Use a cheque receipt voucher template to streamline your accounting process and maintain clear financial records. This simple tool helps track incoming payments via cheque, ensuring that both parties involved are on the same page about the transaction details. The template provides space for essential information like the cheque number, payer details, amount, and the date of receipt. A clear, structured voucher will minimize errors and ensure that your financial documentation is accurate.

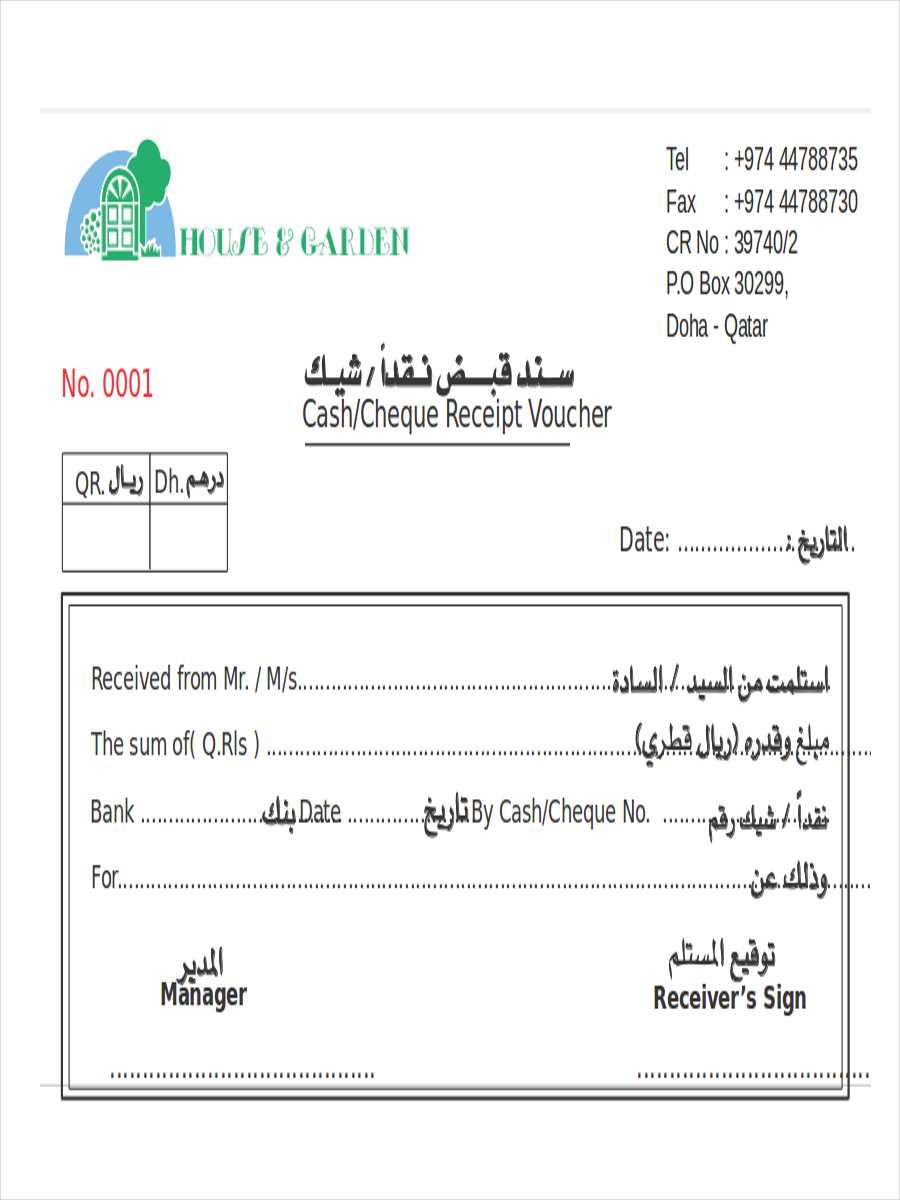

Each section of the template should be tailored to your specific needs, but it’s a good practice to include fields for the cheque’s bank and branch details. This allows you to cross-reference any potential discrepancies and improves overall accuracy. Customizing this template with your company logo and relevant contact details can also enhance its professionalism, especially for business use.

