Dental ReceiptAnswer in chat instead

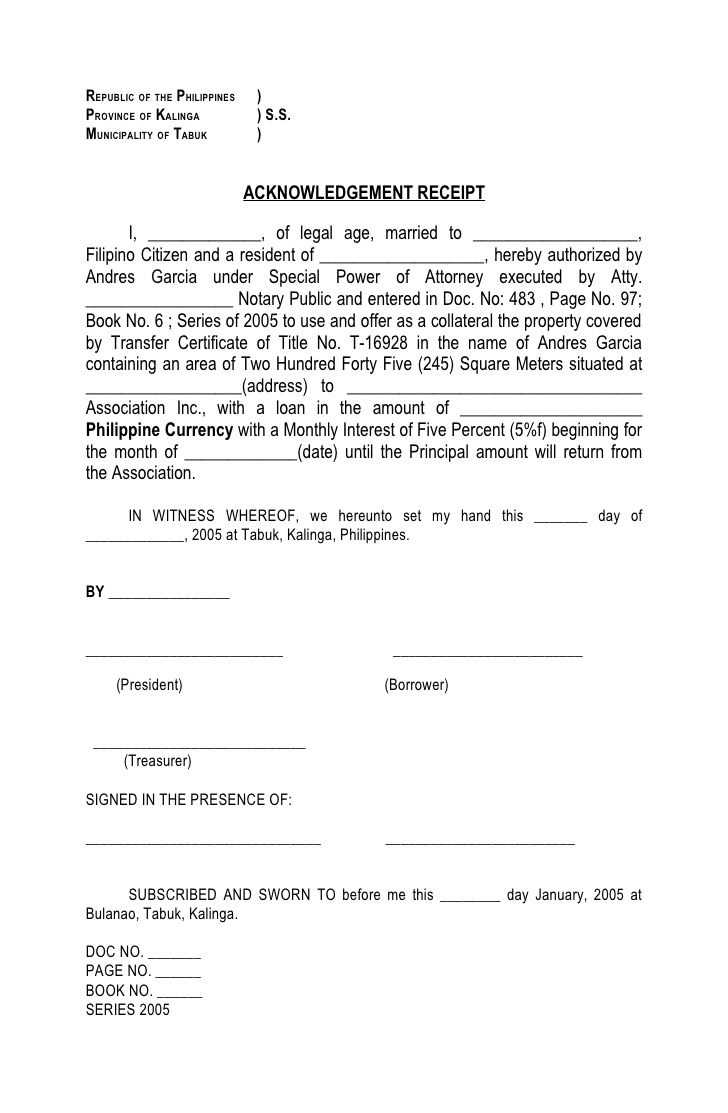

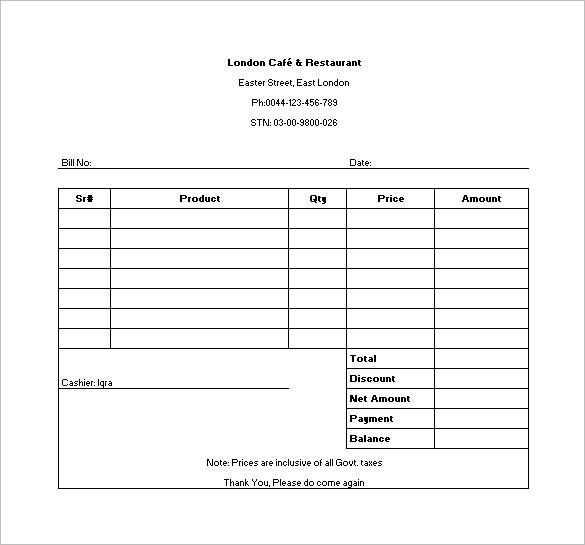

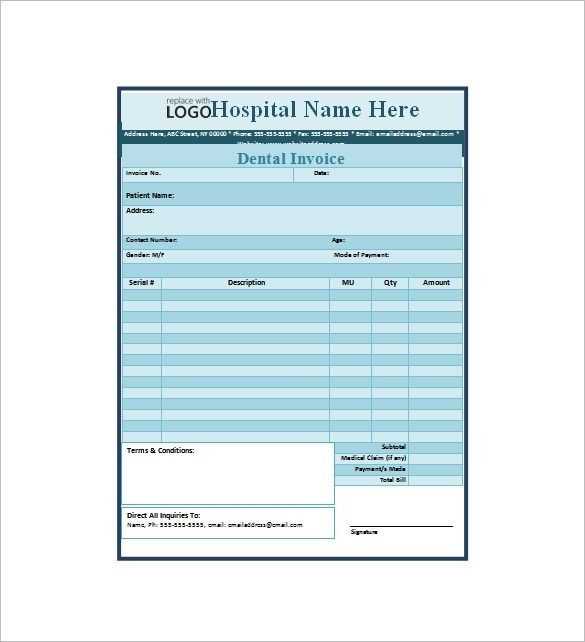

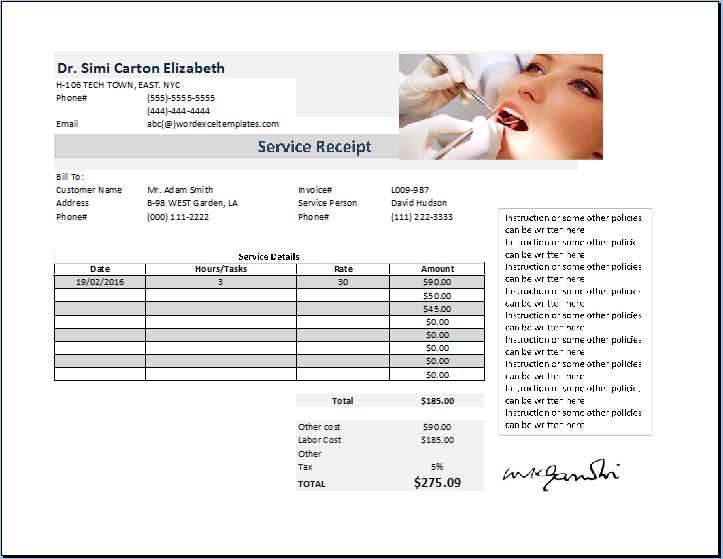

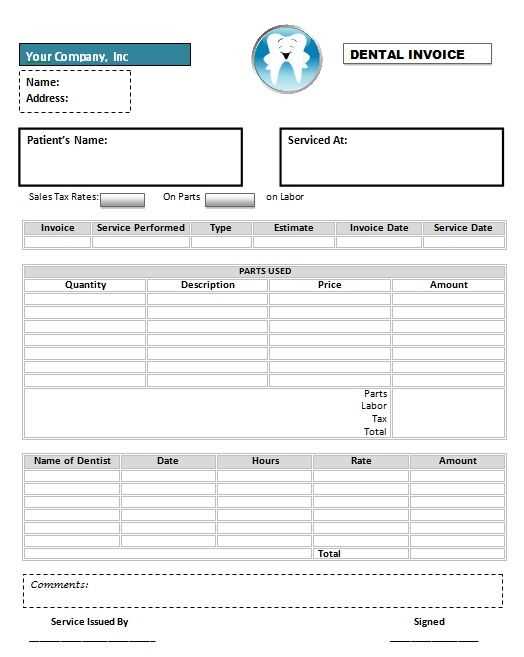

Dental Receipt Template Sample

Key Elements to Include in a Receipt

How to Format for Clarity

Customizing for Insurance Purposes

Common Mistakes to Avoid

Legal and Tax Considerations

Best Software and Tools for Generating Receipts

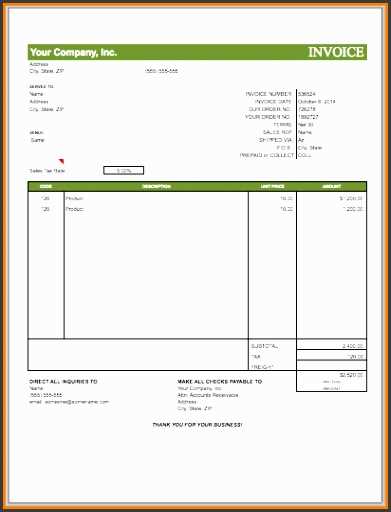

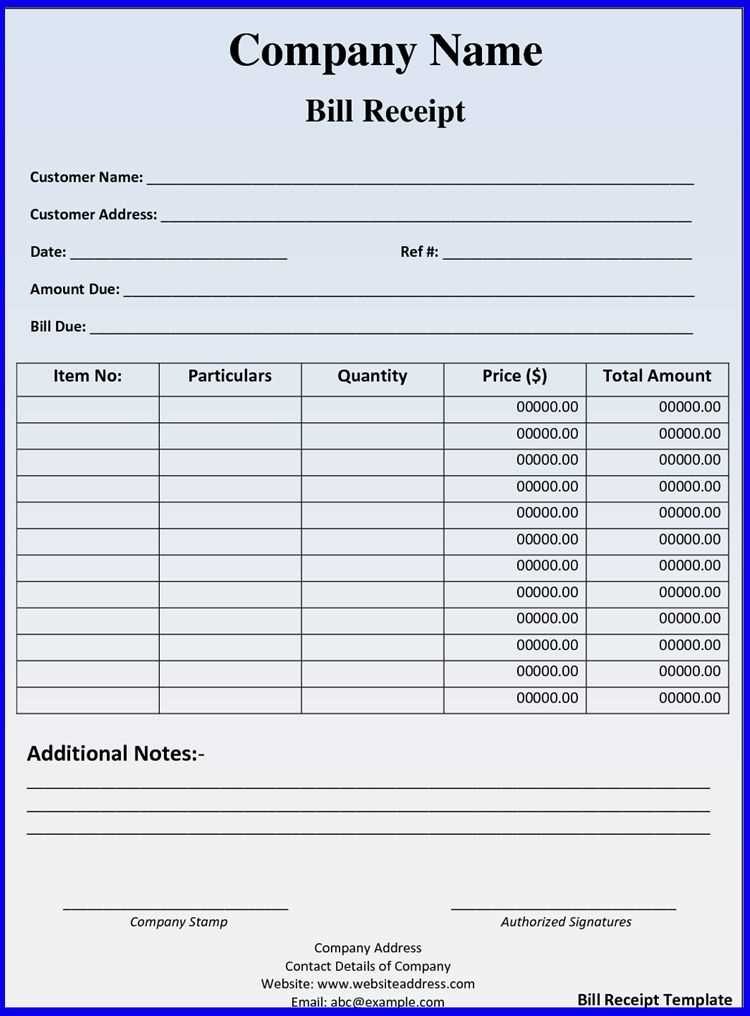

