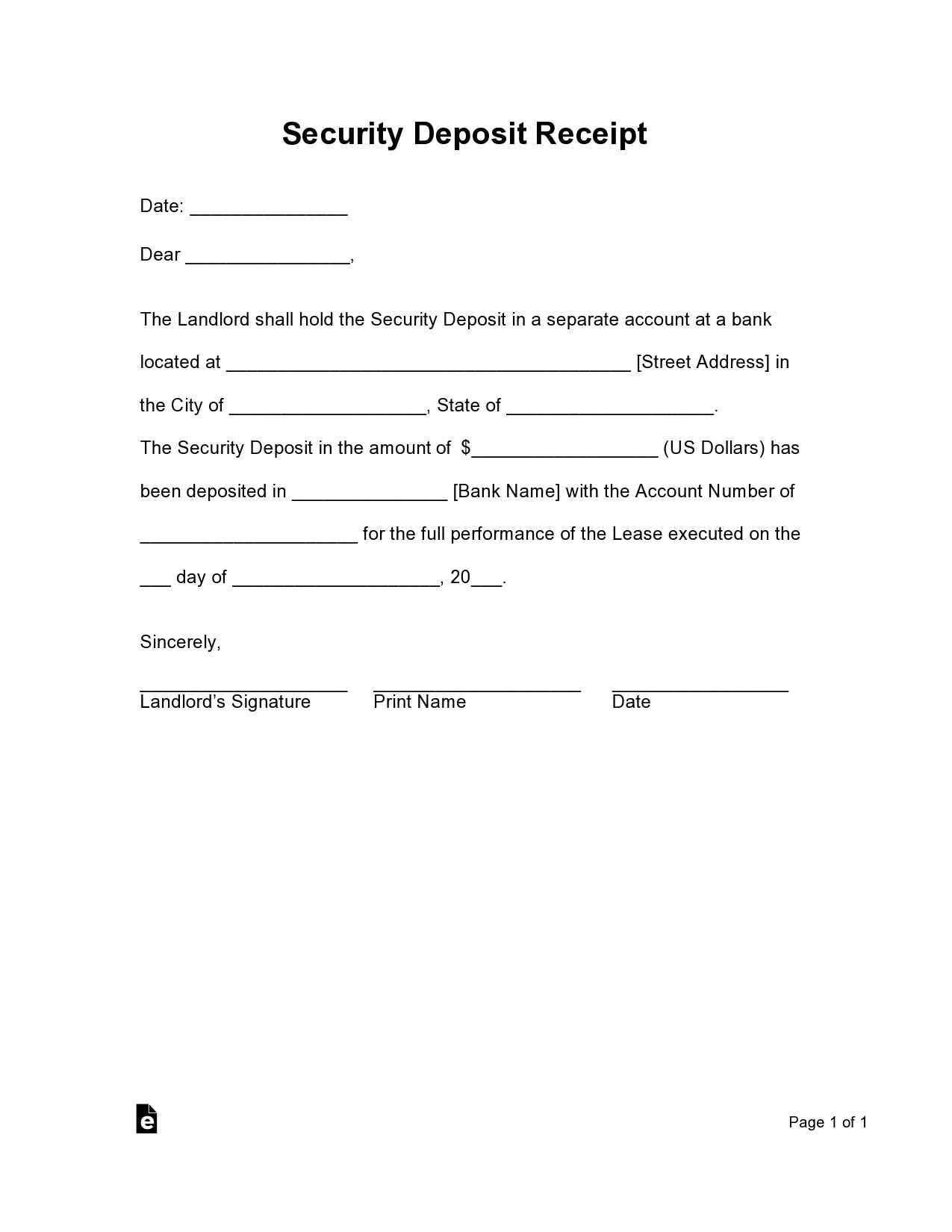

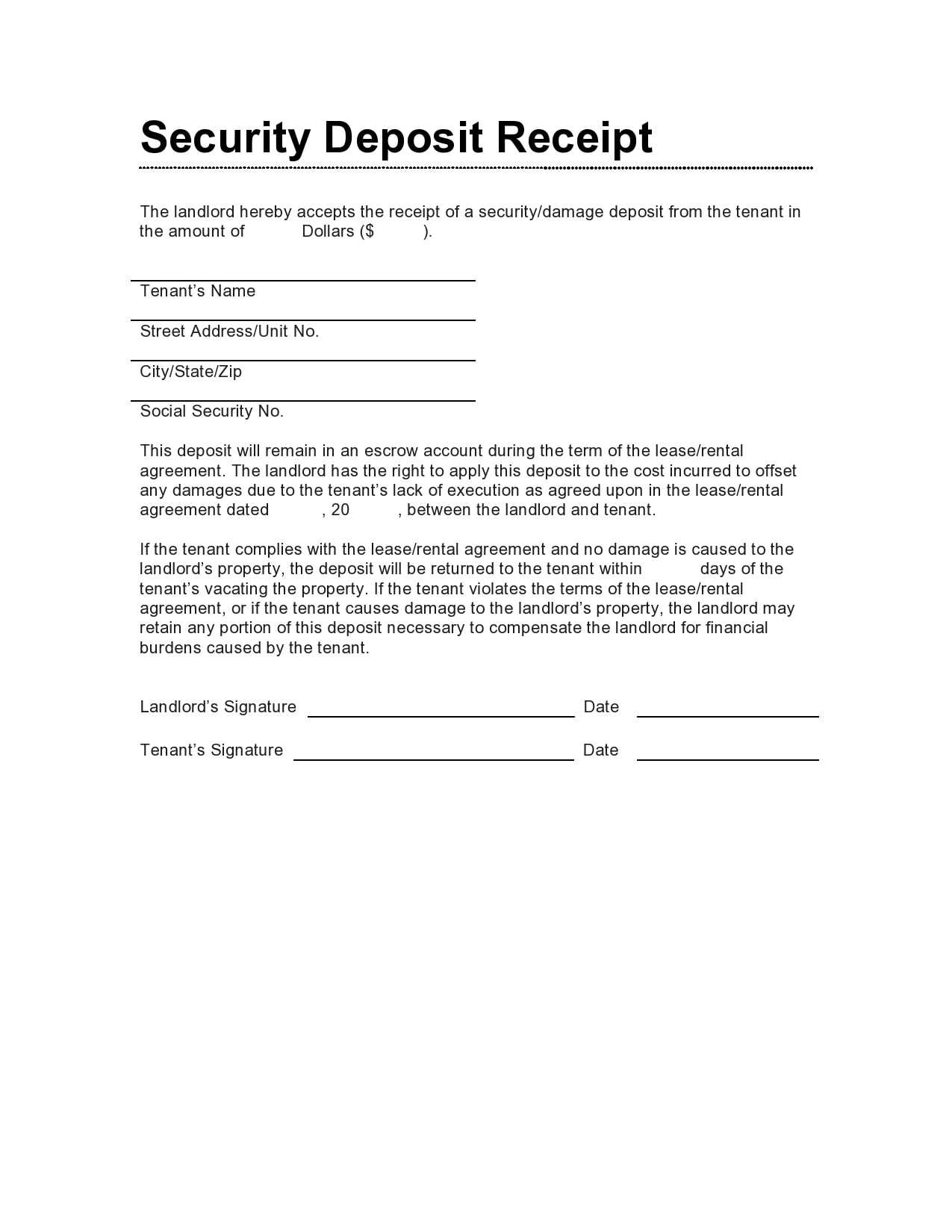

Use a structured ATM deposit receipt template to keep clear financial records and ensure accurate documentation. A well-designed receipt should include the deposit date, transaction reference number, account details (without full account numbers for security), and the total amount deposited. This helps track deposits and resolve discrepancies if needed.