By using a cheque receipt voucher template, you create a consistent, standardized process that simplifies bookkeeping and auditing. It also provides a quick reference in case of any disputes or verification needs down the line. Whether you’re a small business or managing personal finances, having this template on hand can save time and reduce potential confusion during financial reviews.

Here are the revised lines with reduced repetition:

For a clear and streamlined cheque receipt voucher template, start by minimizing repetitive phrases. Use straightforward language to capture essential details such as the payer’s name, date, amount, and cheque number. Avoid redundancy by specifying the transaction type only once and providing concise descriptions for payment methods.

1. Simplify Payer and Payee Information

Instead of repeating “payer” and “payee” throughout the document, include these terms in the header or initial section. Keep the structure neat, with fields for each party’s name and details without unnecessary duplication.

2. Consolidate Payment Details

Streamline the payment section by mentioning the cheque number, amount, and payment date just once. Avoid restating the cheque’s validity or form unless necessary, and ensure the payment terms are succinctly outlined.

This reduces clutter and makes the template more user-friendly while maintaining all necessary details in a clear, concise format.

- Cheque Receipt Voucher Template

To create a cheque receipt voucher, start by including the key details that will ensure the voucher is both clear and informative. A basic template should include the following sections:

1. Voucher Header

At the top of the document, clearly label it as “Cheque Receipt Voucher.” This will help distinguish it from other types of receipts. Include the voucher number for easy reference and tracking.

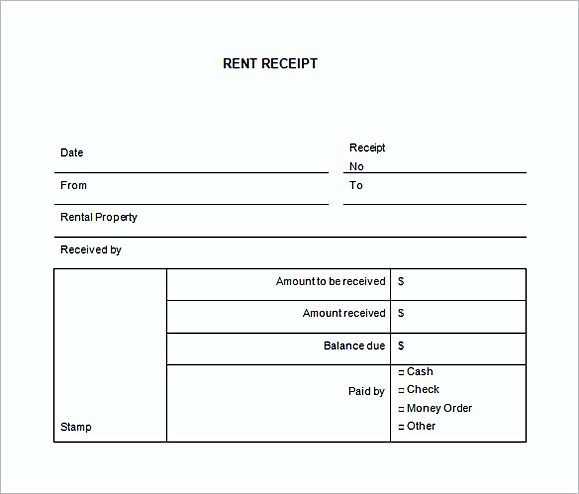

2. Payer and Payee Information

Specify the name and address of both the payer (the person issuing the cheque) and the payee (the person receiving it). This provides clarity on who is involved in the transaction.

3. Cheque Details

Include the cheque number, bank name, date of issue, and the amount in both words and figures. This ensures that all the relevant cheque information is clearly visible.

4. Receipt Date

State the date the cheque was received. This date is crucial for record-keeping and future reference.

5. Purpose of Payment

Indicate the purpose or description of the payment. This helps to clarify why the cheque was issued and makes the transaction transparent.