Ensure the receipt includes the dentist’s name, clinic address, contact information, and tax identification number. Clearly state the patient’s full name, date of service, and a breakdown of charges, specifying each procedure, materials used, and applicable taxes.

Use a structured format with bold headers for each section, aligning amounts to the right for easy scanning. Avoid clutter by keeping descriptions concise and grouping similar items together.

For insurance purposes, include ADA codes, the dentist’s license number, and the patient’s insurance details. Indicate the amount paid, outstanding balance, and accepted payment methods.

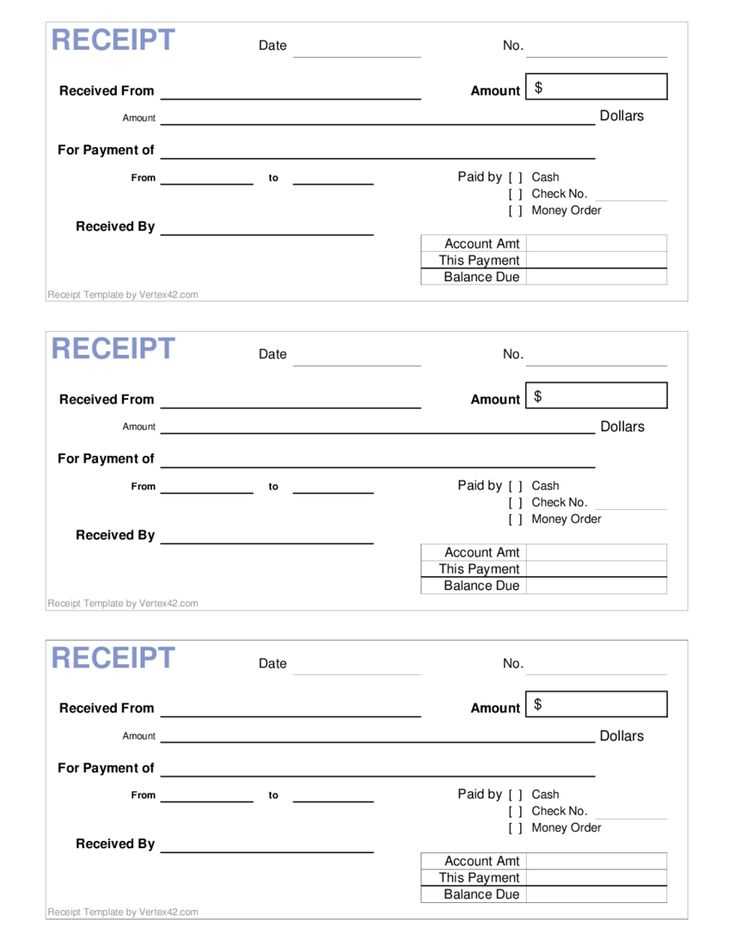

Common mistakes include missing tax details, unclear service descriptions, and incorrect patient information. Double-check calculations and ensure all required fields are filled before issuing.

Receipts must comply with local tax laws and privacy regulations. Retain copies for record-keeping and provide digital options when possible.

Tools like QuickBooks, Wave, and DentalWriter help generate professional receipts with automation features, reducing errors and ensuring compliance.