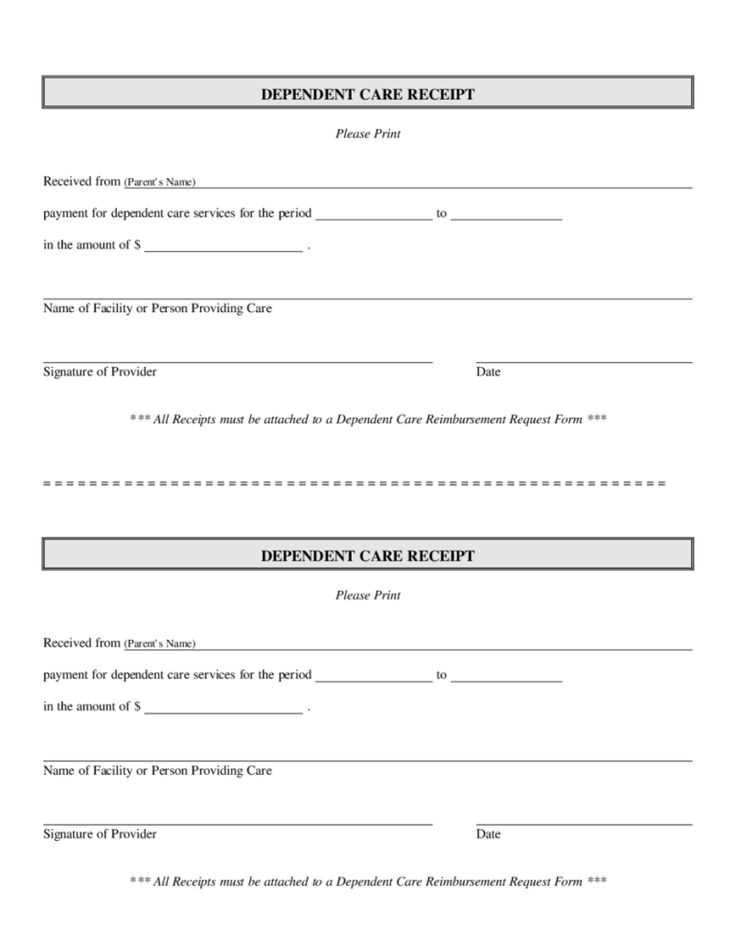

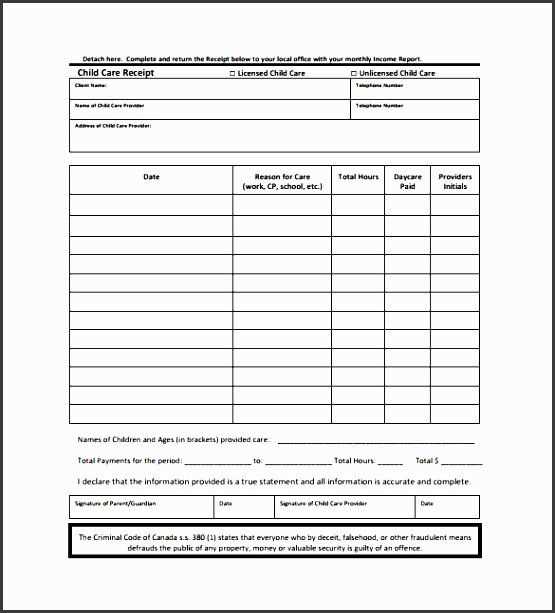

Required Information for a Valid Receipt

A proper receipt for a Dependent Care Flexible Spending Account (FSA) claim must include specific details. Missing or incorrect information may lead to claim rejection.

- Babysitter’s Name: Full legal name of the caregiver.

- Service Date: Exact dates of care provided.

- Child’s Name: Name of the child receiving care.

- Payment Amount: Total paid for the service.

- Babysitter’s Address: Full mailing address.

- Babysitter’s Tax ID or SSN: Required for IRS reporting.

- Babysitter’s Signature: Confirms accuracy of the details.