Most banks provide automated receipts, but a customized template can be useful for businesses or individuals handling frequent transactions. Adding fields for payment method (cash or check), depositor’s name, and a verification section enhances transparency. Including a note section allows for additional details, such as check numbers or internal references.

A clear layout improves readability. Organize details in a structured format, using bold labels for key information. Ensure the template is easy to print or store digitally. If used for record-keeping, consider adding a signature line or confirmation stamp for verification.

ATM Deposit Receipt Template

Design a straightforward ATM deposit receipt template with all necessary fields for accurate documentation. The template should include the date, transaction amount, and bank account number, ensuring clarity and completeness. Also, include a unique reference number for each deposit to track the transaction easily.

Key Components of the Template

Include the following essential details on the ATM deposit receipt template:

| Field | Description |

|---|---|

| Date | Provide the exact date the deposit was made. |

| Time | Indicate the time of the transaction for better tracking. |

| Amount Deposited | List the exact amount of money deposited into the account. |

| Bank Account Number | Include the recipient’s account number for reference. |

| Reference Number | A unique number generated for tracking the deposit. |

Formatting Tips

Use clear, legible fonts and a clean layout to make the receipt easy to read. Ensure the spacing between fields is consistent and logical. Place the most important details, such as the deposit amount and reference number, in bold to stand out. This approach guarantees the document’s practical use for both the customer and the bank.

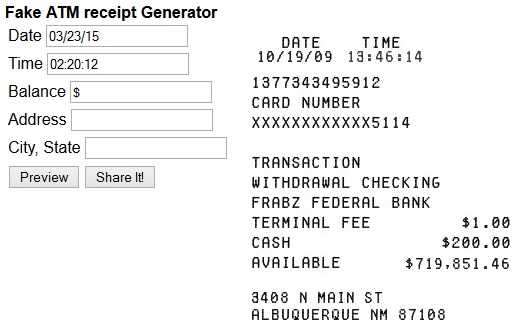

Key Elements of an ATM Deposit Receipt

Make sure the receipt clearly shows the date and time of the deposit. This helps track the exact moment of the transaction. Next, the machine should print a unique transaction number, which serves as a reference point if there are any discrepancies. Always verify that your account number is displayed correctly to avoid any issues with the deposit being credited to the wrong account.

The receipt should also list the total deposit amount, broken down by bills or checks if applicable. This ensures transparency and accuracy, allowing you to cross-check the physical deposit with the printed amount. Pay attention to the ATM location, which should be printed on the receipt. This is particularly helpful if you make deposits at different locations and need to verify the specific machine used.

Another important element is the confirmation message or status. The receipt should confirm whether the transaction was successfully completed or if any issues occurred. If a deposit is pending verification, make sure the receipt reflects this status. Lastly, check for any fees associated with the deposit, as some ATMs charge for certain types of transactions.

Design and Layout Considerations

Keep the design clear and user-friendly. The layout should prioritize readability and quick identification of important details, such as transaction amounts and the date. Avoid overcrowding the space with excessive information. Instead, focus on the essentials that the user needs to verify their deposit quickly.

Use a well-organized hierarchy, with headings that guide the user’s eyes naturally across the receipt. Group related information together, like transaction details, account numbers, and date stamps, to improve readability. Utilize clear font choices and sizes to create an easy-to-scan document, ensuring that key elements stand out.

Spacing is another key factor. Ensure sufficient padding around text and between sections to make the document less cluttered. A clean, open design allows the user to focus on the most important data without distractions.

Include a clear call to action or instructions if needed. For example, if any follow-up is required from the user, make that information easily noticeable by using bold or emphasized text.

Test the layout for both printed and digital formats. Adjustments might be needed depending on how the receipt will be used, whether in a physical form or displayed on a screen. Prioritize readability and structure, ensuring that the receipt is practical and easy to interpret regardless of the format.