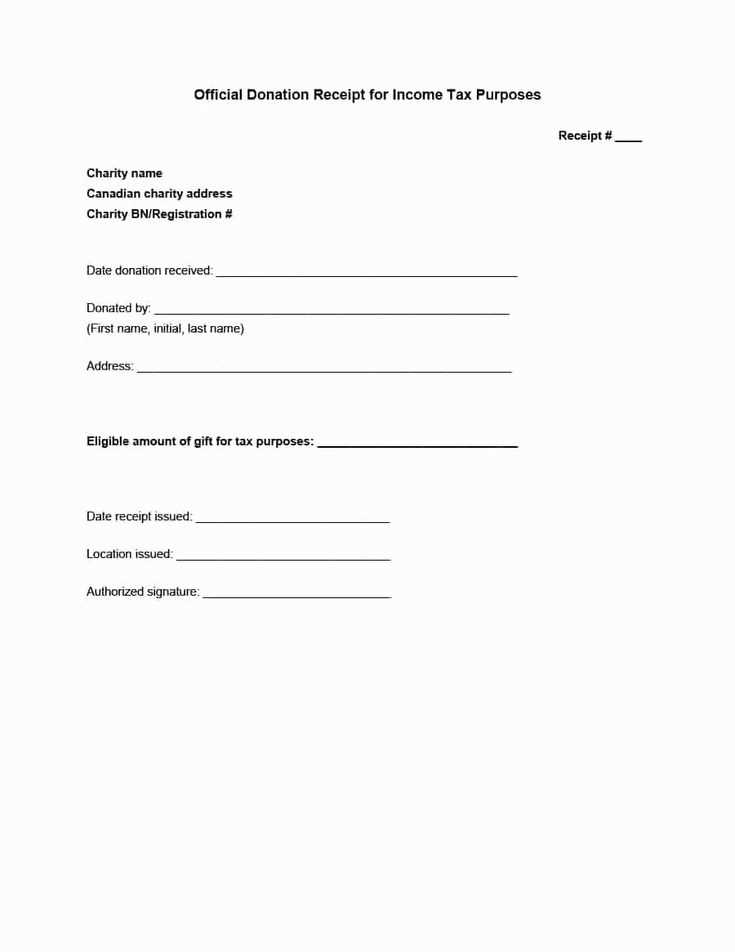

6. Authorized Signatory

Include space for the signature of the person receiving the cheque. This serves as proof of receipt and validation of the transaction.

Ensure that all fields are filled out correctly. Having a standardized format helps maintain consistent records and simplifies accounting processes.

A cheque receipt voucher serves as an official record for the receipt of payment via cheque. It includes specific details that guarantee both transparency and accountability. The voucher needs to be structured to avoid confusion and ensure a smooth transaction process.

1. Cheque Details

The first key component is the cheque information, which includes the cheque number, date of issue, and the bank name. These elements verify the authenticity of the cheque and provide a clear reference for future tracking. The cheque number should be listed clearly to avoid any mix-up between receipts.

2. Payer Information

The payer’s details such as name, address, and contact number should be recorded. This helps identify the individual or company responsible for the payment and enables follow-up if needed. It’s also useful for maintaining a proper record of transactions in case of audits.

Each voucher should also capture the amount received, written both numerically and in words, to prevent errors or disputes regarding the value of the cheque. This information must be clear and easily readable for all parties involved.