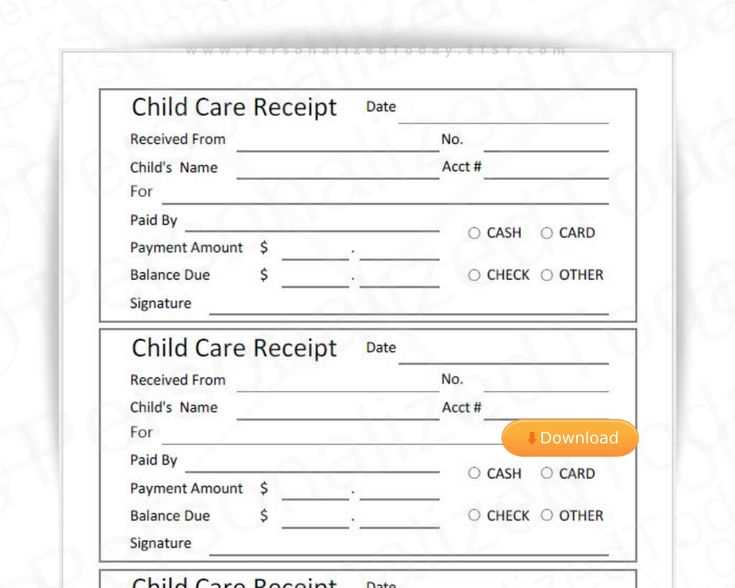

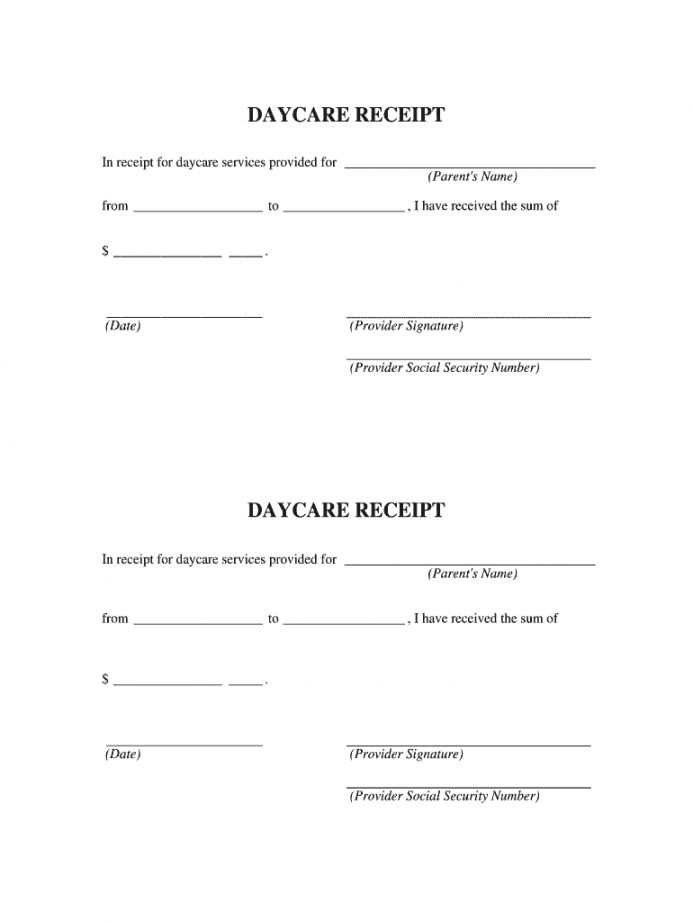

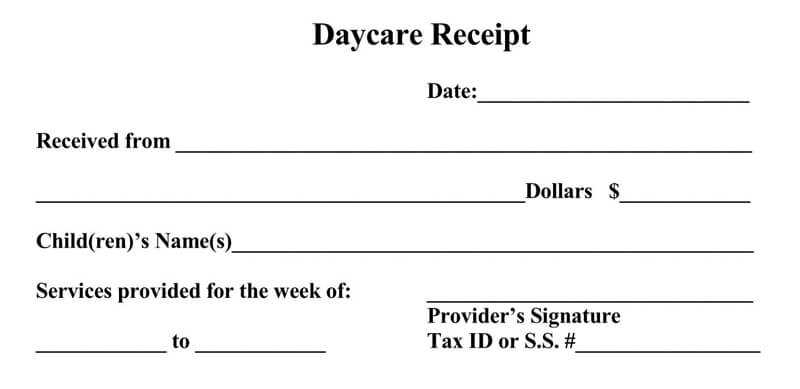

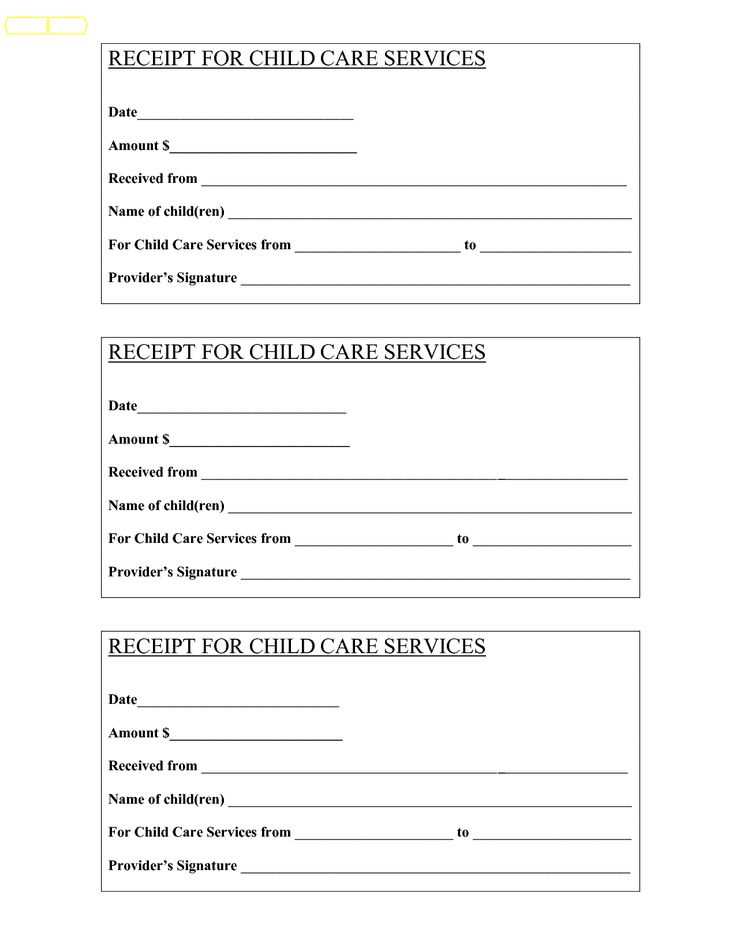

Simple Babysitter Receipt Template

Using a structured format ensures that all essential information is captured. Below is a simple template:

Babysitter Receipt

Caregiver Name: ________________________

Caregiver Address: ________________________

Caregiver Tax ID/SSN: ________________________

Parent’s Name: ________________________

Child’s Name: ________________________

Service Dates: From ______ to ______

Amount Paid: $______

Payment Method: Cash / Check / Electronic

Babysitter Signature: ________________________

Date: _______________

Submitting the Receipt

Most FSA providers accept scanned copies or digital uploads. Always retain a copy for tax records. If submitting by mail, ensure it reaches the provider before the claim deadline.

Dependent Care FSA Babysitter Receipt Template

Required Details for a Valid Childcare Receipt

Formatting Tips for a Clear and Acceptable Document

Handwritten vs. Digital Receipts: Benefits and Drawbacks

Frequent Errors That Cause Rejected Reimbursement Claims

Ways to Verify and Store Receipts for IRS Compliance

Using Online Tools to Create a Proper Childcare Receipt

Include the caregiver’s full name, address, and contact details. Specify the child’s name, service dates, and total amount paid. Ensure the receipt states the method of payment and includes a legible signature if handwritten. A unique receipt number helps with tracking.

Use a structured format with clearly labeled sections. Align amounts and dates for readability. Avoid abbreviations that may confuse the reviewer. Digital receipts should be in PDF format to prevent alterations.

Handwritten receipts add a personal touch but may be harder to read. Digital versions ensure clarity and easy duplication. If using handwritten formats, write in black ink and avoid smudging.

Common mistakes include missing signatures, illegible handwriting, and incorrect totals. Avoid rounding amounts or leaving blank fields. Ensure the caregiver’s tax identification number or Social Security number is included if required.

Scan and save receipts in a secure cloud storage solution or keep physical copies in a designated folder. IRS audits may require access to receipts for up to seven years, so organize them accordingly.

Online templates streamline the process and ensure compliance. Use reputable platforms that offer customizable fields, auto-calculations, and printable formats. Verify all details before submission to prevent reimbursement delays.