Security Features to Prevent Fraud

Incorporate multi-factor authentication (MFA) for ATM deposit receipts to reduce the likelihood of unauthorized access. MFA requires multiple forms of verification, such as PIN and biometric data, ensuring that even if one method is compromised, access remains protected.

Encryption Methods

Use strong encryption algorithms to protect data transmitted between the ATM and bank systems. AES-256 encryption, for instance, prevents potential interception and tampering with sensitive information during the deposit process. Always verify that the ATM supports end-to-end encryption to safeguard user data.

Secure Printing Technology

Implement secure printing features that include watermarks or holograms on ATM receipts. These features are difficult to replicate and act as visual indicators to verify authenticity, preventing counterfeit receipt production.

Ensure regular software updates on ATMs to patch vulnerabilities. Cybercriminals often exploit outdated systems, so keeping all systems up-to-date minimizes potential entry points for fraudsters.

Establish transaction monitoring systems to track any unusual activities. These systems can flag suspicious patterns, such as multiple rapid deposits from a single card, for immediate review, helping to spot fraud before it escalates.

Common Customization Options

Adjust the receipt layout to match branding by modifying fonts, colors, and spacing. A clean design improves readability and ensures key details stand out. Choose a font that aligns with other business documents and keep sizes consistent for clarity.

Include a custom logo for instant brand recognition. Place it at the top or near transaction details for a professional look. Ensure the logo is high resolution to avoid pixelation on printed receipts.

Modify field labels to match industry-specific needs. For example, retail businesses might highlight itemized purchases, while banks may prioritize account numbers and deposit types. Removing unnecessary fields keeps receipts concise.

Add a disclaimer or policy statement at the bottom. This may cover transaction terms, refund policies, or customer service contact details. Use a smaller font to keep the main details prominent.

Incorporate a QR code linking to digital records, support channels, or promotional offers. Customers can scan it for quick access to their transaction history or related services.

Use perforated sections for detachable customer copies if receipts are printed. This makes it easier to provide a portion for personal records while keeping the business copy intact.

Test different formats before finalizing the design. Print samples to verify alignment, readability, and spacing. A well-structured receipt improves customer experience and reduces disputes.

Legal and Compliance Requirements

Ensure that ATM deposit receipts include all legally required details, such as transaction amount, date, time, and a unique reference number. Financial institutions must also provide a way for customers to verify deposits, often through an online banking portal or a customer service hotline.

Data Protection and Privacy

Protecting customer information is mandatory. Receipts should avoid displaying full account numbers or personal data that could be misused. Compliance with regulations like GDPR or GLBA requires financial institutions to implement safeguards against unauthorized access to sensitive information.

Audit and Recordkeeping

Maintain digital copies of receipts for regulatory audits and dispute resolution. Storage policies should align with industry standards, ensuring records are accessible for the legally required retention period while safeguarding against unauthorized modifications.

Printing and Digital Storage Best Practices

Use high-quality thermal or laser printers to ensure clear, long-lasting text. Inkjet prints can fade quickly, making thermal or laser options preferable for financial records. Always print receipts on durable, fade-resistant paper.

Optimizing Print Settings

- Set the printer to high contrast for better readability.

- Use monochrome printing to avoid unnecessary ink usage.

- Enable “draft mode” only for internal copies to conserve toner.

- Store printed receipts in dry, dark places to prevent fading.

Digital Storage Strategies

Scan paper receipts immediately using a mobile app or dedicated scanner. Save files in PDF format to maintain formatting and security. Name files consistently using a format like YYYY-MM-DD_Amount_Description.pdf for quick retrieval.

- Use cloud storage with encrypted access for security.

- Backup copies on an external drive in case of data loss.

- Organize files in structured folders by year and category.

- Enable automatic syncing across devices for easy access.

Regularly check both printed and digital copies for legibility. Replace faded receipts and update storage methods as needed.