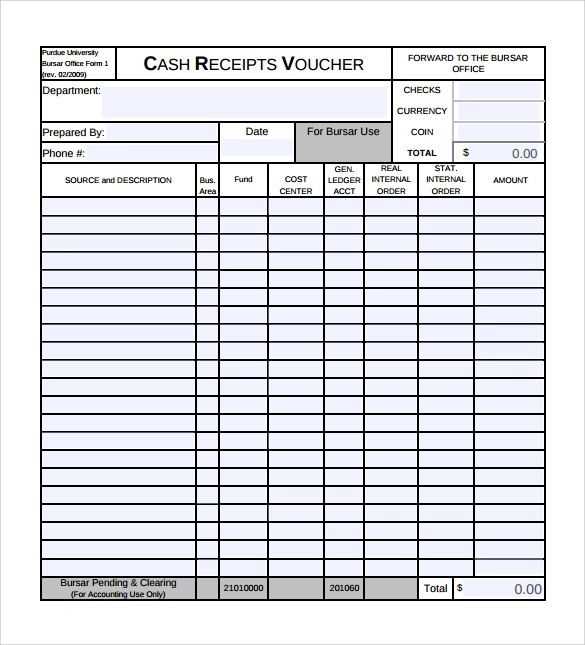

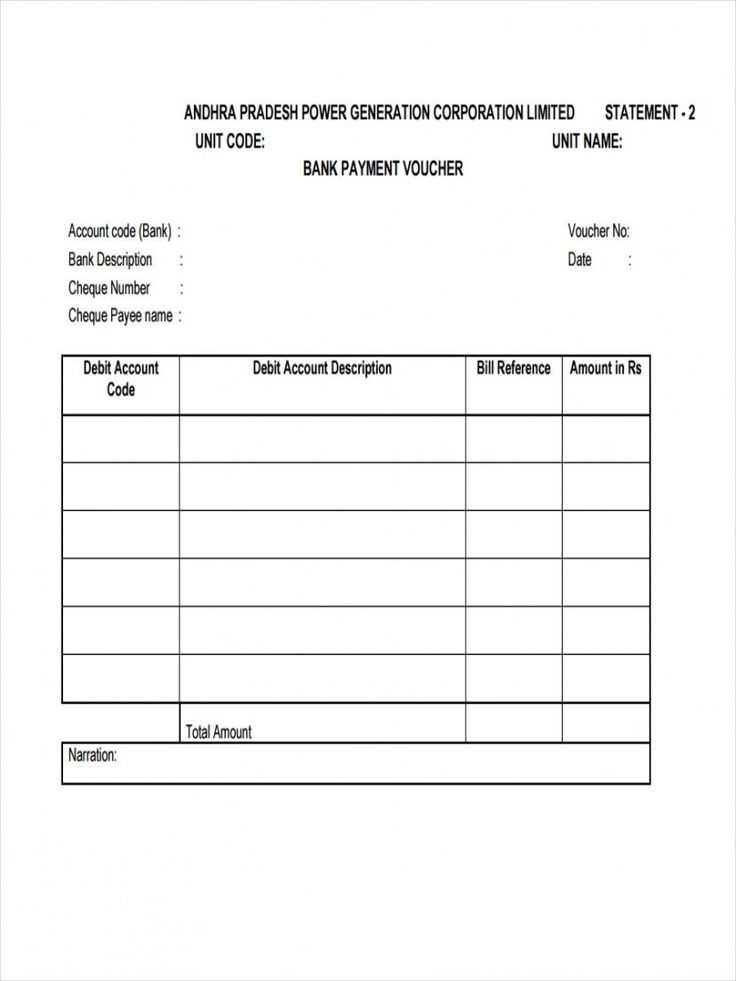

Begin by opening a new Excel workbook. Label the first sheet as “Cheque Receipt Voucher” or any name that fits your purpose.

Step 1: Set Up Basic Information Fields

In the first row, create headers to organize the necessary information. Label the columns as follows:

- Cheque Number

- Date

- Payee Name

- Amount

- Bank Name

- Branch

- Signature

These categories will ensure that all relevant details are captured for each receipt.

Step 2: Format the Table and Add Styling

Highlight the rows and columns you just set up, and format them to look clean and professional. Use borders around each cell, and adjust column widths to fit the data. You can use bold for headers and add shading to differentiate between the categories easily.

For currency, select the “Amount” column and apply the currency format to keep the financial data clear and standardized.

Step 3: Add Data Validation for Consistency

Apply data validation where necessary. For example, set up a dropdown menu for the “Bank Name” column to limit options to specific bank names you use frequently. This ensures consistency when entering data.

Step 4: Protect the Template

Once you finish setting up the table, protect the sheet to prevent accidental editing of the template itself. You can unlock cells for data entry, then apply protection to the rest of the document.

Now you have a functional cheque receipt voucher template that’s easy to use and ensures accurate record-keeping every time. Save the template to reuse it for each transaction without the need to start from scratch.

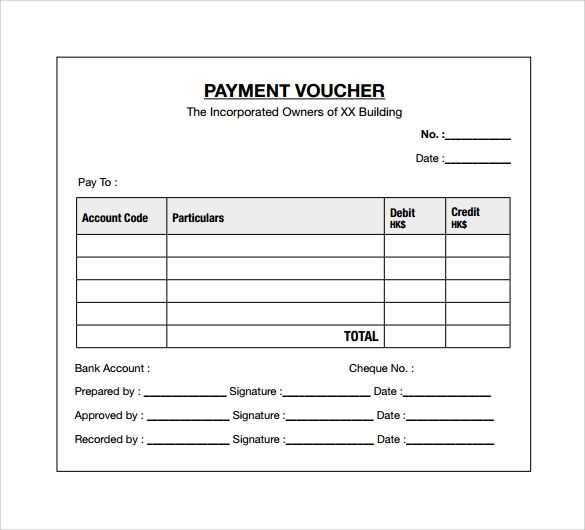

Define the essential fields your voucher must include. At a minimum, ensure it has:

| Field | Description |

|---|---|

| Voucher Number | Unique identifier for tracking and auditing. |

| Issue Date | Clarifies when the voucher was created. |

| Payee Details | Full name or company name receiving the payment. |

| Amount | Exact sum paid, in the correct currency format. |

| Payment Method | Cheque, bank transfer, or another option. |

| Authorized Signature | Validates the transaction and prevents fraud. |

Incorporate your brand identity by adding a logo, custom fonts, and company colors. Keep the layout clean and readable. Digital vouchers should support electronic signatures for convenience and security.

