Donation ReceiptsAnswer in chat instead

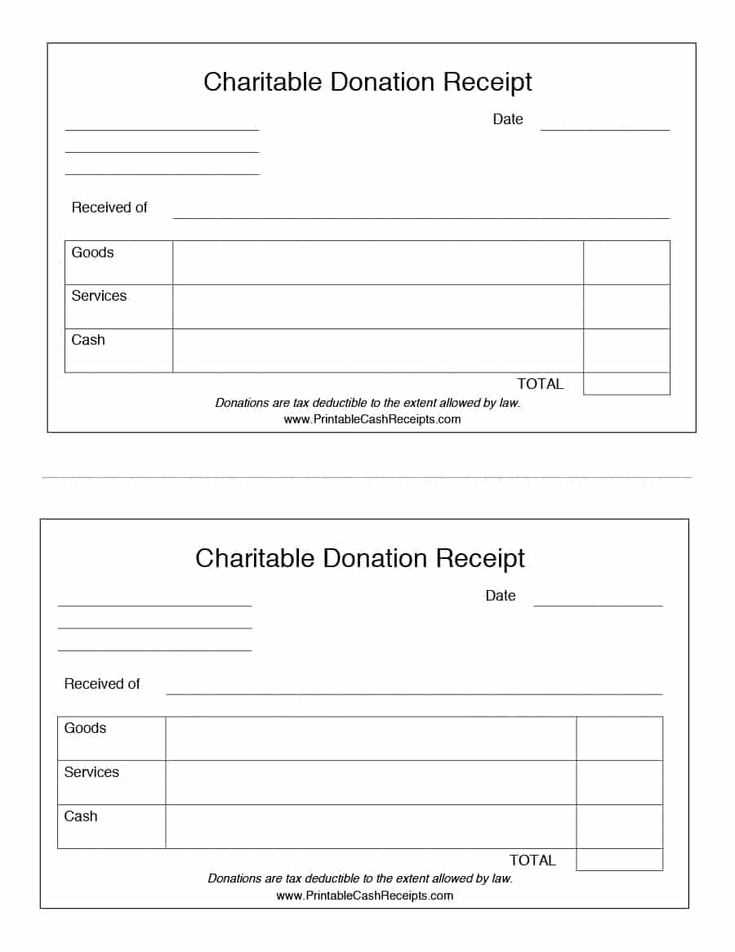

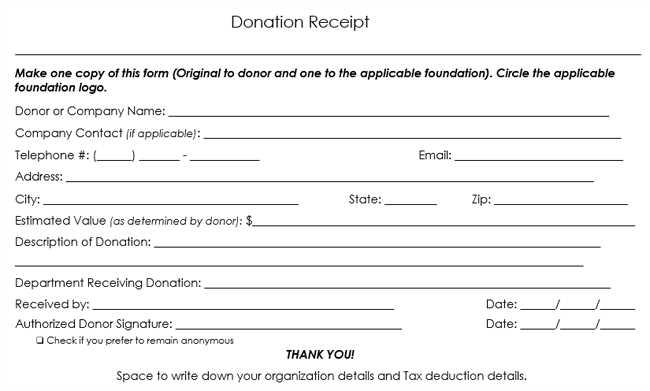

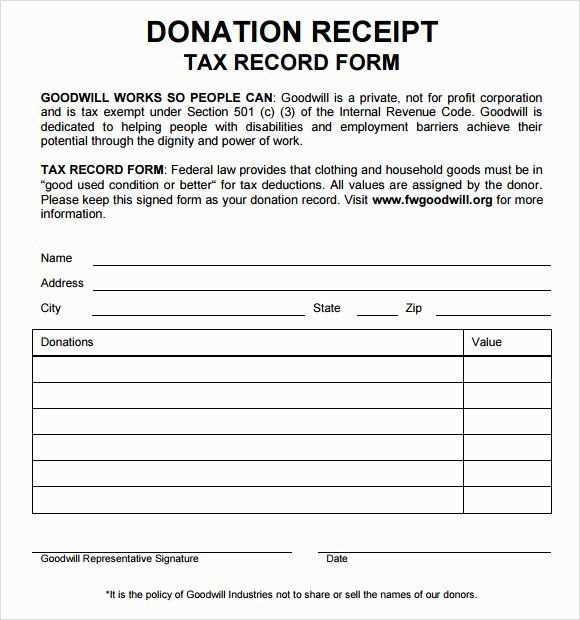

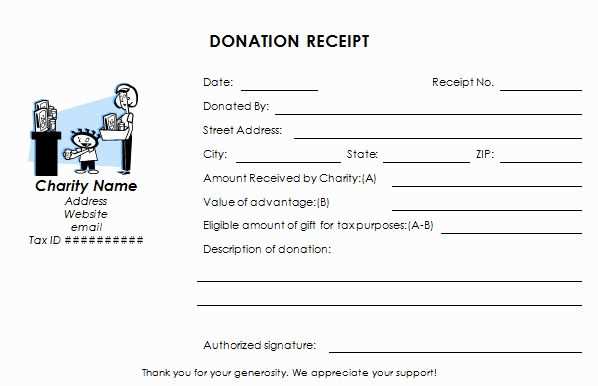

Donation Receipts Templates

Key Elements to Include in a Receipt

Legal Requirements for Donations

Formatting Guidelines for Clear Records

Customizing Forms for Different Organizations

Common Mistakes to Avoid in Documentation

Digital vs. Paper: Pros and Cons

Include donor and organization details. A receipt must list the donor’s full name and the organization’s official name, address, and tax identification number. This ensures legitimacy and compliance with tax regulations.

Specify the donation amount and type. Clearly state whether the contribution was monetary, goods, or services. If non-monetary, provide a description but avoid assigning a value unless required by law.

Confirm the donation date. Tax authorities often require proof of the exact date. Ensure accuracy, especially for year-end contributions that may affect tax deductions.

State whether goods or services were provided in return. If none were given, explicitly mention this. If something was received in exchange, detail its value and deduct it from the total contribution.

Use consistent formatting for clarity. Keep sections well-structured, use clear labels, and ensure the receipt is easy to read. Avoid excessive design elements that may distract from essential details.

Adapt receipts for different organizations. Nonprofits, charities, and religious institutions may have unique reporting needs. Customize templates to reflect specific legal and operational requirements.

Prevent common mistakes. Avoid missing signatures, incorrect donation values, and incomplete information. Errors can lead to compliance issues or tax claim rejections.

Compare digital and paper receipts. Digital formats offer easy storage and retrieval, while paper receipts provide tangible records. Choose based on organizational needs and donor preferences.