If the voucher is for internal use, include approval sections and cost centers. For external recipients, clarify terms such as expiry dates or restrictions.

Automate voucher generation through accounting software or spreadsheets with templates, reducing errors and saving time.

- Leaving Out Key Details

Every cheque receipt must include the full name of the payer, the exact amount received, the date, and a reference number if applicable. Missing any of these can cause disputes or delays in processing.

- Using Illegible Handwriting

If writing by hand, ensure the text is clear and easy to read. Smudged ink or unclear numbers can lead to misinterpretations, especially when matching records.

- Incorrectly Recording the Amount

Always double-check that the amount in words matches the numerical value. A mismatch can invalidate the receipt or cause payment discrepancies.

- Forgetting to Sign

A cheque receipt without a valid signature may not be legally recognized. Ensure that an authorized person signs it before handing it over.

- Omitting Payment Purpose

Indicating why the payment was made helps with tracking and future reference. Specify whether it’s for an invoice, service, or another transaction.

- Failing to Provide a Copy

Always give a copy to the payer and keep a duplicate for records. This prevents disputes and ensures accountability.

Automate voucher entry by linking your receipt templates to accounting software. Most modern systems support CSV imports, API connections, or direct entry through integrated dashboards.

Use a standardized format to ensure compatibility. A structured CSV file should include:

| Field | Example |

|---|---|

| Date | 2025-02-08 |

| Voucher Number | RV-102345 |

| Payee Name | John Doe |

| Amount | $500.00 |

| Payment Method | Bank Transfer |

| Account Code | 6010 – Office Supplies |

Set up automation rules to categorize transactions based on payee, amount, or reference numbers. This minimizes manual adjustments and ensures accuracy.

Integrate approval workflows by assigning role-based access. Accounting software with user permissions allows managers to review vouchers before they post to ledgers.

Regularly reconcile voucher data with bank statements. Automating this process reduces errors and identifies discrepancies early.

Test integrations before full deployment. Upload sample data, verify tax calculations, and confirm reports match expectations.

Ensure that every cheque receipt includes mandatory legal details: full names of both parties, cheque number, date of issue, amount, and purpose of payment. Missing these elements may lead to disputes or invalidation in court.

- Verify Signature Legitimacy: Always confirm that the cheque issuer’s signature matches the one on record with the bank. Unauthorized signatures can result in non-payment and legal complications.

- Check Local Financial Regulations: Banking laws differ across jurisdictions. Some regions impose limits on cheque validity periods or specific wording for endorsements.

- Keep Records Securely: Retain copies of all receipts for at least the legally required period. Digital backups with timestamps add an extra layer of security in case of audits.

- Prevent Fraud: Crossed cheques offer more security by ensuring payment is deposited into a bank account rather than cashed directly. This reduces the risk of fraudulent transactions.

- State Payment Purpose Clearly: A vague description can create loopholes. Specify whether the payment is for goods, services, debt settlement, or any other obligation.

- Confirm Bank Clearance: A receipt does not guarantee fund availability. Wait for the cheque to clear before considering the payment settled, especially for large transactions.

Legal compliance strengthens the validity of cheque receipts, reducing financial risks and ensuring smoother transactions. Regularly update cheque-handling procedures to align with banking regulations and avoid potential liabilities.

Use a structured layout to ensure all necessary details are included in the cheque receipt voucher. A well-organized template minimizes errors and speeds up processing.

Key Elements of a Cheque Receipt Voucher

Include the following fields:

- Date: Clearly indicate when the cheque was received.

- Receipt Number: Assign a unique identifier for tracking.

- Payer’s Name: Specify who issued the cheque.

- Cheque Details: Include cheque number, bank name, and branch.

- Amount: Write the exact sum in numbers and words.

- Purpose: State the reason for the payment.

- Authorized Signature: Ensure the document is validated by a responsible party.

Best Practices for Accuracy

Verify all details before issuing the receipt. Ensure the cheque amount matches the voucher, and confirm that the cheque is properly dated and signed. Store copies for future reference.